Keep Your Payments The Same When Changing Your Mortgage

When you renew your mortgage, you may be able to get a lower interest rate.

Some mortgage lenders may allow you to extend the length of your mortgage before the end of your term. Lenders call this early renewal option the blend-and-extend option. They do so because your old interest rate and the new terms interest rate are blended.

When your interest rate is lower, you have the option to reduce the amount of your regular payments. If you decide to keep your regular payments the same, you can pay off your mortgage faster.

Also Check: What Is Rocket Mortgage Interest Rate

Income And Financial Commitment

When calculating your maximum mortgage amount, banks usually factor the ratio of your debt to income. This is known as the Total Debt Servicing Ratio , which is capped at 55% of your gross monthly income.

If you are looking to buy a HDB flat, banks usually calculate your Mortgage Servicing Ratio , which is capped at 30% of your gross monthly income.

The calculation of the MSR is based on your monthly gross income and loan amount. In other words, your maximum mortgage amount is determined by the TDSR, MSR , a medium-term 3.5% interest rate, and the loan tenure.

Understand Your Mortgage Payment

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. When you pay extra on your principal balance, you reduce the amount of your loan and save money on interest.

Keep in mind that you may pay for other costs in your monthly payment, such as homeowners insurance, property taxes, and private mortgage insurance . For a breakdown of your mortgage payment costs, try our free mortgage calculator.

Read Also: How Long Should My Mortgage Be

Can My Monthly Payment Go Up

Your monthly payment can rise in a few cases:

You May Like: What Does A Co Signer Do For A Mortgage

What Is A Fixed

A fixed-rate mortgage is a home loan that has the same interest rate for the life of the loan. This means your monthly principal and interest payment will stay the same. The proportion of how much of your payment goes toward interest and principal will change each month due to amortization. Each month, a little more of your payment goes toward principal and a little less goes toward interest.

Read Also: How Many Times Annual Salary For Mortgage

A Good Pay Down Loan Strategy Is To Pay Extra Principal Every Month

One of the most common ways to pay down a loan early is to pay additional principal each month. You dont have to pay a lot of extra each month to make a significant difference in your loan payoff time. An additional $50, or even $25 extra principal each month may make a surprising difference. You can save a lot of interest if you pay down the loan early.This extra payment calculator is designed to tell you how much interest and time youll save if you know how much extra you can pay each month. The Early Loan Payoff Calculator is another loan payoff calculator that will help you figure out how much extra to pay each month to pay down the loan by a desired years or months.

Why Should I Pay Off My Mortgage Early

Lets take another look at that $200,000 loan. Your principal and interest payment would be $904 a month. If you started paying $100 more a month in the fifth year of that loan, making your payment $1,004 a month, youd save $15,135 in interest and shorten your loan term by three years and eight months. Start paying $100 more right away and youll save $22,800 in interest and pay off your loan four years and 10 months early.

Paying down a mortgage early also accelerates your home equity, which is the value of your home minus the debt you owe. Its your stake in the property.

Higher home equity has several advantages. For one, most banks require mortgage insurance if you have less than 20 percent equity in the residence. Your premium is part of your loan payment. In general, mortgage insurance is about 0.5 to 1.5 percent of the loan amount per year. So for a $200,000 loan, mortgage insurance would cost around $80 to $250 per month.

Mortgage insurance covers the bank in case you default it has no payoff value to you. The sooner you get to 20 percent equity, the sooner you can get rid of your mortgage insurance and be free of paying the premium.

Recommended Reading: What Is The Highest Mortgage Rate Ever

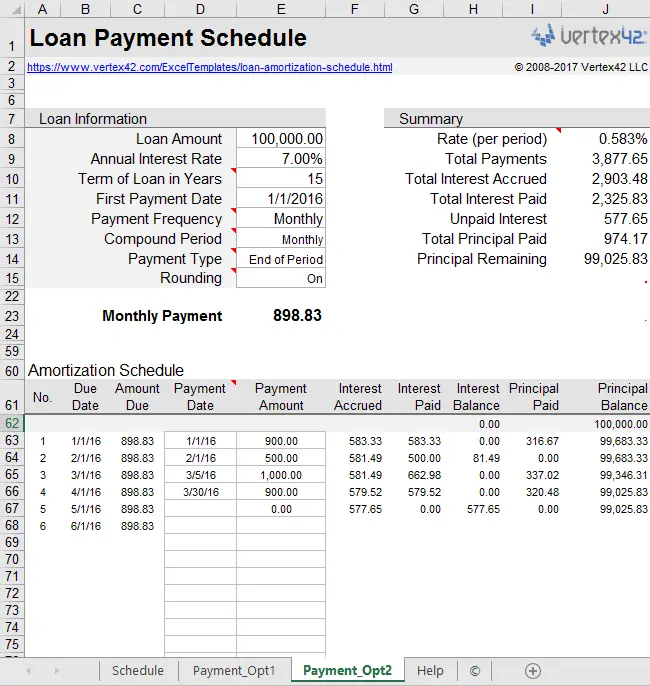

Calculate The Balance Remaining On Any Mortgage

This mortgage balance calculator will figure the remaining balance of yourshow instructions

To use this calculator just enter the original mortgage principal, annual interest rate, term years, and the monthly payment. Then choose one of the three options for calculating the number of mortgage payments made to determine the remaining balance.

Note: this mortgage balance calculator is only for fixed rate mortgages where the terms are constant. Dont use for any mortgage where the terms will vary over time .

How Do You Calculate A Loan Payoff

Part 1 Part 1 of 2: Knowing the Essentials Download ArticleUnderstand why your mortgage payoff amount does not equal your current balance. Gather the information needed for your calculations. In order to determine the payoff amount,either using a calculation program or on your own,you need to know a handful Consider online calculators if youd rather not exercise your math muscles. More items

Read Also: How To Remove Co Signer Off Mortgage

How To Calculate A Mortgage Payoff

Mortgage payments are paid in arrears, that is, behind.

Take a sample mortgage with an original balance of $100,000, 10 % interest, 180 months. The monthly payments are $1,074.61.

After 60 months the principal balance is $81,316.29 on the day the 60th payment is made. From that day forward the interest accrues till the next payment date. The daily, or per diem, rate is the current principal times the interest rate divided by 365. In this case $81,316.29 X 10% / 365 = $22.28 per day.

If the mortgage is paid off 10 days after the last payment due date then the payoff would be $81,316.29 + 10 X $22.28 = $81,539.09.

A useful calculator is the Days between two dates calculator so you can work out how many days to multiply the daily amount by.

If you dont fully understand how the payments and outstanding principal was calculated, please see our FREE online Mortgage Calculator Tutorials.

What Is A Mortgage Balance

A mortgage balance is the amount owed at a particular moment in time during the mortgage loan term.

Heres an example:

Mrs. Davis finances a home by taking out a fixed-rate $150,000.00 mortgage at 4% interest with a 30-year term. She has agreed to make payments of $900 per month. At this point in time, the mortgage balance is $150,000.00.

Mrs. Davis pays her mortgage for 10 years, and checks her mortgage balance using the Mortgage Balance Calculator. She knows that she has been paying every month for 10 years, so she enters 120 as the number of payments into the calculator, along with the rest of the required variables. She finds her mortgage balance at this point in time to be $91,100.05.

While Mrs. Davis was able to use the Mortgage Balance Calculator in our example, there are some things to keep in mind . . .

Recommended Reading: Can You Get A Conventional Mortgage On A Manufactured Home

Recommended Reading: How To Shop For Mortgage Loans

How To Payoff Your Mortgage Faster

When it comes to paying off your mortgage faster,try a combination of the following tactics:Make biweekly payments.Budget for an extra payment each year.Send extra money for the principal each month.Recast your mortgage.Refinance your mortgage.Select a flexible-term mortgage.Consider an adjustable-rate mortgage.

You May Like: What Is A Mortgage Contingency Date

Your Current Mortgage Payment

Lets say that in the previous example Joe is closing his refinance on October 10th and his payoff has Octobers 10 days of interest added to it. NOW lets say that Joe hasnt made his current October payment since its not late until after the 15th. In this case Joes payoff will have 40 days of interest added to it: the 10 days of October and the 30 days of Septembers interest that would have been paid had he made his October payment.

There is nothing wrong with having the 40 days added to the payoff however, it does mean that our estimates will be less accurate since Joes per diem interest is significantly more than initially estimated. That said, in a roundabout way Joe can skip two months payments both October and Novembers payments instead of the normal one.

Recommended Reading: What Is 1 Point On A Mortgage

About The Mortgage Payoff Calculator

The calculator has four main sections. First, the top section where you enter the information about your loan and the additional amount youd like to pay each month. Below that is a short summary showing your new monthly payments and comparative savings. Further down is a chart comparing the trends in your mortgage balance and interest payments over time with both your regular and additional payments.

At the top, theres a green box labeled See Report. Clicking that will display a detailed amortization schedule showing exactly what your total payments, loan balances and accumulated interest payments will be over the life of the loan, on either a month-by-month or year-by-year.

Cut Out Your Credit Cards

Back in your father’s day, it was easy enough to stop using credit cards – you just cut them up into little pieces with scissors. Nowadays, it’s not so simple. Your credit card info is already on file with many vendors and websites. You need to cut OUT your credit card use completely, even if it means closing the accounts.

Unfortunately, for many of us, credit cards are like Wi-Fi connections we can’t live without them. Fortunately for you, there are proven ways to wean yourself off of credit cards, and you’ll be surprised to learn that there is life after Visa and MasterCard.

One way to eliminate your credit card habit is to leave the culprit at home when you go out. If you see something you really want, you’ll either have to buy it with cash or wait until you bring your card the next time. Another way is to build up a little nest egg for emergencies only. If you have a bit of cash to pay for emergency or unforeseen expenses, you won’t have to go into hock when a minor disaster strikes.

But the best way to curb your credit card use is to consider how much money you throw away every year in interest, or how long it would take to pay off your credit card balance by paying the minimum monthly payment. These grim statistics are a wake-up call and a reminder of just how dumb it is to use a high-interest credit card to buy frivolous impulse items.

You May Like: What Happens If I Outlive My Reverse Mortgage

Mortgage Payoff Calculator Terms & Definitions

- Principal Balance Owed â The remaining amount of money required to pay off your mortgage.

- Regular Monthly Payment â The required monthly amount you pay toward your mortgage, in this case, including only principal and interest.

- Number of Years to Pay Off Mortgage â The remaining number of years until you want your mortgage paid off.

- Principal â The amount of money you borrowed to buy your home.

- Annual Interest Rate â The percentage your lender charges on borrowed money.

- Mortgage Loan Term â The number of years you are required to pay your mortgage loan.

- Mortgage Tax Deduction â A deduction you receive at tax time on the interest you pay toward your mortgage.

- Extra Payment Required â The extra amount of money youll need to pay toward your mortgage every month to pay off your mortgage in the amount of time you designated.

- Interest Savings â How much youll save on interest by prepaying your mortgage.

Dont Miss: How To Get Pre Approved For A Mortgage Chase

Important Notes Regarding The Mortgage Balance Calculator

There is a difference between your mortgage balance and your mortgage payoff amount. If you are looking to pay off your mortgage, your mortgage balance may not provide you with the relevant information needed. The payoff amount will be higher than your mortgage balance. This is because of additional fees required by the lender to close out the mortgage.

Related:5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

Also remember this mortgage balance calculator only works with fixed-rate mortgages. Fixed-rate mortgages have fixed interest rates â meaning the interest rate stays the same over the course of the loan term. Adjustable-rate mortgages, on the other hand, have interest rates that are periodically adjusted.

There are, however, additional ways to find your mortgage balance. The Mortgage Balance Calculator isnt the only way. Try one of these methods too . . .

You May Like: How To Get A Mortgage On A Foreclosure

Recommended Reading: Can You Get A Mortgage Without A Down Payment

Are There Any Other Advantages To Making Extra Mortgage Payments

Another advantage to paying down your mortgage more quickly: As you build up home equity, you get the ability to tap that equity in an emergency or if you need to make an expensive repair or addition. You have to use home equity loans carefully, because if you dont repay them, you could lose your house. Nevertheless, its good to know that the money is available if you need it.

Make sure you get credit for an extra mortgage payment. Most loans allow you to prepay principal. Its always wise to mark your extra principal when you make your payment and to check that your bank has credited it to your principal, rather than interest. Be sure to ask your lender for instructions on how to make your extra principal payment.

And dont forget: When you get to 20 percent equity, ask your lender to remove the mortgage insurance payment.

Also of Interest

When To Consider Refinancing

Aside from making extra payments, mortgage refinancing is another strategy to shorten your term. But other than that, it can help you obtain lower interest rates. You can decrease your loan term and acquire a lower interest rate to pay your mortgage early. If you have a 30-year mortgage, you can refinance to a 15-year mortgage with reduced interest. Moreover, it allows you to shift from a fixed-rate mortgage to an adjustable-rate mortgage , and vice versa. But dont forget: It should be done early enough into the loan term.

Heres when its good to refinance from a 30-year to 15-year term:

- If interest rates are low

- If you have a qualifying or high credit score

- If youve paid your loan for just a couple of years

- If you are not planning to move out of the house

- If you are able to make higher monthly payments Refinancing to a shorter term makes your monthly payment higher even with a reduced interest rate. This yields significant interest savings.

Moreover, refinancing is taking out a new loan to replace your old one with more favorable terms. This means you need to go through all the credit checks and paper work. It requires a high qualifying credit score , with the best rates going to consumers with 740 credit scores. On top of this, you must shoulder many fees, including inspection, recording fees, origination fees, and housing certifications.

Refinancing is not ideal under the following circumstances:

Whats the Ideal Interest Rate to Refinance?

You May Like: How Long After Car Repossession Can I Get A Mortgage

How To Pay Off Your Mortgage Early Using This Calculator

The calculator on this page helps you visualize different scenarios for making additional payments toward your mortgage. You can use it to determine how much more youd need to pay if you want to hit a particular time goallike paying off your mortgage in 10 years or by the time you retire.

Or if you have a specific amount of extra money to put toward your mortgage each month, you can use the calculator to see how quickly youd pay off the debt with the increased payments. It can also break down what that means in terms of principal and interest, but it doesnt take into account insurance and taxes.

What If Youre Trying To Prepare An Estimate And Would Like A Figure

You can always call your lender and obtain a payoff from them over the phone. Some lenders will calculate a payoff amount for you online as well. Just remember to add a few days to the closing date so that you have allowed for a cushion.

But for most estimates, using this trick will suffice: take your principal balance and add to it a monthly payment. Assuming that you are on time with your payments, this number should always be a bit higher than your actual payoff, but at least this way you will be overestimating instead of underestimating, which is typically the case when you use the principal balance as the payoff amount.

* Interest on an FHA mortgage accumulates monthly. Therefore, interest is always owed through the end of the month. However, to calculate an estimated payoff, the same concept applies: take the principal balance and add a monthly mortgage payment to obtain an estimated payoff.

Also Check: When Is A Mortgage Payment Considered Late