Summary Apr Vs Note Rate

The difference between APR and Note Rate is dependent on which costs are taken into consideration in its calculation. Due to the inclusion of total cost, use of APR is more beneficial than Note Rate. It also allows effective comparison of rates than the Note Rate. On the other hand, Note Rate is the usual rate used to demonstrate the annual interest on borrowings by many financial institutions.

References

Image Courtesy

Also Check: Can I Refinance My Parents Mortgage

Watch Out For Aprs On Arms

So far weve only been working with fixed-rate loans in our examples. But APR calculations become more complicated and more limited in their utility when dealing with adjustable-rate mortgages . With ARMs, interest rates will vary over the life of the loan, and at the beginning, they typically have lower interest rates than 30-year fixed-rate mortgages.

However, ARMs are structured so the lower APR is only fixed for an initial period, usually between one month and 10 years and once its over, the loan will adjust according to a benchmark interest rate known as an index. The lender will then also add a margin a set amount of percentage points to the index in order to calculate your interest rate. The timetable associated with an ARMs fixed and adjustable periods will be right in its name: in the case of a 5/1 ARM, for example, the rate is fixed for the first five years of the loan and then adjusts annually thereafter.

Calculating the APR on an ARM is a bit like trying to hit a moving target, as its very improbable that in five years, when the interest rate on a 5/1 ARM begins to adjust, the index rate will be at the exact same level it was on the day you closed. Its also practically impossible that the index rate will stay the same for the remainder of the loan term, when the rate adjusts annually.

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinancing if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage points . It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money you’d save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you’d pay off your house sooner.

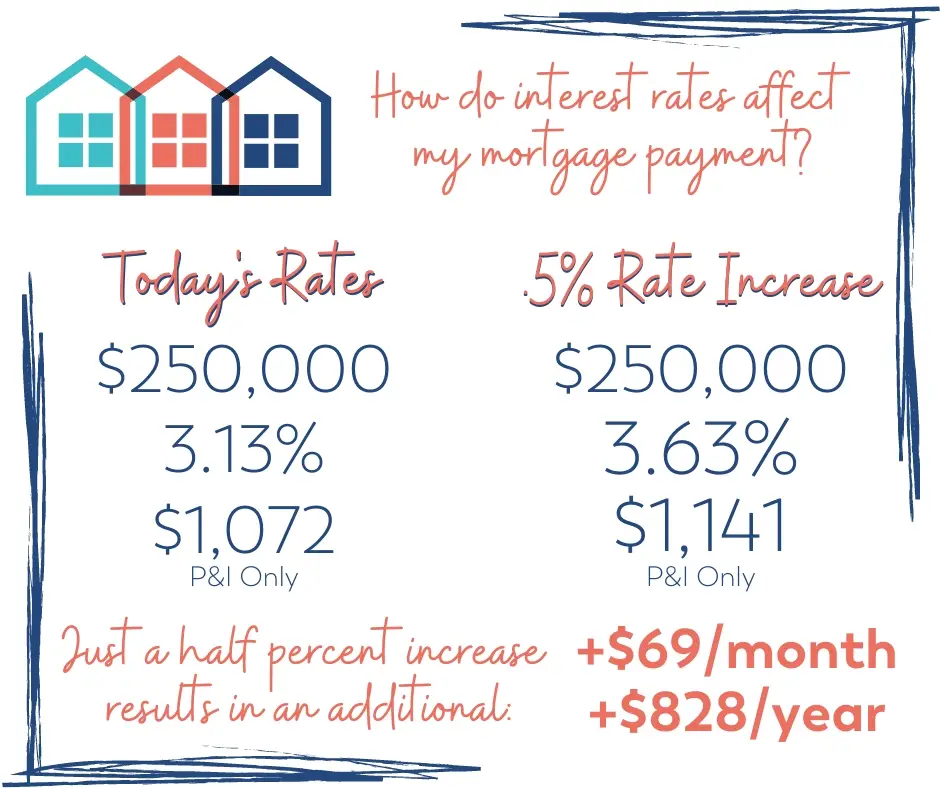

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

Also Check: Is Carrington Mortgage A Good Company

Here Are Todays Mortgage Rates: November 17 2022rates Decrease

The average rate on a 30-year fixed mortgage is 6.89% with an APR of 6.91%, according to Bankrate.com. The 15-year fixed mortgage has an average rate of 6.26% with an APR of 6.29%. On a 30-year jumbo mortgage, the average rate is 6.88% with an APR of 6.89%. The average rate on a 5/1 ARM is 5.52% with an APR of 7.17%.

Money’s Average Mortgage Rates For September 9 2022

Mortgage rate moved lower across all loan categories today. The average rate for a 30-year fixed-rate loan was down for the second day in a row, decreasing by 0.136 percentage points to 6.731%.

- The latest rate on a 30-year fixed-rate mortgage is 6.731%.

- The latest rate on a 15-year fixed-rate mortgage is 5.601%.

- The latest rate on a 5/6 ARM is 6.395%.

- The latest rate on a 7/6 ARM is 6.422%.

- The latest rate on a 10/6 ARM is 6.393%.

Money’s daily mortgage rates are a national average and reflect what a borrower with a 20% down payment, no points paid and a 700 credit score roughly the national average score might pay if he or she applied for a home loan right now. Each day’s rates are based on the average rate 8,000 lenders offered to applicants the previous business day. Your individual rate will vary depending on your location, lender and financial details.

These rates are different from Freddie Macs rates, which represent a weekly average based on a survey of quoted rates offered to borrowers with strong credit, a 20% down payment and discounts for points paid.

Read Also: Can I Have A Co Signer On A Mortgage

How To Get The Best Mortgage Rate

Mortgage rates change daily and can vary widely depending on a variety of factors, including the borrower’s personal situation. The difference in mortgage rates can mean spending tens of thousands of dollars more in interest over the life of the loan. Here are some tactics to help you find the best mortgage rate for your new home loan:

Tips To Remember When Loan Shopping

Shopping around for a mortgage will help you get the best deal. In fact, nearly half of borrowers who compare multiple loan options will save money on their mortgage, according to a recent LendingTree survey. The lesson here is that, although it may be tempting to settle on one mortgage lender before combing through competitors loan offers, taking the time to comparison shop can potentially save you thousands in interest over the life of your loan.

Keep the following tips front of mind as you compare offers and prepare to get a mortgage:

1. Focus on APR vs. interest rate based on your needsIt makes sense to focus on APRs if you care most about getting the best deal on your monthly payments. On the other hand, if youre more concerned about saving money in the long haul, its logical to give more weight to interest rates.2. Ask about additional fees Although APRs can be a powerful tool as you compare loan offers, they arent foolproof. Lenders are required to include certain costs in their APR calculations, but there are additional fees for example appraisal or inspection fees that may not be represented in the APR.

Tip.

You May Like: Can You Get A Mortgage With No Job

Also Check: What Documents Are Needed For Mortgage Pre Approval

Whats A Good Mortgage Rate

Mortgage rates can change drastically and oftenor stay the same for many weeks. The important thing for borrowers to know is the current average rate. You can check Forbes Advisors mortgage rate tables to get the latest information.

The lower the rate, the less youll pay on a mortgage. Depending on your financial situation, the rate youre offered might be higher than what lenders advertise or what you see on rate tables.

If youre hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

Do I Need A Mortgage Prequalification Or Preapproval

Mortgage lenders can pre-qualify borrowers to help them know how much home they can afford based on a credit report and description of the borrowers financial circumstances. It can help you focus your search for a new home.

A mortgage pre-approval takes a more intricate look at your finances, including your income, assets, credit, and debt, to determine whether you qualify for a mortgage and determine what you can afford. Mortgage pre-approval gives you a realistic look at your borrowing capabilities.

When considering buying a home, it is important to:

- Be preapproved to let sellers and real estate agents know they can trust you as a buyer and that you are serious about purchasing a home.

- Remember that even if you get preapproved for a mortgage, you will still have to apply for a mortgage once you have an offer accepted on the property you wish to buy.

After you are preapproved, avoid making common mistakes like applying for new credit, co-signing a loan, and disturbing your steady income. These changes will alter your preapproved status, potentially resulting in completely new terms for your actual mortgage.

Visit our mortgage preapproval page for more information.

Recommended Reading: Can You Write Off Mortgage Payments

How Do I Choose The Best Mortgage Lender

You should always compare several different lenders when shopping for a home loan. Not only will the rates and fees vary, but the quality of service as well. Regardless of what lender you end up working with, its important to find someone that can help your individual challenges. For example, if youre a military veteran getting a VA loan, youll want to work with someone who has experience with those types of loans.

To find a trusted lender, you can look at online reviews, or even better, ask around. Your real estate agent and friends who recently purchased a home are great sources for mortgage lender recommendations. Try comparing a variety of different mortgage lenders. The best mortgage lender for you may be a bank, credit union, mortgage broker, or an online mortgage lender, depending on your situation.

What Is The Apr On A Mortgage

When referring to the rate on a mortgage, its easy to confuse the .

The APR annual percentage rate on a mortgage reflects the interest rate, but also includes additional mortgage fees that are paid upfront, such as origination fees, broker fees and points, explains Nilay Gandhi, senior financial advisor with Vanguard Personal Advisor Services in Philadelphia.

The APR helps the borrower evaluate the true all-in cost of their mortgage, Gandhi says.

Because the APR factors in costs beyond just the interest rate, its smart to pay attention to every expense to get the best overall rate for your mortgage. Small changes in the APR can have a big impact on the total amount youll pay for your home over time.

To sum it up, the higher the APR, the more youll pay, everything else being equal, Gandhi says.

Also Check: Is A Mortgage Public Record

How Does A Mortgage Work

A mortgage is a type of secured loan where the property often your home is the collateral. So youll never be able to take out a mortgage without having some sort of real estate attached to it. Mortgage loans are issued by banks, credit unions, and other different types of lenders.

Aside from paying the loan back, you pay for a mortgage in two ways: fees and interest. Interest is paid on your loan balance throughout the life of the loan and is built into your monthly payment. Mortgage fees are usually paid upfront and are part of the loans closing costs. Some fees may be charged annually or monthly, like private mortgage insurance.

Mortgages are repaid over what is known as the loan term. The most common loan term is 30 years. You can also get a mortgage with a shorter term, like 15 years. Short-term loans have higher monthly payments but lower interest rates. Mortgages with longer terms have lower monthly payments, but youll typically pay a higher interest rate.

Using The Mortgage Apr Calculator

Here’s how it works:

Your mortgage APR will automatically display and be updated by the calculator as you enter or change information. The “Total Payments” chart will show your total interest and principle costs for the life of the loan, while “Principle Balance by Year” will chart the gradual decline of loan principle as you pay the loan off over the term of the loan.

Don’t Miss: What Do I Need To Refinance My Mortgage

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

How Do Lenders Calculate My Dti

At a minimum, lenders will total up all the monthly debt payments youll be making for at least the next 10 months Sometimes they will even include debts youre only paying for a few more months if those payments significantly affect how much monthly mortgage payment you can afford.

Lenders primarily look at your DTI ratio. There are two types of DTI: front-end and back-end.

Front end only includes your housing payment. Lenders usually dont want you to spend more than 31% to 36% of your monthly income on principal, interest, property taxes and insurance. For example, if your total monthly income is $7,000, then your housing payment shouldnt be more than $2,170 to $2,520.

Back-end DTI adds your existing debts to your proposed mortgage payment. Lenders want this DTI to be no higher than 41% to 50%. Lets say your car payment, credit card payment and student loan payment add up to $1,050 per month. Thats 15% of your income. Your proposed housing payment, then, could be somewhere between 26% and 35% of your income, or $1,820 to $2,450.

Recommended Reading: What Can I Do To Lower My Mortgage Payments

What Do I Need To Refinance My Mortgage With A Fixed Rate Loan

A 30 year mortgage could be very beneficial, but you need to consider how long you plan to stay in your new home. If what matters most to you is having lower mortgage payments each month, you should consider a 30 year fixed rate mortgage with the help of a loan officer.

Where Can You Find Your Apr

Banks and lenders are required to display APR information prominently. You can find your APR on your loan estimate, lender disclosures, closing paperwork or credit card statement. On your credit card statement, its usually at the bottom and is often labeled interest charge calculation or something similar.

Dont Miss: What Is Loan Servicing In Mortgage

Recommended Reading: What Is The Mortgage Rate For Bank Of America

What Is A Good Mortgage Interest Rate

The best mortgage rate for you will depend on your financial situation. A home loan with a shorter term may have a lower interest rate but a higher monthly payment, while a home loan with an adjustable interest rate may have a lower interest rate at first but then change annually after a set period of time. For example, a 7-year ARM has a set rate for the initial 7 years then adjusts annually for the remaining life of the loan , while a 30-year fixed-rate mortgage has a rate that stays the same over the loan term.

What Is A Discount Point

Discount points are fees you pay the lender upfront in exchange for a lower interest rate. Buying down the rate with discount points can save you money if youre planning on keeping your home for a long time. But if youre going to sell or refinance before the full loan term is up, paying more fees upfront may not make sense.

Discount points can be part of a good deal, but you need to make sure you know when they are being added to your loan. When youre comparing mortgage offers, be sure to ask if the interest rate includes discount points.

Don’t Miss: How To Get Mortgage Help From The Government