Commit To Making One Extra Payment A Year

The average American gets about $2,833 in their tax refund, according to the IRS. For most people, this is more than enough money to cover an extra mortgage payment every year.

You can put your tax return to good use and make an extra mortgage payment. On a $150,000, 30-year loan with a 4% interest rate, a single extra payment every year will help you pay off your mortgage 4 years early.

Benefits Of An Early Mortgage Payoff

There are two main benefits of paying a mortgage early less interest paid and more home equity faster.

But paying off the mortgage is not necessarily always the best choice if you have more expensive debt, like outstanding credit card balances. Or if you havent yet saved for retirement. You may also want that money to purchase additional real estate, as opposed to it being locked up in your home.

This calculator can at least do the math portion to illustrate the power of paying extra and paying off your mortgage ahead of schedule. Youll then need to weigh those savings against other options like paying your credit cards or ensuring youve saved for retirement.

In other words, make sure youre actually saving money by allocating a larger amount of money toward paying off the mortgage as opposed to putting it elsewhere.

If you want to see the payment schedule, which details every monthly payment based on your inputs, simply tick the box. This will also show you your loan balance each month along with the home equity you are accruing at an ideally faster rate thanks to those additional payments.

To determine your home equity, simply take your current property value and subtract the outstanding loan balance. For example, if your home is worth $500,000 and your loan balance is $300,000, youve got a rather attractive $200,000 in home equity!

And thats all it takes to use this mortgage calculator with extra payments. Happy mortgage saving!

Paying Off Your Mortgage Early: Is It Worth It

If you find yourself with a little extra cash at the end of the month, should you put it toward your mortgage loan or refinance to a shorter term? Theres no simple yes or no answer. There are both risks and benefits to paying off your loan early or switching loan terms, and the right decision will be different for everyone. In this section, well look at a few instances in which it makes sense to pay off your mortgage early and when it doesnt.

Get approved to refinance.

Don’t Miss: What Is My Mortgage Payment Calculator

Why Should I Get A 15

If you can afford the larger monthly payment that comes with a 15-year fixed mortgage, it can help you pay off your home, freeing up funds for retirement. You will spend less in interest over the life of the loan compared to a 30-year mortgage, and usually, a 15-year fixed mortgage means a better interest rate.

Is It More Difficult To Get A 15

Is It Harder to Qualify for a 15-Year Mortgage Loan? If you have a higher income that proves you can afford the higher payments associated with a short term mortgage loan, then it’s easy to qualify. You may also find interest rates that are between . 5 and 1% lower than they are for a 30-year mortgage.

Also Check: Which Credit Bureau Is Used For Mortgages

Most Homeowners Benefit From A Super

Adcocks point of view isnt actually unpopular. Financial experts agree that the flexibility of lower monthly mortgage payments is important for many homeowners.

Ive explained it to clients this way, says Mark La Spisa, a certified financial planner and president of Vermillion Financial Advisors in South Barrington, Illinois. If you had a 15-year mortgage and a 15-year super-duper flexible mortgage, which one do you think you would choose?

Most them then ask what a super-duper flexible mortgage entails. If you need cash, the payments can drop 20% if you want any time you want, he says, and the rate is only about a quarter of a point higher than the typical 15-year loan.

The punchline, La Spisa says, is the 15-year super-duper flexible mortgage is a 30-year mortgage that, like Adcock suggested, you pay back more quickly as your finances allow.

When your financial situation allows, you can put extra money toward your balance and pay off the loan faster as Adcock put it, turning it into a 15-year. But when money is tight, then you can take advantage of the 30-years lower payments and use the difference to help with other bills, says Greg McBride, chief financial analyst for Bankrate. Youre not locked into that large payment.

Money in the bank will pay the bills home equity will not, McBride says.

Use The Early Mortgage Payoff Calculator To Determine The Actual Savings

- This calculator will illustrate the potential savings

- Of paying off your home loan ahead of schedule

- Knowing the actual numbers can help you determine if it makes sense

- To make extra payments based on your financial goals

For example, if youre interested in paying off your mortgage off in 15 years as opposed to 30, you generally need a monthly payment that is 1.5X your typical mortgage payment.

So if youre currently paying $1,000 per month in principal and interest payments, youd have to pay roughly $1,500 per month to cut your loan term in half. Of course, thats just a ballpark estimate. It will depend on the mortgage rate and the loan balance.

This early payoff calculator will also show you how much you can save in interest by making larger mortgage payments.

You might be surprised at the potential savings, but be sure to consider where youd put that money elsewhere. It might earn a better return in the stock market or someplace else.

Don’t Miss: Do You Have To Pay Taxes On A Reverse Mortgage

How Can Making Extra Payments Help

When you make an extra payment or a payment that’s larger than the required payment, you can designate that the extra funds be applied to principal. Because interest is calculated against the principal balance, paying down the principal in less time on a fixed-rate loan reduces the interest youll pay. Even small additional principal payments can help.

Here are a few example scenarios with some estimated results for additional payments. Lets say you have a 30-year fixed-rate loan for $200,000, with an interest rate of 4%. If you make your regular payments, your monthly mortgage principal and interest payment will be $955 for the life of the loan, for a total of $343,739 . If you pay $100 extra each month towards principal, you can cut your loan term by more than 4.5 years and reduce the interest paid by more than $26,500. If you pay $200 extra a month towards principal, you can cut your loan term by more than 8 years and reduce the interest paid by more than $44,000.

Another way to pay down your loan in less time is to make half-monthly payments every 2 weeks, instead of 1 full monthly payment. When you split your payments like this, youre making the equivalent of 1 extra monthly payment a year . This extra payment may be applied directly to your principal balance. Be sure to first check with your lender if this is an option for your loan.

Maximize Your Down Payment

The best way to buy a home is with 100% down. Paying cash for a home may sound weird, but imagine all the fun youd have without a mortgage payment weighing you down.

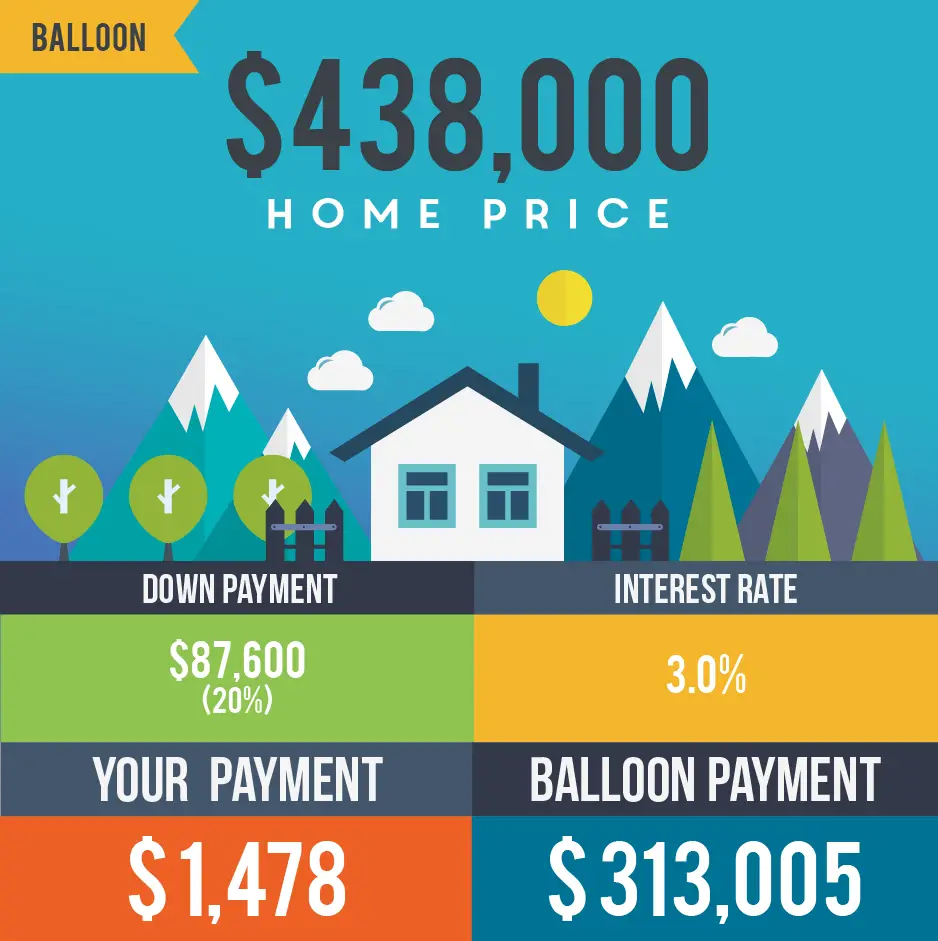

If you cant postpone the purchase until you can pay cash, plan to make a down payment of 1020% of the home price . Of course, 20% or more is better because then youll avoid paying private mortgage insurance .

PMI typically costs 0.51% of the loan amount annually. For example, on a $250,000 mortgage, PMI will cost you $1,2502,500 a year. Why give the bank extra money each month if it doesnt pay your mortgage down faster?

Keep in mind that the more cash you put down on the front end, the less money youll need to finance. That adds up to a lower mortgage payment each month, making it easier to pay off your house early.

Don’t Miss: How Long Does It Take To Get Your Mortgage Approved

Is It Wise To Pay Off My Mortgage With My 401

You might have a pile of cash sitting in your 401, but its never a good idea to use your retirement money to pay off your house. First off, youre going to need that money if you ever plan to retire. And second, youll be hit by taxes and a 10% early withdrawal penalty. So youll lose 30% or more of your money before you can even put it toward your mortgage.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

How Do I Pay Off My Mortgage Early

One way to pay off your mortgage early is by adding an extra amount to your monthly payments. But how much more should you pay? NerdWallets early mortgage payoff calculator figures it out for you.

Fill in the blanks with information about your home loan, then enter how many more years you want to pay it. The calculator not only tells you how much more to pay monthly to pay down your principal faster it also shows how much youll save in interest.

Recommended Reading: Reverse Mortgage Mobile Home

Recommended Reading: How To Calculate Percentage Of Mortgage

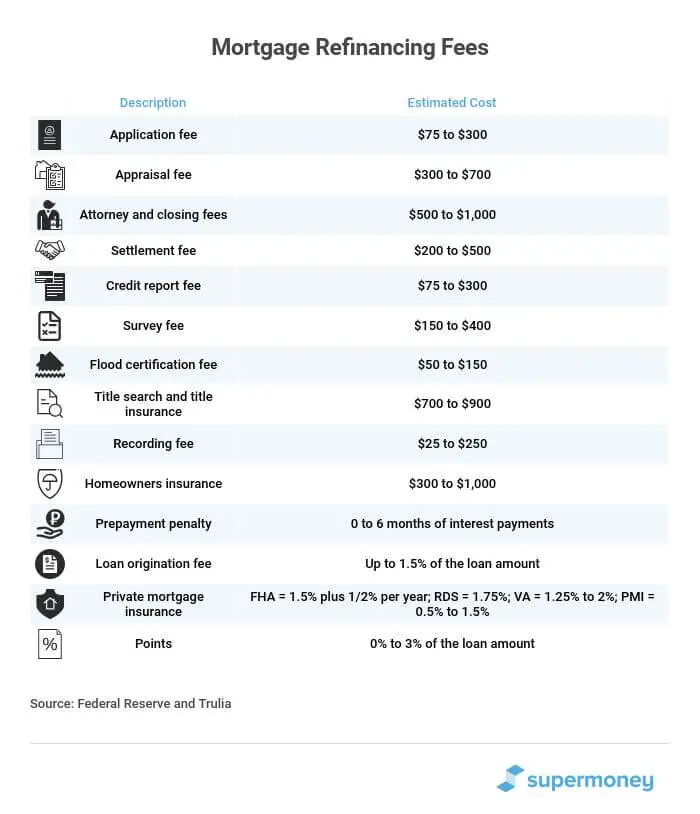

Not Asking If Theres A Prepayment Penalty

Mortgage lenders are in business to make money and one of the ways they do that is by charging you interest on your loan. When you prepay your mortgage, youre essentially costing the lender money. Thats why some lenders try to make up for lost profits by charging a prepayment penalty.

Prepayment penalties can be equal to a percentage of a mortgage loan amount or the equivalent of a certain number of monthly interest payments. If youre paying off your home loan well in advance, those fees can add up quickly. For example, a 3% prepayment penalty on a $250,000 mortgage would cost you $7,500.

In the process of trying to save money by paying off your mortgage early, you could actually lose money if you have to pay a hefty penalty.

Recommended Reading: Can You Cancel Mortgage Insurance

Can You Pay A 30

Yes. In fact, a lot of people get a 30-year mortgage with the expectation that they will pay it off in 15 years. If you are able to pay off your 30-year mortgage in 15 years, it would also be cheaper, since you would potentially save yourself 15 years worth of interest payments. Opting for that route isnt so different from choosing a 15-year mortgage in the first place, the only difference being choosing to make those added payments would be your choice entirely.

Of course, it is important to remember that paying a 30-year mortgage in 15 years is less common since financial obligations can arise at any time. You might decide you need a vacation instead of making the extra payments or that your kitchen could use an upgrade, as a couple of examples. For these reasons, rather than paying a 30-year mortgage in 15 years, it is sometimes a better idea to take out a 15-year mortgage from the start. The reason for that option is you will not be tempted to spend those funds on anything elseyou will have built-in accountability to get your home paid off more quickly.

Don’t Miss: What Is A Bad Mortgage Rate

How To Pay Off Your 30 Year Mortgage In 15 Years

When home buyers go shopping for a mortgage, 90% of them opt for a 30-year term for one simple reason: Its the most affordable home loan on the market.

That is especially true of first-time homeowners, who want the safety and security of a monthly payment they can easily handle. If you put 20% down on a $150,000 home, your monthly payment for a 30-year mortgage is only $626 a month, which probably is less than the cost of renting.

But what happens if you stumble into some extra income five years into owning the home? Suppose you get married and theres another income in the house or you rent out a spare room and suddenly there is extra money in the budget at the end of every month?

That is when its time to consider using the extra money to build equity in the home by paying off your mortgage faster.

If you already paid five years on the loan, a 15-year mortgage would raise your monthly payment to $828 month. You would save about $38,700 in interest payments and own the home free and clear 10 years faster!

Ben Keys, an assistant professor of real estate at the prestigious Wharton School of Business, likened paying off a mortgage early to giving yourself a forced savings account.

Should You Pay Off A Mortgage Before You Retire

If youre like most people, paying off your mortgage and entering retirement debt-free sounds pretty appealing. Its a significant accomplishment and means the end of a major monthly expense. However, for some homeowners, their financial situation and goals might call for keeping a mortgage while attending to other priorities.

Lets look at the reasons why you mightor might notdecide to pay off a mortgage before you retire.

Also Check: Can You Do A Reverse Mortgage On A Condo

Recommended Reading: What Mortgage Rate With 650 Credit Score

Alternatives To Paying Extra On A Mortgage:

- 529 College Savings Plan

A typical mutual fund should earn about 7% a year in the stock market and is much more liquid than home equity, meaning its easier to take the money out.

Lets say you took the $85/month put toward bi-weekly mortgage payments and instead invested that in a mutual fund. With a 7% annual gain, you could return over $104k after 30 years. Compare that against the $29k you would save with bi-weekly payments.

A 401, Roth IRA and 529 College Plan could produce similar results and have added tax advantages, though you sacrifice liquidity.

The main takeaway is that your home shouldnt be your only investment. If you are already investing long term, then it could be a good idea to pay down your mortgage. But all of this is contingent on whether your home is the only real debt.

Paying down your mortgage only makes sense if you are free and clear of other debts, Keys said. What you really need to do is think of this as a way of saving money. Ask yourself Is this a safe investment? How volatile is the housing market in my area? How much risk am I willing to take? What am I saving for next?

If you can answer those questions, hopefully that will clarify for you whether it makes sense to pay down your mortgage or put money toward other types of investments.

Own Your Home Faster And For Less

Of all the benefits to refinancing your home, paying off your mortgage in less time is the biggest. Reducing the term of your loan by refinancing can not only shave years of payments. It can save you tens of thousands of dollars in the process over the life of your loan.

Because paying off your home earlier reduces the overall amount of interest youll pay, it could let you to retire earlier, travel more, or put extra cash in your pocket. Youll increase your homes equity faster. Youll not only own your home in less time, but youll pay much less to own it. Talk to one an Ark Mortgage Advisor to see how you could benefit from refinancing your home to shorten your term.

Recommended Reading: Will Section 8 Help Pay Mortgage

Is It Smart To Pay Off Your House Early

Whether or not it is smart to pay off your house early is dependent on one key factor: the interest rate for your mortgage. During the current economic climate, however, when the COVID-19 pandemic has slowed the economy, it is a decent idea to keep your 30-year mortgage because those outside factors have pushed interest rates so low.

The best way to reduce your total interest can be to turn your 30-year loan into a 15-year loanbut you should ensure your budget allows for you to make the extra monthly payment. If you are thinking of paying off your house early, you should consider the following: if you can eliminate the debt you owe on any loan that has an interest rate higher than your mortgage if your funds would be better used paying for your retirement, like an IRA or 401k if you would feel more comfortable financially having an emergency fund, in case you fall ill or lose your job and if you should put that money toward funding your childrens college education, which is a strong investment for them and a tax benefit for you.

How To Pay Off A 30 Year Mortgage In 5 Years

How To Pay Off Your Mortgage In 5 Years

Don’t Miss: Are Low Mortgage Rates Good