Total Interest Paid On A $150000 Mortgage

Longer-term loans will always come with more interest costs than loans with shorter lifespans. For example, a 15-year, $150,000 mortgage with a 4% fixed rate would mean spending $49,715 over the course of the loan. A 30-year mortgage with the same terms, however, would cost $107,804 in interest nearly $60,000 more once all is said and done.

Enter your loan information to calculate how much you could pay

Learn: How to Buy a House: Step-by-Step Guide

How Much Is Private Mortgage Insurance

Private mortgage insurance costs vary by loan program . But in general, the cost of PMI is about 0.5-1.5% of the loan amount per year. This is broken into monthly installments and added to your monthly mortgage payment.

So for a $250,000 loan, mortgage insurance would cost around $1,250-$3,750 annually or $100-315 per month.

Some mortgage types also charge an upfront mortgage insurance fee, which can often be rolled into the loan balance so you do not have to pay it at closing.

How We Calculate How Much House You Can Afford

Our home affordability calculator estimates how much home you can afford by considering where you live, what your annual income is, how much you have saved for a down payment, and what your monthly debts or spending looks like. This estimate will give you a brief overview of what you can afford when considering buying a house.Go one step further by applying some of the advanced filters for a more precise picture of what you can afford for a future residence by including the costs associated with homeownership. The advanced options include things like monthly homeowners insurance, mortgage interest rate, private mortgage insurance , loan type, and the property tax rate. The more variables you enter into the home affordability calculator will result in a closer approximation of how much house you can afford.

Read Also: When Is Mortgage Down Payment Due

What Are Typical Closing Costs

According to Zillow.com, home buyers should expect to pay between 2 5% of the purchase price of their home in closing costs. So, if your home costs $150,000, you could pay anywhere between $3,000 and $7,500 in closing costs.

Closing costs can vary significantly depending on what state you are in. CoreLogic and Closing Corps Purchase Mortgage Closing Cost Report 2021 outlines average closing costs by state.

How To Lower Closing Costs

Closing costs are a significant expense associated with buying a home. The first critical step is to understand that closing costs will be part of the expenses that you will need to budget for. Also, there are strategies to reduce closing costs.

You will put significant effort into looking for your new home and understanding the amount you can afford on that new mortgage payment. Be sure to spend some time understanding and budgeting for closing costs as well. A good rule of thumb when shopping for your first home is to always create a budget for buying a house, build a buffer into your budget, and plan ahead for unexpected costs

Also Check: Can I Have Multiple Mortgages

Fha Mortgage Insurance Premium

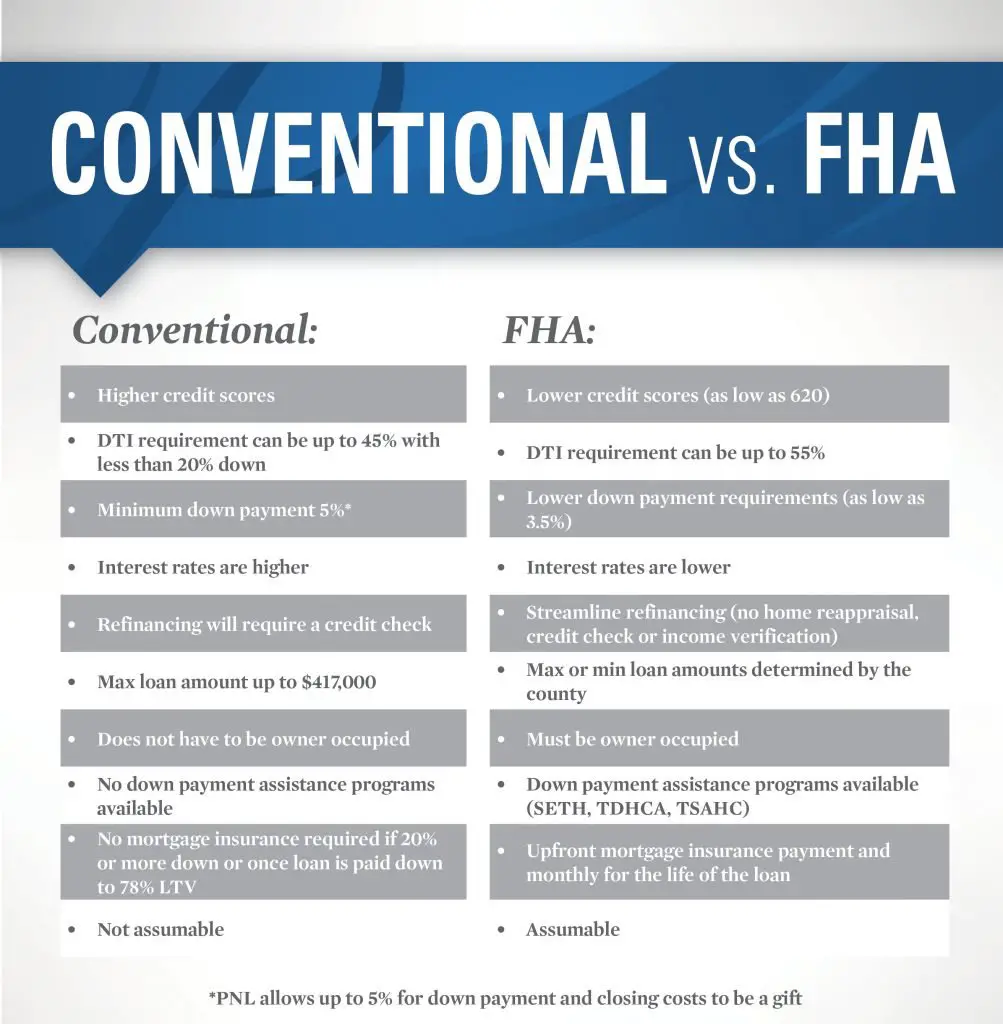

FHA loans, backed by the Federal Housing Administration, require their own type of mortgage insurance. This is known as mortgage insurance premium or MIP.

MIP charges two separate fees: an upfront payment and an annual one:

- Upfront mortgage Insurance premium costs 1.75% of the loan amount. It can be paid at closing but most home buyers roll it into the loan balance

- Annual mortgage insurance premium costs 0.85% of the loan amount per year, split up into 12 installments and paid monthly with the mortgage payment. This is due the life of the loan unless you put at least 10% down. In that case, the MIP payments will cancel after 11 years

Of course, a homeowner could refinance out of an FHA mortgage to get rid of their MIP payments. If the homes loan-to-value ratio has fallen below 80%, refinancing into a conventional loan could help eliminate MIP later on.

What Mortgage Deposit Do You Need For A Mortgage On 150k

For a 150k the mortgage deposit you will need will depend on the mortgage lenders criteria. Different mortgage lenders will each have different mortgage deposit requirements.

You can, of course, increase your mortgage deposit by using a government scheme where eligible.

The table below gives you an idea of the possible mortgage deposit requirement on a 150k mortgage:

| Mortgage deposit % | |

| 25% | 37,500 |

If you have bad credit, buying a non-standard construction house or have anything which may reduce your mortgage affordability then expect the mortgage deposit requirement from the mortgage lender to be much higher.

Read Also: Can You Put Renovation Costs Into Your Mortgage

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

How Much Does Mortgage Insurance Cost

Not every potential homebuyer can afford the traditional 20% down payment. In fact, many Americans struggle to pull together enough finances for a substantial down payment on a mortgage. However, that doesnt mean your dream home is out of reach. When that happens, potential buyers can still purchase their property with the help of mortgage insurance. Mortgage insurance is one of the ways lenders protect themselves from potential loss. And while its a common cost, it doesnt last forever. Consider consulting a financial advisor on how to make sure your mortgage doesnt disrupt your financial plan.

Also Check: How Much Mortgage Can I Afford Florida

How To Remove Pmi

There aremultiple ways to remove PMI, but they all require some contributions from the borrower. PMI for home loans can be removed in one of the following ways:

- LTV Ratio Reaches 78% If you make enough payments such that your LTV is 78%, then PMI should automatically be removed by the insurer. You can also get PMI manually removed when you have 20% ownership of the house, but you will have to reach out to your insurer to get it removed. In most cases, it takes homeowners 11 years to own enough equity in the home to get PMI removed. For example, on a $300,000 home price, if you have $234,000 outstanding in your mortgage, then you have achieved 78% LTV and PMI would be removed.

The Cost Of Private Mortgage Insurance

As of 2022, Freddie Mac estimates thatPMI costs $30 to $70 per month for every $100,000 borrowed. In other words, annual PMI premiums usually range from 0.5% to 2% of the outstanding principal. There are specific factors that may affect how much a borrower will have to pay for Private Mortgage Insurance. These factors are usually related to the risk profile of the borrower. This means that the insurer will require a higher premium if the borrower is more likely to default on their loan. A borrower should consider the following factors before getting private mortgage insurance:

Read Also: How To Remove Pmi From Mortgage Payment

Homeowners Insurance Costs By Policy Limit

Each home insurance policy comes with its own coverage limit, which is the maximum threshold for coverageessentially, the maximum amount that the company will pay when you file a claim.

This limit can start as low as $100,000, but the Insurance Information Institute recommends that you purchase a policy that offers between $300,000-$500,000 in maximum coverage.

If you choose an insurance policy with a higher limit, that will likely come with higher annual premium rates.

INSURANCE WHERE YOU LIVE

Home insurance by state.

Costs To Expect When Buying A Home In Texas

One of the first things to consider when you find a home youd like to buy is a home inspection. In Texas, expect to pay $350 to $600 for the service. If you want a termite or mold inspection or radon testing, youll pay an additional fee for each service. If youre curious about your inspectors education, Texas issues inspector licenses so the industry is regulated.

Closing costs are another expense youll have to consider before buying a home. Luckily, these fees are only charged once at the closing of the mortgage, and dont carry on annually like insurance and property taxes. On average, to cover closing costs for a home in Texas, youâll need to save around 2.1% of the purchase price. Fortunately, Texas is one of the few states that doesnt levy transfer taxes or include a state recordation tax, which will save you a percentage of overall costs.

Recommended Reading: What Is The Mortgage Rate For Bank Of America

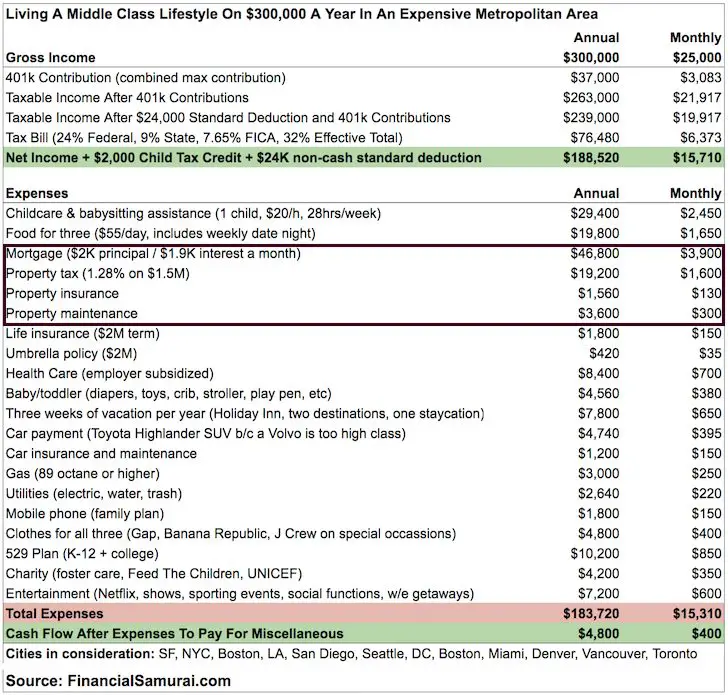

How Much Do You Need To Earn To Get A 150k Mortgage

As mentioned above the income multiple is one of the key factors a mortgage lender will consider before giving you a mortgage of 150k.

The mortgage lenders income multiple determines the maximum they may be willing to lend to you.

The income multiple below will give you an idea of what the minimum annual income you may need to earn before a mortgage lender will consider you for a 150k mortgage is.

| Mortgage multiple | |

| 5.5 | 27,272 |

As you can see from the above, the mortgage lenders income multiple can greatly affect if you can get a 150k mortgage with a particular mortgage lender.

How To Get Rid Of Fha Mortgage Insurance

One of the main ways to get rid of FHA MIP is to make at least a 10% down payment at closing. Youll still pay the premiums, but just for 11 years.

Another way to get an FHA MIP removal it is to refinance into a conventional loan however, there are several things youll need to do to prepare for a refi, including:

- Having a credit history thats free from any blemishes that could stop you from qualifying for a refinance

- Improving your credit score to 620 or higher

- Building at least 20% home equity

Still, FHA mortgage insurance may not bother you much if youre a first-time homebuyer. The benefit of making a small down payment and achieving homeownership sooner rather than saving up for a 20% down payment may outweigh the disadvantage of carrying this extra loan cost.

Also Check: How Much Mortgage Might I Qualify For

How Do You Compare Loan Offers

In any loan scenario, you have to make underlying assumptions such as:

- If you are likely to remortgage the loan again.

- When you are likely to remortgage.

- Where you think interest rates are headed.

- If you think you will sell the home soon.

- If rates head higher and your rate resets well above the initial offer, will your wages be enough to cover payments?

Look Beyond the Monthly Payment

Its important to consider the overall mortgage costs, not just the monthly payment amount. Borrowers will find interest-only payments affordable. However, compared to a full repayment mortgage, you immediately build equity in your home. This bring you closer to home ownership, stability, and grants you further life flexibility. In contrast, interest-only payments do not build equity. It does not provide financial cushion which helps protect you against shifting market conditions.

If one loan amortises and the other does not, then you have to look at how much equity you build in a home. This is a key factor in determining value. Most people also do not want to pay mortgages for the entire lifetime, or until they hit a tough patch and risk foreclosure.

Example Loan Comparison from a Reader

The key to being able to accurately compare mortgage offers is to only adjust a single variable at a time. This way you can easily see the differences between offers, instead of trying to compare apples to oranges.

The example below is based on a question from one of our users named Dan.

| Year |

|---|

can700can

How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is, unless you have enough cash to purchase a property outright, which is unlikely. Use the mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

Recommended Reading: Is A Timeshare Considered A Mortgage

Mortgage Calculations And Mortgage Considerations

Use the free online Mortgage calculator to calculate your monthly repayments, compare Mortgage repayments over different periods and define what is the most affordable option for your financial situation. The Mortgage calculator will provide you a monthly interest repayment over 1 year,2 years,3 years,4 years,5 years, 10 years and compare them to a monthly repayment period of your choosing .

How Loan Term And Interest Rates Impact Your Mortgage

The monthly amount of your mortgage payment depends on loan term and interest rate. Generally, a longer-term loan will have lower monthly payments, but at a higher interest rate, so youll end up paying more money over the life of the loan. You can build up your credit or save for a larger down payment to help qualify for a lower interest rate. A lender can also help determine your mortgage affordability, and present the best loan term and interest rate for your home.The below table demonstrates the difference between a 15 and a 30-year loan and how it would impact your monthly mortgage payment if all other variables, including interest rates, remained equal. Using a home loan of $300,000 this would be the results :

| Loan Term |

|---|

| $563,379 |

Read Also: How To Calculate Interest Payment On Mortgage

Pmi And Home Price Appreciation

Consider that todays homeowners are building wealth more rapidly than previous generations.

According to the Federal Housing Finance Agency , U.S. home prices rose 17.5% from the fourth quarter of 2020 to the fourth quarter of 2021. That translates into an average gain of $56,700 in home equity per borrower.

Whats more, Fannie Mae and Freddie Mac predict this growth trend will continue with an estimated rise of 7.4% through 2022 and 2.9% in 2023.

Whats surprising, then, is advice saying you should buy a home only when you have a 20% down payment.

Putting 20% down is less risky than making a small down payment, but its also costly.

Even strong opponents of mortgage insurance find it hard to argue against this fact: PMI payments, on average, yield a huge return on investment.

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

Read Also: Is There Interest On A Reverse Mortgage

What Is Mortgage Insurance

Mortgage insurance is a type of insurance policy that protects the lender against default on home loans. Since private mortgage insurance lowers this risk, it allows people to buy homes with down payments smaller than the traditional 20%.

Generally, conventional lenders require homebuyers who put down less than 20% to purchase PMI. The buyer then pays a regular monthly premium each month along with the mortgage payment.

However, mortgage insurance doesnt just apply to conventional loans. Borrowers of Federal Housing Administration and United States Department of Agriculture loans also have to pay a form of mortgage insurance.

Recording Fees And Transfer Taxes

Local or county governments charge fees whenever a property changes hands. The seller is usually responsible for covering transfer taxes and recording fees. Sellers may have to pay fees to the county government, state government, both or neither it all depends on your state.

Transfer taxes are usually expressed as a set number of dollars per $100,000 of the homes appraised value.

Also Check: How To Get A Mortgage After Chapter 7

Should I Avoid Private Mortgage Insurance

Private mortgage insurance is a heated topic of debate in the world of personal finance. On one hand, accepting PMI allows you to move into a home with a lower, more accessible down payment. But on the other hand, it increases your monthly mortgage payment.

People think its a waste of payment, and the extra theyre paying monthly is doing nothing for them, says Ide. This argument suggests PMI only helps the lender while increasing costs for the borrower.

However, PMI can open up access to homeownership for people who dont have a 20% down payment. And once a homeowner gets into a property, theres always the possibility of refinancing down the line, renting out a room in the home to earn passive income, or upgrading the house and making a great return on investment when they sell the home at a later date. Each situation is nuanced and specific to the individual, but some look at PMI as simply a cost that brings greater good.

PMI is therefore a good tool to have, says Ide: It makes some properties more affordable, and I dont think its that expensive for what it is.

Additionally, PMI doesnt last forever, according to Petrowski. It can be removed once you pay enough of the mortgage that you have at least 20% equity in the home.

If youre really close to saving the 20%, maybe its worth it to just wait a little bit longer and save up that extra money, Petrowski says.