How Much Does Title Insurance Cost In New York City

- On a $1 million property with a mortgage, you can expect to pay .6 percent

- You can save as much as $1,000 to $2,000 by negotiating extra charges

Here’s a tip to spot extra fees: Ask your attorney to send a copy of the title bill before closing day, and compare it to one or two quotes from other title insurance companies.

What Do You Need To Know About Pmi In Texas

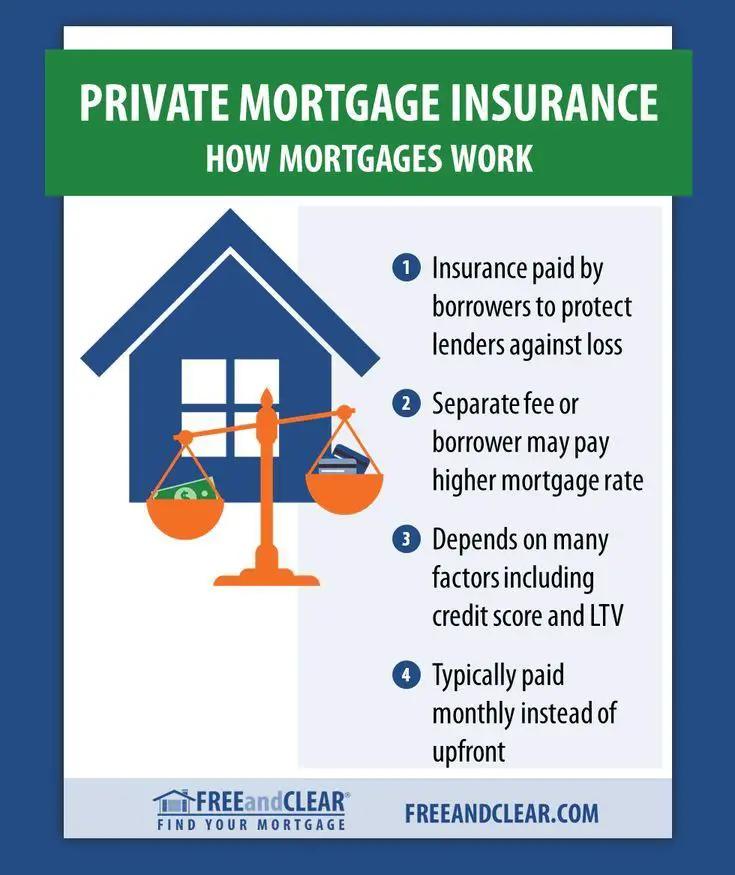

PMI, or Private Mortgage Insurance, is generally required by home loan lenders as a means of protection in the event the borrower defaults. Typically, private mortgage insurance in Texas as well as other states is required for borrowers that seek loans ranging from 80 percent to 100 percent of the purchase price.

How much does PMI cost on a home loan?

How To Calculate Your Pmi Cost

The PMI calculator starts by asking for the price of the home you want to buy and your anticipated down payment amount to calculate a down payment percentage. If this percentage is under 20%, its likely that youll have to pay for private mortgage insurance.

With this and other loan details, the calculator estimates your monthly PMI cost. The calculator also estimates the total amount youll pay for mortgage insurance until you have 20% equity and can get rid of PMI.

Follow these steps to use the calculator.

Enter the amount you plan to spend on a home. For the most accurate results, enter the amount for which youre already pre-qualified or been preapproved, but you can also enter your best guess of how much you can afford.

Enter a down payment amount. This is the amount of cash you plan to pay upfront for the home.

Enter an interest rate. If you dont yet have a personalized interest rate quote from a lender, click the link underneath the entry field to see todays average mortgage rate and use it as an estimate.

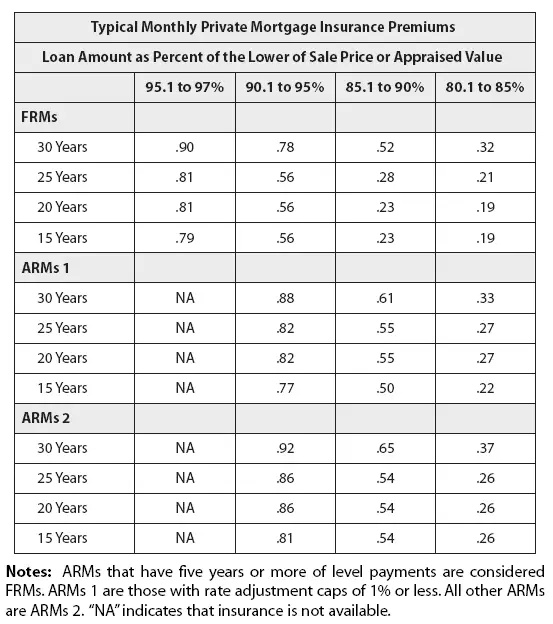

Enter a mortgage insurance rate. When shopping lenders, ask for their typical PMI rates. If youre not sure what your mortgage insurance rate will be, choose a rate somewhere in the middle of the typical range 0.58% to 1.86%.

Enter a loan term. The 30-year term is the most common, especially among first-time home buyers. With a 15-year mortgage, you’ll pay off the loan faster and pay less interest, but have higher monthly payments.

Lenders usually require

Recommended Reading: What Are Current Mortgage Rates In Oklahoma

Do Real Estate Attorneys Get Paid By Title Companies

Real estate attorneys typically work with two or three title companies that they trust to get the job done smoothly, and theyll recommend that buyers use one of them. Sometimes, real estate attorneys also pocket a big chunk of your title fees.

In NYC, a lot of attorneys have affiliated relationships with title companies, Haltman says. The attorney does none of the title work, but the title companies will open separate companies for each attorney and give them a large split of their fee. It could be 50/50.

Some real estate lawyers actually own the title company they recommend to clients.

If yours does, hes making $4,800 on title insurance on top of a $2,500 transaction fee on your $1 million purchase, Haltman says.

In either scenario, The attorney is legally supposed to disclose to the buyerbut its typically done in a form thats presented at the closing table, Haltman says, so ask up front if your attorney has any financial ties with the title company.

Trouble at home? Get your NYC apartment-dweller questions answered by an expert. Send your questions to .

For more Ask an Expert questions and answers, click here.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Recommended Reading: What Does A Mortgage Do

How To Compare Mortgage Protection Policies In Ireland

Comparing mortgage protection policies is easy with bonkers.ie.

Just fill in some simple details such as your age, the amount of cover you want, and the term the policy should run for using our online comparison service, and well compare policies from Irelands main providers and produce a quote for you in just seconds.

You can then apply online with us. Our in-house insurance specialists will look after you right until your policy has issued and in some cases we can get your policy live in less than an hour!

What Does Private Mortgage Insurance Cover

When you take out a mortgage and you cannot afford to put a 20% down payment, the lender is at risk. First, since you cannot afford to make a 20% down payment you are viewed as a riskier borrower. Secondly, when the lender has to lend you more money than they would have with the 20% down payment, a greater amount of money is put at greater risk. Therefore, lenders turn to private mortgage insurance companies to assume some of that risk.

The coverage a private mortgage insurance company offers determines what portion of the amount lost the lender will be able to recover in the case that the borrower defaults on their mortgage. For example, if the PMI provider provides 30% coverage, this means that the lender will be paid back by the insurer for 30% of the losses related to the borrowers default. These losses can include the unpaid principal balance, interest that the lender would otherwise get, and 30% coverage for the lenders costs associated with the foreclosure.

For example, imagine that you wish to purchase a $300,000 home with a 5% down payment. The coverage provided by the PMI company is 30%. If you then default on your mortgage while you still owe 90% or $270,000 to the lender, the lender would be able to recover $81,000 from PMI, instead of losing the whole amount. This can help supplement the amount recovered from aforeclosure. PMI would also cover 30% of interest loss and foreclosure costs.

You May Like: How To Get A Job In Mortgage Lending

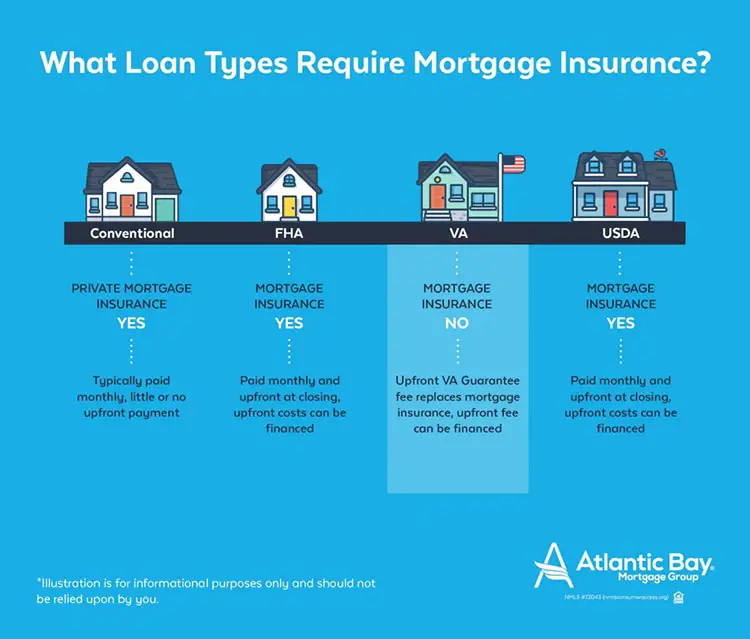

Do I Need Pmi For An Fha Loan

Mortgage insurance is different for government-backed mortgages like Federal Housing Association loans.

With an FHA loan, two types of mortgage insurance are added: an upfront mortgage insurance premium and the annual mortgage insurance premium .

According to the U.S. Department of Housing and Urban Development, UFMIP is 1.75% of the total amount of the loan. It can be paid for upfront at closing or rolled into the monthly mortgage payment. MIP is paid in monthly installments for the life of the loan. Its cost depends on the terms of the loan.

How Long Do You Have To Buy Private Mortgage Insurance

Borrowers can request that monthly mortgage insurance payments be eliminated once the loan-to-value ratio drops below 80%. Once the mortgage’s LTV ratio falls to 78%, the lender must automatically cancel PMI as long as you’re current on your mortgage. That happens when your down payment, plus the loan principal you’ve paid off, equals 22% of the home’s purchase price. This cancellation is a requirement of the federal Homeowners Protection Act, even if your homes market value has gone down.

Don’t Miss: How Much Would I Be Approved For A Mortgage Loan

How To Avoid Paying Pmi With A Piggyback Loan

If you cant gather up enough funds for a 20% down payment but are adamant about not paying mortgage insurance, a piggyback loan may be a good alternative. It involves taking out a first mortgage up to 80% of your homes value, and piggybacking a home equity loan or home equity line of credit on top of it. Heres how it works:

- Borrow 80% of your homes value with a first mortgage

- Borrow 10% of the homes value with a home equity loan or HELOC

- Make a 10% down payment

This particular example is also known as an 80-10-10 loan. If youre buying your home, theres an added bonus: The interest on both mortgages is usually tax-deductible.

Is Pmi Worth It

The answer to that question largely depends on how quickly home prices are rising in the area where you want to purchase. What PMI essentially buys you is the ability to cash in on appreciating values before youve saved the lump sum needed for a 20% down payment.

Of course, it brings other homeownership benefits, too. But, from a financial standpoint, its that early ability to benefit from home price inflation thats key. Suddenly, you see rising real estate prices as a plus, rather than something to watch with dread.

Also Check: How Long To Pay Off Reverse Mortgage After Death

When Do I Stop Paying Pmi/mip

If you have an FHA loan, you will pay PMI as long as you have the mortgage. If you have a conventional loan with PMI, then when you get your amortization to 78% of the original mortgage it will be removed automatically. If you believe that your equity has reached the 80% level with the help of appreciation, the best bet is to call your lender and see what their process is to remove the extra monthly cost. Having PMI is a reality for millions of people that may have never been able to own a home without it. If you are looking to buy and do not have 20% down payment, do not be afraid of PMI. The cost is minimal and the benefits are huge.

How Much Does Pmi Cost

PMI rates on average can range from0.55% to 2.25% of the original loan amount. At those rates, for a $300,000 30-year fixed rate mortgage, PMI would cost anywhere from $1,650 to $6,750 per year, or approximately $137.50 to $562.50 per month. PMI can be paid upfront or it is included in the monthly mortgage payments.

You May Like: How To Get Approved For Mortgage With Low Income

What Are The Different Types Of Pmi

In general, there are two types of mortgage insurance: mortgage insurance bought from the government, designed for those with FHA loans or private mortgage insurance for conventional loans which is bought from the private sector . MIP for FHA and VA loans is run differently and managed internally than private mortgage insurance, and they have their own set of rules.

Basically, the type of mortgage insurance required will depend on the type of mortgage loan you get.

Canceling Pmi On A Multi

If you have a multi-unit primary property or investment property, things work a little bit differently.

Fannie Mae lets you request cancellation of your PMI once you reach 30% equity, while Freddie Mac requires 35% equity.

Freddie Mac doesnt automatically cancel mortgage insurance on multi-unit residences or investment properties. Fannie Mae mortgage insurance cancels halfway through the loan term if you do nothing.

Read Also: Can You Get A Mortgage To Build A House

How Is Mortgage Insurance Calculated

Mortgage insurance is always calculated as a percentage of the mortgage loan amount. It is not based on the homes appraised value or purchase price.

For example: If your loan is $200,000, and your annual mortgage insurance is 1.0%, youd pay $2,000 for mortgage insurance that year. That breaks down to a payment of $166 per month.

Since annual mortgage insurance is re-calculated each year, your PMI cost will go down every year as you pay off the loan.

How Do Pmi Payments Work

PMI is usually included in your mortgage payment. You may choose to pay PMI in one lump sum at the start of your loan. Or, you can opt for your lender to cover your PMI, but that means a higher interest rate on your mortgage. Understand that if you select the lender-paid option, you may pay more interest on your loan than you would including PMI in your monthly mortgage payment or paying in full.

Also Check: Can You Write Off Mortgage Payments

How To Get Rid Of Fha Mortgage Insurance

One of the main ways to get rid of FHA MIP is to make at least a 10% down payment at closing. Youll still pay the premiums, but just for 11 years.

Another way to get an FHA MIP removal it is to refinance into a conventional loan however, there are several things youll need to do to prepare for a refi, including:

- Having a credit history thats free from any blemishes that could stop you from qualifying for a refinance

- Improving your credit score to 620 or higher

- Building at least 20% home equity

Still, FHA mortgage insurance may not bother you much if youre a first-time homebuyer. The benefit of making a small down payment and achieving homeownership sooner rather than saving up for a 20% down payment may outweigh the disadvantage of carrying this extra loan cost.

When Is Private Mortgage Insurance Required

Private mortgage insurance protects lenders in case the borrower cant afford their mortgage payments. The lender will probably require that the borrower pay mortgage insurance if they take out a mortgage and put 20% or less down for their down payment. Or, in other words, if the loan-to-value ratio is 80% or higher. Loan-to-value ratio is determined by dividing your mortgage loan amount by the appraised property value of your home.

When a mortgage lender gives you a loan, theyre essentially investing in you. They trust that youll pay back the loan, with interest. A down payment is one way borrowers establish trust with a lender, so when a down payment is 20% or lower, the lender might want some additional insurance to protect their investment.

Its worth noting that private mortgage insurance does not protect you from foreclosure if you fail to make your loan payments.

Also Check: How Much Mortgage Can I Get With 50k Salary

Recommended Reading: How Does The Fed Rate Affect Mortgage Rates

Fhas Mortgage Insurance Premium Through The Years

The FHA has changed its MIP multiple times in recent years. Each time the FHA raised its MIP, FHA loans became more expensive for borrowers. Each increase also meant some prospective borrowers werenât able to qualify for or afford the higher monthly mortgage payments due to the MIP.

In January 2015, the FHA reversed course and cut its MIP to 0.85 percent for new 30-year, fixed-rate loans with less than 5 percent down. The FHA projected that this decrease would save new FHA borrowers $900 per year, or $75 per month, on average. The actual savings for individual borrowers depends on the type of property they own or purchase, their loan term, loan amount and down payment percentage.

Changes in FHAâs MIP apply only to new loans. Borrowers whoâve closed their loans donât need to worry that their MIP will get more expensive later.

Recommended Reading: What Is Coe In Mortgage

How Do I Make Pmi Payments

There are three primary schedules for making PMI payments. The options available to you will vary depending on your lender.

- Monthly: The most common method is paying PMI premiums monthly with your mortgage payment. This boosts the size of your monthly bill, but allows you to spread out the premiums over the course of the year.

- Upfront: Another option is an upfront PMI payment, meaning you pay the full premium amount for the year all at once. Your monthly mortgage payment will be lower, but you need to be ready for that larger annual expense. Additionally, if you move sometime in the year, you might not be able to get part of your PMI refunded.

- Hybrid: The third option is a hybrid one: paying some upfront and some each month. This can be useful if you have extra cash early in the year and want to limit your monthly housing costs.

Ask your lender if you have a choice for your payment plan, and decide which option is best for you.

Don’t Miss: What Is Included In Apr For Mortgage

The Different Types Of Mortgage Insurance

While there are a few different types of mortgage insurance, they all essentially work the same way. Mortgage insurance protects the lender in the event that you default on your loan. If you have mortgage insurance, it will typically be required by your lender if you put less than 20% down on your home.There are two main types of mortgage insurance: private mortgage insurance and mortgage insurance premium . PMI is typically required if you have a conventional loan and put less than 20% down on your home. MIP is required if you have an FHA loan regardless of how much money you put down.Mortgage insurance is something that is typically required by lenders in order to protect them in the event that borrowers default on their loans. There are two main types of mortgage insurance- private mortgage insurance and mortgage insurance premium . PMI is usually required when borrowers take out a conventional loan and they putting less than 20% down as a down payment for their home. MIP is often times required when borrowers take out an FHA loan, no matter how big or small the down payment for their home may be.Monthly payments for both PMI and MIP can sometimes be added into the overall monthly payment for the loan, or they could be paid separately each month.

Also Check: How Much A Month Would A 200k Mortgage Cost