What Are The Differences Between A Fixed Rate And Adjustable Reverse Mortgage Loan

Adjustable rate reverse mortgages give seniors the most flexibility in loan payment options and can often unlock more equity than fixed rate mortgages. While fixed-rate reverse mortgages offer the benefit of locked rates, they only allow borrowers to access their loan in one lump sum, up-front payment. Because HECM guidelines mandate only 60% of a borrowers available credit line can be accessed from their reverse mortgage in the first year, fixed-rate mortgages also limit the amount homeowners can borrow. No payments are made in the second year from a fixed rate HECM. Only with the adjustable rate HECM can you receive any proceeds in year 2.

If I Have A Reverse Mortgage Loan Will My Children Or Heirs Be Able To Keep My Home After I Die

It depends. If you have a Home Equity Conversion Mortgage your heirs will have to repay either the full loan balance or 95% of the homes appraised valuewhichever is less.

Upon the death of the borrower and Eligible Non-Borrowing Spouse, the loan becomes due and payable. Your heirs have 30 days from receiving the due and payable notice from the lender to buy the home, sell the home, or turn the home over to the lender to satisfy the debt. However, it may be possible for the timeline to be extended up to a year so that your heirs can sell the home or obtain financing to purchase the home. Your heirs can consult a HUD-approved housing counseling agency or an attorney for more information.

Read Also: What Fees Are Involved In Refinancing A Mortgage

Alternatives To A Reverse Mortgage

If youre not sold on taking out a reverse mortgage, you have options. In fact, if youre not yet 62 , a home equity loan or HELOC is likely a better option.

Both of these loans allow you to borrow against the equity in your home, although lenders limit the amount to 80 percent to 85 percent of your homes value, and with a home equity loan, youll have to make monthly payments. With a HELOC, payments are required once the draw period on the line of credit expires.

The closing costs and interest rates for home equity loans and HELOCs also tend to be significantly lower than what youll find with a reverse mortgage.

Aside from a home equity loan, you could also consider:

Also Check: Is Fha Mortgage Insurance For The Life Of The Loan

How Much Do You Have To Put Down For Reverse Mortgages

The amount you need to put down for reverse mortgages depends on your loan type.

A HECM for Purchase loan typically requires paying about 50 percent of the homes purchase price in cash. For example, if you want to buy a home for $200,000, youll need to pay $100,000 out of pocket.

A HECM for Purchase does not require a down payment. The equity in the home determines the loan amount for a traditional reverse mortgage. There is no equity in a reverse purchase because the property has not been purchased, but there should be equity to cover interest accrued.

Using A Reverse Mortgage To Pay For Assisted Living

A reverse mortgage is a loan that allows homeowners to tap into the equity in their homes and use it to pay for things like home repairs, medical expenses, or in this case, the cost of assisted living. The loan is repaid when the home is sold after the borrower dies or moves out permanently.

Generally, a reverse mortgage is only an option if a spouse or other co-borrower on the loan still lives in the home.

Contact a reverse mortgage specialist in your area for more information about how reverse mortgages work and whether or not you qualify for one.

Read Also: What Is A Satisfaction Of Mortgage

If You Are The Borrowers Spouse

Here is a brief look at the three basic categories into which spouses fall. Please note that the following rules apply to HECMs originated on or after Aug. 4, 2014. The rules are different in some respects for older HECMs. You can find both sets of rules on the Consumer Financial Protection Bureau website.

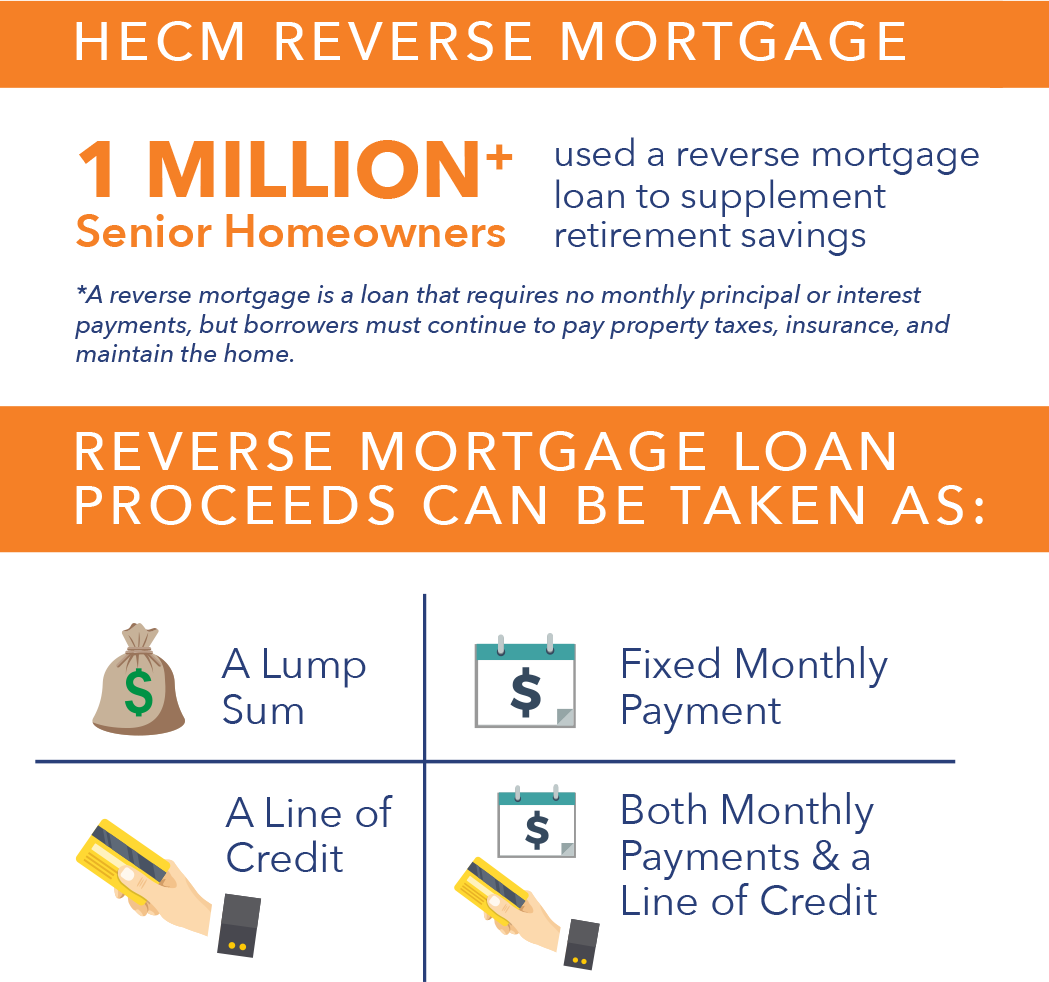

How Reverse Mortgages Work

Youâre probably wondering how itâs possible to get a mortgage with no payments. Normally, when you take out a mortgage loan, the bank gives you a lump sum that you pay back with interest over time. At the end of the term, the loan is paid down to $0.

A reverse mortgage works in, well, reverse. The lender actually makes payments to you: You can choose to receive a lump sum, monthly payments, a line of credit or some combination of those options.

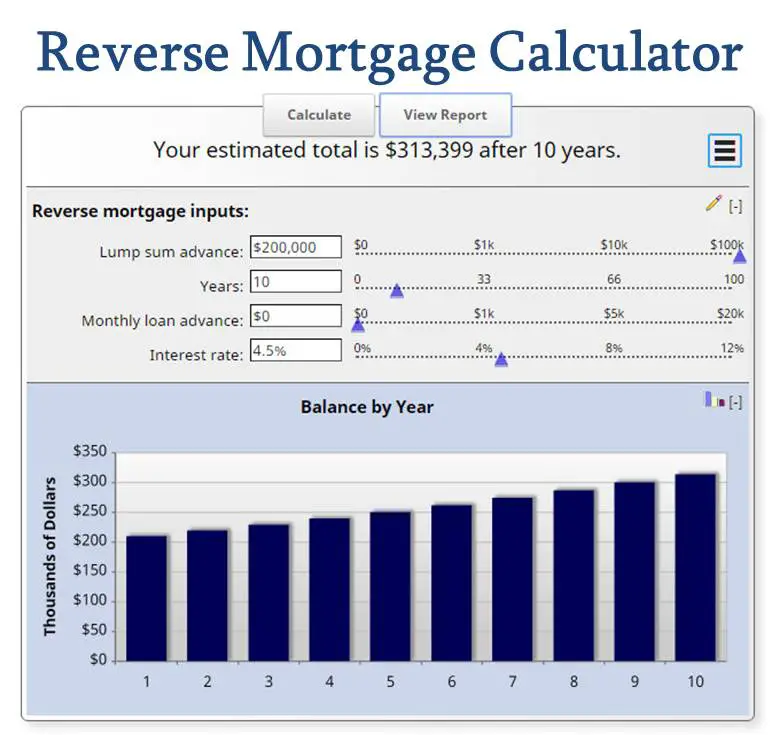

The interest and fees associated with the loan get rolled into the balance each month. That means the amount you owe grows over time, while your home equity decreases. You get to keep the title to your home the whole time, and the balance isnât due until you move out or die.

When that time comes, proceeds from the homeâs sale are used to pay off the debt. If thereâs any equity left over, it goes to the estate. If not, or if the loan is actually worth more than the house, the heirs arenât required to pay the difference. Heirs also can choose to pay off the reverse mortgage or refinance if they want to keep the property.

Read Also: What’s The Mortgage On 500k

To Qualify For A Reverse Mortgage In Canada The Following Factors Are Assessed:

- You and your spouses age

- Location of your home

- Appraised value of your home

- The condition of your home

- Your home equity

The Reverse Mortgage Facts You Need to Know!

Read about the pros and cons of a reverse mortgage to see if it is right for you.

In 2 minutes find out how you can qualify for tax-free cash with the CHIP Reverse Mortgage® and get your FREE guide today!

Your Heirs Could Inherit Less

Homeownership is a key path to building generational wealth. However, a reverse mortgage usually requires the home to be sold to repay the debt. When you die, heirs will be required to pay the full loan balance or 95% of the homeâs appraised value, whichever is less. Usually, that means selling the home or turning the property over to the lender to satisfy the debt.

Not to mention, a reverse mortgage eats away at your homeâs equity. By the time it needs to be paid off, there may not even be any equity to be left to your heirs.

You May Like: When Do You Pay Pmi On A Mortgage

Reverse Mortgages Can Be A Way To Keep Seniors In Their Homes

Whether its the familiar environment, the surrounding community or the sentimental value of the home itself, many reasons contribute to seniors wanting to stay in their homes for as long as possible. A reverse mortgage can help them do that.

Reverse mortgages are loans that allow seniors to tap into the home equity theyve built without having to sell their property. And unlike traditional loans, where you make monthly payments against the principal and interest, with a reverse mortgage you only repay the principal and interest once you sell or move permanently from the home.

How Home Sale Proceeds Sharing Works

The provider pays you a reduced amount for the share you sell. How much you get for the share depends on your age.

Terms and conditions vary. The provider may offer a rebate feature. This means you get some money back if you sell your home earlier than expected. The amount you get back depends on when you sell your home and how much you got for your sold share. You may also have the option to buy back the sold share later, if you wish.

For example, suppose your home is currently worth $500,000 and you sell a 20% share of the future value. Depending on your age, the provider may offer you $37,000 to $78,000 to buy that share today. When you sell your home, the provider receives their share of the proceeds. Say in 20 years time you sell your home for $800,000. The provider gets 20% of the sale price , minus any rebate .

Also Check: How To Apply For A House Mortgage

You May Like: Why Do I Need Mortgage Insurance

What Home Sale Proceeds Sharing Costs

It’s not a loan, so you don’t pay interest. You pay a fee for the transaction and to get your home valued . You may also have to pay other property transaction costs.

Home sale proceeds sharing costs you the difference between:

- what you get for the share of your home you sell now, and

- what it’s worth in the future

The more your home goes up in value, the more the provider will receive when you sell it.

Get the provider to go through projections with you, showing the impact over time. Get a copy of this to take away, and discuss it with your adviser. Ask questions if there’s anything you’re not sure about.

What Happens & Whos Responsible For A Reverse Mortgage After Death

Theres a lot to think about following the death of a loved one. Is there a will in place that legally states who in the family receives certain belongings? Does it mention how to go about dividing the profits from a future real estate transaction?

One thing that can really complicate this process is if your loved one had a reverse mortgage on their house. While they hopefully enjoyed years of mortgage-free living thanks to a significant amount of equity in their home, its now up to you to determine the next steps. Yet many heirs in this situation have no idea how to handle a reverse mortgage, let alone the possible implications if they fail to act swiftly.

Lets take a closer look at what heirs can expect when it comes to this type of loan.

Recommended Reading: Where Can I Find My Mortgage Account Number

Recommended Reading: A Better Mortgage Company Reviews

Use Your Right Of Rescission

Reverse mortgages have a 3-day period directly after you close on your loan in which you can cancel the transaction with no penalty. This is known as the right of rescission and it allows you to change your mind should you have buyers remorse right after you sign the closing documents. Within 20 days, the lender will return all fees, closing costs and unused funds paid by the borrower.

If you decide to practice your right of recission, you will need to inform your lender in writing. Remember, this window of time lasts up to only 3 days after you close. After that, you cannot cancel your loan without penalty.

How Long Does A Reverse Mortgage Take To Close

How long does a reverse mortgage take to close? Can it be completed in a month or less?

We have had many reverse mortgage closings that have been completed within 30 days but I have to be honest with you, all the stars have to align just right or it will not close in the 30 days and especially at this time of the year. Let me explain

Every borrower has to have the HUD mandated counseling before we can do very much with your loan and many states also have counseling requirements. If your counseling has not been completed, then you have to get an appointment and that is sometimes easier to do than others.

Right after HUD made the announcement that they were going to change the program in 9/2017, counseling agencies were jammed and appointments were harder and harder to get. It is much easier to get an appointment now, but in some states, there are other requirements such as no application until after the counseling or as in CA, a 7 day cooling off period during which time the lender can do nothing on the loan.

That means if you live in California or one of these other states and it takes just 2 days to get an appointment, you are dead in the water until after you receive the counseling and in California, thats 9 days into that 30 day time frame already and the lender has not been able to really start the loan by law.

Also Check: How Do I Know If My Mortgage Is Fha

Eligibility For Government Programs

Some government programs, such as Medicaid , are based on the applicant’s liquid assets. If you have reverse mortgage money, it may therefore affect your eligibility for some of these programs by turning illiquid home equity into liquid cash.

Before signing a contract, check with an independent financial professional to ensure that the cash flow from a reverse mortgage will not impact other funds you receive.

Can You Refinance A Reverse Mortgage

Yes, you can refinance a reverse mortgage. Because of the origination fee, upfront mortgage insurance premium, and other closing costs, refinancing a reverse mortgage should be reserved for situations where a spouse needs to be added to the loan, more equity is needed, or the interest rate can be lowered substantially.

Also Check: Can You Add To Your Mortgage For Renovations

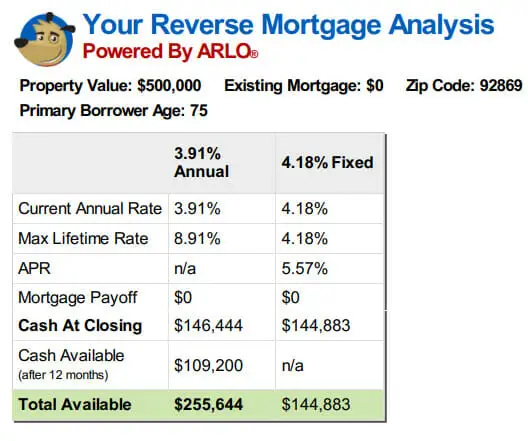

How Much Money Can You Get From A Reverse Mortgage

The amount of money you can get from a reverse mortgage depends upon a number of factors, according to Boies, such as the current market value of your home, your age, current interest rates, the type of reverse mortgage, its associated costs and your financial assessment.

The amount you receive will also be impacted if the home has any other mortgages or liens. If theres a balance from a home equity loan or home equity line of credit, for example, or tax liens or judgments, those will have to be paid with the reverse mortgage proceeds first.

Regardless of the type of reverse mortgage, you shouldnt expect to receive the full value of your home, Boies says. Instead, youll get a percentage of that value.

Could You Lose Your Home

With a reverse mortgage, you keep the title of your home, which means youll have to continue to pay ongoing expenses like property taxes, utilities, HOA fees, and maintenance. If you fail to pay some of these expenses, you could face foreclosure. These ongoing expenses often become more costly over time and can be somewhat unpredictable, so its important to think carefully about whether youll be able to afford the necessary bills in the coming years.

Don’t Miss: Is Quicken Loans A Mortgage Broker Or Lender

How Do You Pay Back A Reverse Mortgage

A reverse mortgage is commonly paid back by using the proceeds from the sale of the home. If the loan comes due because youve passed away, your heirs will be responsible for handling the repayment and will have a few options for repaying the loan:

- Sell the home and use the proceeds to repay the loan.

- Refinance into a traditional mortgage or use their finances to purchase the home for the amount due on the loan or 95% of the appraised value of the home whichever is less.

- Sign the title over to the lender and walk away from the loan.

How The Home Equity Access Scheme Works

The loan is secured against real estate you, or your partner, own in Australia. You can choose how much you offer as security.

You can choose the amount you get paid fortnightly. Your combined pension and loan payments cannot exceed 1.5 times the maximum fortnightly pension rate.

From 1 July 2022, you can get an advance payment of your loan . This is in addition to, or instead of, your fortnightly loan payments. Taking up this option may reduce the fortnightly loan payment you get for the next year .

There is a maximum amount of loan you can borrow over time. This is based on your age and how much you offer as security for the loan.

You May Like: Should I Refinance My Mortgage Or Make Extra Payments Calculator

Who Can Get A Reverse Mortgage

They are only available to homeowners who are at least 62 years old. Borrowers have to meet other requirements, according to the Consumer Finance Protection Bureau. They must:

- live in the home they’re borrowing against

- either own the home outright or have a low balance on the mortgage, which they will need to pay off when they close on the reverse mortgage

- not owe any federal debt

- keep their home in good condition

- get counseling from a reverse mortgage counseling agency that’s approved by the United States Department of Housing and Urban Development

There’s also an application process. The bank will want to make sure you have enough equity in your house and that you have sufficient funds to keep paying costs like property taxes, homeowner’s insurance, homeowner association fees, and general upkeep of the property.

My Lender Told Me I Would Have To Complete Repairs To My Home Before They Will Give Me A Reverse Mortgage Should I Do It

Sometimes a lender will include certain repair and/or maintenance provisions in the terms of a reverse mortgage. This is because, for the majority of reverse mortgages, the loan is secured by the value of the home. As such, a lender is within their rights to require a consumer to make certain repairs as a prerequisite to obtaining a reverse mortgage. In addition, after a reverse mortgage is made, a lender may require a borrower to maintain the home through ongoing repairs. If a borrower is unwilling or unable to complete such repairs, a lender may arrange for such repairs and pay for it with loan proceeds.

You May Like: Can You Refinance Mortgage And Add Credit Card Debt

What Is A Home Equity Conversion Mortgage

A Home Equity Conversion Mortgage, more commonly referred to as a HECM, is the most frequently used type of reverse mortgage. It is insured by the Federal Housing Administration protecting borrowers from any interruption in loan proceeds, should the lending institution become unable to fulfill loan obligations.