Pmi And Home Price Appreciation

Consider that todays homeowners are building wealth more rapidly than previous generations.

According to the Federal Housing Finance Agency , U.S. home prices rose 17.5% from the fourth quarter of 2020 to the fourth quarter of 2021. That translates into an average gain of $56,700 in home equity per borrower.

Whats more, Fannie Mae and Freddie Mac predict this growth trend will continue with an estimated rise of 7.4% through 2022 and 2.9% in 2023.

Whats surprising, then, is advice saying you should buy a home only when you have a 20% down payment.

Putting 20% down is less risky than making a small down payment, but its also costly.

Even strong opponents of mortgage insurance find it hard to argue against this fact: PMI payments, on average, yield a huge return on investment.

Example Of Private Mortgage Insurance

Assume you have a 30-year, 2.9% fixed-rate mortgage for $200,000 in New York. Your monthly mortgage payment would be $832.00. If PMI costs 0.5%, you would pay an additional $1,000 per year or . As a result, your monthly PMI payment would be $83.33 each month, or , increasing your monthly payment to $915.33.

You may also be able to pay your PMI upfront in a single lump sum, eliminating the need for a monthly payment. The payment can be made in full at the closing or financed within the mortgage loan. In many cases, this is the more affordable option as long as you plan on staying in the home for at least three years. For the same $200,000 loan, you might pay 1.4% upfront, or $2,800.

However, it’s important to consult your lender for details on your PMI options and the costs before making a decision.

Today’s Best Mortgage And Refinance Rates January 19th 2023

Jeff Ostrowski covers mortgages and the housing market. Before joining Bankrate in 2020, he wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

You May Like: How Do You Prequalify For A Mortgage

How Long Do You Have To Pay For Mortgage Insurance

With PMI, the borrower pays monthly insurance premiums until they have at least 20% equity in their home. If they fall into foreclosure before that, the insurance company covers part of the lenderâs loss.

With MIPs, youâll pay for as long as you have the loan unless you put down more than 10%. In that case, youâll pay premiums for 11 years.

How To Get Rid Of Mortgage Insurance

The process for getting rid of mortgage insurance depends on which type you have.

For a conventional mortgage with borrower-paid monthly premiums, you can get rid of PMI after you accumulate 20% equity by paying down your mortgage. You can also get rid of PMI if:

- Your homeâs value goes up enough to give you 25% equity, and youâve paid PMI for at least two years

- Your homeâs value goes up enough to give you 20% equity, and youâve already paid premiums for five years

- You put extra payments toward your loan principal to reach 20% equity faster than you would have through regular monthly payments

Youâll need to ask your lender in writing to waive PMI if one of these things happens. For cancellation based on an increase in home value, your lender may require an appraisal. Youâll also need to be current on your payments and have a good payment history for the lender to grant cancelation at this point.

The passive way to get rid of insurance is to make mortgage payments every month until you have 22% equity. Federal law requires your lender to cancel PMI automatically at this point as long as youâre current on payments.

Another way you might get rid of PMI is through refinancing to get a lower rate or shorter term. You wonât need PMI on the new loan if your homeâs value has gone up enough or you do a cash-in refi, which means making a lump-sum payment at closing to lower your mortgage balance.

Also Check: How Many Years Can I Knock Off My Mortgage Calculator

Mortgage Protection Insurance Vs Pmi

Mortgage protection insurance is quite different from private mortgage insurance .

PMI protects lenders from financial loss in case they foreclose on you. You may be required to buy PMI if you purchase a home with a small down payment — typically less than 20% of the home’s value.

MPI protects you or your loved ones. It ensures your mortgage is paid off if you pass away. Or it enables you to keep making monthly payments if you become disabled. It’s optional coverage.

MPI also differs from homeowners insurance. Most lenders require homeowners insurance too. Homeowners insurance protects your home and its contents. It covers financial costs if your home is destroyed or damaged by a covered event.

Understanding Private Mortgage Insurance

PMI benefits the lender , and it can add up to a sizable chunk of your monthly house payments. Typically, you send one payment to your lender each month to cover both the mortgage and the insurance premium. PMI rates can range from 0.5% to 1.5% of the loan amount on an annual basis. A mortgage calculator can be a good resource to budget for the monthly cost of your payment.

Your PMI rate will depend on several factors, including the following.

Investopedia / Julie Bang

You May Like: How A Reverse Mortgage Works After Death

Are There Advantages To Paying Pmi

In some cases, purchasing PMI may help you qualify for a mortgage that you wouldnt otherwise be able to get. Lenders may be more inclined to offer a mortgage to borrowers who have lower credit scores or are unable to pay 20% down if they pay PMI. You may also be able to get a lower interest rate than you would without it.

Private Mortgage Insurance Example

Lets take a second and put those numbers in perspective. If you buy a $300,000 home, you could be paying somewhere between $1,500 $3,000 per year in mortgage insurance. This cost is broken into monthly installments to make it more affordable. In this example, youre likely looking at paying $125 $250 per month.

Recommended Reading: How To Become A Mortgage Broker In Florida

Next Steps Next Steps

How Much Is Pmi

The average cost of private mortgage insurance, or PMI, for a conventional home loan ranges from 0.58% to 1.86% of the original loan amount per year, according to the Urban Institute’s Housing Finance Policy Center. The amount varies in part by credit score. Borrowers with lower credit scores pay more for PMI than borrowers with higher credit scores. The calculator estimates how much you’ll pay for PMI, which can help you determine how much home you can afford.

At those rates, PMI on a $300,000 mortgage would cost $1,740 to $5,580 per year, or $145 to $465 per month.

You May Like: Can I Use Land As Collateral For A Mortgage

Mortgage Insurance Protects The Lender Not You

Mortgage insurance, no matter what kind, protects the lender not you in the event that you fall behind on your payments. If you fall behind, your credit score may suffer and you can lose your home through foreclosure.

There are several different kinds of loans available to borrowers with low down payments. Depending on what kind of loan you get, youll pay for mortgage insurance in different ways:

Is Mortgage Insurance A Bad Thing

Private mortgage insurance is usually required if you put less than 20% down on a house.

Many homebuyers try to avoid PMI at all costs. Why? Because unlike homeowners insurance, mortgage insurance protects the lender rather than the borrower.

But theres another way to look at it.

Mortgage insurance can put you in a house a lot sooner. You might pay more than $100 per month for PMI. But you could start gaining tens of thousands per year in home equity.

For many people, PMI is worth it. Its a ticket out of renting and into equity wealth.

In this article

You May Like: A& m Mortgage Merrillville Indiana

Is Mortgage Life Insurance The Same As Mortgage Loan Insurance

No, these are two totally different policies. A mortgage loan insurance policy covers the lender should you default on your mortgage. This policy is often mandatory if you put less than 20% down on your home. A mortgage life insurance policy is a completely optional insurance plan that pays off your outstanding mortgage balance if you pass away.

What Factors Into Your Mortgage Insurance Rate

Heres how these variables factor into your mortgage insurance rate:

- The size of the loan: Obviously, 1% or so of a larger loan corresponds to a larger monthly premium than it would for a smaller loan.

- Down payment amount: Mortgage insurance is required when the down payment is small in order to protect the lender. You wont have to pay it if you put 20% down on a home.

- LTV: The cost of your mortgage insurance varies based on that loan-to-value ratio, or the amount of money a borrower owes on the mortgage compared to the homes value.

- Your credit score: Borrowers with higher credit scores will have lower mortgage insurance rates.

- Your loan term: Shorter loan terms will have higher monthly insurance payments.

- How much coverage is being provided on the home: More coverage means higher payments.

Recommended Reading: Is It A Good Idea To Pay Off Mortgage Early

What Are Mortgage Rates

Mortgage rates are the costs associated with taking out a loan to finance a home purchase. Because properties cost so much, most people cant pay for them with cash, so they opt to stretch the payments over long periods of time, often as much as 30 years, to make the regular monthly payments more affordable.

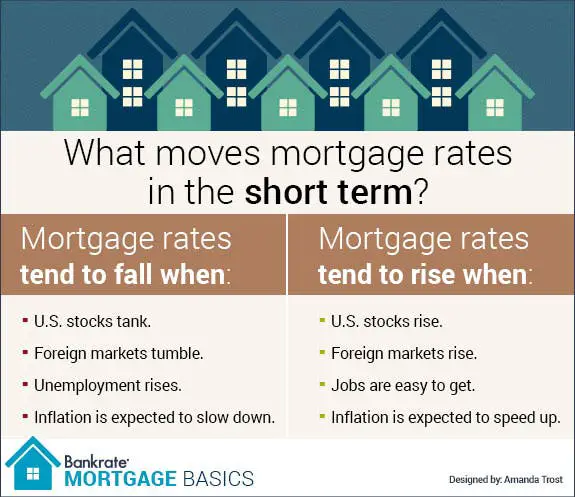

When interest rates rise, reflecting changes in the economy and financial markets, so too do mortgage ratesand vice versa.

Is Pmi Bad For Homeowners

Paying monthly PMI might sound like a tough deal. But the upside is, mortgage insurance gives you a fast track to homeownership.

Without mortgage insurance, many people would have to wait years to save up for a bigger down payment before buying a house. Those are years they could have spent investing in their home and building equity, rather than paying rent to a landlord each month.

Plus, most borrowers can eventually cancel their PMI. So youre not stuck with the added fee forever. Its a temporary cost that can have very long-term rewards.

Read Also: Do Any Mortgage Lenders Use Fico 8

Why Can Mortgage Life Insurance Cost So Much

Mortgage life insurance is expensive because, unlike other types of life insurance, mortgage life insurance premiums aren’t based on your health. This type of insurance is not fully underwritten.

Underwriting means the insurance company asks about your health and decides, based on their own data, how risky you are to insure. Even if it is underwritten, The Globe and Mail reports,

âMortgage life insurance is typically underwritten post-claim. That means that eligibility is often only determined when it comes time for a payout. And people can be denied at that point.â

Skipping underwriting and getting mortgage insurance could be a good option if you have a pre-existing condition that would make regular life insurance very expensive or challenging. But if you’re relatively healthy, which most people are, you won’t get a cheaper rate from mortgage life insurance.

Relatively healthy people can get lower premiums with term life insurance in Canada.

Types Of Mortgage Insurance

There are four kinds of PMI:

- Borrower-paid monthly. This is just what it sounds likeâthe borrower pays the insurance monthly typically as part of their mortgage payment. This is the most common type.

- Borrower-paid single premium. Youâll make one PMI payment up front or roll it into the mortgage.

- Split premium. The borrower pays part up front and part monthly.

- Lender paid. The borrower pays indirectly through a higher interest rate or higher mortgage origination fee.

You might choose one type of PMI over another if it would help you qualify for a larger mortgage or enjoy a lower monthly payment.

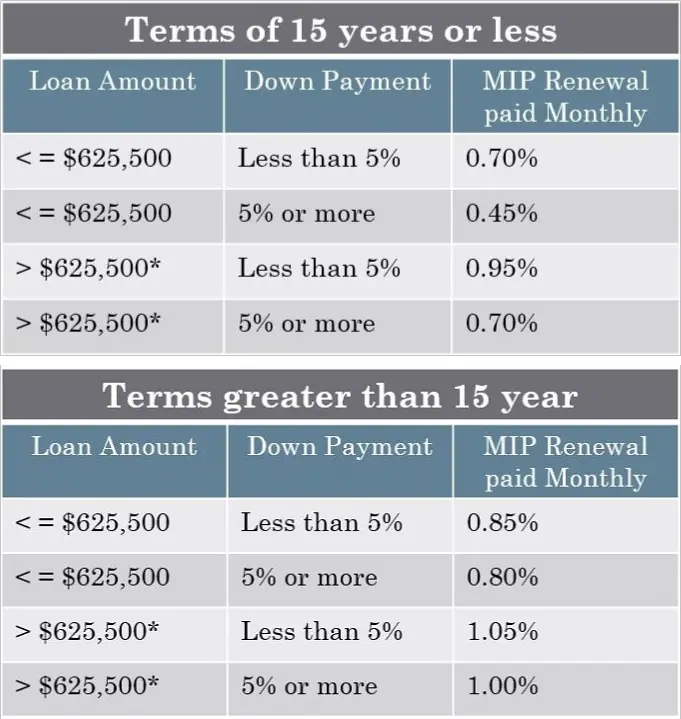

Thereâs only one type of MIP, and the borrower always pays the premiums. But FHA loans donât just have monthly MIPs. They also have an up-front mortgage insurance premium of 1.75% of the base loan amount. In this way, the insurance on an FHA loan resembles split-premium PMI on a conventional loan.

You May Like: Is 4.5 A Good Mortgage Rate

When Should You Lock In Your Mortgage Rate

When you receive a mortgage loan offer, a lender will usually ask if you want to lock in the rate for a period of time or float the rate. If you lock it in, the rate should be preserved as long as your loan closes before the lock expires.

If you donât lock in right away, a mortgage lender might give you a period of timeâsuch as 30 daysâto request a lock, or you might be able to wait until just before closing on the home.

Once you find a rate that is an ideal fit for your budget, itâs best to lock in the rate as soon as possible, especially when mortgage rates are predicted to increase. While itâs not certain whether a rate will go up or down between weeks, it can sometimes take several weeks to months to close your loan.

If you donât lock in your rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement in order to lower your interest rate costs.

How Long Do I Have To Pay Pmi

Under Federal law, if you meet certain conditions, you may be able to request cancellation of PMI once your loan-to-value ratio reaches 80% . PMI may also be automatically terminated by your lender when your LTV reaches 78% or the loan reaches the midpoint of its repayment schedule.

Its important to note that mortgage insurance cant be canceled on FHA loans.

Don’t Miss: How To Shave Years Off Your Mortgage

Benefits Of Mortgage Insurance

While mortgage insurance primarily benefits the lender, it does serve a purpose for the borrower because it allows you to get a mortgage with limited down payment savings. Putting down 20 percent can be challenging, especially with home values on the rise, so by paying for mortgage insurance, you can still get a loan without needing a large down payment.

Waiting until you have a 20 percent down payment also runs the risk of missing out on favorable mortgage rates. Mortgage insurance offers the ability to get those rates now, meaning you can save on interest over time, despite borrowing more money with a smaller down payment at first.

However, there are downsides to mortgage insurance, as well, mainly that its an extra expense you wouldnt otherwise have to pay, and that it can be difficult to get out of if you have an FHA loan.

How Long Do You Have To Buy Private Mortgage Insurance

Borrowers can request that monthly mortgage insurance payments be eliminated once the loan-to-value ratio drops below 80%. Once the mortgage’s LTV ratio falls to 78%, the lender must automatically cancel PMI as long as you’re current on your mortgage. That happens when your down payment, plus the loan principal you’ve paid off, equals 22% of the home’s purchase price. This cancellation is a requirement of the federal Homeowners Protection Act, even if your homes market value has gone down.

Read Also: What Is A Good Dti For A Mortgage

Do I Need Mortgage Insurance

You can generally avoid paying for mortgage insurance if you make at least a 20% down payment when you buy a home. There are also some lenders and government programs that offer mortgages with lower down payments and no mortgage insurance requirement, although they may be more expensive in other ways.

Whats A Good Mortgage Rate

Mortgage rates can change drastically and oftenâor stay the same for many weeks. The important thing for borrowers to know is the current average rate. You can check Forbes Advisorâs mortgage rate tables to get the latest information.

The lower the rate, the less youâll pay on a mortgage. Depending on your financial situation, the rate youâre offered might be higher than what lenders advertise or what you see on rate tables.

If youâre hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

Don’t Miss: What Is The Hiro Mortgage Program

How To Estimate Your Mortgage Insurance

Its not easy to calculate mortgage insurance yourself, but its helpful to get a sense of your general range to guide your expectations.

So lets say that a typical mortgage insurance rate ranges from 0.5% to 1%. To secure the home, you want to borrow $150,000. Youll likely pay somewhere between $750 and $1,500 every year in mortgage insurance.

Of course, if youre putting more money down closer to 20% and you have a higher credit score, the rate will likely be a bit lower. Likewise, if youre putting down less and have lower credit, your rate could be on the higher end up to 2.25%.

To get a closer estimate based on your custom specs, try plugging your data into this online mortgage insurance calculator