Should You Pay Off A Mortgage Before You Retire

If youre like most people, paying off your mortgage and entering retirement debt-free sounds pretty appealing. Its a significant accomplishment and means the end of a major monthly expense. However, for some homeowners, their financial situation and goals might call for keeping a mortgage while attending to other priorities.

Lets look at the reasons why you mightor might notdecide to pay off a mortgage before you retire.

Also Check: Can You Do A Reverse Mortgage On A Condo

Why Shouldnt You Pay Off Your Mortgage Early

Homeowners who havent fully funded their retirement accounts, who dont have an emergency fund, or who have other debt with high interest rates may not want to pay off a mortgage early. Also, those who think they can earn a better return on their money with investments may not want to pay off their mortgage early.

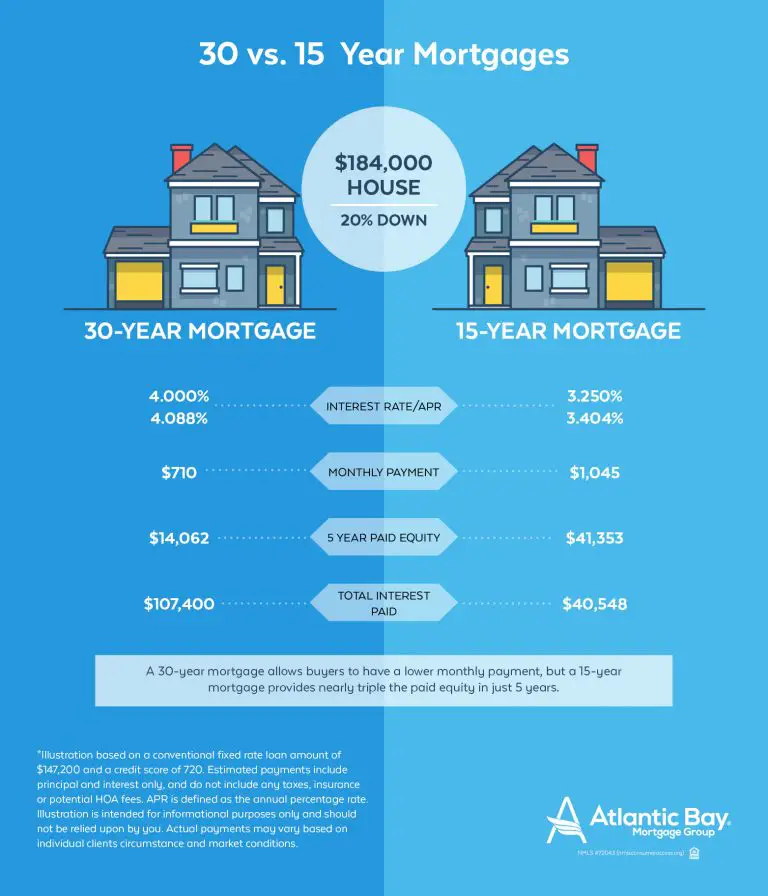

Considering A 15 Year Mortgage

With interest rates at record lows, youre probably thinking about refinancing your mortgage to save money. If you currently have a 30 year loan, you may have trouble deciding whether you should refinance into a 15 year mortgage or stick with a 30 year term.

Switching to a 15 year mortgage will enable you to pay off your home faster and save more money on interest. But refinancing into a shorter-term loan may raise your monthly mortgage payments and make them harder to afford.

To help you determine which loan term is best for you, here are the main pros and cons of 15 year mortgages.

You May Like: What Bank Gives The Best Mortgage Loans

You May Like: How Much Income For A 250k Mortgage

Refinanceor Pretend You Did

Another way to pay off your mortgage early is to trade it in for a better loan with a lower interest rate and a shorter termlike a 15-year fixed-rate mortgage. Lets see how this would impact our earlier example. If you keep the 30-year mortgage, youll pay more than $158,000 in total interest over the life of the loan. But if you switch to a 15-year mortgage with a lower interest rate, youll save almost $100,000and youll pay off your home in half the time!

Sure, a 15-year mortgage will come with a bigger monthly payment. But if it fits within your housing budget, itll totally be worth it! And hey, maybe youve boosted your income or lowered your cost of living since you first took out your mortgagethen youd definitely be able to handle the bigger payment.

You can refinance a longer-term mortgage into a 15-year loan. Or if you already have a low interest rate, save on the closing costs of a refinance and simply pay on your 30-year mortgage like its a 15-year mortgage. What if you already have a 15-year mortgage? If you can swing it, imagine increasing your payments to pay it off in 10 years!

How Can I Pay Off My 30 Year Mortgage In 10 Years

How to Pay Your 30-Year Mortgage in 10 Years

Read Also: How To Estimate Mortgage Loan Approval

Most Homeowners Benefit From A ‘super

Adcock’s point of view isn’t actually unpopular. Financial experts agree that the flexibility of lower monthly mortgage payments is important for many homeowners.

“I’ve explained it to clients this way,” says Mark La Spisa, a certified financial planner and president of Vermillion Financial Advisors in South Barrington, Illinois. “If you had a 15-year mortgage and a 15-year super-duper flexible mortgage, which one do you think you would choose?”

Most them then ask what a “super-duper flexible” mortgage entails. “If you need cash, the payments can drop 20% if you want any time you want,” he says, “and the rate is only about a quarter of a point higher” than the typical 15-year loan.

The punchline, La Spisa says, is the “15-year super-duper flexible mortgage” is a 30-year mortgage that, like Adcock suggested, you pay back more quickly as your finances allow.

When your financial situation allows, you can put extra money toward your balance and pay off the loan faster as Adcock put it, turning it into a 15-year. But when money is tight, then you can take advantage of the 30-year’s lower payments and use the difference to help with other bills, says Greg McBride, chief financial analyst for Bankrate. You’re not locked into that large payment.

“Money in the bank will pay the bills home equity will not,” McBride says.

Add All Fixed Costs And Variables To Get Your Monthly Amount

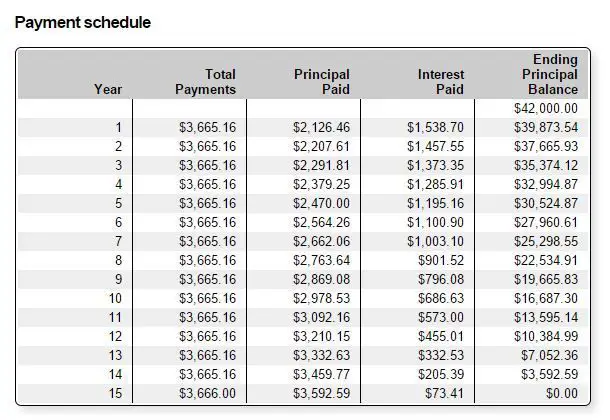

Figuring out whether you can afford to buy a home requires a lot more than finding a home in a certain price range. Unless you have a very generous and wealthy relative who’s willing to give you the full price of your home and let you pay it back without interest, you can’t just divide the cost of your home by the number of months you plan to pay it back and get your loan payment. Interest can add tens of thousands of dollars to the total cost you repay, and in the early years of your loan, the majority of your payment will be interest.

Many other variables can influence your monthly mortgage payment, including the length of your loan, your local property tax rate and whether you have to pay private mortgage insurance. Here is a complete list of items that can influence how much your monthly mortgage payments will be:

Don’t Miss: Can You Get A Mortgage Loan With No Credit

Make Sure You Can Pay More

Before you begin paying off your mortgage sooner than the agreed-upon term, you need to look at what your bank will allow you to do. Some banks penalize you for paying extra and you should be aware of what those additional fees are. The only way to get a loan paid off in half the time is to pay twice as much, so if there is anything in the contract that says you cant do that you will be unable to proceed under your current agreement.

Not Asking If Theres A Prepayment Penalty

Mortgage lenders are in business to make money and one of the ways they do that is by charging you interest on your loan. When you prepay your mortgage, youre essentially costing the lender money. Thats why some lenders try to make up for lost profits by charging a prepayment penalty.

Prepayment penalties can be equal to a percentage of a mortgage loan amount or the equivalent of a certain number of monthly interest payments. If youre paying off your home loan well in advance, those fees can add up quickly. For example, a 3% prepayment penalty on a $250,000 mortgage would cost you $7,500.

In the process of trying to save money by paying off your mortgage early, you could actually lose money if you have to pay a hefty penalty.

Recommended Reading: Can You Cancel Mortgage Insurance

This Is The Key To Paying Off Your Mortgage Early

If you are a first time home buyer and wondering what type of mortgage you should choose, ideally, you want a 15 year fixed rate mortgage over a 30 year one. The payments are higher, so you need to make sure you can handle the monthly costs. Your target should be about 25% of your monthly earnings. You can offset the monthly mortgage payment by putting more money down, but that all depends on what you have saved. The reason for applying for a 15-year mortgage rather than a 30-year mortgage is that you are out of debt in half the time and you pay less money in interest.

A 15-year mortgage is not always the best idea because you have to be practical in assessing what you can afford. If you bite off more than you can chew, you will wind up suffering from repercussions that far outway the money saved on interest payments. However, be cautious about choosing a 30-year mortgage too hastily. Lots of people opt for the 30-year plan with the idea that they will pay it off in 15. However, its very uncommon that they actually accomplish this. With that said, If you find yourself in a 30-year mortgage and you want to pay it down in half the time, there are some measures you can take to reach that end goal of paying off your mortgage and lowering the amount of interest you pay. Heres a quick guide on how to pay off a 30-year mortgage in 15 years.

Youll Pay Off Your House In Half The Time

Guess what? If you get a 15-year mortgage, itll be paid off in 15 years. Why would you choose to be in debt for 30 years if you could knock it out in only 15 years?

Just imagine what you could do with that extra money every month when your mortgage is paid off. Thats when the real fun begins! With no debt standing in your way, you can live and give like no one else.

Recommended Reading: What Is The Monthly Mortgage On A 350 000 Home

Recommended Reading: How Much Should I Mortgage

Whats The Difference Between 15

The 30-year fixed-rate mortgage is the most common mortgage loan in the United States, but it is not your only choice.

The 15-year fixed rate mortgage is a popular substitute for the traditional 30-year option. The main difference between the two is the monthly payments. Monthly payments for a loan with a 15-year duration are higher than those for a loan with a 30-year tenure. Theyll save tens of thousands of dollars over the course of their mortgage by taking advantage of a shorter term and a cheaper interest rate.

In the beginning, a more significant portion of your monthly mortgage payment would go toward interest. The interest rate on a 30-year mortgage is higher than that on a 15-year mortgage. Therefore the former will cost the homeowner more money over time.

Note: Borrowers who dont expect to stay in their homes for very long may want to look at adjustable-rate mortgages instead of fixed ones because of their attractively low-interest rates at the outset.

How Much Would A 1% Rate Difference Save You On A 30

A 1% difference in mortgage rate for a 30-year mortgage could add up to tens of thousands of dollars in savings over the lifespan of the loan.

For example, if you purchase a $300,000 home with a 20% down payment at 4.5% interest, you would pay $437,794 over the life of the loan. With just a 1% rate decrease , you would pay $388,170which is a total savings of about $50,000.

You May Like: What Happens When You Mortgage A House

Best To Save Money Over Time: 15

The 15-year mortgage may be best for those who wish to spend less on interest, have a generous income, and also have a reliable amount in savings. With a 15-year mortgage, your income would need to be enough to cover higher monthly mortgage payments among other living expenses, and ample savings are important to serve as a buffer in case of emergency.

Are Biweekly Mortgage Payments A Good Idea

Biweekly mortgage payments, or half-payments made every two weeks, will add a full mortgage payment every year. Using this method can take a few years off your mortgage.

SoFi MortgagesTerms, conditions, and state restrictions apply. Not all products are available in all states. See SoFi.com/eligibility for more information.SoFi Loan ProductsSoFi loans are originated by SoFi Bank, N.A., NMLS #696891 . For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.Financial Tips & Strategies: The tips provided on this website are of a general nature and do not take into account your specific objectives, financial situation, and needs. You should always consider their appropriateness given your own circumstances.Tax Information: This article provides general background information only and is not intended to serve as legal or tax advice or as a substitute for legal counsel. You should consult your own attorney and/or tax advisor if you have a question requiring legal or tax advice.SOHL0322023

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

Home Loans General Support:

- Mon-Fri 6:00 AM 6:00 PM PT

- Closed Saturday & Sunday

- Mon-Thu 8:00 AM 8:00 PM EST

- Fri 8:00 AM – 7:00 PM EST

- Closed Saturday & Sunday

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

You May Like: Does Rocket Mortgage Do Manufactured Homes

Can You Pay A 30

Yes. In fact, a lot of people get a 30-year mortgage with the expectation that they will pay it off in 15 years. If you are able to pay off your 30-year mortgage in 15 years, it would also be cheaper, since you would potentially save yourself 15 years worth of interest payments. Opting for that route isnt so different from choosing a 15-year mortgage in the first place, the only difference being choosing to make those added payments would be your choice entirely.

Of course, it is important to remember that paying a 30-year mortgage in 15 years is less common since financial obligations can arise at any time. You might decide you need a vacation instead of making the extra payments or that your kitchen could use an upgrade, as a couple of examples. For these reasons, rather than paying a 30-year mortgage in 15 years, it is sometimes a better idea to take out a 15-year mortgage from the start. The reason for that option is you will not be tempted to spend those funds on anything elseyou will have built-in accountability to get your home paid off more quickly.

Benefits Of Paying Mortgage Off Early

Many people struggle when deciding whether to pay off their mortgage or build up savings, but in the long run, the benefits of getting free from that mortgage really shine through. For one, having one debt paid off means being able to handle any short-term debts such as credit cards. You also end up saving money if you pay off your mortgage earlier, avoiding additional interest that would have otherwise accrued. Your financial stability is bolstered by cutting out these future payments and also by your ability to better endure turbulent housing market conditions.1

Recommended Reading: What Is The Mortgage Rate In Florida

How Much Extra Do I Pay On My Mortgage Each Month

Even paying $20 or $50 extra each month can help you to pay down your mortgage faster. For example, if you have a 30-year $250,000 mortgage with a 5 percent interest rate, you will pay $1,342.05 each month in principal and interest alone.

How much money can you save with 15 year mortgage?

If you pay $500 a month extra for 15 years, you will save a total of $73,689.54 in interest. Thats more than one-third of the cost of the home originally. If your house costs more or your interest rate his higher, the savings would add up even more.

What Happens If I Pay An Extra $100 A Month On My Mortgage

In this scenario, an extra principal payment of $100 per month can shorten your mortgage term by nearly 5 years, saving over $25,000 in interest payments. If you’re able to make $200 in extra principal payments each month, you could shorten your mortgage term by eight years and save over $43,000 in interest.

Don’t Miss: Is Paying Points On A Mortgage Worth It

How Much Would A 30

How to pay off a 30-year mortgage in 15 years: If you want to cut your mortgage term in half, simply figure out what the 15-year payment would be, then make that payment each month until the mortgage is paid in full. In general, this is about 1.5X the 30-year payment.

Is it cheaper to pay off a 30-year mortgage in 15 years?

Because a 30-year mortgage has a longer term, your monthly payments will be lower and your interest rate on the loan will be higher. But because the interest rate on a 15-year mortgage is lower and youre paying off the principal faster, youll pay a lot less in interest over the life of the loan.

How can I pay off my 30-year mortgage in 10 years?

How to Pay Your 30-Year Mortgage in 10 Years

There Are Other Ways To Pay Down Your Mortgage Faster

If your goal is to pay down your mortgage faster, you can do that with a 30-year loan by simply making extra payments whenever youre able. If you make enough extra payments over your loan term, you can easily shave off time from your loan, even as much as 15 years.

The catch with this strategy is that youll still pay a somewhat higher interest rate on the 30-year mortgage compared to a 15-year note.

If you do make extra payments, make sure you indicate that these payments are to go toward your loan principal. Your Caliber Loan Consultant can show you how to do that.

Recommended Reading: What Would My Mortgage Be With Taxes And Insurance

Jumbo Loan Interest Rate Declines

The current average rate you’ll pay for jumbo mortgages is 6.88 percent, a decrease of 43 basis points from a week ago. Last month on the 15th, the average rate for jumbo mortgages was above that, at 7.14 percent.

At today’s average rate, you’ll pay $657.26 per month in principal and interest for every $100,000 you borrow. That’s down $28.99 from what it would have been last week.