What Is A Verification Of Rent

A verification of rent, or VOR, is a form that is filled out by your landlord or rental management company, that shows your rental history. A verification of rent will include:

- Your correct physical address

- Your landlord or rental management companys contact information

- How long you have been renting

- How much your rent is

- How often you are late on your rent payments

A verification of rent is generally on requested on files that are going through manual underwriting.

- A manual underwrite is done on loans that doe not pass through typically Fannie Mae or Freddie Mac guidelines, but that can still be approved with extra stipulations.

To obtain a verification of rent, your loan officer will send the VOR form to your landlord or other person in charge of your rental and ask that it be filled out and returned.

If youre being asked to provide a verification of rent, its very likely that youll be asked to show that you have a couple of months of reserves saved in your bank account.

How Does Renting Affect A Mortgage Application

Many people rent for a period of time before buying their first home, whether thats to allow them time to save up a deposit, or as an opportunity to live with a partner before committing to a long-term home together.

Lenders understand this and assuming you would give up your rental property when you buy a home, the rent wont need to be considered when the lender calculates your affordability, meaning there will be no negative impact on your application.

As much as renting wont negatively impact your application, however, there is no hard and fast rule to say that it will directly benefit your application either. Most lenders wont take your ability to pay x amount of rent as proof that you can afford to pay x amount of mortgage, and there are a number of reasons for that.

What Does A Rent Payment Cover

Now let’s contrast mortgage costs with what it takes to rent. A major difference between buying and renting is the deposit requirement. Landlords vary, of course, and most of my rental experience has been with either individuals who own and rent out homes or with very small property management companies. I have always been required to pay a refundable deposit on a rental, and occasionally a smaller nonrefundable amount for cleaning and maintenance after my lease ends and I move out. I’ve also always been required to give the first month’s rent upon signing a lease.

This is different from buying a house, which usually requires a larger down payment that is applied to the total cost of your home, and your mortgage is used to finance the rest of that cost. While there are programs offering mortgages for no down payment or a very small down payment , you will have to pay for additional mortgage insurance to protect your lender, rather than you.

Ideally, home maintenance and repair costs should be paid by your landlord. The higher amount of your rent payment compared to a mortgage payment reflects this. And while it is highly recommended that renters carry renters insurance, the cost of it is much lower than homeowners insurance, which insures the entire property, inside and outside.

Also Check: What Is A Good Home Mortgage Rate

How Does Rent History Affect Your Mortgage Approval

Does rental history affect your mortgage approval? This question is a little tricky, because there are a couple different scenarios that can decide whether it will affect your approval or not.

Easily put, your rental history does not always affect your mortgage approval but in certain situations it CAN affect your ability to obtain a loan.

Most rental payments are not reported to your credit, so lenders arent seeing it unless they implicitly ask to see it via a verification of rent. So in the case of good rental history, it doesnt necessarily help your application if you are an automated underwriting candidate. If you are a manual underwrite, then yes, good rental payment history will allow you to obtain a loan!

Now, derogatory rental history is a different ball game. If you are currently renting and are asked to obtain a verification of rent, but have a history of late payments, you may need to get back on track with paying your rent on time before buying a home.

Late or missed payments reflect to your lender that you do not consistently pay your housing payment on time, which really is their main concern.

Continually paying your rent on time each month so that you can have a full year with no late payments is key in obtaining a mortgage through a manual underwrite.

How To Fix Rental History Report Mistakes

One small mistake on a rental history report can cost an applicant a lease. An incorrect date, for instance, could erroneously indicate a late rent payment. Its imperative to check even the most minor details of the report for inaccuracies. Follow these simple steps to dispute incorrect information on a rental history report.

You May Like: What Does Cash Out Mortgage Mean

Why Fannie’s Move Should Help Homebuyers

Despite consistent rent payments being considered a relatively reliable indicator of trustworthiness and financial stability, fewer than 5% of renters see their rent history reported on their credit reports, Fannie Mae says.

That often leads to borrowers having much shorter credit histories, something that works against them when they apply for mortgages. When you don’t have an established track record as a borrower, lenders have little evidence of your ability to repay creditors and little incentive to offer you a favorable mortgage rate.

Adding 12 prime examples of responsible behavior to your credit history every year that is, monthly rent payments could change that.

According to Fannie Maes own research, lenders factoring in first-time homebuyers’ histories of consistent rent payments in the past would have resulted in more borrowers qualifying for mortgages.

In a recent sample of mortgage applicants who had not owned a home in the past three years and did not receive a favorable recommendation through , 17% could have received an ‘Approve/Eligible’ recommendation if their rental payment history had been considered,” the company says.

Only consistently on-time rent payments will be factored into your evaluation as a borrower. Missed payments will not have a similarly negative effect, Fannie Mae says in a news release.

When Is Rental Income Accepted For Underwriting

If you already own the rental and can document the income that came from it, your income is considered real rather than projected by the lender. Real rental income will be considered by underwriters.

A bank could look at two years of your tax returns to see how much proven income has been generated from your leases.

For your personal tax returns to be sufficient per Fannie Mae youll need to file IRS Form 1040, Schedule E. If you file a business tax return, youd fill out the Rental Real Estate Income and Expenses of a Partnership or an S Corporation form, which is also known as IRS Form 8825.

Fannie Mae will also likely require that an appraisal report is conducted to estimate the propertys market value. If you have a one-unit rental property, this will require having an appraiser fill out a Single-Family Comparable Rent Schedule . For two- to four-unit properties, the appraiser should fill out Form 1025 the Small Residential Income Property Appraisal Report.

Read Also: What Do You Need To Refinance Mortgage

How Does Rent Affect Your Mortgage Loan Approval

When you apply for a mortgage, your lender looks at many things: your credit score, credit history, debt-to-income ratio, and proof of income, for example. Your rental history may also impact a lenders decision, especially with new Fannie Mae guidelines released in September 2021.

Under the new lending guidelines, Fannie Mae will now consider rental history as part of the underwriting process. This might sound surprising, as its commonly believed that this was already the case. But while some lenders have considered rental history in the past, it has never been a requirement.

Here are more details on the new Fannie Mae guidelines for rental history and how it impacts your loan eligibility.

What Happens At The End Of My Trial

If you do nothing, you will be auto-enrolled in our premium digital monthly subscription plan and retain complete access for CA$95 per month.

For cost savings, you can change your plan at any time online in the Settings & Account section. If youd like to retain your premium access and save 20%, you can opt to pay annually at the end of the trial.

You may also opt to downgrade to Standard Digital, a robust journalistic offering that fulfils many users needs. Compare Standard and Premium Digital here.

Any changes made can be done at any time and will become effective at the end of the trial period, allowing you to retain full access for 4 weeks, even if you downgrade or cancel.

Recommended Reading: What Is Included In Mortgage Closing Costs

How A Broker Can Help You Secure A Mortgage As A Tenant

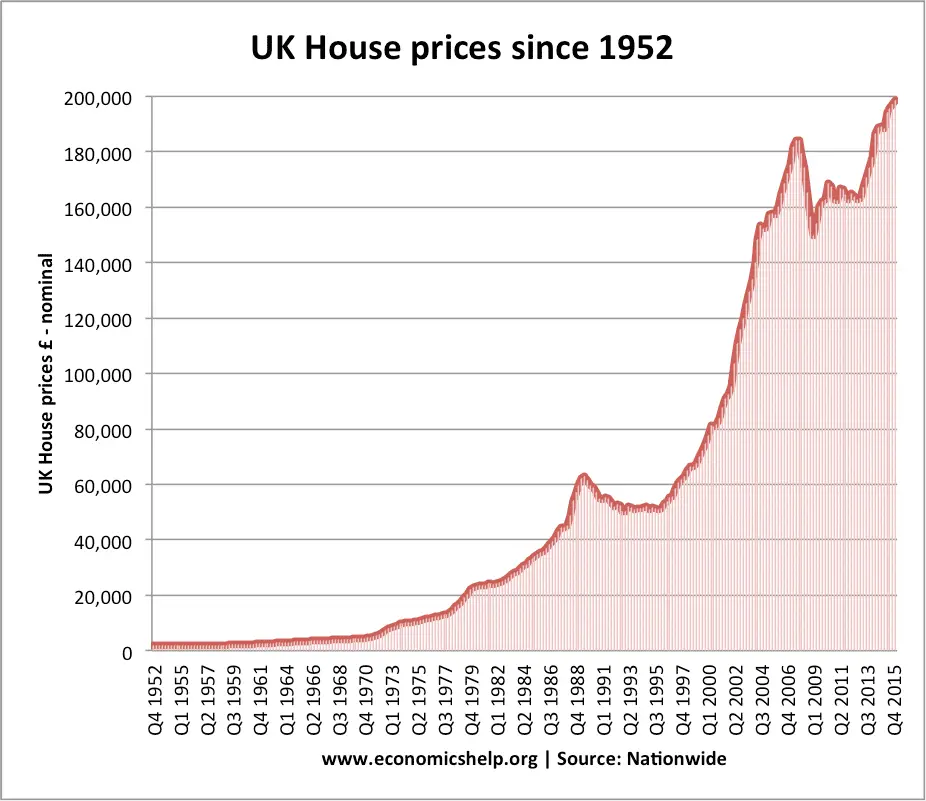

Many of todays first-time buyers are in a unique position whereby they are prisoners of the rental market. The struggle to save a high enough deposit and the fact that responsibly maintaining rental payments has little to no impact on your ability to qualify for a mortgage makes it increasingly difficult to find a solution.

The good news is, with the right advice, it can be absolutely possible to get onto the property ladder as a tenant, and brokers that specialise in supporting first-time buyers will be well-placed to help you. They will be able to recommend those lenders that are more sympathetic to the needs of first-time buyers and, if you only have a small deposit, they can look at a wide range of suitable mortgage schemes, based on your individual circumstances.

We know it’s important for you to have complete confidence in our service, and trust that you’re getting the best chance of mortgage approval at the best available rate. We guarantee to get your mortgage approved where others can’t – or we’ll give you £100*

Positive Rent Payment History Guidelines

- Must be a first-time home buyer and loan has to be a purchase transaction

- Must have been renting for at least 12 months with payment of $300+ per month

- Must purchase a principal residence

- Must have a credit score

- Lender must obtain a 12-month VOA of bank statement data to verify payments

In order to potentially qualify using positive rental history, youll need to meet the guidelines above.

They include being a first-time home buyer, having a credit score, paying rent of at least $300 for the past 12 months, and the transaction being a purchase .

Assuming you meet that criteria, the lender must obtain a 12-month VOA from an authorized DU validation service asset verification report vendor.

If Desktop Underwriter initially finds that the loan isnt eligible for sale to Fannie Mae, the system will check if a 12-month history of on-time rental payments would change that outcome.

Assuming it would, Fannie Mae would let the lender know, and they could then request borrower permission to access their bank statements.

This vendor would then send a text or email to the customer to obtain consent in order to access that data.

The key will be using a mortgage originator that is already partnered with one of these vendors, as few mortgage originators use them due to privacy concerns, per the Urban Institute.

So if you think youre on the cusp of approval, and rent history could help, make sure the lender you use is set up to take advantage of this new process.

Also Check: What Documents Are Needed To Get A Mortgage

A No Genuine Savings Solution

A tenant rental history form confirms how much you pay in rent and demonstrates your ability to save money.

If youve been paying your rent on time and in full, you may be in a position to borrow anywhere between 90-95% of the purchase price.

However, not all rental history letters will be accepted. Most lenders will only accept a rental reference letter from your property manager and not from a landlord.

Use Your Existing Proof

Gather together your cancelled checks or money order receipts. Written rent receipts are usually acceptable as long as they include the date, amount of rent you paid and the name and signature of the person receiving your rent. If you dont have a rental agreement, you can use these documents to show your history as a renter. Cancelled checks should note in the memo section that the payments went to rent.

Read Also: What Are 30 Year Mortgage Rates Based On

How Does A Gift Of Equity Work

Sometimes there is an opportunity to purchase a home from a family member. Not only that, but it may be sold at a discounted purchase price to the family member. Bonus! In a case like this, the seller may actually gift the equity to the buyer. Basically, on paper, the equity is used as the buyers down payment and/or closing costs. In many cases, a buyer may not have to bring any of their own money to closing. With enough equity, even the seller may not have to bring money to closing. Talk about a win-win!

When using a gift of equity purchase, there are certain requirements to follow.

Contact An Expert To Learn More About Rental History Reports

Rental applications take a lot of work, including dealing with rental history reports. Rent Safe is a digital service that helps renters easily submit their applications for rentals , and it lets landlords streamline their steps to screen potential tenants.

Our user-friendly dashboard allows for one-click submissions that take most of the hassle out of the process. Call Rent Safe today to get help with your rental applications.

Also Check: What Is A Mortgage Bond

Landing A Mortgage Is About To Become Easier If You Made On

With homes for sale in short supply and prices climbing higher and higher, becoming a first-time homebuyer is tough enough as it is.

But if you have a limited credit history, many lenders will use that fact to charge you a higher interest rate on your mortgage so your foray into the housing market will feel like its over before you’ve even had a chance to be outbid on your first 20 homes.

Now, one of the countrys biggest mortgage players wants to change that, by rewarding responsible renters with expanded access to affordable mortgage loans.

Paying your rent every month may not feel like its getting you any closer to being a homeowner. But in just over a month, that might actually be the case.

How To Use Rent Payment History To Get Approved For A Mortgage

Just say yes! The new change will allow mortgage lenders to automatically integrate rent payment history to establish creditworthiness. Fannie Mae has updated the underwriting system to automatically pull rent payment history from your bank account. Your mortgage lender only needs one thing: your approval.

Why is this valuable?

Mortgage lenders look to credit history to assess risk. When a homebuyer has a high credit score and a solid credit history, they might qualify for a better mortgage. On the other hand, mortgage applicants with thin credit or short credit history are typically considered higher risk.

With the new rule in place, mortgage lenders can automatically include rent payments during the underwriting process. The updated software integrates with banks and credit unions to automatically recognize rent payments and populate your mortgage application with your rent payment history.

Based on Fannie Mae research which sampled mortgage applicants who were declined, 17% could have received an Approve/Eligible recommendation if their rental payment history had been considered.

Read Also: Can A Mortgage Be Transferred

Do You Need Rental History For A Mortgage

When you apply for a mortgage, lenders usually verify that you have made your housing payments be it your rent or mortgage payment on time for the prior twelve months. In most cases, your rent history is not included on your credit report, although there are companies that provide this service for a fee.

Do mortgage companies check rental history?

Do Mortgage Lenders Look at Rental History? Yes, lenders typically use verification of rent to gauge the reliability of applicants. In most cases, your landlord or property manager will fill out a verification of rent form supplied by the mortgage company.

Automate Rent Collection With Avail

When using property management software platforms like Avail, writing a proof of payment letter can be easily done in minutes. With Avail, you can see all rent payments youve collected from tenants in your account to check if theyve consistently made on-time rent payments. You can also see when payments are past due, any late fees youve collected, and much more.

Create an account today to automate the rent collection process with Avail for free.

- Schedule rent payments in advance

- Get next-day payments with Fastpay

- Allow tenants to set up recurring payments

- Track rental income and expenses in one place

Don’t Miss: How To Increase Your Mortgage Credit Score

Bad Rental History: What Are Your Options For Getting A Mortgage

Avisha

Bad rental history can make it hard to get approved for a mortgage. Lenders will often look at your rental history as a way to gauge your ability to make timely payments on a home loan. If you have a history of late payments or evictions, it will be more difficult to qualify for a mortgage. There are a few options available to those with bad rental history looking to buy a home. You can work with a subprime lender or get a cosigner with good credit. With some effort, it is possible to buy a house with bad rental history.

You can determine whether a borrower is capable of repaying a home loan using rental history rather than genuine savings. If you consistently make rent payments, you can qualify for a mortgage, but if you do not, your credit rating may not be affected. If you havent saved the deposit youve set aside with regular savings over the last three months, most lenders wont approve your mortgage application. If you dont have a rental agreement, you can use these documents to prove your rental history as a tenant. You will see the leasing information on your Experian credit report. If you have a bad reputation with your previous landlords, you should not expect them to give you a good recommendation.