Buying A House With No Credit

First-time home buyers have never had a mortgage. They may own their car outright instead of paying down an auto loan. And they may reach for debit cards over credit cards when given the chance.

These three traits put first-time buyers off the credit grid and can make qualifying for a mortgage a challenge.

Thankfully, you may not need a traditional credit profile to get mortgage-approved.

The FHA mortgage is available to first-time home buyers with thin credit or no credit whatsoever. Most mortgage lenders offer these loans, although youll have to shop for a lender with flexible credit policies.

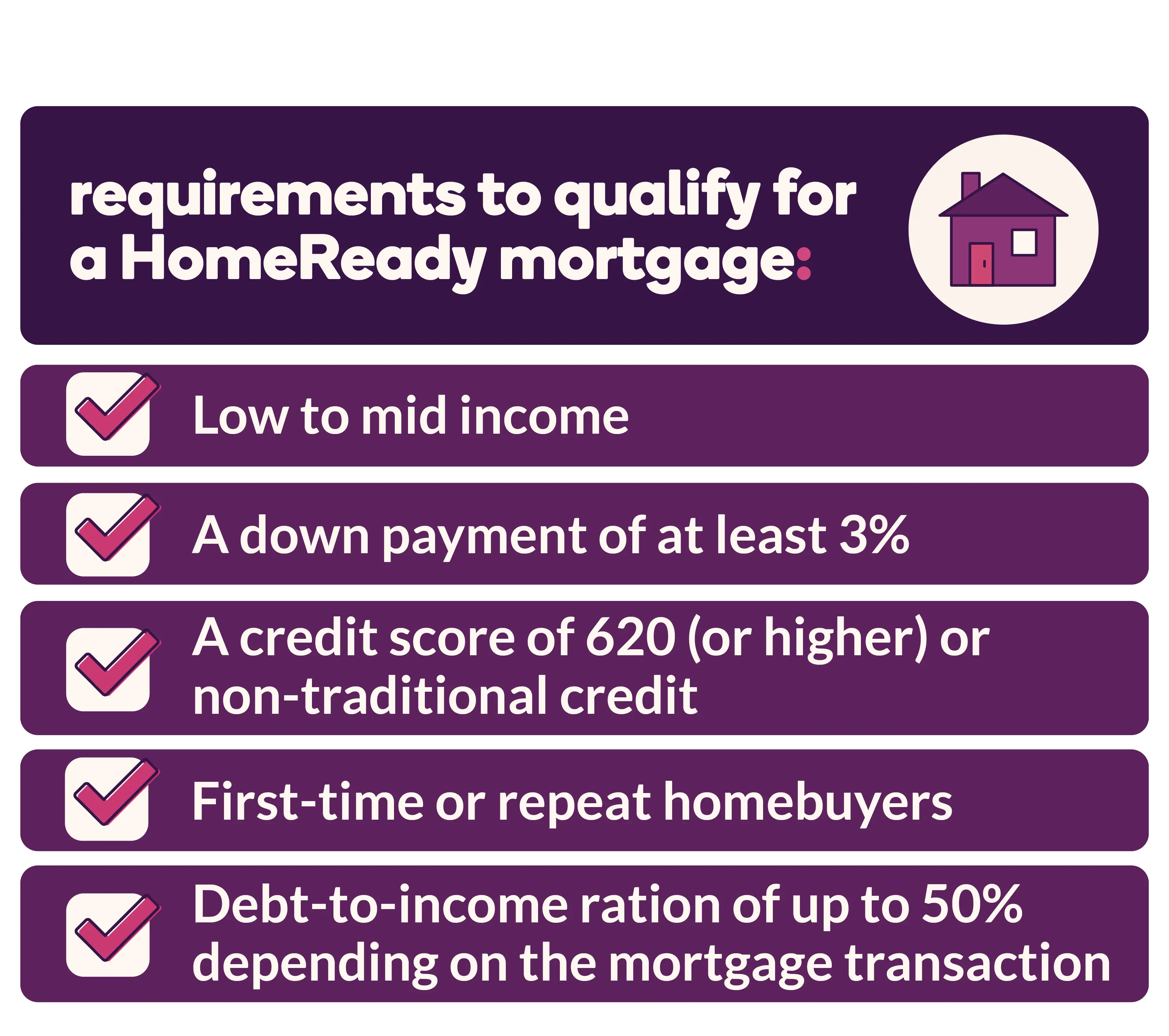

Conventional mortgages, VA loans, and USDA loans may also be an option. However, the rules for these types of mortgages are a little stricter for borrowers with no credit history. And it may be harder to find a willing lender.

Jon Meyer, The Mortgage Reports loan expert and licensed MLO, notes that these loans may be harder to obtain right now with Covid still affecting mortgage approvals.

How Credit Inquiries Affect Your Credit Score

A credit inquiry or credit check is a formal request to review a persons credit report. Its essentially a background check of a home buyers personal finances.

Consumers encounter two types of credit checks: hard credit checks and soft credit checks. A request for a mortgage rate quote results in a hard inquiry.

- A hard credit inquiry will generally lower your credit score. This is a formal request for your credit report with at least one of the three major credit bureaus, and you need to provide consent beforehand. Examples of hard pulls include personal loan and auto loan applications or opening a line of credit with a credit card issuer

- Soft credit inquiries do not typically lower your credit score. Theyre intended to quickly verify financial information and can occur without your consent. Examples of soft inquiries include an employer performing a background check, checking your own credit report, or seeing if youre prequalified for a credit card offer

Keep in mind that a hard inquiry means youre searching for additional credit. Statistically, youre more likely to have debt problems and default on financial obligations when you increase your available credit. This is especially true if youre maxed out or carrying credit card debt and looking for more.

Understanding this, it makes sense that your credit scores drop when you go applying for new credit cards or charge cards.

Register On The Electoral Roll

The easiest and quickest thing you can do to start building up your credit history is registering on the electoral roll. Your credit applications wont get anywhere if youre not registered on the electoral roll. Make sure you are registered to vote and your address and personal details are correct. To check if youre on the electoral roll, visit the Gov.uk website.

Also Check: How Many Mortgages Can You Have For Rental Property

Getting A Mortgage With No Credit History

Lenders use computer algorithms to help them process mortgage applications. They need that help, because the COVID era’s ultra-low mortgage rates have brought lenders a flood of applications.

If youre a low-risk borrower with a high credit score, steady income, low debt-to-income ratio and sizable down payment, the algorithms can approve your loan quickly.

If you do not have a credit history, the process is a bit more tedious. Instead of getting approved by a computerized model, you need to have your application underwritten manually.

How We Got Dee’s Mortgage Approved

“Nationwide declined my mortgage application due to having no credit history, which felt so unfair. I’ve always been good with money, hence not needing any credit but that stung me. Online Mortgage Advisor found me a lender willing to accept my application, and I’m so thankful that they did!”

Dee, OMA Customer

Don’t Miss: How To Become A Mortgage Processor In Florida

Do I Need A Credit Card For A Mortgage

If you have had at least two lines of credit, such as a phone contract and a registered bank account, then having a credit card isnt absolutely necessary.

Having two lines of credit should give you enough credit history to get a mortgage. That being said, each lender has its own criteria, so its always worth checking with an advisor before applying for a mortgage.

If you do approach a lender before consulting an advisor, you may be declined. Any application for credit, including a mortgage will leave a footprint on your credit file. If youve just started building your credit history, the last thing youd want is a failed application.

If Your Credit Score Is Between 500 And 580

FHA loans arent just great for people with a low down payment. Theyre also a viable option if you have a low credit score. All you need is a credit score of 580 to get an FHA loan combined with a lower down payment. However, youll have to make up for it with a larger down payment if your credit score is lower than 580. You may be able to get a loan with a credit score as low as 500 points if you can bring a 10% down payment to closing. The minimum credit score with Rocket Mortgage is 580.

You May Like: How Much Should You Put Down On A Mortgage

You May Like: How To Find A Cosigner For A Mortgage

Can You Get A Business Loan For Vacation Rental Property

SBA business loans can assist you in obtaining the funds you require for just about any purpose, including a business loan for rental property. SBA loans provide borrowers with a lower cost alternative to traditional business loans.

3 Things To Consider When Financing A Holiday Let

There are a few things to consider when looking into financing for a holiday let. The first thing you should know is the interest rate on your mortgage. As of May 1, the SBA CDC/504 loan rate is around 5.8%-5.97%. For-profit businesses currently receive an interest rate of 37.5% on COVID loans, while nonprofit businesses receive a rate of 27.5%. As a result, whatever option you choose will result in a lower interest rate than the market rate. The term of your mortgage is also an important factor to consider. A short-term mortgage, like the one youâd need for a vacation rental, can be obtained for up to three years. As a result, you wonât be forced to make large down payments or deal with long loan terms. Holiday lets are typically short-term rentals. As a result, you will need to be prepared to make your property available to renters as soon as possible. To accomplish this, you should be prepared to submit applications and have your property inspected.

Should You Take Out A Mortgage Or Increase Your Credit Score

So how badly do you want that house? Or, better yet, how badly do you need that house?

Because if youve got some time at least six months, preferably a year you can take steps to increase your credit score by 100 points. The first two steps are

- Start making on-time payments every month

- Stop using your credit cards until you paid them all off

Paying on time accounts for 35% of your credit score. Credit utilization how much of your available credit you use every month accounts for another 30%.

If you are on time with at least the minimum payment every month and use cash or checks to pay all bills , you are taking positive steps to address 65% of the factors that determine your credit score.

Is it easy? No, but its certainly doable if you really want that house at a payment level you can afford for the next 15-30 years.

Recommended Reading: How Long Is A Credit Report Good For Mortgage

Don’t Miss: What Does Pmi Cover On A Mortgage

Can You Buy A House With No Credit

5 Min Read | Jan 19, 2022

One of the side effectsor side benefitsof becoming and living debt-free is that you eventually have a credit score of zero. If thats you, congratulations! Youre unscorable, and because youre invisible to credit sharks and credit bureaus, you face a unique challenge: How can you prove to a mortgage lender youre a reliable borrower without a credit score?

Its going to take a little more workbut dont lose hope. You can get a mortgage without a credit score. Its totally worth it. And were going to show you how.

How To Maintain A Good Credit Score During Covid

Taking steps to protect and maintain your credit score has always been important. Thats especially true if youre planning on buying a home.

So its important to stay on top of your finances during this challenging time. That includes paying your bills on time, and contacting lenders and service providers if you do run into trouble. Here are a few things you can do:

- Create a budget to know where you stand. The Barclays Budget Planner can help.

- If you foresee problems paying your loan or credit cards, contact them right away to explore your options.

- If you think youll be late paying your phone, utilities or other service providers, contact them to let them know and to discuss a possible arrangement. You can also find helpful advice at Barclays money management.

- To help you manage during this period, you can also find valuable ideas and resources at Barclaycard coronavirus help and support about protecting yourself from fraud and managing your finances.

- Youll also find other information about managing your Barclaycard account during the crisis at the Frequently Asked Questions page.

Also Check: How Fast Can You Get Preapproved For A Mortgage

How To Improve Your Credit Score

Although you can get a mortgage with no credit history, its worth if its possible – trying to improve your credit score and overall credit profile. This is especially true if the reason you have no credit history and a low credit score is because youre a first-time buyer.

To give yourself the best chance of getting a mortgage, you can:

- Make sure youre registered on the voters roll

- Always pay rent and bills on time

- Set-up direct debits for regular bills, like your phone, gas, electricity, etc.

- Make small purchases on a credit card which you always pay off every month

What The Experts Say

While Lindsay is anxious to buy a larger condo, financial planner Heather Franklin doesnt feel Lindsay is in the position to take on a bigger mortgage. She really needs to bring down her personal debtboth on her line of credit and bank loanbefore she considers signing up for a bigger mortgage and all the extra associated costs of a move, says Franklin.

Rob McLister, owner of RateSpy isnt surprised that Lindsay was offered a larger mortgage loan amount by a competing bank but says Lindsays willingness to close down her untapped $29,000 line of credit could have something to do with it. If Lindsay was paying out her line of credit with the new mortgage, the underwriter might have wanted to mitigate risk by asking for the credit line to be closed, says McLister. Some lenders require account closure as a matter of policy on debt consolidations, says McLister.

In general, a strong credit profile and reasonable debt ratio are equally important if you want the best mortgage rates and terms. The best mortgage options go to those with a credit score about 700. If you score dips below 680, it gets harder to qualify for the best rates and returns.

In most cases, cancelling cards isnt a great idea. It reduces the average age of your accounts, and the credit bureaus prefer to see long-established accounts. If you have no debt, then credit utilization is not something Id worry about.

Don’t Miss: How Much Per Month Is A 100k Mortgage

Does Applying For A Mortgage Hurt Your Credit Score

Similar to a mortgage pre-approval, applying for a mortgage involves a hard inquiry on your credit report, which could lower your credit score by a few points. If you fill out multiple mortgage applications within the 14 to 45-day shopping window, then it will only count as a single inquiry.

The mortgage shopping window only applies to credit checks from mortgage lenders or brokers credit cards, according to the Consumer Financial Protection Bureau, and other inquiries will show separately on your credit report.

After you close on a new mortgage, your credit score may go down again temporarily. Because of this, it may be difficult to get other loans or with the terms you prefer. You may have to wait several months before applying for a larger loan.

On the other hand, a mortgage can also help build your credit over the long run if you make timely payments.

Read Also: How To Calculate Self Employed Income For Mortgage

Why You Need To Get Pre

Its all the time a good suggestion to get pre-approved earlier than searching for a house. Thats as a result of the pre-approval course of helps you:

- Set a finances: Youll have the ability to set up your worth vary and store for houses inside your finances, which may prevent time.

- Get organized: Since youll have lots of the paperwork gathered for the official house mortgage software later, this step helps you put together for the homebuying course of.

- Help your buy supply: While youre placing in a proposal, a mortgage pre-approval letter might help you stand out from different consumers, particularly in a bidding battle.

- Make a monetary plan: Should you dont qualify for a pre-approval, youll have the ability to discover out why and create a plan to enhance your funds.

Recommended Reading: Does It Matter What Mortgage Lender You Use

Don’t Miss: What Is The Monthly Mortgage On A 350 000 Home

Do Mortgages With No Credit Cost More

Compared to a repeat home buyer with 20 years of excellent credit history, borrowers with thin credit files will likely pay more for their mortgage loans.

But this doesnt mean borrowing should be cost prohibitive. You could still become a homeowner with an affordable monthly payment and start building equity.

The extra borrowing costs come in a couple different forms:

- Higher interest rates: Borrowers with less credit typically pay a higher interest rate compared to borrowers with a long and stable credit history

- Mortgage insurance: This special insurance policy protects the lender in case you default on the loan, but the borrower pays the premiums

These two costs play off each other: Paying mortgage insurance lowers your interest rate.

Re: Question: Is An 800+ Fico Score Achievable Without A Mortgage

I have never had a mortgage and neither has my wife. She’s in the 800+ club. I was too until I recently signed an auto lease. In fact, my EX FICO score was 822 at one time.

@Revelate wrote:

Mortgages are the crown-jewel of the credit scoring world, and I suspect nearly all of the top tier buckets require one to have a mortgage on record.

800 is possible without one , but who cares: anything above 760 is meaningless other than for bragging rights in the current credit-economy.

I most respectfully disagree. Responsible management of revolving credit is second only to payment history as the most important aspect of scoring. You can have 800+ scores without any mortgage or installment accounts.

From a BK years ago to:EX – 3/11 pulled by lender- 835, EQ – 2/11-816, TU – 2/11-782″Some people spend an entire lifetime wondering if they’ve made a difference. The Marines don’t have that problem”.

Ah, you’re correct in that, I wasn’t clear in my post. My apologies.

What I was trying to state is that compared to all other tradelines , mortgages > everything else in terms of a credit report, and access to potential high-scoring buckets.

In terms of actual instant-in-time FICO scoring, absolutely utilization and other factors are factored more heavily.

Read Also: Can I Just Pay The Interest On My Mortgage

What To Do If Your Prequalification Application Is Denied

There are some steps you can take to improve your situation if your prequalification application is denied. Equifax recommends obtaining a copy of your credit report and reviewing it for errors and areas where you can improve. Perhaps you need to start making extra payments to reduce your debt, or find a cosigner for a small loan or retail card to develop your credit history. Youll also want to ask the lender the reason for the denial. If the lender requires two years of employment history, for example, and you only have a year and a half, youll know to look for another lender or wait six more months before applying again.

Apply For An Fha Loan

An FHA loan is a mortgage that is backed by the Federal Housing Administration. These loans help people to purchase a home when they otherwise might not be able to. The program is often aimed at first-time home buyers, but anyone that meets the requirements can borrow an FHA loan.

To qualify for an FHA loan, youll need:

- 5% down and a credit score of 580+ (This is the minimum score requirement at Quicken Loans®

- 10% down and a credit score of 500+

- A debt-to-income ratio of 43% or less

Per the FHA loan regulations, lenders are allowed to consider candidates with no credit history. This situation falls under the FHAs category of a nontraditional credit history, and lenders can find other ways to verify your on-time payment history. In fact, the federal government specifically prohibits lenders from using the lack of a credit history as a reason to reject a loan application.

Keep in mind that FHA loans generally require two different types of mortgage insurance. Youll have to pay an upfront mortgage insurance premium of 1.75%, as well as monthly mortgage insurance payments.

Don’t Miss: Who Bought Out Ditech Mortgage