There Are Signs The Market Is Cooling Somewhat

While home prices remain elevated, there are some indications that increased mortgage rates are starting to level out the white-hot housing market.

Mortgage purchase applications were down 6% from a year earlier, for the four-week period ending April 10, according to a recent Redfin study.

Redfin’s Homebuyer Demand Index, which measures home tour requests for properties listed for sale, has also declined 3% in the past four weeks, compared to a 5% increase during the same period last year. This suggests that there are fewer buyers in the market, which could lead to an easing of home price increases if the trend continues.

“There really is a limit to homebuyer demand, even though the market over the past few years has made it seem endless,”says Redfin’s chief economist Daryl Fairweather. She expects that price growth will continue to level out in 2022.

Ways To Reduce Your Monthly Mortgage Repayments

We mentioned interest-only mortgages earlier, and this type of product is certainly much more affordable when comparing the monthly payments.

However, the issue is that interest-only mortgages do not include any element of the original amount borrowed. When you arrive at the end of the term, you still owe the lender the full amount and need to demonstrate how you plan to pay this back at the point of application.

Exit strategies can include selling the home or refinancing.

An interest-only mortgage might reduce your monthly mortgage payment, but is usually more expensive when you add the interest payments made over the term and the final balance payable.

A larger deposit will immediately decrease your interest rate because the lenders risk is mitigated, as they are considering a lower LTV on the property.

Options to boost your deposit value include:

- Gifted deposits or contributions from family members.

- Applying for a equity loan scheme.

- Delaying your purchase to enable you to save more.

Extending the loan term is another option, which means that the monthly repayments will drop the longer the mortgage remains active.

Some mortgage lenders offer flexibility with repayments, so you can overpay or underpay, although there may be restrictions on how often you can do so per year.

If you have this option and can overpay, you will chip away at the total interest payable and bring down your monthly cost.

Where To Get A $300000 Mortgage

To get a $300,000 home loan, youll want to get quotes from at least a few different lenders. Though this can be done by reaching out to each mortgage company directly, you can also use an online marketplace like Credible.

Once you receive your quotes, youll want to compare them line by line. You should look at the interest rate, total costs on closing day, any origination fees, mortgage points youre being charged, and more.

After you determine the best offer, you can move forward with that lenders application and submit any required documentation.

Credible makes the process of finding the right mortgage rate easier and more efficient. You can get tailored prequalified rates from our partner lenders simultaneously all with just one form and it only takes a few minutes.

Learn More: How to Know If You Should Buy a House

You May Like: Who Pays Points On A Mortgage

Youll Build Equity In Your Home Faster

One way to build equity is to pay back the principal balance of your loan, rather than just the interest.

Since youre making bigger monthly payments on a 15-year mortgage, youll pay down the interest a lot faster, which means more of your payment will go to the principal every month.

On the flip side, the smaller monthly payments of a 30-year mortgage will have you paying down the interest a lot slower. So less of your monthly payment will go to the principal.

Costs Included In A Monthly Mortgage Payment

In the Census Bureau’s American Community Survey’s data, the monthly mortgage payment includes things like insurance and taxes. In part, it’s because that’s how mortgages actually work oftentimes, you pay for more than just the loan’s principal and interest in your monthly payment.

If your mortgage includes an escrow account, you’ll pay for two costs each month in your monthly mortgage payment:

- Property taxes: You’ll pay tax on your home to your state and local government, if necessary. This cost is included in your monthly payment if your mortgage includes escrow.

- Home insurance: To keep your home covered, you’ll need to purchase a homeowner’s insurance policy. The average cost of homeowners insurance is about $1,200 per year.

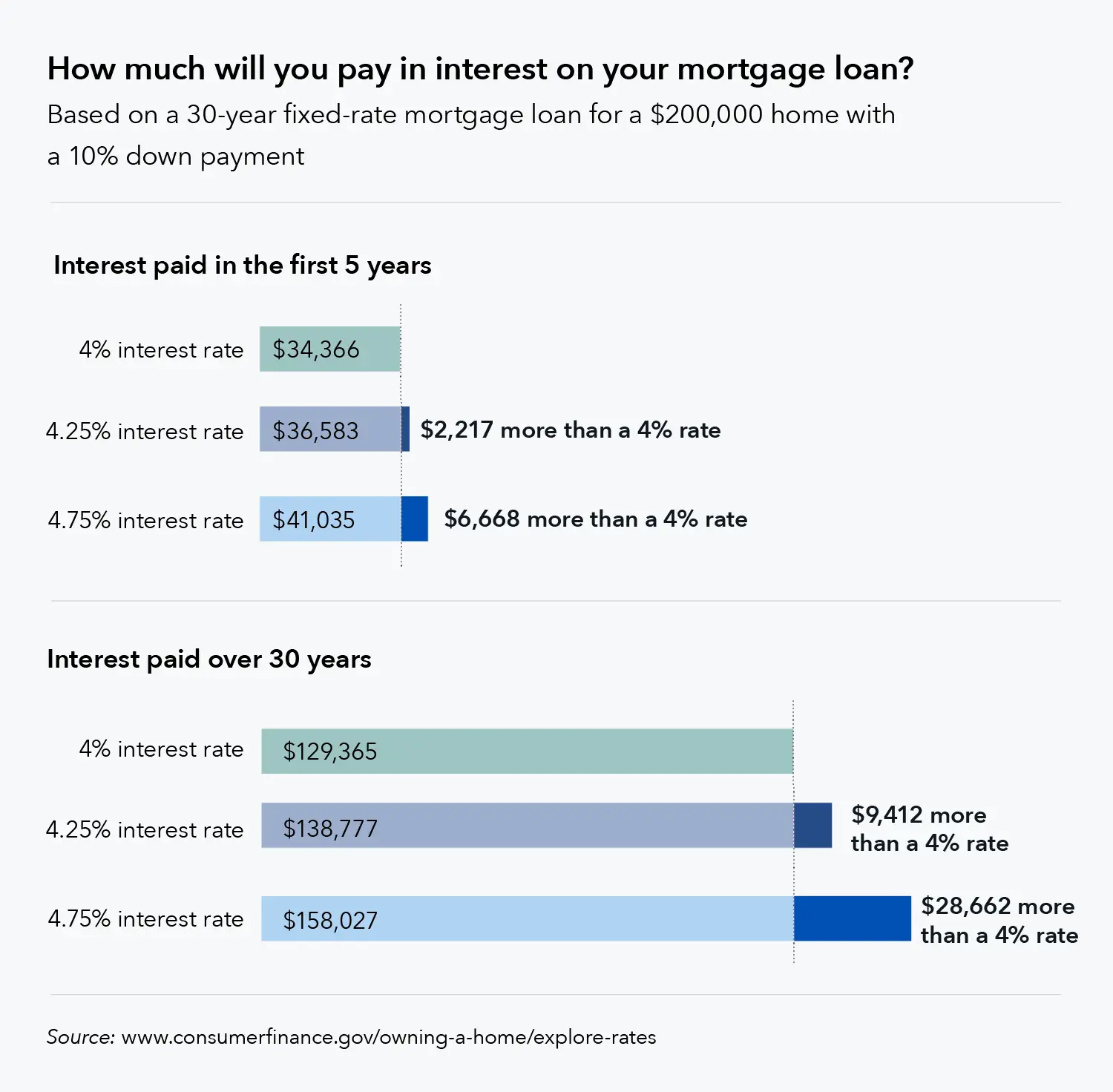

Your monthly mortgage payment will also be impacted by how much money you borrow, and what your lender charges you for that money. Here’s how those two factors can get you a higher or lower monthly payment:

Another monthly cost to consider should be how much you’ll need to save for repairs. In general, the older your home is, the more you should keep on hand for repairs. Utilities like internet, garbage removal, and electricity will also add to your monthly costs of homeownership.

You May Like: What Is A Mortgage Company

Federal Housing Administration Loans

The FHA provides housing programs suitable for first-time homebuyers. It allows borrowers to qualify even if they have low credit scores. With FHA loans, you can make a smaller downpayment to obtain a 30-year fixed-rate mortgage. This makes it a popular financing option for buyers with tight finances. FHA loans come in 15 and 30-year fixed terms, as well as 20-year terms.

Qualifying for FHA Loans

Under the FHA program, if your credit score is 500, your downpayment should be 10% of the loan amount. But if your credit score is at least 580, your downpayment can be as low as 3.5 percent.As for DTI ratio requirements, your front-end DTI should not be lower than 31 percent. Your back-end DTI should not exceed 43 percent, though some borrowers qualify at 50 percent with compensating factors.

In the beginning, FHA loans are affordable for homeowners because of low rates. But after several years of payments, it gets costly because of mortgage insurance premium . In an annual basis, the MIP cost is around 0.45 percent to 1.05 percent of the loan amount. The rates increase as you gain more home equity.

How to Remove Mortgage Insurance Premium

What Are The Advantages Of A 30

A 30-year fixed mortgage gives you a more affordable monthly payment than a 15- or 20-year mortgage because it stretches the repayment over a longer period. But it also provides flexibility you can pay the mortgage off faster by making extra payments or adding to your monthly payment.

Unlike an adjustable-rate mortgage, a fixed-rate mortgage is predictable. The principal and interest portion of your mortgage payment stays the same, no matter what happens in the economy.

»MORE: See NerdWallets picks for best 30-year fixed-rate mortgage lenders

You May Like: What Mortgage Can I Get With My Salary

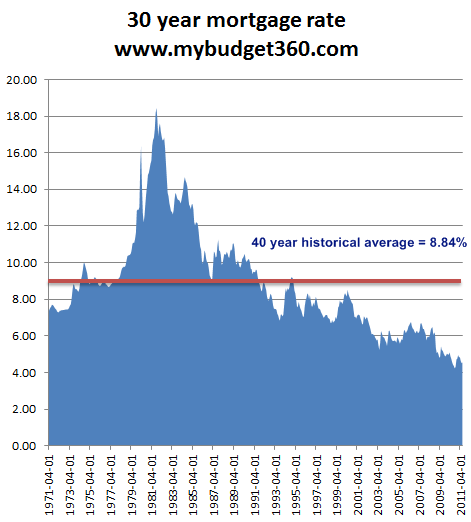

A Look At Mortgage Rates Over Time

After rising sharply throughout 2022, mortgage rates took their largest dip in 41 years on November 17. While current mortgage rates are well above recent levels, theyre still below average from a historical standpoint.

Keep in mind that average mortgage rates are just a benchmark. Borrowers with good credit and strong finances often get mortgage rates well below the industry norm. So rather than looking only at average rates, its worth taking the time to get a personalized estimate and see what you qualify for.

In this article

When Refinancing Makes Sense

Refinancing your mortgage can be a wise move for many reasons, most notably lowering your interest rate or your monthly payments. It can also help you pay down your mortgage sooner, access your homes equity or get rid ofprivate mortgage insurance .

But there are closing costs associated with refinancing, so it probably makes more sense to refinance if you know youll be keeping your home for some time. You can determine the break-even point for a potential refinance, or how long it will take for savings from a new mortgage to surpass any closing costs. Find out what those costs will be and divide them by the monthly savings youll realize with the new mortgage.

The Forbes Advisor mortgage refinance calculator can help you run the numbers to see if its a good time for you to refinance.

Read Also: What Are Arm Mortgage Rates

How Piti Affects Your Mortgage Qualification

When lenders assess whether or not you can afford a mortgage loan, theyll compare your estimated PITI with your gross monthly income .

Your PITI, combined with any existing monthly debts, should not exceed 43% of your monthly gross income this is called your debt-to-income ratio .

Your DTI is a primary factor in whether or not youll qualify for a mortgage.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Recommended Reading: Should I Refinance My Mortgage Or Make Extra Payments Calculator

How Smartasset’s Mortgage Payment Calculator Works

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

Make More Frequent Repayments

As well as making extra repayments, making more frequent repayments can also help you get ahead on your loan. For example there are 12 months in a year but 26 fortnights. If you make fortnightly repayments instead of monthly ones, youre making one extra month of repayments per year which puts you slightly ahead.

You May Like: What’s Happening With Mortgage Interest Rates

How Much Is The Average Monthly Mortgage Cost

Most residential mortgages are repayment products, and that means you pay a proportion of the capital back each month, plus the interest.

An interest-only loan is primarily used in rental property mortgages, so we will focus on repayment mortgages.

As of March 2022, Lloyds Banking Group reports that:

- The average UK monthly mortgage repayment is £759, up 2% year-on-year .

- Renting a property costs £874 on average, up 6% YoY.

- Monthly mortgage costs have increased 31% in the last ten years.

- The average first time buyer deposit is now £62,415.

While buying a home will cost an average of £759 a month, these statistics show that it remains more affordable in terms of regular, monthly, expenditure than renting. However this does not take into account equity tied up in the property or maintenance costs.

Statista compares the monthly averages between regions, although these most recent metrics refer to 2021:

| Region | Average Monthly Mortgage Cost – 2021 |

|---|---|

| Greater London | |

| £476 |

What Are The Drawbacks Of Prepaying My Mortgage

There are potential downsides to prepaying. For starters, tying up your cash in your home means you have less liquidity and wiggle room in your budget. In other words, youll have less readily available cash to put toward increasing your 401 contributions or paying down high-interest debt, for example. These financial goals could offer a higher return on your investment.

Another consideration is the opportunity cost of not having that extra money invested elsewhere. Over the past four decades, the stock market has returned an average of 13 percent a year.

When asking yourself, Can I prepay my mortgage? look at your entire financial picture. Here are some important questions to consider:

- Is your monthly budget tight after meeting necessary expenses?

- Is your income variable or unpredictable?

- How long do you plan to stay in your home?

- Do you have an adequate emergency savings fund of three to six months of household living expenses?

- Do you have a lot of high-interest credit cards or loans?

Assessing your financial goals, income and budget can help you decide whether it makes more sense to address other pressing financial concerns before paying ahead on your mortgage.

Dont Miss: Is Fico Score 8 Used For Mortgages

Recommended Reading: Who Is Eligible For Fha Mortgage Loan

Average Length Of A Mortgage

As mortgages are the biggest loan youre likely to get, theyre often the longest, too.

Mortgages normally take 25, 30 or 35 years to pay back. Historically, the most popular length people opt for is 25 years, but in recent years the 30- and even 35-year mortgages are becoming more popular.

The reason longer mortgages are attractive is because they lower your monthly mortgage repayments. This makes is easier for people to afford a mortgage, helping people to get on the property ladder. Remember though, a longer mortgage means you end up paying substantially more over the lifetime of the mortgage.

Mortgage pay-off times actually vary a bit. This is for a few reasons.

Often people will remortgage every few years. This means you go back to a mortgage lender and thrash out a new mortgage deal, taking into consideration how much of your homes value youve paid off. Sometimes its possible to knock a couple of years off the total time youre paying your mortgage, as you could get a better deal.

Most people though will take the chance to lower their monthly repayments instead of shortening their mortgage term.

Some people also overpay each month on their mortgage. This means that the overall mortgage is lower, which makes the interest charged against it lower. All this means the mortgage itself can be paid off earlier.

Be careful though. Some mortgages charge fees for overpayments, or have a limit of how much can be paid. Go over the limit and you could get charged a fee.

Do I Qualify For A Mortgage

A mortgage calculator can be helpful when estimating your home buying budget. But remember even if you can afford the monthly payments, you still need to qualify for a home loan.

To see if you qualify for a mortgage, a lender will check your:

- Borrowers with higher credit scores tend to have more loan options. But mortgages are secured loans, which means you dont always need stellar credit to qualify. Some lenders can approve FHA loans for borrowers with FICO scores as low as 580

- Loan-to-value ratio : LTV measures your loan amount against your new homes value. For example, borrowing $200,000 to buy a $200,000 home equals 100% LTV. Lenders can offer VA or USDA loans at 100% LTV, but not everyone is eligible for these programs. FHA loans cant exceed 96.5% LTV, which leaves 3.5% as the minimum down payment. Conventional loans can reach 97% LTV, meaning they allow a 3% down payment

- Home appraisal: A home appraisal identifies the homes value. Lenders wont approve loan amounts that exceed the homes value, regardless of the homes listing price or agreed-upon purchase price

- Personal finances: Lenders must verify your income to make sure you can afford the loan payments. Theyll check W-2s, bank statements, and employment records. If youre self-employed, a lender will likely ask to see tax records

You can ask for a mortgage pre-approval or a prequalification to see your loan options and real budget based on your personal finances.

Recommended Reading: How To Get Out Of Mortgage Insurance

Example: Costs When You Break Your Mortgage Contract To Change Lenders

Suppose a different lender is offering you 3.75% interest. To break your mortgage contract with your current lender youll need to pay a prepayment penalty of $6,000.

You may also choose a blend-and-extend option with your current lender. This would give you a 4.6% interest rate.

Table 2: Example of costs to change lenders| Costs | |

|---|---|

| $40,350 | $38,005 |

In this example, you pay less when you choose a blend-and-extend option with your current lender.

Note that youll usually need to pay fees when you set up a new mortgage, including when you choose a blend-and-extend option. This example doesnt take into account any fees. Lenders may be willing to pay some or all of the fees. If this is the case, your costs to renegotiate your mortgage will be less.

Read Also: What Makes A Jumbo Mortgage

Other Mortgage Costs To Keep In Mind

Remember that your mortgage rate is not the only number that affects your mortgage payment.

When youre estimating your home buying budget, you also need to account for:

- Private mortgage insurance or FHA mortgage insurance premiums

- Homeowners insurance

When you get pre-approved, youll receive a document called a Loan Estimate that lists all these numbers clearly for comparison. You can use your Loan Estimates to find the best overall deal on your mortgage not just the best interest rate.

You can also use a mortgage calculator with taxes, insurance, and HOA dues included to estimate your total mortgage payment and home buying budget.

Don’t Miss: What Are The Negative Aspects Of A Reverse Mortgage