Are Mortgage Points Right For You

Buying mortgage points is a way to pay upfront to lower the overall cost of your loan and reduce its monthly payment. It makes the most sense if you plan to be in the home for a long period of time. The amount youll save each month is likely to make the upfront cost worth it.

Of course, if you dont plan to stay in a home for a long time, paying points is likely to lose you money overall.

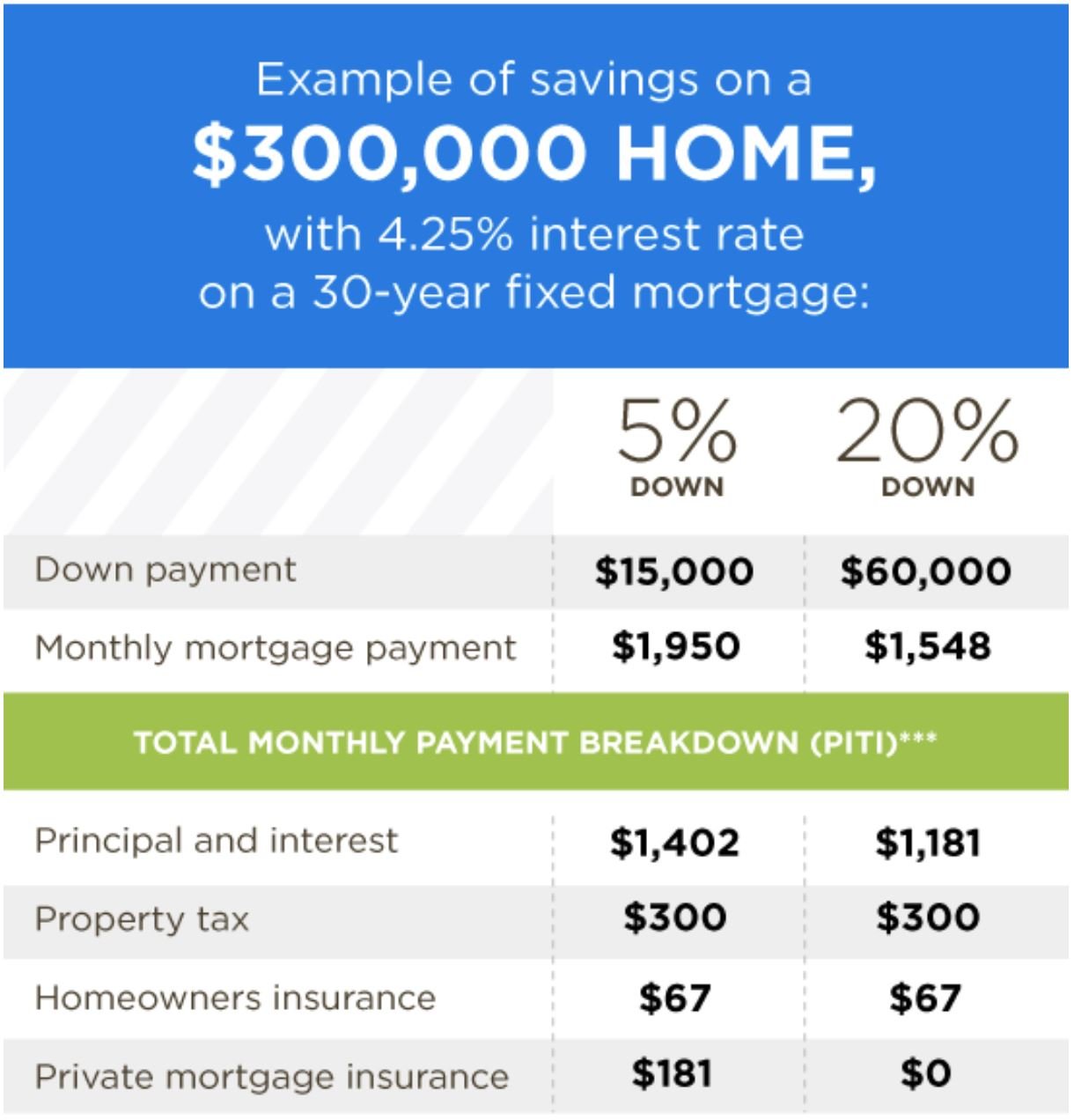

Another consideration is whether you should put money toward points or a larger down payment. A larger down payment can often help you secure a lower interest rate anyway. Additionally, hitting the 20% down payment mark can also let you avoid the additional cost of PMI.

A bigger down payment can get you a better interest rate because it lowers your loan-to-value ratio, or LTV, which is the size of your mortgage compared with the value of the home.

Borrowers should consider all the factors that could determine how long they plan to stay in the home, such as the size and location of the property and their job situation, then figure out how long it would take them to break even before buying mortgage points.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Heres How Much The Same Mortgage Costs Now Compared To Last Year

Fewer people are shopping for homes, a sign that homebuyers are getting priced out of the market due to surging mortgage rates, which spiked to an average of 5% this week for 30-year fixed-rate mortgages.

The fixed-rate mortgage rate jumped 0.28% in the last week alone, reaching a high not seen since February 2011, according to government-mortgage company Freddie Mac. A year ago, the 30-year rate averaged 3.04%, which is nearly 2% lower than the rate now.

That 2% difference can add hundreds of dollars to the monthly cost of financing a home, making it unaffordable for some potential buyers.

For a home worth $408,100 the median home price in the U.S. with a 20% down payment, 30-year fixed mortgage and a 5% interest rate, monthly mortgage costs would come to $1,752.62, according to CNBC calculations.

But for the same home purchased last year, when interest rates were 3.04%, monthly mortgage payments would only come to $1,383.51, according to CNBC calculations. Thatâs nearly $400 less per month, and more than $4,400 less per year.

Dont Miss: What Type Of Interest Is A Mortgage

You May Like: What’s The Average Mortgage Payment

How To Calculate A Mortgage Payment

Under “Home price,” enter the price or the current value . NerdWallet also has a refinancing calculator.

Under “Down payment,” enter the amount of your down payment or the amount of equity you have . A down payment is the cash you pay upfront for a home, and home equity is the value of the home, minus what you owe.

On desktop, under “Interest rate” , enter the rate. Under “Loan term,” click the plus and minus signs to adjust the length of the mortgage in years.

On mobile devices, tap “Refine Results” to find the field to enter the rate and use the plus and minus signs to select the “Loan term.”

You may enter your own figures for property taxes, homeowners insurance and homeowners association fees, if you dont wish to use NerdWallets estimates. Edit these figures by clicking on the amount currently displayed.

The mortgage calculator lets you click “Compare common loan types” to view a comparison of different loan terms. Click “Amortization” to see how the principal balance, principal paid and total interest paid change year by year. On mobile devices, scroll down to see “Amortization.”

Increase Your Credit Score

The higher your credit score, the greater your chances are of getting a lower interest rate. To increase your credit score, pay your bills on time, pay off your debt and keep your overall balance low on each of your credit accounts. Dont close unused accounts as this can negatively impact your credit score.

Also Check: Is The Property Tax Included In Mortgage Payments

Recommended Reading: Can You Negotiate A Lower Mortgage Rate

How To Calculate Mortgage Payments

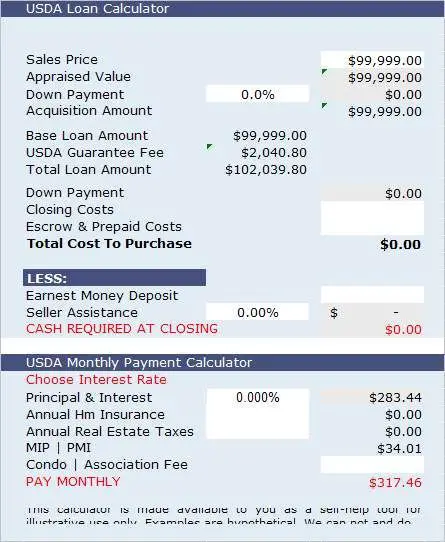

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

What Is A Good Front

While recommended front-end ratios vary based on rules of thumb, a “good” front-end ratio will depend on your situation. For you, that may mean youll be able to pay for and live in a home you like while still allowing you to reach your other financial goals, such as saving for retirement and emergencies, paying down debt, and enjoying hobbies.

Recommended Reading: Why Do Mortgage Companies Sell Loans

Understanding Gross Income Net Income And Mortgages

Before you can calculate the income percentage for your mortgage, youll need to understand what defines gross income, net income, and mortgages.

As such, lets break these definitionsone-by-one.

Gross Income

Gross income for individuals is the total payment you receive from your employer before any taxes or other deductions. Gross income is not limited to cash payments it includes services received and property. Your gross annual income is the amount of money you earn in a year before tax and includes all your income sources.

For businesses, gross income is identical to gross margin or gross profit. As printed on their income statement, a companys gross income is the revenue earned from all sources minus the cost or services or cost of goods sold .

Net Income

Net income is the total amount earned by a person in any given period from their taxable wages, investment incomes, tips, and any other income. The amount is calculated after Social Security taxes, income taxes, Federal Insurance Contributions Act tax, 401k payments, health insurance, and any outstanding legal obligations such as child support, loan payments, and wage garnishments.

For individuals, net income is calculated using this equation:

Total amount Earned Paycheck Deductions = Net Income.

Mortgages

Mortgages are paid back over time, typically over 15 or 30-year terms. The property purchased acts as collateral for the money lent by an individual to buy the home.

Front-End Ratio and Back-End Ratio

Determining How Much You Can Afford

Financial Leverage & Economic Risks

If you put 20% down on your home that investment is using 5x leverage. If you put 10% down that investment is using 10x leverage. The results of the above calculator can offer a rough idea of max loan qualification, however for most people it is better not to get close to the limit so they have a financial cushion in case of a layoff or a downturn in the broader economy.

When mortgage lenders evaluate your ability to afford a loan, they consider all the factors in the loan, such as the interest rate, private mortgage insurance and homeowner’s insurance. They also consider your own financial profile, including how the monthly mortgage payment will add to your overall debt and how much income you are expected to make while you are paying for the home.

Obtaining Investment Returns

Those who are seeking investment returns will usually obtain higher returns in the stock market & stock investments are much more liquid & easier to sell than homes. Over the longterm real estate generally appreciates only slightly better than the inflation rate across the broader economy. Since 1963 U.S. residential real estate has appreciated about 5.4% per year in the United States. Over the past 140 years U.S. stocks have returned 9.2%.

You May Like: How Large Of A Mortgage Can I Get Approved For

How Can I Pay Off My 30

A: Of course, this answer depends on the amount of your loan and your standard monthly payment. But for example, if you take out a 30-year loan of $300,000 and your monthly payment is $1,454, you would need to pay an additional $800 onto your principal amount to pay your loan off in 15 years. So instead, you could spread that extra $800 a month out by switching to a bi-weekly payment schedule and pay an extra $400 per paycheck in addition to what’s already being taken out for your standard mortgage payment.

Add All Fixed Costs And Variables To Get Your Monthly Amount

Figuring out whether you can afford to buy a home requires a lot more than finding a home in a certain price range. Unless you have a very generous and wealthy relative who’s willing to give you the full price of your home and let you pay it back without interest, you can’t just divide the cost of your home by the number of months you plan to pay it back and get your loan payment. Interest can add tens of thousands of dollars to the total cost you repay, and in the early years of your loan, the majority of your payment will be interest.

Many other variables can influence your monthly mortgage payment, including the length of your loan, your local property tax rate and whether you have to pay private mortgage insurance. Here is a complete list of items that can influence how much your monthly mortgage payments will be:

Read Also: Are Mortgage Origination Fees Negotiable

Mortgage Payments Arent Your Only Homeownership Cost

Theres more to homeownership cost than your monthly payment. More on that later. But what makes up your monthly payment itself?

Mortgage professionals use the acronym PITI to cover some of the main ones. That stands for:

- Principal: The amount by which you reduce the amount you borrowed each month.

- Interest: The cost of borrowing.

- Taxes: The property taxes you have to pay.

- Insurance: Homeowners insurance. Plus, depending on where you buy, possibly flood, earthquake or hurricane cover.

None of these is optional and if you fall far behind on any of them, youll be in breach of your mortgage agreement and subject to action by your lender.

How Can I Pay Less Interest On My Mortgage Each Month

- Mortgages & Financing

- How can I pay less interest on my mortgage each month?

Each month, like clockwork, your checking account balance is reduced by another of your mortgages monthly payments. If you are like most homeowners, youve wondered if it is possible to pay less interest, reduce your monthly expenses and pay off your mortgage faster?

Yes, there are techniques to reduce the interest you pay monthly if your cash flow allows you to pay extra monthly payments towards principal.

But first, it is important to explain the basics of your mortgage payment before you try to reduce your interest.

Your monthly mortgage obligation, which is often referred to as PITI is composed of Principal, Interest, Taxes, and Insurance.

- Principal & Interest this is the portion of the monthly payment that is directly related to the mortgage balance and the rate of interest. These are the factors that influence how much interest you pay.

- The Principal Portion the amount of your payment that is applied to the outstanding mortgage loan.

- The Interest Portion the amount of your payment that is applied toward the interest, based on your outstanding balance and rate.

At the beginning of the mortgage, the P& I payment is mostly applied to interest due on the outstanding balance. However, as you progress through the mortgage term, the principal portion paid each month slowly increases which means that the interest portion decreases as the loan balance decreases.

Recommended Reading: What’s The Mortgage On 500k

What Percentage Of Your Monthly Income Should Go To Mortgage

A general rule of thumb for homebuyers is your home loan should eat up no more than 28% of your pre-tax monthly income.

But some borrowers should set their personal level higher or lower. Below, well help you figure out how much you can afford and well also tell you the affordability rules lenders require for different types of mortgages.

Read Also: Does Rocket Mortgage Service Their Own Loans

How Does Mortgage Amortization Work

Mortgages are generally fully amortized installment loans, which means you repay the loan over a fixed repayment term and your monthly payment gets split between the principalthe amount you borrowedand interest.

A mortgage’s amortization table shows how this split changes over time. For example, here’s an amortization table with the first four and last four payments on a $280,000 mortgage with a 30-year term and a fixed 3.25% interest rate.

| Month | |

|---|---|

| $4.24 | $0.00 |

If you have a fixed-rate mortgage, your monthly mortgage payment will be the same over the life of your loan. Initially, most of your mortgage payment will go toward interest. But as you pay down the loan’s principal balance, less interest accrues and a larger portion your payment goes toward the principal. By the end, nearly the entire payment goes to paying down the principal.

With an adjustable-rate mortgage , your monthly payment may change as the interest rate adjusts. The loan can still have a set repayment term, such as 15 or 30 years, and there are estimated amortization tables. However, when your rate adjusts, your monthly payment may be recalculated, or “recast,” based on a new amortizable table and the remaining loan term.

In some cases, your mortgage could also have negative amortizationwhen your monthly payment isn’t enough to pay off the accruing interest and your balance grows. As a result, you can wind up owing more than your house is worth.

Don’t Miss: What Should I Bring To A Mortgage Pre Approval

Signs It’s Time To Refinance

Falling Interest Rates

One of the best signs that it’s a good time is that interest rates have dropped or that you now qualify for lower interest rates based on your improved credit score or credit history. A two-point interest rate deduction on a $200,000 home could save you tens of thousands of Dollars over the life of a 30-year, fixed-rate loan. Typically, a full point or two is necessary to make refinancing worth your while. The savings from a half-point or less may take years to offset expenses, depending on the terms of your loan.

Shift From Adjustable to Fixed Rates

Another good reason to refi is if you want to get out of an adjustable-rate mortgage or to eliminate a second mortgage loan, or a piggyback loan. When your ARM is going to reset to a higher interest rate, you may be able to shift into a fixed-rate loan with a lower interest rate. Of course, your credit history will need to have improved significantly from when you were approved for the original loan. You can also refi to consolidate two loans into one single loan with one monthly payment.

Shift Into a Conventional Loan

FHA loans are easier to qualify for than conventional loans, allowing both low down payments and lower credit scores. FHA loans typically charge mortgage insurance premium for the life of the loan. By shifting over to a conventional loan a homeowner can drop the insurance requirement so long as they have at least 20% equity in their home.

Pay Off Your Loan Faster

Extract Home Equity

How To Use This Mortgage Payment Calculator

Regardless of where you are in the homebuying process, estimating your monthly mortgage cost is a crucial step in determining what you can truly afford and what youre comfortable paying. This tool can help you evaluate different scenarios and figure out the type of loan, term and down payment thats right for your financial situation.

Read Also: What Does Arm Mean In Mortgages