Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

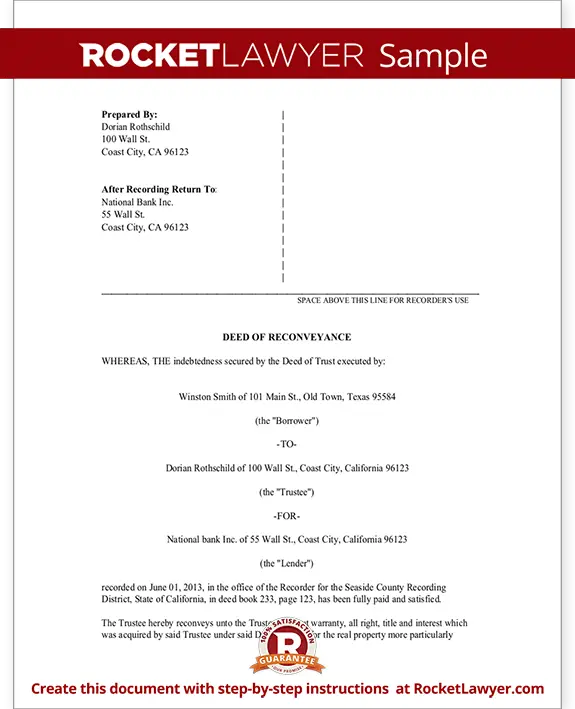

Rocket Mortgage Loan Types

Rocket Mortgage offers a loan lineup that’s fairly typical of nonbank lenders. Conventional loans, FHA loans and VA loans are available with fixed or adjustable rates. A customizable fixed-rate conventional loan with a term from eight to 29 years is also available, in addition to the standard 15- or 30-year mortgage.

Even though FHA loans made up only 7% of its total business, Quicken was the second-largest FHA lender in the nation in 2020, boasting more than twice the FHA loan volume of the next lender.

Home equity loans and home equity lines of credit, or HELOCs, aren’t available. Those seeking to put their home equity to work with Rocket will need to look to a cash-out refinance.

What Are Rocket Mortgage’s Terms Fees And Conditions

Rocket Mortgage charges most of the typical fees that all lenders do, but there is no fee to lock in an interest rate for 45 days. Locking in your rate can be helpful, particularly since interest rates are rising and are expected to keep going up throughout 2022. Even one-tenth of a percentage point can add tens of thousands of dollars over the life of your loan.

However, if you want to extend your rate for an additional 15 days it will cost you 25 basis points, which means your mortgage rate will go up by 0.25%. While some lenders offer a free float down, which lets you lower your locked interest rate if rates go down, Rocket Mortgage does not offer this as a standard feature. Instead, Rocket Mortgage offers Rate Shield, a product that allows you to lock in an interest rate for 90 days before you find a home, which does include one free float down — but it will cost you 1 basis point.

This online mortgage giant also charges a deposit of $500 for home appraisals, which is used to pay for the appraisal when you’re closing on your new home at the end of the transaction.

Outside of specific lender fees, there are other standard costs and fees associated with buying a home. Some of the most common ones include:

Read Also: What Happens If You Miss A Mortgage Payment

Approval Underwriting And Closing Timelines

No matter what type of mortgage you apply for, you can expect to get preapproved in as little as eight minutes, and usually within 24 hours of submitting your request.

Once you apply, the company can underwrite your loan in as little as one hour, but more commonly within two days.

Rocket Mortgage says it can close a loan in eight days in a best-case scenario. On average, Rocket Mortgage closes its loans in 26 days, according to a company spokesperson. The companyâs average time to close a conventional refinance is 21 days, and the average time to close a conventional purchase loan is 36 days.

You can sign your loan disclosures and closing documents electronically with Rocket Mortgage, which can help speed up the process.

Rocket Mortgage Review: Full Approval In Just 8 Minutes

Do you know how long it takes for the space shuttle to reach orbit? Apparently it takes just eight minutes, the same amount of time it will take borrowers to get a full mortgage approval online via Rocket Mortgage.

At least, this is the powerful claim the company is touting via a new online mortgage approval engine that promises to shake up the age-old, and very stale home loan process. They created quite a stir during their Super Bowl ad as well.

The company launched the end-to-end online product in late 2015 in what appeared to be a direct response to the many online mortgage startups now in existence.

Essentially, parent company Quicken Loans didnt want to get left behind, and in fact, wanted to be a leader in the new digital mortgage world. So far, it seems to be working.

Also Check: Who Offers 10 Year Mortgages

Rocket Mortgage Ease Of Application

Rocket Mortgage allows you to complete your mortgage application online, providing shortcuts along the way to make the process even faster. You can apply on the Rocket Mortgage app or on its website, which unsurprisingly, given Rocket’s online-first roots is fully optimized for mobile. The biggest difference between applying on your phone versus your computer is the size of your screen.

If you’d prefer to work with an actual person face to face , you can reach out to a mortgage broker affiliated with Rocket Mortgage.

A typical online application takes about half an hour, according to Rocket Mortgage, but you can work at your own pace. You’ll start by creating an account, then answering basic questions like the ZIP code where you’re planning to buy a home. Much of your financial information, such as bank and investment accounts, can be downloaded directly by Rocket Mortgage from many U.S. financial institutions. Rocket can also import income and employment information for many working Americans.

Then, you’re at the “See solutions” stage. This is where Rocket Mortgage pulls your credit data and reveals your loan choices, as well as how much house you can afford. From there, you can customize your options by changing the term, the money due at closing or your interest rate.

Applying Online With Rocket Mortgage

-

It starts by clicking or tapping on one of the Home Purchase or Home Refinance buttons. You provide the usual contact information to sign in.

-

Answer a few more questions and soon youre at the See solutions stage. This is where Rocket Mortgage pulls your credit data and reveals your loan choices. Customize your options by changing the term, the money due at closing or your interest rate or compare fixed- and adjustable-rate mortgages.

-

Once youre satisfied with your loan choice, Rocket Mortgage verifies your qualifications and submits the application to an automated underwriting system.

-

Upon approval, you can lock your loan rate and, if necessary, get a preapproval letter.

-

Once the loan is at the underwriting stage, you and your mortgage team will use Rocket to manage outstanding tasks, e-sign paperwork, monitor the progress of your loan processing, and even schedule your loan closing.

Don’t Miss: What Does A Mortgage Payment Consist Of

Do You Need A Trust If You Have A Will

If you already have a will, should you also set up a trust? It depends on your needs and the needs of your family. Generally, a trust is a faster, more efficient way to get your assets to your heirs, though its often more expensive to set up a trust than to create a will.

Well-planned estates often utilize both trusts and wills. You might choose to put just a few vital assets, such as your house, in a trust and leave everything else to be decided by your will. This can help ensure a speedy transfer for your most important assets while the rest of your estate goes through the normal probate process.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Special Perks For Veterans With Quicken

Rocket Mortgage is an experienced VA lender with a reputation for providing a high level of customer support to veteran loan applicants.

From helping secure a Certificate of Eligibility to helping disabled veterans with funding fee exemptions, Rocket Mortgages experts can assist eligible VA borrowers in all aspects of the home buying and refinancing process.

Rocket Mortgage representatives can explain eligibility requirements for a VA Loan Certificate, determine how VAs residual income requirements will apply to a borrowers underwriting criteria, and share special VA program information designed for borrowers who have a disability as a result of their time in the service of our country.

Through Rockets VA lending programs, borrowers may also be eligible to take advantage of VAs seller concessions policy, allowing home sellers to contribute larger amounts of funding toward closing costs.

Eligible veterans and their family members may also qualify for exemption from VAs funding fee or for grants for disabled veterans.

VA grant programs include Specially Adapted Housing for the building or remodeling of a home with disability-related modifications and Special Housing Adaptation for the adaptation of an existing home already owned by the veteran or a home the veteran intends to purchase.

Read Also: Do You Need Mortgage Insurance With An Fha Loan

Conventional Loan Vs Usda Loan

USDA loans are intended for lower-income borrowers in eligible rural or suburban areas.

To be eligible for a USDA loan, youll need to meet the programs income limits and be purchasing a property in an area that meets the USDAs definition of a rural area.

You can check out whether a given property meets this requirement by using the USDAs property eligibility tool. They have a tool to determine income eligibility as well. Generally, your households total income cant exceed 115% of your areas median income.

Like VA loans, USDA mortgages dont require a down payment.

In lieu of mortgage insurance, USDA borrowers must pay a guarantee fee. Youll pay both an upfront fee and an annual fee. The upfront fee can be financed into your loan.

Typically, youll need a credit score of at least 640 to qualify.

Read Also: Can You Add Closing Costs Into Your Mortgage

Bottom Line On Rocket Mortgage

Rocket Mortgage shines as a quick and easy online mortgage experience for consumers on the hunt for a home loan for their new house. It can also be a useful experience because Rocket Mortgage offers multiple loan types and mortgage products, and it can easily provide assistance throughout the process.

Disclaimer: All rates and fees are accurate as of July 8, 2022.

- No documents or registration required

- Handy refinance payment calculator

- Massive variety of refinancing options

You May Like: What If I Pay Extra On My Mortgage

How To Qualify For A Home Equity Loan With Rocket Mortgage

Rocket Mortgage requires a median credit score of at least 680 for home equity loans. If you and your partner or spouse are both listed on the loan application, the lower of your credit scores will dictate your eligibility and borrowing terms. Youll also need a debt-to-income ratio that doesnt exceed 45 percent. Youre allowed one late payment on your primary mortgage in the last 12 months to still be eligible for a home equity loan. The outstanding amount on your primary mortgage and the amount you borrow with a home equity loan cannot exceed 90 percent of your homes value.

Rocket Mortgage Site And Apps

One of Rocket Mortgages convenience drives is their commitment to a seamless site and apps. The Rocket Mortgage website is easy to use. Mortgage seekers really can apply and get approved in minutes.

Their Rocket Mortgage Launchpad app lets users launch a mortgage from an iPhone or other mobile device. Their mortgage calculator app lets users see how much home they can afford. It also gives insights into the amount of monthly payments and total interest.

Also Check: How To Write A Hardship Letter To My Mortgage Company

Rocket Mortgage Customer And Employee Awards

Another reason the question, Can I trust Rocket Mortgage can be answered with a yes is their awards. Rocket Mortgage and Quicken Loans have received numerous customer and employee satisfaction awards since 2010. See a list of their awards below.

| List of Rocket Mortgage Awards | Year |

|---|

Also see: 33 iPhone Apps That Will Save You Money Now

J.D. Power & Associates has given Quicken Loans and Rocket Mortgage their highest award for customer satisfaction in a mortgage operation the past six years in a row. Thats a pretty stout reason to trust Rocket Mortgage. J.D. Power rates businesses on strict guidelines for customer satisfaction. To get their top award six years running, Rocket Mortgage has to be doing something right.

The company has also received nods from Forbes, Fortune and PC Magazine. Each of those magazines have included Rocket Mortgage in their Best of the Web sections.

Rocket Mortgage and Quicken Loans have received over 15 Best Place to Work type awards. Those awards are both national and local. Finally, according to Quicken Loans internal data, 95% of their clients would recommend their service.

Top Review Highlights By Sentiment

- “Great culture and very fast”

- “The benefits are great and it pays well enough for the level of work I am expected to know and do.”

- “Pay is great if you are good fit for the position and willing to put in the work.”

- “Great people that are fun to work with!”

- “Training was great to get you to pass the safe test but after that it was on the job training.”

- “Long hours and for me it was a long drive 25 miles and with that being said traffic would be heavy back and forth”

- “There is no work/life balance with 55+ mandatory hours and many employees struggle to be family oriented while pursuing this career.”

- “Super long hours.”

- “Micro management on a whole other level”

Read Also: What Is A Pre Qualified Mortgage

Who Can Use Rocket Mortgage

Rocket Mortgage® is best for people who have a credit score of 580 or above and are ready to buy a home or refinance within the next few months. Check your credit score through our sister company, Rocket Homes®.

If you already have a signed purchase agreement, apply online to get started. Afterwards, one of our Home Loan Experts will give you a call so we can speed up your mortgage process.

If youre self-employed, you can start your application with Rocket Mortgage®, but you wont be able to do everything online. Well connect you with a Home Loan Expert along the way.

If you think youll need a co-signer to get a mortgage, we recommend before applying online.

You May Like: Can You Buy Two Properties With One Mortgage

Refinancing With Rocket Mortgage

Homeowners whod like to refinance their current loan amount at a lower rate or with a shorter loan term can use any of the products above, assuming they qualify.

There are other good reasons to refinance, too. For example, ARM borrowers may want to refinance into a fixed-rate loan. Or an FHA borrower could refinance into a conventional loan to remove mortgage insurance payments.

Rocket customers can access most major refinance loans, including:

- FHA Streamline: A refi program designed specifically to help existing FHA homeowners access todays mortgage rates without much hassle

- VA IRRRL: This loan can refinance an existing VA loan into a new VA loan at a lower rate with low fees

- Cash-out refinance: Replace your existing loan with a larger loan and keep the extra cash for home improvements, debt consolidation, or any other needs

Read Also: How Much Income To Qualify For 200 000 Mortgage

Working With Rocket Mortgage

Rocket Mortgage offers rich online and mobile functionality. It provides a secure environment where you can communicate with loan officers, upload documents, monitor your loan information, and access your closing documents all online. In fact, if you really dont want to talk to another person, you can opt to communicate via its Talk to Us page. But you always have the option to talk to a real-live home loan expert over the phone.

How To Apply For A Mortgage With Rocket Mortgage

Use the steps below to apply for a mortgage:

You May Like: What Are Current Mortgage Rates In Oregon

Recommended Reading: Does Rocket Mortgage Offer Heloc

Refinancing A House With Rocket Mortgage

Refinancing can enable homeowners to lower their monthly payments, convert from an adjustable-rate to fixed-rate, or shorten the term of their loan. Many homeowners are able to benefit from their homes appreciation and refinance to take cash out of their equity.

Rocket Mortgage offers refinancing options that may help borrowers achieve their objectives quickly and easily.

Rocket Mortgages refinance options include FHA, Conventional and VA loans with a variety of terms.

For VA homeowners, Rocket offers 100% VA cash-out loans meaning you may be able to cash out all your home equity, provided you qualify for the new loan.

Rocket also offers VA Interest Rate Reduction Refinance Loans with no income or asset approval required and no-appraisal options. These programs provide tremendous value for VA-eligible borrowers.

Rocket Mortgage experts work with borrowers through all steps of the refinancing process from application through closing and they make loan status reports available to keep customers informed of their progress.

After a refinance loan application is approved, borrowers can identify a location and date for closing their loan and Rocket Mortgage will prepare all closing documentation.

Our Take On Rocket Mortgage

Rocket Mortgage is the largest home lender in the US for a reason. Its a good choice for first-time homebuyers, offering helpful brokers and online tools to walk you through the process.

Its online application is quick and streamlined, making Rocket Mortgage a solid choice for homebuyers who like to independently work online. But after you apply, you can choose whether you want to work in-person with a mortgage broker or continue the fully online process.

But if you need a specialty loan or help to work around the standard qualifying requirements, this lender will be of little help. Rocket also doesnt offer home equity products. And you shouldnt apply unless youre certain youll be approved, as its application deposit can be as high as $700.

Also Check: Do You Have To Pay Back A Reverse Mortgage