Your Fico Score From Fico

90% of top lenders use FICO® Scoresdo you know yours?Choose your plan.

- Scores for mortgages, auto loans & more

- $1 million identity theft insuranceImportant information 33

- 24×7 identity restoration

Automatically renews at $19.95/month. Cancel anytime, no refunds. Includes FICO Score 8. Your lender/insurer may use a different credit score. See important information belowImportant information 11.

Monitor Your Credit And Accounts

Review your credit reports and bank accounts periodically looking for suspicious activity and errors that could signify identity theft.

If you feel your FICO® Score is a lot lower than you think it should be, that could be a sign that an identity thief might have gotten hold of your information. To know for sure, you can check your credit report and look for incorrect information, suspicious inquiries and new accounts.

How Can I Get Something Wrong On My Credit Report Removed

If you think that information on your credit report is wrong, you have the right to dispute it with the company that has registered the error. This can sometimes be a tedious process but errors on credit reports can delay mortgage applications and can exclude you from access to the best rates.

If you decide to seek help from a mortgage broker, youll be happy to know that they can assist with helping you to get bad credit removed from your record as well as advising you on how to improve your score with the CRAs in the UK.

Read Also: Does Rocket Mortgage Sell Their Loans

Don’t Miss: Do Mortgage Applications Affect Credit Score

How Do I Check My Auto Score

You can check your FICO® Auto Score by purchasing your credit reports and scores . However, there are also many ways to check your other credit scores for free.

While each score you receive will depend on the scoring model and the underlying credit report, knowing these other scores can give you a general idea of where you stand before you apply for an auto loan.

Some of the places you can look for a free credit score include:

- Banks and credit unions

- Online financial product comparison sites

- Experian gives you free access to a FICO® Score 8 based on your Experian credit report

- AnnualCreditReport.com offers one free report from each of the credit bureaus each year

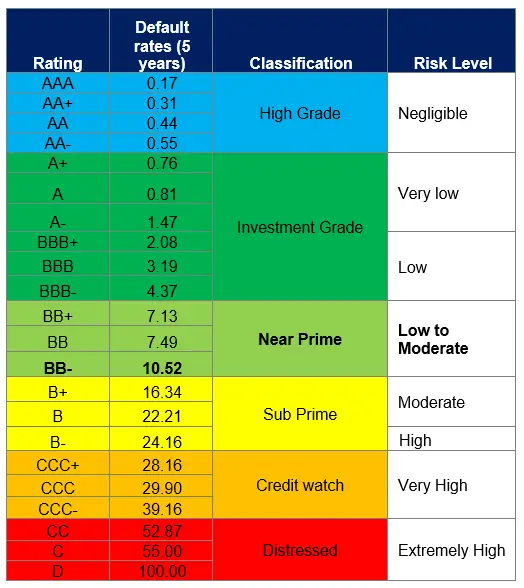

Lenders Use A Different Credit Scoring Model

For example, auto lenders typically use a credit score that better predicts the likelihood that you would default on an auto loan. Mortgage lenders, on the other hand, pull FICO scores from the three main credit bureaus Equifax, TransUnion, and Experian and use the mid score.

Mortgage lenders use a tougher credit scoring model because they need to be extra sure borrowers can pay back large debts.

Since mortgage companies loan money on the scale of $100,000 to $1 million, theyre naturally a little stricter when it comes to credit requirements.

Mortgage lenders will use a tougher credit scoring model because they need to be extra sure borrowers can pay back those large debts. So theres a good chance your lenders scoring model will turn up a different sometimes lower score than the one you get from a free site.

Don’t Miss: How To Become A Mortgage Loan Officer In Arizona

Low Credit Finance: Best For Payday Loans Online No Credit Check Instant Approval Up To $5000 Alternatives

If youre looking for payday loans online no credit check instant approval alternatives, Low Credit Finance is a great place to start. Here, you can apply for payday loans online no credit check instant approval of up to $5000 alternatives as credit checks are mandatory under US regulations. For those who need only a few bucks, there is the option to borrow small payday loans online no credit check instant approval alternatives starting from $100.

Repaying the loan is an important aspect of taking out payday loans online no credit check instant approval alternative. For this reason, lenders carry out affordability assessments to ensure that borrowers can afford to repay their loan. Theyll assign interest according to the size of the loan, and of course, the repayment period, which can range from 3 to 24 months. Interest is usually between 5.99% and 35.99%.

Application Requirements for Payday Loans Online No Credit Check Instant Approval up to $5000 Alternatives

- Minimum age of 18

- Income of no less than $1k p/m

Pros of Payday Loans Online No Credit Check Instant Approval Between $100 and $5000 Alternatives

- Flexible repayment options

Cons of Payday Loans Online No Credit Check Instant Approval Up to $5000 Alternatives

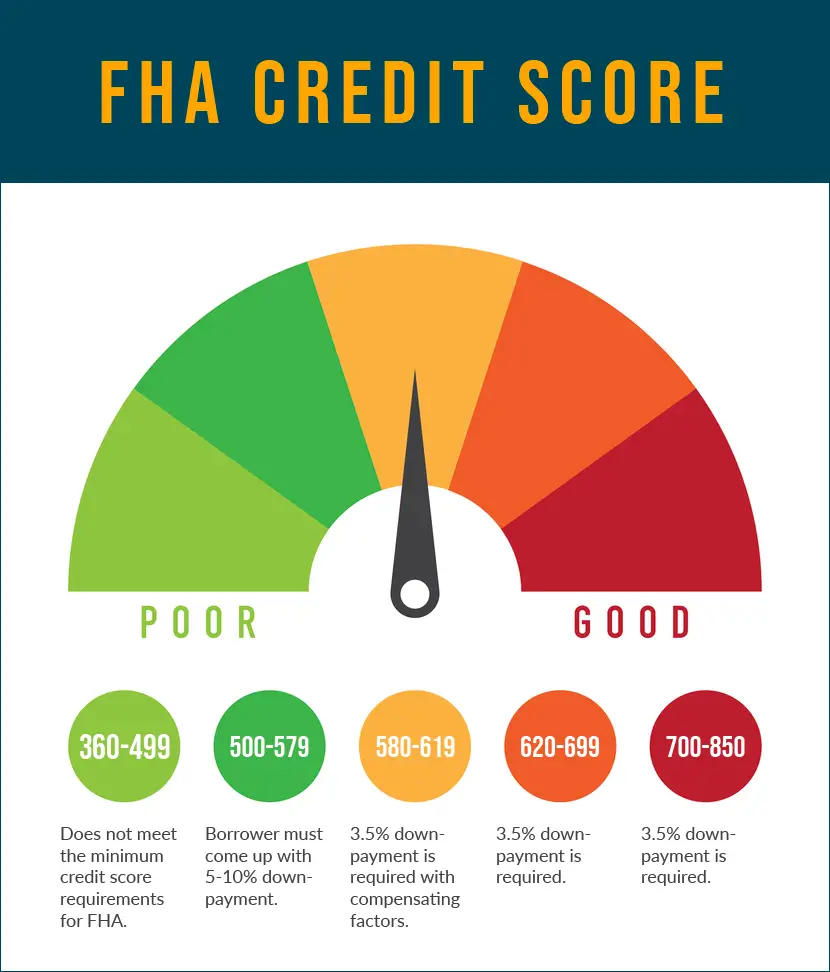

What Is A Good Credit Score To Buy A House 2020

While you don’t need a perfect 850 credit score to get the best mortgage rates, there are general credit score requirements you will need to meet in order to take out a mortgage. Prospective home buyers should aim to have credit scores of 760 or greater to qualify for the best interest rates on mortgages.

Recommended Reading: Is Rocket Mortgage The Same As Quicken Loans

What Is A Credit Pull

A credit pull or inquiry is a request by a retailer, financial institution or any other individual to view your credit report. Third parties can pull your credit report to review your creditworthiness and other details before extending credit. There are two types of credit pulls, hard inquiries and soft inquiries. Only you can see your soft inquiries, but hard inquiries are visible to anyone who looks at your report.

Anytime a potential lender looks at your credit report, a hard credit inquiry occurs. An example of a hard inquiry is when you apply for a mortgage and the lender pulls your credit report to determine your worthiness for extension of credit.

On the other hand, a soft inquiry occurs when a routine check is performed on your report without your permission. Soft inquiries happen when a creditor youre currently working with checks your credit to ensure youre still creditworthy or when you check your report yourself.

Check out this infographic to learn how bad credit can affect your daily life.

Green Dollar Loans: Best For Same Day Processing Of Loans No Credit Check Alternatives

Same day processing of loans no credit check is not possible due to US regulations, but Green Dollar Loans offer great alternatives and that is why it made it onto our editors pick! This loan finder platform provides a free service of connecting borrowers with lenders most likely to approve their loan requests. Whats more, is that loans no credit check alternatives on the platform start low at $100 but can go as high as $5000. Catering to a wide range of borrowers is a focus of Green Dollar Loans.

When applying for loans no credit check alternatives on Green Dollar Loans, youll need to select an amount between $100 and $5000 and then select the required term, between 3 and 24 months. Repayments are kept simple with a reasonable interest of 5.99% to 35.99% attached.

You can apply for this loans on Green Dollar Loans and expect feedback on the outcome within a few minutes!

Application Requirements for Same Day Processing of Loans No Credit Check Alternatives

- $1k+ p/m income

Pros of Loans No Credit Check Same Day Alternatives

- Quick access to cash online

- Reasonable eligibility criteria

- Bad credit wont affect the loan outcome

Cons of Same Day Loans No Credit Check Alternatives

- High interest rates

Don’t Miss: Can I Trust Rocket Mortgage

Us Bank Auto Loan Details

You can expect competitive rates when financing a new or used car through U.S. Bank.

| Loan Amount Range |

|---|

| None |

*Rate range as of Aug. 31, 2022.

If you fit the following profile, youll receive the lowest APR that the company offers:

- : 800 or higher

- Loan term: 60 months or less

- Loan amount: $35,000 or more

These factors may result in higher loan rates:

- Purchasing a vehicle from a private party

- A vehicle that is older than six model years

- Loan amounts below $35,000

- Loan terms longer than 60 months

The U.S. Bank Vehicle Marketplace makes browsing dealerships more convenient. If youre pre-approved for a loan through U.S. Bank, you can send your approval letter to a dealership representative and get the exact car you want.

How Mortgage Lenders Pull Credit

When you apply for a mortgage, lenders pull your credit report from all three major credit bureaus: Transunion, Equifax, and Experian.

Whether you get approved for the loan and the terms of your loan will depend on the result of those reports.

Lenders qualify you based on your middle credit score.

For example, if your scores are 720, 740, and 750, the lender will use 740 as your FICO. If your scores are 630, 690, and 690, the lender will use 690 as your FICO.

When you apply with a spouse or co-borrower, the lender will use the lower of the two applicants middle credit scores.

Expect each bureau to show a different FICO for you, since each will have slightly different information about you. And, expect your mortgage FICO score to be lower than the VantageScore youll see in most free credit reporting apps.

In all cases, you will need to show at least one account which has been reporting a payment history for at least six months in order for the bureaus to have enough data to calculate a score.

You May Like: Should I Refi To A 15 Year Mortgage

How Do My Fico Scores Affect My Ability To Get A Mortgage

Lending a huge amount of money is risky business. Thats why mortgage lenders need a good way to quantify the risk, and your FICO® scores with all of the data and research that go into them fit the bill.

Different lenders have different requirements for their loans. And because there are many different types of mortgages from many different types of lenders, theres no one single minimum FICO® score requirement.

Do The Lmi Providers Credit Score

All of the major Lenders Mortgage Insurers use credit scoring, in fact they are much stricter than the banks.

Genworth Financial, QBE LMI, Westpac LMI, ANZLMI and St. George Insurance all use credit scoring.

It is almost unheard of for a Lenders Mortgage Insurer to override a credit scoring decision. If you are declined there is nothing you can do except for applying with another lender or reducing your loan so that Lenders Mortgage Insurance is no longer required.

QBE LMI for example, has two scorecard systems that are used for each and every LMI proposal sent to them by the banks and you must pass both systems!

One looks at your Equifax credit file and the other assesses your entire application including the loan purpose, loan amount, serviceability, security property and other aspects of your situation that are not related to your credit history.

Dont worry, some of our lenders have a Delegated Underwriting Authority which allows them to approve loans that the mortgage insurers wouldnt normally look at

Read Also: How To Get A Mortgage Loan After A Foreclosure

What Scores And Models Are Used When Applying For A Mortgage

FICO® created different scoring models for each credit bureauExperian, TransUnion and Equifax. The commonly used FICO® Scores for mortgage lending are:

- FICO® Score 2, or Experian/Fair Isaac Risk Model v2

- FICO® Score 5, or Equifax Beacon 5

- FICO® Score 4, or TransUnion FICO® Risk Score 04

Mortgage lenders will often get a single report that contains your credit reports from each of the three credit bureaus and the associated FICO® Scores. It may base the lending decision on your middle credit score or, if you’re applying jointly with a partner, the lower middle score.

Keep this in mind when you’re trying to figure out what . If you’re looking for a mortgage that requires a minimum credit score of 580, you may need your middle score to be at least 580 based one these specific FICO® Score models.

There are exceptions, though. Mortgage lenders could use different credit scoring models for loans that aren’t secured or bought by Fannie Mae or Freddie Mac. You might even be able to get a mortgage if you don’t have a credit history or score at all.

Additionally, there’s a review underway that could open up the use of different credit scoring models for mortgages, even if they’re secured or bought by Fannie Mae or Freddie Mac. However, until there’s a change, many mortgage lenders will continue to use these three classic FICO® Scores.

Bottom Line On Us Bank

When considering your auto financing options for your next vehicle, U.S. Bank is a solid choice if youre a borrower with excellent credit who wants to buy a new or used vehicle or to refinance your auto loan. The company can also help you with buying out a lease. The online application process is simple and fast.

| Overall Rating |

|---|

You May Like: How Much Will My Mortgage Be Calculator

Interest Paid By Fico Score

| FICO Score |

Based on the in August 2021

If your credit score is on the lower end, even a small difference in your mortgage score can make a big difference in the cost of your home loan. You could wind up paying more than 20% more each month, which can make it harder to afford a mortgage.

The Credit Scores Lenders Use

The score you pulled from the or another third-party provider was an educational credit score, provided just to give you a perspective on your credit standing. Theyre not the scores that lenders actually use to approve your application. Services that provide credit scores include this information in their disclaimers.

On top of that, you likely purchased a generic credit score that covers a range of credit products. Creditors and lenders use more specific industry credit scores customized for the type of credit product youre applying for. For example, auto lenders typically use a credit score that better predicts the likelihood that you would default on an auto loan. Mortgage lenders use a score developed specifically for mortgage loans. Your lender also might also use a proprietary credit score thats developed for use by just that company.

Many lenders use the FICO score, but even the score you receive through myFICO may be different from what your lender sees. Some lenders also use VantageScore, but again, their version is different from yours.

The score the lender pulls might differ from the one you used sometimes by several points, possibly enough to disqualify you from the best interest rate or maybe enough to have your application denied. When you order your credit report and score from myFICO, youll receive access to the most widely used FICO industry scores. This will give the best idea of what the lender sees when they check your credit score.

Don’t Miss: Do 15 Year Mortgages Have Lower Interest Rates

It Could Change Your Interest Rate

Even if you did not overextend your credit between the time you applied for the loan and the closing date, you may still be affected when the lender pulls your credit. If there is a significant disparity between your original credit score and the score they receive prior to closing, the lender may have to readjust. Your credit score determines the interest rate you receive. Its called a loan-level pricing adjustment. For every credit score category, the lender must adjust the interest rate. If your credit score dropped to a lower category because you had a late payment during the time you waited to close on your home or you closed an account without realizing the implications, it could affect your interest rate. It is in your best interest to keep your credit as consistent as possible during this time. Make sure you make your payments on time, dont increase any of your outstanding credit, and dont close any accounts. Once you close on your mortgage, you are free to do what you want with your credit, but until then, keep things as consistent as possible.

Also Check: Does Paypal Working Capital Report To Credit Bureaus

How Can I Save And Invest For Retirement

Canada offers two individual savings accounts through which you can save for retirement, called the registered retirement savings plan and the tax-free savings account . An RRSP, an investment account thats available to residents of Canada who file taxes in the country and have an income and a SIN, allow you to build up funds for retirement while reducing your current tax bill. A TFSA, another type of investment account that isnt taxed at withdrawal but also doesnt reduce your current tax bill, is available to Canadian residents over the age of 18 with a valid SIN.

Mr. Omololu stressed the importance of heeding the annual contribution limits for both RRSPs and TFSAs to avoid being taxed on the overage something he said many newcomers arent immediately aware of. Newcomers whove just heard about the TFSA, for example, have opened accounts and overcontributed, and its just a mess trying to sort that out. It makes for a messy start to investing in Canada, he said, suggesting that a more prudent approach to these accounts is to set up a pre-authorized monthly contribution.

If youre not sure whether an RRSP or a TFSA makes the most sense for your financial situation, Tim Cestnick, co-founder and chief executive officer of Our Family Office Inc. and a regular Globe contributor, has a helpful breakdown of scenarios where one or the other may make the most sense.

Recommended Reading: Which Credit Report Do Mortgage Lenders Use

What Affects Your Credit Score

The FICO Score and VantageScore credit models take the same general factors into account when calculating your credit score, although they weigh them slightly differently.

- Payment history: Paying your bills on time is the single biggest factor in your credit score. In the FICO Score model, this comprises up to 35% of your credit score.

- The amount of credit you use as a percentage of your available credit is another important factor. To maintain a good credit score, you shouldnt use more than 30% of your credit limits. If you have a credit card with a limit of $3,000, that means your maximum balance should be $1,000. Credit utilization accounts for 30% of your FICO Score.

- Length of credit history: The longer youve had credit, the more time youve had to prove you can make your payments on time. The length of your credit history accounts for 15% of your FICO Score.

- This refers to the different types of credit you have. A mix of both installment credit and revolving credit will help boost your FICO Score this accounts for 10% of the FICO Score.

- Every time you apply for credit, the lender checks your credit report this process is known as a hard inquiry. Because a hard credit inquiry typically lowers your credit score slightly for a few months, you should avoid applying for too much credit in a short time. Having a lot of hard inquiries accounts for 10% of your FICO Score.