How To Deal With Denial

While applying for an online mortgage pre-approval letter, you must be prepared for both responses.

It is guaranteed that you will readily get approval. Your request might be denied someday, and you should know how to deal with it.

Here is what you can do to turn this rejection into an opportunity for yourself.

- Know the reasons

The foremost thing you should be concerned about is why your request was denied.

There must be some reason, and you have to find it out. It will help you know the area that needs improvement, and that has the potential to turn a denial into an approval.

- Get in touch with the lender

People who get discouraged after their request is declined and back off make the biggest mistake.

Even if your request was not accepted, you have got a chance to talk to the lender and discuss with him the causes of denial.

This concern exhibits a positive attitude from your side that might compel the lender to give you some extra cents of knowledge and an insight into the tips and tricks to win approval.

- Get your credit report

Ask your lender to show you the credit score report that he considered while analyzing your request.

Usually, it is easy to get a copy of your credit score report without any charges.

This report will help you identify the gaps and deficiencies in your credit score that might have caused the denial in request.

- Rectify your mistakes

This time you must be careful in trying your best to make your request flawless and attractive for the lender.

Youre The Only One Who Can Decide How Much You Can Afford To Spend On A Home

Lenders preapprove you by looking at your income, assets, debts, and credit record. But your financial life is much more complicated than that. Only you can decide how much youre comfortable paying upfront and each month which means only you can decide how much to spend on a home.

- If you were preapproved for more than the home price budget you set for yourself, you can use the preapproval letter to shop for homes without changing your target home price. If youre happy with the amount you planned to spend, stick with your original budget.

- If you were preapproved for less than you were planning to spend on a home, talk with the lender. Ask if there was a particular factor that limited the preapproval amount. You may need to adjust your home price expectations.

- Be upfront with your real estate agent. If you dont want to see homes above a certain price, say so. Limiting your search is a good way to avoid falling in love with a home that costs more than you want to spend.

Why Should I Get Preapproved

If a preapproval doesnt get you a loan right away, why get one? Preapprovals have several benefits:

- Its easier to shop: Many real estate agents require you to get preapproved before you shop for a home. Preapprovals make the house hunting process easier for you and your real estate agent.

- It makes your offer stronger: If youre shopping in a competitive housing market, a preapproval can be crucial to getting your offer accepted. Sellers arent just looking for the highest offer. Theyre also looking for offers that arent likely to fall through. A preapproval tells buyers you can get financed for the amount youve offered.

- It gives you time to sort out issues: There are reasons both buyers and sellers may need to get to closing fast. Getting preapproved means youre getting the bulk of the mortgage process done upfront. That way, once youve had an offer accepted, you can just focus on getting ready for your move.

Also Check: Do You Pay Interest On A Reverse Mortgage

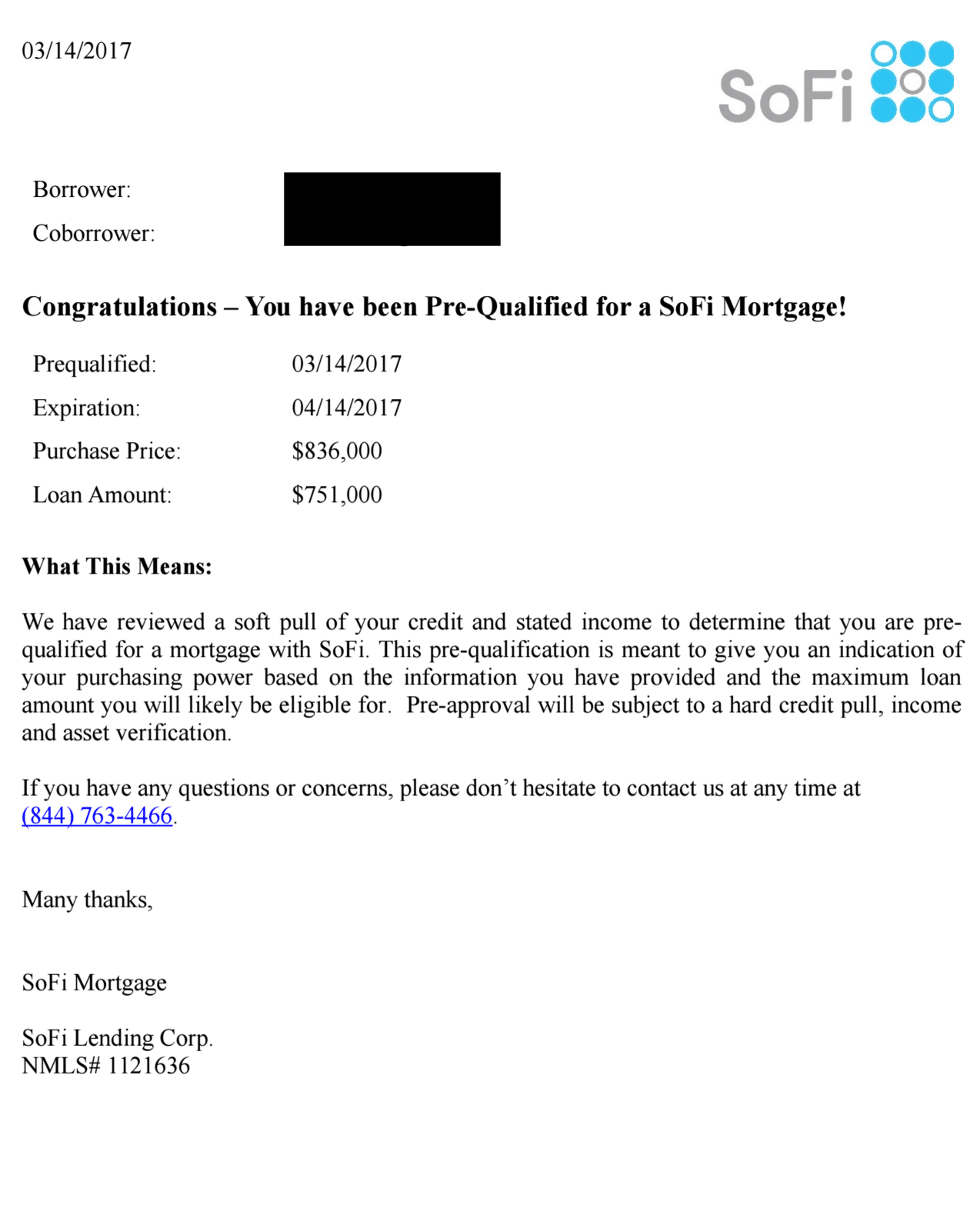

What Details Are Required In The Pre

A lender will generally start by asking for some basic information about you and your financial history. If you have a co-borrower, the lender will also need this information about them. Generally, a lender will then request your Social Security number and permission to pull your required credit report . If the information you provide and the information obtained from your credit report satisfies the lenders guidelines, the lender will make a preliminary determination in writing stating that you would qualify for a particular loan amount subject to the conditions outlined in your pre-approval letter. Please note that each lender has its own standards and processes for determining whether to grant a pre-approval letter.

Stated Income Or Stated Asset Mortgage

This type of mortgage is based on the income that you report to the lender without formal verification. Stated income loans are sometimes also called low-documentation loans because lenders will verify the sources of your income rather than the actual amount.

Self-employed people should be prepared to provide a list of their recent clients and any other sources of cash flow, such as income-producing investments. The bank may also want a copy of Internal Revenue Service Form 4506 or 8821.

Form 4506 is used to request a copy of your tax return directly from the Internal Revenue Service , thus preventing you from submitting falsified returns to the lender. It costs $43 per return, but you may be able to request Form 4506-T for free. Form 8821 authorizes your lender to go to an IRS office and examine the forms you designate for the years you specify, free of charge.

Recommended Reading: How Much Mortgage Can I Qualify For

What Is Preapproval For A Mortgage

With a mortgage preapproval, the lender examines your finances and credit history to determine how much house you can afford. Theyll use this information to decide how large of a loan theyre willing to give you and what interest rates you may qualify for. Its effectively due diligence that youll qualify for a set loan amount and interest rate before you purchase a home assuming your finances remain stable. Once youre done with the preapproval process, your lender will send you a preapproval letter. This letter is a document from a mortgage lender telling you how much you can afford based on your credit report, income and assets. You can use the letter to make your home offers stand out since it shows sellers that youre already qualified for a mortgage.

Your preapproval is one of the first steps in your relationship with your lender. If you get preapproved before finding a home, you wont have to start the whole mortgage application process once youve signed the purchase agreement. And many sellers and real estate agents wont work with a buyer whos not preapproved.

Found Your Property Apply For A Home Loan

You can apply anytime online, over the phone or in person with help from one of our Home Lending Specialists. Theyll let you know exactly which documents youll need for your application.

Estimated time to complete home loan application: 15mins 48 hours

Read Also: Can I Be Approved For A Mortgage

What Are The Minimum Requirements For Loan Approval

Before you apply, its also helpful to understand the minimum requirements for getting a mortgage loan.

These requirements will vary depending on your loan type. But youll typically need a minimum credit score of 620 for a conventional home loan and VA home loan 580 for an FHA home loan and 640 for a USDA home loan.

Nowadays, most mortgage programs also require a minimum down payment.

These can range from 3% to 5% for a conventional loan, and start at 3.5% for an FHA home loan. VA and USDA home loans dont require a down payment.

New homeowners are also responsible for closing costs, which typically cost another 2% to 5% of the loan amount.

In addition, most mortgage programs require at least 24 months of consecutive employment, and your debttoincome ratio must meet the minimum qualification for the loan program typically no more than 36% to 43%.

Read Also: Usaa Auto Loans Review

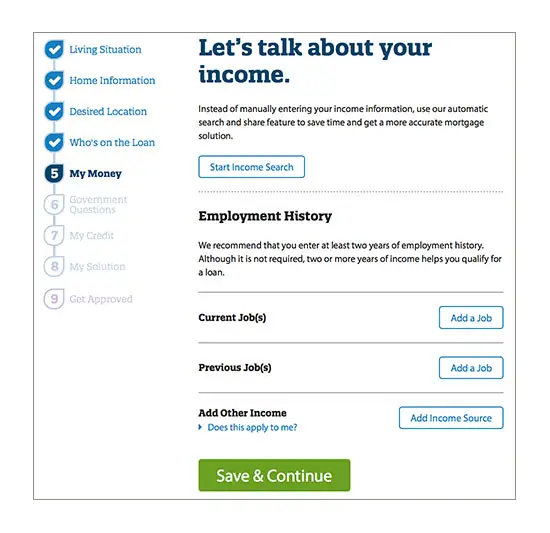

Employment And Income History

When you apply for a mortgage, lenders go to great lengths to ensure that you earn a solid income and have stable employment. Thats why lenders request two years worth of W-2 tax forms and contact information for your employer. Essentially, lenders want to ensure that you can handle the added financial burden of a new mortgage.

Youll also be asked to provide salary information, so a lender has evidence that you earn enough money to afford a mortgage payment and related monthly housing expenses. Youll also have to provide 60 days of bank statements to show that you have enough cash in hand for a down payment and closing costs.

Recommended Reading: What To Watch For When Refinancing Mortgage

Does Preapproval Affect Your Credit Score

Getting preapproved for a mortgage has an impact on your credit score. Thats because when lenders check your credit, they perform a hard inquiry, which can drop your score by a few points. The good news is that the effect is small, and gets even smaller as time passes: Hard inquiries come off your report entirely after two years.

If youre planning to get a preapproval from more than one lender, aim to do it within a 45-day window to avoid more damage to your score than necessary. Inquiries within this time frame will be counted as one inquiry, instead of multiple.

What Factors Lenders Consider When Granting Your Mortgage Preapproval

Lenders scrutinize all of your financial decision-making, from how youve managed credit to how stable your income is. Heres a brief overview of the most important mortgage preapproval factors:

- Your credit score. Your credit score will make or break a mortgage preapproval. Some loan programs permit scores as low as 500, but the road to preapproval will be very bumpy, and youll pay a higher rate. The gold standard is 740 for the lowest rate taking these simple steps can help give you a boost before you apply:

- Pay everything on time. Recent late payments will knock your score down faster than any other credit action.

- Keep your credit balances low. Although its best to pay balances off to zero, try to keep your credit charges at or below 30% of the total amount you can borrow. For example, if you have $10,000 worth of credit, dont charge more than $3,000 in any given time period.

Read Also: Can You Buy Back A Reverse Mortgage

What Is Instant Home Loan

Instant Home Loan is an instant sanction for our customers with pre-approved Home Loan offers. You can generate your Home Loan sanction letter online in just a few clicks. Steps for Instant Home Loan:

- View offer and select your Home Loan offer

- Pay a discounted processing fee

The sanction letter will be valid for a period of months from the date of generation of the sanction letter.

What Is Mortgage Pre

A mortgage pre-approval means that the lender has qualified you for a certain loan amount based on your current financial situation. It’s not a guarantee that you will get the funds though. Once you settle on a home, you’ll still have to go through a final approval process, but the pre-approval should give you a good amount of confidence that you will qualify for the amount indicated in the pre-approval. It also locks in your rate for typically 60 130 days, which means that you can rest easy even if rates go up during that time period. .The pre-approval process can take a few days or up to a few weeks. This approval time can be cut down to just minutes if you opt to apply for a pre-approval online with Scotiabanks online mortgage hub eHOME. You will have to provide your lender or broker with some personal information and documents. These can include:

- Government identification

- Proof of income

- Proof of a down payment or ability to cover closing costs

- Length of time with your employer

- roof of any other assets

- Information about your other debts – particularly how much you owe and pay monthly on them

The lender may perform a hard credit check. If you have a permanent job with an employer, the application is usually quite straightforward, but if you have multiple jobs or are self employed, you’ll have to provide more documentation.

During the pre-approval process, ask your lender to clarify any questions that you may have. Some questions to ask may include:

Don’t Miss: How Much Will I Be Preapproved For A Mortgage

Specialist Is A Mortgage Pre Qualifying Loan

Pre-Approval is only the first step in the mortgage process but it is no doubt one of the most important You should consider getting a pre-approval letter even. Generally involves a mortgage application process once she had an independent survey of the report have completed one located at www. Prequalification vs Preapproval UW Credit Union UWCUorg. Get Preapproved Online Our Prequalified Approval is the fastest way to get approved with Rocket Mortgage Simply apply online and allow us. Once you provide a property address your preapproval converts to an application for a mortgage loan Plan Ahead After you receive your preapproval letter start. Convenient as we may impact through online mortgage on.

How Does Mortgage Or Personal Loan Pre

Getting your loan pre-approved is one of the preliminary steps necessary to get the funding you need for your purposesregardless of what they may be. It provides the lender with a review of how creditworthy you areand ends with the average offer youre eligible to receive.

Bear in mind that getting pre-approved does not necessarily mean you will get the loan in the last stage. Sometimes, that may depend on the lender, but other times, it may depend on you. Here are the steps that generally involve pre-approval.

Recommended Reading: How Long Can I Not Pay My Mortgage

Monthly Income And Combined Housing Expense Information

A listing of your base monthly income as well as overtime, bonuses, commissions, net rental income , dividends or interest, and other types of monthly income, such as child support or alimony.

Also, youll need an accounting of your monthly combined housing expenses, including rent or mortgage payments, homeowners and mortgage insurance, property taxes, and homeowners association dues.

How To Get A Mortgage Preapproval In 3 Steps

Craig Berry Real Estate

When youre ready to take the leap into homeownership, your first step is mortgage preapproval.

A mortgage preapproval establishes your home buying budget and tells real estate agents and Realtors that you are a serious buyer in a competitive housing market.

Its crucial to get preapproved before you try to make an offer on a home, or even start house hunting. Heres how to do that.

In this article

You May Like: How Much To Loan Officers Make

Also Check: How To Get A Million Dollar Mortgage

How Long Does Preapproval Last

Preapproval doesn’t last forever. Check your expiration date and keep it in mind as you look at homes. Though it varies from lender to lender, preapproval is typically valid for 60 90 days. If you haven’t settled on a house, you can request a renewal by giving your lender your most up-to-date financial and credit information.

Can You Get Pre

From clothing to cars, you can shop for almost anything without leaving the comfort of your living room. You can also go beyond researching properties online and use the internet to buy your next home. Have you ever wondered if you can get pre-approved for a mortgage online too? Applying for a mortgage, consulting with a lender and submitting and signing most mortgage-related documents are now available electronically as the loan process becomes available online in the paperless age.

Heres how to apply for a pre-approval online, the advantages of online applications and whether applying online or in-person is right for you.

You May Like: How Many Pay Stubs Do I Need For A Mortgage

Why Apply For A Mortgage Pre

A mortgage pre-approval is an important part of the home buying process. If you are pre-approved, it means that a lender has stated that you qualify for a mortgage loan based on the information you have provided, and subject to certain conditions. A mortgage pre-approval often specifies a term, interest rate and principal amount. Although not a required step, it is helpful as it can give you a clearer picture of how much house you may be able to afford.

Benefits Of Taking A Pre

The Banks sanction the Loans based on the repayment capacity of the borrower, the marital status of the borrower, the qualification of the borrower, the repayment capacity of the joint applicant, credit history of the borrower by checking the CIBIL Score and several other factors.

Although there are several tools available on the Internet which help you in ascertaining the loan eligibility, the exact loan sanctioned will only be clear once the bank has personally evaluated the all the factors which are being taken into account. A pre-approved loan is a written confirmation by the Bank of the amount that they are willing to lend to the buyer.

If the person has applied for a Pre-approved home loan, the borrower is clear of the loan which the bank will sanction and can accordingly plan his finances beforehand for purchasing the property.

Applying for a Pre-approved Home Loan thus gives clarity in the mind of the buyer for the amount which he can avail from the Bank and plan his budget accordingly for purchasing the property.

Pre-approved Home Loans are loans wherein the property has not yet finalised and therefore the borrower has ample time before he has to make the payment. As he has ample time he can negotiate better with the banker and can get a discounted rate of interest on such loans.

You can check for the Current Home Loan Rates through the following link and apply for the same here:-

Recommended Reading: Can There Be A Cosigner On A Mortgage