You Have Health Challenges

Retirement-age homeowners with health issues might consider a reverse mortgage to raise cash for medical bills. However, if your health declines to the point where you must relocate, the loan must be repaid in full because the home no longer qualifies as the borrowers primary residence. If you might have to move due to health or disability, a reverse mortgage is probably unwise because, in the short run, its upfront costs are unlikely to pay off.

Homeowners who suddenly vacate or sell the property generally have just six months to repay the loan. And though borrowers may pocket any sales proceeds above the balance owed on the loan, thousands of dollars in reverse mortgage costs will have already been paid out.

Also Check: What Are Current 20 Year Mortgage Rates

Are There Any Income Or Credit Score Requirements

Yes. Since monthly payments are not required, proof of your income is used to ensure you can continue to pay your basic living expenses, plus home insurance, property taxes and any association dues. A credit check is used to confirm if you have any federal tax liens or other items that may affect qualification. Credit scores are not a consideration.

Do I Have To Complete In

The answer depends on the type of reverse mortgage loan for which you are applying. In New York, in order to get a proprietary reverse mortgage loan , the borrower must either complete in-person counseling or waive such requirement in writing. In order to get a HECM reverse mortgage loan , a borrower may not waive the counseling requirements but he or she may opt to complete the required counseling either in person or over the telephone. You can find a list of non-profit housing counselors on the Departments website.

Don’t Miss: Why Get An Adjustable Rate Mortgage

Types Of Reverse Mortgages

As you consider whether a reverse mortgage is right for you, also consider which of the three types of reverse mortgage might best suit your needs.

Single-purpose reverse mortgages are the least expensive option. Theyre offered by some state and local government agencies, as well as non-profit organizations, but theyre not available everywhere. These loans may be used for only one purpose, which the lender specifies. For example, the lender might say the loan may be used only to pay for home repairs, improvements, or property taxes. Most homeowners with low or moderate income can qualify for these loans.

Proprietary reverse mortgages are private loans that are backed by the companies that develop them. If you own a higher-valued home, you may get a bigger loan advance from a proprietary reverse mortgage. So if your home has a higher appraised value and you have a small mortgage, you might qualify for more funds.

Home Equity Conversion Mortgages are federally-insured reverse mortgages and are backed by the U. S. Department of Housing and Urban Development . HECM loans can be used for any purpose.

HECMs and proprietary reverse mortgages may be more expensive than traditional home loans, and the upfront costs can be high. Thats important to consider, especially if you plan to stay in your home for just a short time or borrow a small amount. How much you can borrow with a HECM or proprietary reverse mortgage depends on several factors:

Tips For Retirement Planning

- Will you need a reverse mortgage? SmartAssets retirement calculator can help you figure out set and track how much money your will need for retirement.

- A financial advisor could help you put a retirement plan together for your needs and goals. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

Don’t Miss: How Much Of My Mortgage Payment Is Interest

What To Do If Youre Facing Reverse Mortgage Problems

From not fully understanding how a reverse mortgage works to facing unexpected changes or needs, borrowers often have to figure out how to get out of a reverse mortgage. Consider these steps should you run into reverse mortgage problems.

Seek help from a HUD-approved counselor

Borrowers with concerns about their reverse mortgage loan should speak with their reverse mortgage counselor, Irwin said. In addition to discussing the loan repayment process, the counselor can also run a benefits checkup to determine if the borrower is eligible for federal or state resources, such as SNAP or other government programs.

Review your long-term plans

Know what goals you want to prioritize, such as whether you wish to remain in the home long term or pass the property to your heirs.

Consider the costs

Keep in mind, any course of action you take will come at a cost. Refinancing your existing loan with either a conventional mortgage or a new reverse mortgage will entail closing costs.

Communicate with your lender

At the first sign of trouble, reach out to your lender to discuss the reverse mortgage problems you are facing.

Make partial payments

Even if you cant afford to repay your reverse mortgage in a lump sum, you might consider making partial prepayments to reduce the amount owed later on. Most reverse mortgages allow partial prepayments without charging a penalty, but be sure to talk to your loan servicer about your prepayment options and confirm how those payments will be applied.

What Does It Cost To Apply For A Reverse Mortgage

Before closing on a proprietary reverse mortgage under New Yorks Real Property Law Section 280 or 280-a, the only charges a lender may collect from a borrower before closing are an application fee, an appraisal fee, and a credit report fee. That application fee must be designated as such and may not be a percentage of the principal amount of the reverse mortgage or of the amount financed. For a HECM loan, there generally is no separate application fee as that fee is include in the origination fee collected at closing.

Don’t Miss: Does Fha Require Mortgage Insurance

Who Is Considered A Spouse For Reverse Mortgage Purposes

For someone to qualify as a spouse under the rules that apply to eligible non-borrowing spouses, they must be legally married to the borrower according to the laws of the state where they reside or where the ceremony took place and must have remained married. For different-sex couples, they must have been married at the time that the home equity conversion mortgage was issued. Same-sex couples who were legally prohibited from marrying at the time that the HECM was issued can qualify as spouses if they married subsequently.

Can I Get A Fixed Interest Rate On A Reverse Mortgage

Yes, borrowers can get a fixed rate. However, you will have to choose a lump-sum distribution of proceeds.

About the Author

Gina Pogol writes about mortgages and personal finance for several national publications. Pogol is a licensed Nevada mortgage lender with more than 20 years of experience. Gina is a well-rounded business professional with experience as an estate planning and bankruptcy paralegal, a systems consultant for Experian and a tax accountant with Deloitte. She loves teaching and empowering consumers.

Read Also: What Documents Are Needed For Mortgage Pre Approval

Problems With Reverse Mortgage

Even if you make a plan to pay off your reverse mortgage early, things may not go as smoothly as you expect. Life changes, such as illness, can make it difficult to keep up with required living expenses. In some cases, the value of your home may decrease, or you may no longer reside in your home as your primary residence.

Reverse mortgages are not for everyone. Be sure to do your research and consult with a reverse mortgage specialist to ensure that this type of loan is right for you.

It Could Impact Your Other Retirement Benefits

A reverse mortgage may not be considered income for tax purposes, but it could impact your ability to qualify for other need-based government programs such as Medicaid or Supplemental Security Income . Itâs a good idea to discuss this with a benefits specialist to make sure your eligibility wonât be compromised.

Read Also: How To Sell Reverse Mortgages

Reverse Mortgage Heirs Responsibility

Reverse mortgage heirs are not responsible to pay the loan balance or pay back the loan. If the loan balance is more than the appraised value of the home, the heirs are not held responsible to pay the difference or making the monthly payments.

This is because a reverse mortgage is a non-recourse loan and the FHA insurance absorbs the loan balance. The borrower pays this insurance during the loan closing as well as each month.

When the borrower dies, the heirs can keep the home by financing the HECM loan. They may sell the home and keep the remaining proceeds that dont go toward the reverse mortgage loan repayment. Alternatively, heirs may walk away without any negative effect on their credit histories or sign a Deed-in-Lieu of opens in a new windowForeclosure to satisfy the loan.

Heirs are advised to process a reverse mortgage loan quickly after it becomes due. Selling your home can be done if the heirs are unable to use the property.

A reverse mortgage can be paid off early by refinancing it with a traditional loan or paying the difference between how much was borrowed and how much is owed on the home.

The borrower may also make monthly payments, which will shorten how long they have left in their life before getting a HECM.

Paying Off The Balance

Heirs or the homeowners themselves can pay off the balance due to keep the home after a maturity event. It usually requires some kind of alternative financing, as well as notice to the reverse mortgage lender.

If youre inheriting the home, youll still need to respond to the lender within 30 days of receiving the due and payable letter. You can usually set up a payment plan. Heirs are typically allowed six months to repay the debt.

You May Like: Are There Any Mortgage Lenders For Bad Credit

Reverse Mortgage Problems And Responsibilities For Heirs

According to a USA Today article from December 2019, heirs who want to pay off a reverse mortgage and keep the home often face months of red tape and frustration when dealing with the loan servicer. Shoddy loan servicing practices often hinder what should be routine paperwork, debt calculations, and communications with borrowers or heirs.

Refinance The Reverse Mortgage

Perhaps it isnt the reverse mortgage you want to get out of, but the specific terms of your reverse mortgage that are the problem. If thats the case, you could consider refinancing your current reverse mortgage into one with better terms. If interest rates are lower than when you first got your loan or your homes value has increased, you could refinance into a new reverse mortgage. This could give you a better interest rate, change an adjustable rate to a fixed rate, help you pay your loan off faster or provide access to more equity.

Keep in mind that youll need to pay closing costs for a refinance.

You May Like: What Does It Mean To Take Out A Mortgage

How The Home Equity Access Scheme Works

The loan is secured against real estate you, or your partner, own in Australia. You can choose how much you offer as security.

You can choose the amount you get paid fortnightly. Your combined pension and loan payments cannot exceed 1.5 times the maximum fortnightly pension rate.

From 1 July 2022, you can get an advance payment of your loan . This is in addition to, or instead of, your fortnightly loan payments. Taking up this option may reduce the fortnightly loan payment you get for the next year .

There is a maximum amount of loan you can borrow over time. This is based on your age and how much you offer as security for the loan.

Get Set Up To Sell A House Fast

There are several techniques to consider when selling a house that can both fit in the timeline budget of your lender and still yield a satisfying return. Selling your house as is doesnt necessarily mean settling on price.

We recommend taking a look at a comparison we made in a blog article comparing the different techniques of selling a house, discussing which options are faster and which put the most money in your pocket.

Also Check: How To Get A Contractor Mortgage

What Are The Risks Of Using A Home Equity Loan To Buy Another House

The major risk of a home equity loan, as with a regular mortgage, is that it is secured by your home. This means that if you are unable to keep up with the payments, your lender could seize the home, sell it, and evict you. Instead of a home equity loan, you also may be eligible for an unsecured personal loan, which wont put your house at risk, although it typically will have a higher interest rate.

What You Need To Know Before Selling Your House As Is With A Reverse Mortgage

There are a few crucial details that are involved in reverse mortgages when it comes to selling.

To sell your house as is, youll need to have a clear idea of how much you owe on your reverse mortgage versus how much your property is currently worth. Those numbers will directly affect how much your lender will be likely to accept as a payoff.

The lender will often accept 95% of your homes appraisal value or your entire loan balance, whichever is less. A potential hold up in this situation is awaiting the lenders approved appraisal of the homes value. Until you have that appraisal, you cant know for certain what amount your lender will be willing to accept as a payoff.

Recommended Reading: What Does Mortgage Insurance Do

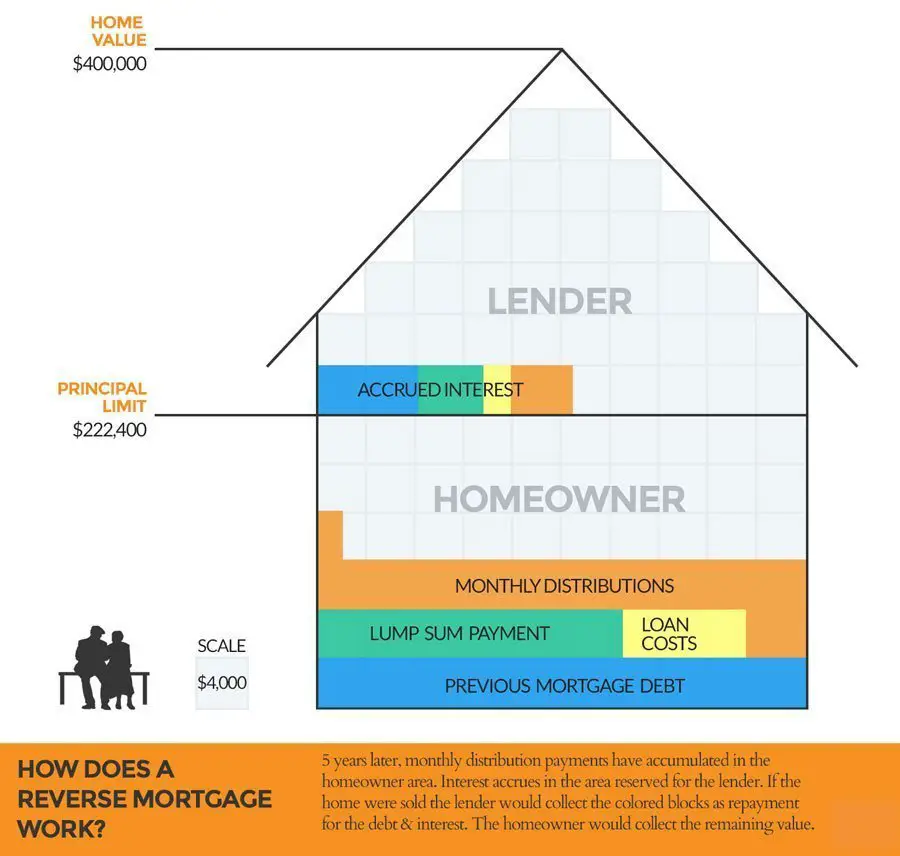

Of Equity Payout Matters

The amount you can borrow also depends on the way you choose to take your reverse mortgage proceeds. HUD discourages homeowners from taking their proceeds in a single lump sum by limiting the amount you can take out in the first year of the loan term. Why? A significant number of borrowers in the past used up all of their home equity at the outset. When they needed money later, they found no remaining equity in their homes and ended up in foreclosure.

As a result, in 2013 HUD changed its rules to prevent borrowers from damaging their financial stability by using up home equity too rapidly. Under current HUD rules, you can take out up to 60 percent of your initial principal limit in the first year of your HECM loan term, regardless of whether youve opted for a lump sum, line of credit or monthly payments. You can take out more only if your current mortgage balance already exceeds 60 percent of your initial principal limit. In that case, you can take out enough to pay off your mortgage plus additional cash up to 10 percent of your initial principal limit.

Recommended Reading: Chase Mortgage Recast

Will I Be Penalized If Im Underwater In A Reverse Mortgage

On home equity conversion mortgages , there is no penalty for spending more than your current equity. They are called non-recourse loans. If you go underwater on your reverse mortgage, the Federal Housing Administration pays the difference to the lender out of the money paid for your up-front and annual mortgage insurance premiums.

Recommended Reading: How To Be A Mortgage Loan Originator

Will I Have To Repay The Reverse Mortgage

You generally do not have to repay the reverse mortgage as long as you and any other borrowers continue to live in the home, pay property taxes, maintain homeowners insurance, and keep the property in good repair. Your reverse mortgage lender may include other conditions that will make your reverse mortgage payable, so you should read the loan documents carefully to make certain you understand all the conditions that can cause your loan to become due.

How Much Equity Do I Get Out Of A Reverse Mortgage Loan

Your lender will determine how much equity you can get based on a number of factors, including your age, the appraised home value, and current interest rates. These factors determine your initial principal limit, which is the total amount you can borrow. You can usually borrow up to 60% of your initial principal limit in the first year.

Want to read more content like this? for The Balances newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Read Also: How Much Do Mortgage Loan Originators Make

Is A Reverse Mortgage Right For Me

A reverse mortgage is a complex financial product and you should carefully consider whether it is right for you. When considering whether to apply for a reverse mortgage, you should consider, among other things, whether:

- you want to remain in your home

- you are healthy enough to continue living in your home

- other alternatives, such as selling your home and purchasing a smaller, less expensive home, would be better for you

- your children, or other heirs, want to inherit the home

- the loan proceeds will be enough, with any other source of income you have, will be enough to enable you to live in your home

This is not an exclusive list of topics to consider, and everyones situation is unique. It is important for you to weigh whether a reverse mortgage is right for your situation and, you should consult with a legal or financial advisor or a housing counselor to help you assess your options.

A list of New York non-profit housing counseling agencies is available.