Veteran Mortgage Relief Options

One benefit of a VA loan is that the Department of Veterans Affairs can help you out if youre having trouble making mortgage payments.

Veteran mortgage assistance comes in two forms:

If youre underwater on a VA loan and need to refinance, you may be able to use the VA Streamline Refinance to do so. Like other Streamline programs, the IRRRL requires no income or employment check, and skips the home appraisal so your LTV wont matter.

If youre not sure whether a refinance is right for you, you might take advantage of the other VA relief program.

For VA loan holders as well as veterans with non-VA mortgages, the VA offers access to professional counselors who can help you if youre having trouble making your payment. These people help veterans figure out whether they should refinance, try to restructure their loan, or take another measure to prevent foreclosure.

Even better, the VAs loan technicians work with your lender on your behalf so you dont have to figure out all the logistics of a mortgage relief program yourself.

Basic Factors For Mortgage Qualification

There are several different types of mortgages, and depending on the type, the requirements for borrowers can vary. But no matter what type of mortgage a person applies for, there are some basic qualifications for mortgage loans to keep in mind.

As a general rule, lenders want to see that borrowers are able and willing to repay the mortgage loan. This means they expect borrowers to have a stable, verifiable source of income, a manageable level of debt, and a history of repaying loans as agreed.

Some types of mortgages have requirements beyond the basic criteria. For some types of loans, borrowers may be required to have a certain credit score. Other loans may require borrowers to put a certain amount of money down.

Who Is Eligible For A Loan Modification

To qualify for a loan modification, a borrower usually must have missed at least three mortgage payments and be in default.

Sometimes, a borrower who has experienced financial setbacks, which makes a default imminent, can qualify for a loan modification. But not everyone in default under their mortgage is eligible for a loan modification, says Elizabeth Whitman, attorney and managing member of Whitman Legal Solutions, LLC.

Borrowers whose financial setback is so severe that they will never be able to repay their mortgage wont receive a modification, nor will borrowers who have the ability to make mortgage payments either from their income or savings.

Borrowers whose financial setback is so severe that they will never be able to repay their mortgage wont receive a modification

In addition to providing a hardship letter or statement to your current lender, prepare to provide proof of income, two years worth of tax returns, bank statements, and other financial statements, says Condor.

Be aware, however, that your mortgage lender is not obligated to provide a loan modification.

Once a lender has an executed contract meaning the home loan they dont have to change it. Many are denied a mortgage loan modification, Gallagher explains.

If the lender desires to modify the terms, per your request, then you have a starting point.

You May Like: Is Peoples Mortgage Company Legit

What Is A Loan Modification

If you have a sustained reduction in income resulting from hardship, then we can look at a loan modification that might suit your new circumstances those changes will aim to reduce your original monthly payment amount. A previous modificationor defermentwont disqualify you from current or future eligibility for a loan modification.

See If Your Mortgage Is Backed By Fannie Mae Freddie Mac Or The Federal Government

Most homeowners are eligible for COVID hardship forbearance and are protected by the temporary halt in foreclosures. This applies if your mortgage is backed by HUD/FHA, USDA, VA, or Fannie Mae or Freddie Mac. Most homeowners have mortgages that qualify. Servicers may offer similar forbearance options for those loans not backed by Fannie Mae, Freddie Mac, or the federal government.

If you dont know who insures or backs your mortgage, you can call your servicer or see the link above. The servicer must provide you the name, address, and telephone number of who owns, insures, or backs your loan. Your mortgage documents and note may also tell you.

Read Also: Can You Do A 40 Year Mortgage

Financial Help For Homeowners And Landlords

Forbearance is not the same as forgiveness. Forbearance only puts off the inevitable day when paused payments must be made up. Programs funded by the Consolidated Appropriations Act, 2021 and the American Rescue Plan Act of 2021 provide financial assistance to homeowners and landlords under two programs: the Homeowner Assistance Fund and the Emergency Rental Assistance program.

Veterans Affairs Loan Requirements

Veterans Affairs home loans are mortgages issued or backed by the U.S. Department of Veterans Affairs. Theyre available to eligible service members, National Guard/Reserve members, and veterans.

VA home loans are designed to help military members and veterans become homeowners. Private lenders, such as banks and mortgage companies provide VA loans. Some of the basic requirements include:

- Employment: Applicants must meet the minimum active-duty service requirement, which varies depending on when they served, and show two years of stable employment.

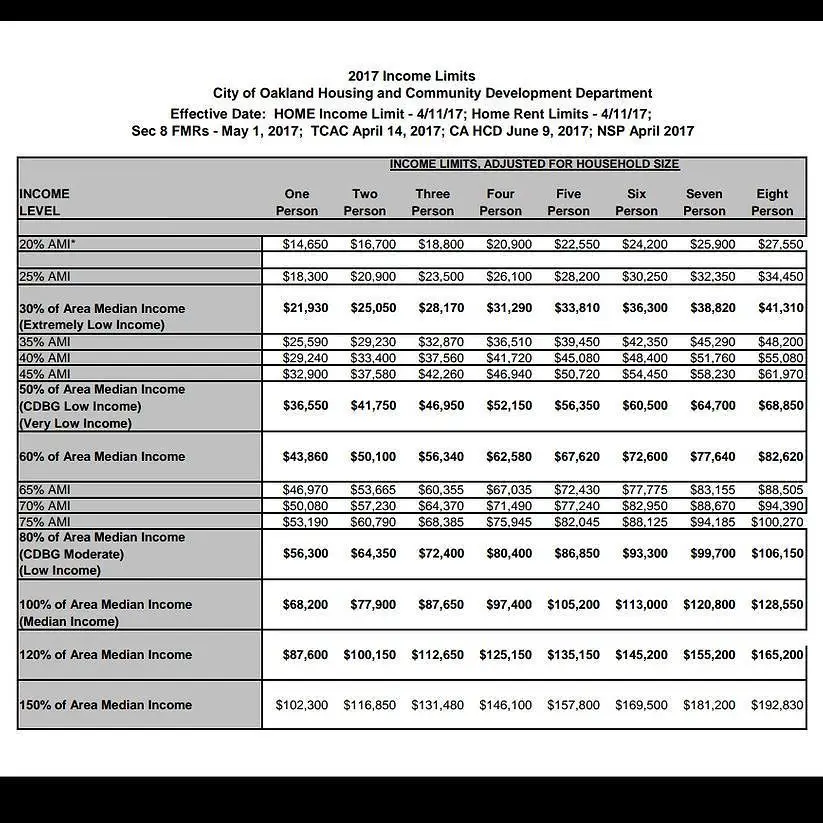

- Income: Borrowers are required to have sufficient residual income after paying their monthly housing expenses. Residual income limits vary by location and family size.

- DTI ratio: The VA doesnt set a maximum DTI but recommends a ratio of less than 41%.

- The VA doesnt set a minimum credit score requirement, but borrowers are required to be able and willing to repay the loan, as shown on their credit history.

- Downpayment: VA loans are typically no-down-payment loans.

- Other criteria: Veterans must have a discharge under honorable conditions.

Read Also: Is It Easier To Get A Mortgage The Second Time

Switch From An Adjustable

Switching from an adjustable-rate mortgage to a fixed-rate mortgage might not lower your existing payments, but it could help protect you from rising interest rates down the road.

Since ARMs are set up to have floating rates, they change with the market. For example, if your interest rate is 3.5% and the average rate rises to 4%, so will your rate. This can be a bad scenario if youre in a rising-rate environment. By locking in your interest rate, youre guaranteed to pay the same interest rate over the life of your loan, regardless of what the market does.

Does Save The Dream Ohio Help A Homeowner With Outstanding Property Taxes

Yes, the Mortgage Assistance component of the program can assist with delinquent property taxes if the property taxes are included in the mortgage payment. If you pay property taxes separate from your mortgage payment, you may receive assistance through the Save the Dream Ohio Utility Assistance Plus.

Read Also: How Low Are Mortgage Rates

What Haf Benefits Are Available In Your State Or Territory

Most U.S. states and territories are currently accepting HAF applications, including Washington, D.C, and Puerto Rico. These are the maximum amounts available per household:

- $20,000: New Mexico, New Hampshire , West Virginia

- $17,000: Wyoming

States that are no longer accepting applications include Alaska, Florida, New York and Rhode Island. But if your state is on this list, there may still be an opportunity to get help.

Many HAF administrators have amended their programs to address the evolving needs in their states, including expanding eligibility, increasing maximum assistance amounts, and adding new assistance programs, said a spokesperson for the NCSHA.

If you previously looked at your states HAF eligibility requirements and you werent eligible, you may want to check the program website again to see if that has changed, recommends the spokesperson.

Mortgage Relief Programs For 2022

If youve had a temporary job loss or reduction in income, it can be hard to keep up with mortgage payments especially with an above-market mortgage rate thats keeping your payments artificially high.

Luckily, there are mortgage relief options that can help. The right one for you will depend on your current financial situation.

Five homeowner relief options in 2022 include:

Currently, theres no Congress mortgage stimulus program or GSE rescue package. But homeowners have plenty of alternatives.

Many lenders are offering forbearance for as long as Covid is considered a National Emergency. And thousands of homeowners are still eligible to refinance despite rising rates.

So explore your options. If youre not sure where to begin, start by reaching out to your mortgage loan servicer. Your servicer will help you understand your choices and determine which mortgage relief path is right for you.

Also Check: Can You Get A Jumbo Mortgage With 10 Down

How To Get A Mortgage Modification

If youve missed one or more mortgage payments or, better yet, know youre about to miss a payment but havent yet gone delinquent, contact your lender and explain the reasons for your difficulty making payments.

Be prepared to discuss your financial difficulties in some detail. Youll have to document your hardship as part of a formal application, so gather relevant paperwork before you call so youll be prepared to answer questions.

The lender will likely require you to apply for the modification in writing, and to submit proof of income and expenses before and after the onset of your hardship. That could include tax returns, pay stubs, monthly bills and statements, plus information on your savings and any assets you may have .

If your mortgage is backed by any number of federal agencies or programs, you may qualify for a government mortgage modification plan:

While the CARES Act only covers federally backed mortgages, private lenders may be extending comparable relief programs to their borrowers.

If Am A Tenant Is Financial Assistance Available

On August 26, 2021, the US Supreme Court struck down the Centers for Disease Control and Prevention eviction moratorium. With this decision, many renters who were protected by the CDC order may be subject to eviction for nonpayment of rent. If you are a tenant and are struggling financially due to COVID-19, visit consumerfinance.gov/renthelp for more information on what assistance is available, or call our Disaster Response Network directly at , where youll get tips on communicating with your landlord and help navigating the rental assistance application process and more.

Read Also: How Much Mortgage Based On Income

If Ive Had A Recent Loan Modification Am I Still Eligible For Another Loan Modification

Any previous customer assistance program, such as a deferment or a modification, wont disqualify you from current or future eligibility for a loan modification. When youre ready to discuss your options, reach out to us via Mortgage assistance from your mortgage account within online banking and the mobile app. You can also call us at 855-698-7627. Well help you with the solutions specific to your financial situation to bring your account to current.

How To Qualify For A Mortgage

Borrower requirements vary by home loan type

You might think buying a home isnt a feasible goal because you dont have an 800 credit score or thousands of dollars in the bank. However, its possible to be approved for a mortgage loan with less-than-excellent credit and you dont even have to drain your savings to offer a down payment.

Owning a home might be a real possibility, even if you worry you wouldnt qualify. If homeownership is a dream of yours, start by investigating your loan options.

Recommended Reading: Can A Senior Get A Mortgage

What Happens At The End Of The Forbearance Period

You can access and explore your repayment options via Mortgage assistance from your mortgage account within online banking and the mobile app. The best solution will depend on your financial situation. Our top priority is to keep you in your home with affordable monthly payments.

We offer programs which will not require you to repay all the suspended payments at the end of the forbearance. Instead, long-term solutions will include adding the suspended payments to the back of the loan or adding the suspended payments into the loan and extending the loan term.

If after reviewing your long-term options you still have questions, you can reach out to your Relationship Manager to discuss your situation and available options.

How To Get Help

If you think you might have trouble making a mortgage payment your first call should be to your mortgage servicer . They may be able to arrange temporary mortgage assistance options, including a mortgage forbearance plan.

No matter what the future brings, Fannie Mae will be here to help, providing you with the reliable information you need about forbearance plans and other kinds of mortgage assistance.

If you’re a homeowner who is financially impacted by COVID-19, you’re not alone. Our Loan Lookup tool can help you see what free resources are available to you.

Read Also: Which Score Do Mortgage Lenders Use

Mortgage Loan Lookup Tool

Use the simple Fannie Mae Mortgage Loan Lookup Tool to find out if Fannie Mae owns your mortgage. If we own your loan, you may qualify for programs providing payment relief including a forbearance plan or loan modification.

Fannie Mae’s Disaster Response Network is another resource you can utilize. When you contact the Disaster Response Network, HUD-approved housing counselors can develop a personalized action plan, explain mortgage relief or rental assistance programs, provide financial coaching, and support your successful recovery for up to 18 months.

What Happens If I Have Unpaid Suspended Payments At The End Of The Forbearance And I Havent Requested Assistance To Bring My Account Current

We encourage you to act immediately to work with us on the next steps of your forbearance. Any unpaid suspended payments could become past due and late fees would resume, which may lead to mortgage default and possibly foreclosure. We want to keep you in your home, and our experienced relationship managers are here to assist.

You May Like: How Can I Get Qualified For A Mortgage

Prepare Yourself And Your Family

- Make sure your state ID or drivers license is current and available. Shelters and assistance programs may have strict ID requirements.

- If possible, store your belongings. Shelters have limits on how much you may bring.

- Arrange for your mail to be delivered somewhere or talk to your local post office. Many have special services for people who are homeless. You may be able to get a free PO box or receive general delivery service.

- Pack a bag for yourself and each member of your family.

- Keep important documents and needed medications with you.

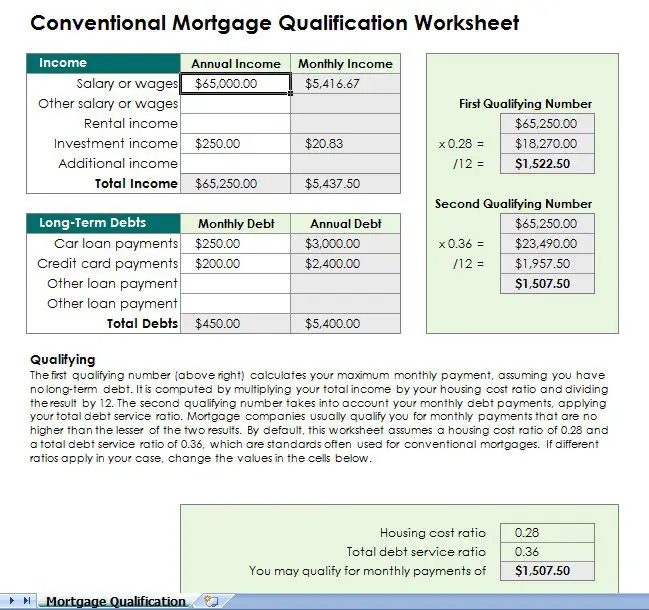

Do You Qualify For A Lower Interest Rate

Refinancing can offer relief from high mortgage payments. By lowering your mortgage interest rate and/or extending your loan term, you can typically reduce your monthly payment and take some pressure off your budget.

To qualify for a refinance, youll need to meet some basic criteria. But these can be very flexible depending on the loan program.

Don’t Miss: How To Get A Mortgage License In Florida

How To Get The Best Mortgage Rates

A lower mortgage interest rate can lower your monthly mortgage payment and reduce the overall cost of the home loan. To increase your chances of qualifying for a mortgage with a lower interest rate, try these actionable steps:

- Improve your credit score. Lenders may offer lower rates to borrowers with higher credit scores. To raise your score, make payments on time, work to pay down outstanding debt, and dispute errors you find on your credit report.

- Save a larger down payment. Homebuyers who put down 20% or more tend to be offered lower interest rates since lenders see them as lower-risk borrowers.

- Get a co-signer. Borrowers with poor credit may consider asking a family member with good credit to cosign the mortgage. This could help you secure a lower interest rate, but note the co-signer is agreeing to be responsible for the loan if you fall behind on the payments.

- Shop around. Interest rates can vary between lenders. Consider getting quotes from multiple mortgage lenders or working with a mortgage broker to compare loan options.

* Total insurance and loan shoppers through Assurance technical platform, 2019 2021, internal data.

This website is owned and operated by Assurance IQ, LLC. Assurance IQ, LLC is not affiliated with Assurance Agency, Ltd., nor any government agency. Assurance IQ, LLC is a wholly owned subsidiary of Prudential Financial, Inc.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

What Is The Dc Map Covid

The DC MAP COVID-19 will provide financial assistance commencing with April 1, 2020 payments of monthly mortgage principal, interest, escrowed property taxes, escrowed homeowners insurance, escrowed monthly mortgage insurance, condominium fees or homeowners association fees, past late fees due commencing with April 1, 2020 payment, and current late fees for those District homeowners who have been financially impacted by COVID-19 causing a loss of income. The financial assistance will be made to qualified homeowners in the form of a zero-interest, recourse loan, secured by a deed of trust with a maximum monthly assistance amount of $5,000 per month for each homeowner for up to 6 months, subject to monthly certification attesting to the need for on-going assistance subject to available funding.

Read Also: How To Increase Mortgage Score

Other Criteria Based On The Loan Type

Some types of mortgage loans have non-financial eligibility criteria. These loans include government-backed mortgage loans that are targeted toward certain types of borrowers or non-conforming bank loans for homebuyers with unusual circumstances.

Depending on the type, government-backed mortgage loans may require borrowers to meet certain criteria, such as being an active duty service member or honorably discharged veteran or buying a home in an eligible rural area. Other niche loans may have their own specific requirements too. For example, someone who wants a mortgage for unimproved land may need to provide surveys or zoning information.