The Monthly Payment Is Higher Than Pre

Mortgage pre-approvals simulate the purchase of generic homes at specific purchase prices. But, when buyers make offers on real homes, those approvals use real numbers.

As part of the final approval, lenders replace pre-approval numbers with real numbers:

- The purchase price of the home

- The expected down payment

- The homes real estate tax bill

- The expected homeowners insurance premium

- The homes monthly assessment, if applicable

If the newly-calculated housing payment is higher than expected, the buyers pre-approval may be invalidated.

How Many Times Can I Get Pre

Mujtaba Syed:

As many times as you want.

Technically until youre ready to purchase. Once again, we want this to be a very enjoyable experience.

We want you to be able to find your perfect dream home, and sometimes it takes a little bit longer to get that dream home. We dont want you to feel rushed.

We dont want you to feel that you were forced into a situation or something.

It is going to be your ideal home. Its going to be one of the biggest purchases in your life that youll do, one of the biggest investments youre going to get into.

We definitely want to make sure you find the absolute best for yourself .

Karl Yeh:

A Mortgage Preapproval Is A Letter From A Lender Saying That Its Tentatively Willing To Lend You A Certain Amount For A House

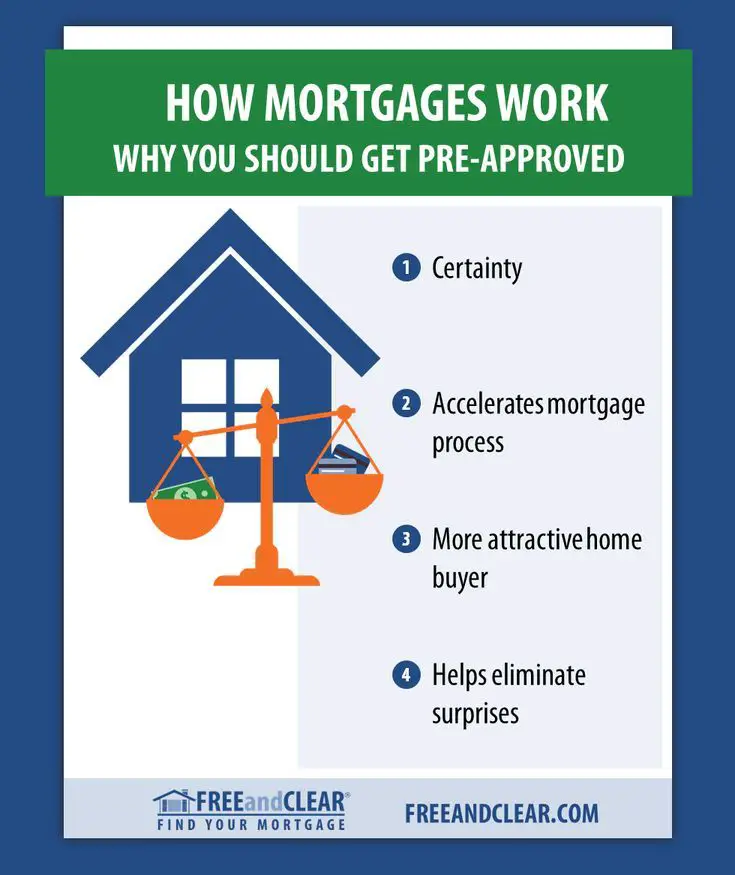

Getting preapproved for a mortgage is a crucial first step in the home-buying process. It gives you an idea of how much you can borrow, which will help narrow down your search to houses in your price range. The preapproval process could also uncover potential issues that would prevent you from getting a mortgage, so you can work them out before setting your heart on a house.

A mortgage preapproval lets sellers know you have the borrowing power to back up an offer you make to buy their home, which could make your offer more competitive. It tells real estate agents, who work on commission, that spending time on you could well pay off with a transaction. And it alerts lenders that youre a savvy borrower who may soon be taking out a mortgage loan.

In short, getting preapproved for a mortgage signals that youre serious about buying a home.

Fortunately, getting preapproved is relatively quick and simple. Lets explore what you need to do for a mortgage preapproval and how it can benefit you during the home-buying process.

Donât Miss: How Much Is Personal Mortgage Insurance

Also Check: Can You Get A 5 Year Fixed Mortgage

Beggars Cant Be Choosers

Borderline applicants or borrowers with bad credit may not benefit from seeking preapproval with various lenders. For example, a recent bankruptcy or foreclosure may prevent you from obtaining a loan for several years with conventional or government-insured lenders, leaving you with only one option for financing private investors. In general, the better your income, assets and credit, the more options you have and the more you benefit from shopping multiple lenders willing to compete for your business.

References

When Should I Get Pre

Always pick your yard based on your Summer lifetstyle.

~ KARL

Wondering when to get pre-approved for a mortgage during the home buying process? In this episode, we discuss when and how far in advance of buying a home should you look to getpre-approved. We also explore how long pre-approvals last for, what happens if your financial situation changes and how many times you can get approved.

Prefer to listen?

Dont Miss: 10 Year Treasury Vs Mortgage Rates

Read Also: How Much Net Income Should Go To Mortgage

How Long Does A Mortgage Preapproval Take

Some lenders offer same-day mortgage preapprovals that include electronic verification of your employment, credit and assets. Others may take several days, depending on how complicated your financial situation is. Ask lenders upfront what their timelines are. Expect a longer wait if you have credit bumps or are self-employed.

Can I Get Denied A Loan After Pre

Yes, its possible to get denied a loan after receiving a pre-approval. A mortgage pre-approval doesnt guarantee a loan, but rather lets you know if youd qualify for a loan based on the information you provide at the time of application.

Before you receive a formal loan approval, your lender will need to verify the information youve provided, see the homes appraised value, check for a clear title and ensure that the homes condition meets the standards of the loan.

If you dont end up getting approved, your lender will provide an explanation, alongside some guidance on what you need to do to improve your chances of being approved.

Read Also: Who Owns Phh Mortgage Services

What Does A Mortgage Pre

A mortgage pre-approval letter shows you how much a lender is willing to let you borrow. Itll typically include the following information:

- Expiration date

Credibles streamlined pre-approval letter is similar. In our letter, youll see the purchase price, loan amount, and expiration of the pre-approval based on the information you provided us. You can see an example of this below. A full copy of the pre-approval letter will also list the steps youll need to take should you find a home and want to move forward with Credible.

Do I Have To Get Prequalified For A Mortgage

Technically, you dont have to get prequalified. Youre free to start house hunting and making offers without one. Realistically, however, you wont get far without a prequalification letter.

Many real estate agents will request a copy of your prequalification letter before showing you a home, because it shows youre serious about buying. They dont want to waste time showing houses to people who are unlikely to get financing.

Including your prequalification letter with your offer can also give you an edge over rival buyers. In Hawaiis competitive housing market, sellers usually have multiple offers. If a seller is looking at two identical offers, one from a prequalified buyer and one from a buyer who hasnt yet talked to a lender about financing, theyre almost certainly going to lean toward the person who has a prequalification letter in hand.

Also, having a letter from a respected local financial institution like Bank of Hawaii can beat out a letter from a less recognizable lender. Theres something to be said for getting prequalified by a lender that understands the local market and has an almost 125-year-long history of helping people successfully buy homes in Hawaii.

Once your offer is accepted, you can officially apply for a mortgage, provide a range of documents to verify your income and assets and move through the rest of the mortgage application process.

Also Check: Does Chase Allow Mortgage Recast

You May Like: Is It Worth Refinancing Mortgage

What Is The Difference Between Pre

Both pre-qualification and pre-approval involve a review of an applicants credit report. The difference is the degree of credit review. Pre-qualification involves a quick review of ones credit and only provides a potential borrower with a general idea of how much mortgage they could qualify for and under what terms. Pre-approval involves a full credit review, while only offered for a limited time window, provides the potential borrower with a solid offer of credit from a lender with which they can use to make good faith offers on homes for sale.

Read Also: Rocket Mortgage Qualifications

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How To Mortgage Rates Work

Get A Prequalification Or Preapproval Letter

A prequalification or preapproval letter is a document from a lender stating that the lender is tentatively willing to lend to you, up to a certain loan amount.

This document is based on certain assumptions and it is not a guaranteed loan offer. But, it lets the seller know that you are likely to be able to get financing. Sellers frequently require a prequalification or preapproval letter before accepting your offer on a house.

Save For Down Payment And Closing Costs

First, before you even think about buying a house, save as much money as you can for a down payment.

The bigger down payment you can make and the better your credit score is, the better your mortgage terms are going to be.

Make sure to also set aside money for a closing cost. Closing costs on homes differ but can be about 2 grand one $200,000 home.

The more money you have saved to start, the less of a burden acquiring your mortgage and buying your house will be.

Also Check: Who Is The Trustee In A Mortgage Loan

When Should You Get Preapproved For A Mortgage

Prospective homebuyers know the importance of “location, location, location,” but timing can be critical too. Securing mortgage preapproval at the right moment in your house-hunting journey can help seal the deal, preserve your credit and spare you unnecessary expenses. Here’s the lowdown on when to seek preapproval.

Avoid Disappointment And Frustration

When you think about applying for a pre-approval, you may be intimidated by all that are involved. From digging out your tax returns to proving your income, it can be a lot to take in at once.

However, this shouldnt be a reason to postpone doing the pre-approval until you actually find a home that you like. To avoid disappointment and frustration, you should embrace your inner-strength and put all of your documents together. Once you have done this, youll likely find that the process isnt as intimidating as you thought it would be.

After the application is completed and youve been pre-approved, you will know exactly what your realistic budget for a home and taxes is. This means you wont waste time looking at listings that are far outside of your budget, such as homes that cost $400,000 whereas youre only approved for $350,000.

Ultimately this saves you from disappointment when home buying, making it clear why real estate agents request you do this from the very start. By doing something as simple as applying for pre-approval now, you will do yourself a great service that will make shopping for a home easier down the road.

Donât Miss: Can I Roll My Down Payment Into My Mortgage

Read Also: Can You Repay A Reverse Mortgage

Prequalified Vs Preapproved For Your Mortgage: Whats The Difference

Both prequalification and preapproval provide borrowers with an estimation of how much home they can afford. However, a mortgage preapproval is a more official step that requires the lender to verify your financial information and credit history. Documents required for a preapproval may include pay stubs, tax returns and even your Social Security card.

This means a preapproval is a stronger sign of what you can afford and adds more credibility to your offer than a prequalification. This will also allow you to show sellers a preapproval letter to demonstrate that your financial information has been verified and you can afford a mortgage. However, check with your lender to be sure.

Why Are We Better For You Than Your Bank

- We put you first.

- We help you save money and stress.

We check with many lenders for the most flexible mortgage rate and product â in fact, we have access to the best rates and thousands of mortgage products.

Then, we hold your best rate for up to 120 days, protecting you from any sudden rate increases. Now, you can hunt around for the right place, knowing that your rate is secure.

When you find the home of your dreams, well get you fully approved, and pass along our volume discount to help you save a pile of cash.

Don’t Miss: Can I Skip A Mortgage Payment With Pennymac

The Similarities Of Pre

Mortgage pre-approval and mortgage pre-qualification have the same great benefits for anyone considering purchasing a home with a mortgage:

- Both can help estimate the loan amount that you will likely qualify for. This can help you save time by starting your home search by looking only at homes that you know will fit in your budget. And it will also prevent the frustration of finding out that the house you wanted to buy is actually out of your budget.

- Regardless of whether you have a pre-approval letter or a pre-qualification letter, both can help show sellers that youre a serious contender when submitting your offer. For a seller to confidently accept your offer, theyll want to know that youll be approved for a mortgage and the home sale will close. A pre-approval letter or a pre-qualification letter can help demonstrate that you have a good chance of being approved for a mortgage for the amount that youve offered on the home.

- Many sellers will require a pre-approval or pre-qualification letter if youre planning to get a mortgage. If its not required, a pre-approval letter or pre-qualification letter may help your offer stand out. This can be especially helpful in competitive real estate markets.

Which Is Right For Me

First-time homebuyers are more likely to find that getting prequalified is helpful, especially when they are establishing their homebuying budget and want an idea of how much they might be able to borrow.

Preapproval can be extremely valuable when it comes time to make an offer on a house, especially in a competitive market where you might want to stand out among other potential buyers. Again, a seller will be more likely to consider you a serious buyer because you have had your finances and creditworthiness verified.

Ready to prequalify, get preapproved or apply? Get started with the Digital Mortgage Experience.

Recommended Reading: What Is A Mortgage And How Does It Work

Does A Preapproval Letter Expire

Once you have your preapproval letter, you may be wondering how long it lasts. Your income, credit history, interest rate think about all the different ways your finances can change after you get your letter. For this reason, a mortgage preapproval typically lasts for 60 to 90 days.

Once it expires, youll need to connect with your lender again with your updated paperwork and apply for a new preapproval letter. The good news is, this typically doesnt take too much time since they have most of your information on file. But bear in mind that re-applying requires another hard inquiry on your credit rating, and your credit score can be further impacted.

The Buyers Credit Score Dropped Below The Minimum

Mortgage pre-approvals are test runs for a buyers actual mortgage approval. So, if the buyers credit score drops before finding a home, the buyers pre-approval may be invalidated.

In general, the minimum credit score requirements are:

- FHA: 500 credit score

Learn more about how to fix your credit score to buy a home.

Recommended Reading: What Is A Mortgage Loan Officer

What To Do When Your Pre

Youll notice that your pre-approval letter has an expiration date on it. After that day, it is no longer valid and you cant use it to shop around for homes or take the next step to finalize your mortgage.

Youll notice that your pre-approval letter has an expiration date on it.

Banks will put an expiration date on pre-approval letters because they need to have your most up-to-date financial information on hand. The credit, income, and asset items they reviewed for your pre-approval typically need to be updated after 90 days.

For example, you might leave your job and no longer have a steady income, or a financial emergency may have taken a big bite out of your savings. As a result, the bank will want to reassess your finances.

If youre using the same lender you will need to show them updated pay stubs and bank statements. Additionally, your bank may check your credit again, which may have an impact on your credit score.

You can minimize the effect of these so-called hard pulls by avoiding seeking renewal when youre not actively shopping for a home and by working with only one lender during the pre-approval stage. If your finances have mostly stayed the same, your bank is likely to renew your pre-approval.

The Benefits And Pitfalls Of Preapproval

In other words, if you are preapproved with three lenders and then apply for a fourth mortgage, your credit score will suffer a three-point drop. If you apply for all four mortgages within a few days of each other, the inquiries will be counted as one, and your credit score will not suffer as a result. This is a good point: preapproval is a good thing, but dont rely on it to help keep your credit rating stable. Apply for pre-approvals from all of the lenders youre considering, and dont put off applying for each one.

Read Also: Can I Get A Mortgage Making 30000

Youll Get An Idea Of Your Budget

One advantage of going through the prequalification process is that youll have a general idea of what you can afford before you shop for a home, says Mac Cregger, senior vice president and divisional manager of Angel Oak Home Loans in Atlanta.

Youll avoid sticker shock by going through this process early, especially if youre buying your first home.

Sometimes buyers may have an unrealistic perception of payments on a particular home due to the way some of the information on mortgage payments may appear online, says Craig Garcia, president of Capital Partners Mortgage in Coral Springs, Florida. Having a strong knowledge of what a realistic payment is on a home can help buyers focus in on properties that realistically match their budgetary desires or constraints.

Potentially, youll also know where you stand with closing costs, says Abel Carrasco, loan originator with Homeowners Financial Group in St. Petersburg, Florida.

Understanding how much money youll need to bring to closing, including the down payment and closing costs, will help you better manage your spending and help plot a course to help you achieve your goal of homeownership, Carrasco says.