Remortgaging In 2022 Is Now The Right Time To Fix & For How Long

This remortgage guide is broken into two parts. First, the short answer which will quickly help you decide whether to fix your mortgage, how long for and secure you the best fixed-rate mortgage deal. The longer answer will explain in detail:

- Why you should consider fixing your mortgage now

- When interest rates are likely to rise

- How long you should fix your mortgage for

- How to find the best fixed-rate mortgage deal

How To Get Out Of A Fixed

Whatever the reason you want to get out of your mortgage before the fixed-rate period is up, the steps you need to take are as follows

Make an enquiry with us and well match you with the right mortgage broker for free.

We know It’s important for you have complete confidence in our service, and trust that you’re getting the best chance of mortgage approval. We guarantee to get your mortgage approved where others can’t – or we’ll give you £100*

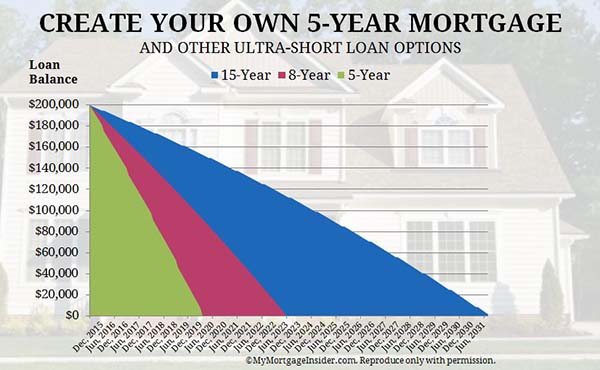

Fixed Rate Mortgage Term Examples

When you take out a fixed rate mortgage, you can generally choose the length of time to fix it for, commonly between 2 to 5 years. You will need to consider how long it might be until you’re moving home again, and the potential impact of interest rate changes over time. Here’s some examples of fixed rate mortgage terms to explain more…

A 2 year fixed rate means your monthly payment will remain the same for 2 years. After 2 years from the point you receive the mortgage, you would move onto the lenders standard variable rate , unless you switch to a new deal with the same lender, or remortgage to a new lender.

- At the end of the 2 year period, you will be able to remortgage or move home without paying an early repayment charge . It may be a good option if you plan to move home in the near future and dont want to be locked into a mortgage rate for a longer fixed term.

- You need to consider how future interest rates may fluctuate up or down when choosing your fixed rate term. An increase in interest rates, for example, could make a remortgage in 2 years time more expensive.

Read Also: When Paying Off A Mortgage Early

What Happens When Fixed

Borrowers are automatically put onto their lenders standard variable rate.

The SVR is not competitive compared to other deals but has flexibility. For example, there will be no charge to switch away and you can usually overpay without restriction.

However, most people will benefit from choosing a new deal before they land on their lenders SVR. Often borrowers can secure a new deal three to six months in advance of their fixed deal ending.

When A 5/1 Arm Adjusts

To understand when a 5/1 ARM adjusts, you need to understand how each cap is disclosed. For example, a 5/1 ARM with 5/2/5 caps means the following:

- The first 5 is the maximum the interest rate can increase after the temporary fixed period ends

- The 2 is the maximum the interest rate can adjust during each adjustment period

- The final 5 is the maximum the interest rate can adjust above the initial rate for the life of the loan

Recommended Reading: How To Calculate Monthly Mortgage Payment

How To Research The Best Mortgage Deals Yourself

Alternatively, if you do want to go it alone the first thing you need to work out is what fixed rate you will get. This will depend on, among other things, the amount you want to borrow compared to the value of your property , your credit rating, your earnings and the type of mortgage you want.

A good starting point is our mortgage calculator , powered by Habito. This can give you an idea of the best and cheapest deals you may be eligible for.

Lower And Fixed Initial Payments

A five-year fixed loan generally has an initial fixed rate that is one or more points below the 30-year fixed. If you were planning on staying in your home five years and then selling, the five-year fixed loan would work out well. For example, if you had a 30-year fixed loan at 5 percent on a $300,000 mortgage your monthly payments would be $1,610 per month whereas if you had a 4 percent five-year fixed loan your payments would be $1432 per month. Over the five-year period you owned your home you would have saved $10,680 with the five-year fixed loan.

You May Like: Which Mortgage Lenders Use Fico Score 2

Get A Free Mortgage Review Now

Whichever type of mortgage you are on, it is a great time to consider fixing your mortgage , before further base rate hikes come into force. Don’t make the mistake of waiting for the Bank of England to raise interest rates again before making your decision because, by that point, the best remaining fixed-rate mortgage deals will have gone.

The simplest trouble-free route to make a decision, which I’d recommend, is to seek the help of a mortgage adviser. If you don’t know a mortgage adviser whose opinion you trust then there are two ways to find a reputable one:

1) Use a leading online mortgage broker

You can have your mortgage reviewed for free online through Habito*, one of the first online mortgage brokers in the UK. I’ve personally been into Habito’s* offices to grill them over their proposition and recommendation process and was impressed. Habito will check through over 20,000 mortgages from more than 90 mortgage lenders for you before making a recommendation. That recommendation may even be that your existing lender offers the best deal and you should stay where you are.

The whole process can be carried out online . Habito has a 5-star rating on Trustpilot from over 5,000 customer reviews who it has helped save hundreds of pounds a month. It only takes 10-15 mins to register online and Habito will be able to give you instant, free mortgage advice.

To get started:

How Long Can You Fix The Interest Rate For

You can currently fix your mortgage rate for one, two, three, five, seven, 10 or 15 years, though one-year and 15-year fixes are rare.

Generally speaking, the longer your fixed-rate period lasts, the higher the interest rate will be.

This is because it is harder for a lender to predict what will happen in the market over a longer period of time – so you’re essentially paying for the security of knowing that your rate won’t go up no matter what happens.

Read Also: What Is The Best Mortgage Loan Company

Which Lenders Offer 10

Lenders including Barclays, Virgin Money, Halifax and First Direct offer mortgages with fixed interest rates periods spanning 10 years or longer. If you think a longer-term fix is the best option for you, it is advisable to speak with an independent mortgage broker before contacting one of these lenders.

There are many other lenders offering long-term fixed deals, so its important to check the whole market rather than limiting yourself to one set of mortgage products.

Ask a quick question

We can help!We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in Fixed rate MortgagesAsk us a question and we’ll get the best expert to help

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

If Your Mortgage Is 100000 And You Have A 30

. If you take out a 30-year fixed rate. 16 hours agoThe most closely followed mortgage rates all climbed up today. Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders.

Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. The 51 adjustable-rate mortgage averaged 336 representing a decline of 10 basis. The 5-year Treasury-indexed hybrid.

Youll need to borrow 225000 so your LTV will be 90. The 15-year fixed-rate mortgage averaged 322 up four basis points. Both 30-year fixed and 15-year fixed mortgage rates moved higher.

This percent is added to the index rate to determine the interest rate charged on the ARM loan. If you want a fixed-rate mortgage but want to qualify for the maximum amount you can afford you can start with a variable-rate mortgage. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans.

2 days ago30-year fixed-rate mortgages. The 30-year fixed-mortgage rate average is 598 which is an increase of 11 basis points from one week ago. For a 30-year fixed-rate mortgage the average rate youll pay is 608 which is an increase of 20 basis points compared to one week ago.

14 hours ago30-year fixed-rate mortgages. The APR was 569 last week. Find A Great Lender Today.

According to the Bank of England since. Using our Mortgage Calculator can take. Overall cost 41 APRC.

2 days ago30-year fixed mortgage rates. Get Pre-Qualified in Seconds. Compare Offers Apply.

Mortgage Calculator Mortgage Calculator Mortgage Amortization Schedule

Don’t Miss: Can I Prequalify For A Mortgage Online

How Do Five Year Fixed Rate Mortgages Work

Five year fixed rate mortgages come with a set interest rate on repayments that stays the same for a five year term.

This means that from the outset you know how much youll pay each month, every month for the next five years. The regularity of these payments means that you can budget easily for the length of the term.

Once the five year term is up, your interest rates will change and youll start paying the mortgage providers standard variable rate . This rate changes regularly, very roughly in line in the Bank of England base rate, though how closely it tracks the base rate is at the discretion of the lender. Each lenders SVR can vary greatly.

What Are Some Of The Pros And Cons Of A 5

There are pros and cons to choosing a 5-year fixed mortgage rate, and weâll walk you through each below. Some of the pros of a 5-year fixed mortgage are:

- Risk protection:For buyers who are risk-averse a fixed rate mortgage enables you to âset it and forget itâ – your rate, and therefore mortgage payment, is locked in and will not fluctuate with changes in bond yields. This allows you to budget with greater accuracy and offers you stability for the duration of your term. Moreover, in recent years, Canadians have enjoyed access to some of the best fixed rates available in decades, although fixed rates have started to climb again since October of 2021.

- Competitive rates: The 5-year term is historically the most popular option, and the one that lenders often encourage you to opt for. The length of this term is a good âmiddle of the roadâ choice for home buyers. Because itâs such a competitive, popular rate term, lenders often get the most aggressive when pricing these terms.

On the flip side, there are some cons to consider as well.

Don’t Miss: How To Create A Rocket Mortgage Account

Uncertainty After Five Years

What if you intend on selling your house after five years but something happens to change your plans? The housing market might be bad, interest rates may be so high you cant qualify for a new loan. If interest rates have gone up, you are going to see your payments go up. Depending on the cap between rate sets you might be assured the total payments on a five-year fixed loan would be less than those for a 30-year loan after six or seven years, but after some point in time the opposite could be true. The only thing you will know for certain at the outset is what the maximum payments could be.

So Why Not Break His Mortgage And Grab The New Lower Rate

When Tom went to talk to his current bank, he discovered that the penalty to break his mortgage before the end of his term was a bit more than he anticipated. He thought he only had to pay 3 months interest, but because he has a fixed-rate mortgage, he actually has to pay the Interest Rate Differential penalty . This IRD assessment is typical of most lenders, depending on the initial mortgage product agreement.

Out of anger and frustration, Tom spoke to the branch manager. Whereas the teller told him that the ‘computer’ just does the calculation, the branch manager informed Tom of the formula they use:

- Take your current rate and term remaining. Then look at your current lender’s best rate that matches your remaining term. Subtract this rate from your current rate and multiply by the years remaining on your term, and then again by your mortgage size, then divide by 100.

- So in Tom’s case, here are the numbers: With 5.49% and 3 years remaining, his bank’s current rate on his remaining term is 3.49%. The rate difference is 2, multiplied by 3, then by $100,000 and divide by 100. So Tomâs penalty would be $6,000 .

For Tom’s example, $6,000 is a hefty penalty on a mortgage that is only $100,000 in size. But can the lower rate of 3.29%, offered by True North Mortgage, overcome his penalty?

Don’t Miss: Why Do Mortgage Need Bank Statements

How To Gauge If The 5 Year Fixed Mortgage Is A Fair Rate

There is always a risk, with a fixed rate mortgage that youll incur a higher interest rate than the market speculates. Though a short term loan can limit the amount of marketplace volatility you experience, have you researched the current interest rate forecast? Does it make sense to act now, or wait, before securing a loan?

The primary perk of a 5 year fixed rate mortgage is the low interest rate. How far below the benchmark can you get? While interest rates on 15 year loans are usually discounted 20 to 30 percent below rates on the benchmark 30 year mortgage, 5 year refinance rates should be even more affordable.

A good rule of thumb is to look for an interest rate that is half of what you would be paying on a 30 year loan. It is possible to land a lower rate depending on your personal finance situation and on market conditions.

What Are The Differences Between Fixed And Variable Rates

In the context of mortgages, if a rate is fixed it means the interest rate charged will stay the same for the duration of your mortgage term. A variable rate, on the other hand, can fluctuate based on the market from month to month, and can therefore change throughout the duration of your term.

Fixed rates are generally chosen for their perceived security, since your payments will remain the same throughout the duration of your term. Fixed rate mortgages are also often chosen where a consumer anticipates that interest rates will increase during their term, so it is perceived as beneficial to lock in to a lower rate. Whether you successfully beat market rates or not, one of the main advantages of a fixed rate mortgage is that youll know exactly how much to budget for repayments for the entire duration of your term. Right now, rates are unlikely to drop any lower, and the Bank of Canada has signaled that they are likely to increase

Recommended Reading: How Much Is Mortgage Insurance Monthly

Year Fixed Rate Mortgage Repayments

The biggest benefit of 5 year fixed rate mortgages is that you know exactly how much youll have to repay every month for the next five years, so you can budget with certainty during that time.

When the five years end, youll usually be moved onto your lenders standard variable rate , which is often higher than your fixed rate, meaning that your monthly repayments may increase at this point. You can either remortgage or look for another deal with the same lender once your fixed term is over.

If you wish to change your mortgage during the five year fixed term, or have to pull out for any other reason, youll likely be liable for an Early Repayment Charge , which is often a significant amount of money.