Receive Your Mortgage Preapproval Letter

When you get preapproved, you usually get a preapproval letter. There are a few reasons the preapproval letter is important. First, real estate agents typically want to see your preapproval letter before they show you houses. This ensures they dont waste time showing you homes outside your budget.

Second, the preapproval letter is something you can share with the homes seller when you make an offer. It shows you wont have problems getting financed for the amount youre offering.

Is Mortgage Preapproval Worth It

Mortgage preapproval comes with several benefits. First, it gives you an idea of how much you can borrow, which will help narrow down your search to houses in your price range. But remember that just because youve been preapproved for an amount doesnt mean you have to borrow the maximum. In many cases, its probably a good idea that you dont. Thats because many mortgage lenders use your gross monthly income as a factor in determining how much you qualify for.

Your lender generally doesnt consider your daily living expenses things like groceries, utilities, childcare, healthcare or entertainment or monthly debts in its calculations. Its up to you to review your budget to make sure youre comfortable with the loan amount. Dont rely on your lender to tell you what you can afford.

The preapproval process could also uncover potential issues that would prevent you from getting a mortgage, so you can work them out before setting your heart on a house.

Lastly, a mortgage preapproval lets sellers know you have the borrowing power to back up an offer you make to buy their home, which could make your offer more competitive. It tells real estate agents, who typically work on commission, that spending time on you could well pay off with a transaction. And it alerts lenders that youre a savvy borrower who may soon be taking out a mortgage loan.

In short, getting preapproved for a mortgage signals that youre a serious buyer.

Documents Youll Need If Youre Self

If youre self-employed or own a business, youll also be required to provide your tax documents and business returns for the past 1 to 3 years, depending on your lenders requirements.

Youll also need to show your year-to-date audited Profit and Loss statement. If you cant obtain that statement, youll need to provide a year-to-date unaudited Profit and Loss statement, along with your most recent 60 days of business bank statements.

You May Like: How Low Can Mortgage Interest Rates Go

How To Get A Prequalification Letter

You can get a prequalification letter in many cases with just your basic financial information. Typically, youll need to provide the lender with your monthly income, a ballpark estimate of your monthly debts and your best guess at how much money youll have for a down payment and closing costs.

Once you have that information ready, you can get your mortgage prequalification started using any of the following methods:

Online loan applications. Most loan officers can provide links that allow you to apply for a home loan online.

Smartphone apps. Some mortgage companies offer their own smartphone app you can download on your phone and use to securely fill out a loan application.

Phone application. You can provide your loan application information over the phone to a loan officer who can run your credit and review your information.

In-person application. Banks and credit unions typically have a loan officer on site who can take care of a prequalification letter while youre finishing up your regular banking activities.

In almost all of these scenarios, the lender will review your information, run a credit report and issue the prequalification letter if you meet the lenders guidelines. If not, they may make some suggestions for what you can do to prequalify for a mortgage in the future.

What Factors Lenders Consider When Granting Your Mortgage Preapproval

Lenders scrutinize all of your financial decision-making, from how youve managed credit to how stable your income is. Heres a brief overview of the most important mortgage preapproval factors:

- Your credit score. Your credit score will make or break a mortgage preapproval. Some loan programs permit scores as low as 500, but the road to preapproval will be very bumpy, and youll pay a higher rate. The gold standard is 740 for the lowest rate taking these simple steps can help give you a boost before you apply:

- Pay everything on time. Recent late payments will knock your score down faster than any other credit action.

- Keep your credit balances low. Although its best to pay balances off to zero, try to keep your credit charges at or below 30% of the total amount you can borrow. For example, if you have $10,000 worth of credit, dont charge more than $3,000 in any given time period.

Don’t Miss: What Does A Mortgage Payment Consist Of

How A Mortgage Preapproval Affects Your Credit

The credit check required for a mortgage preapproval is identical to the one performed when you apply for a mortgage. This check is considered a hard inquiry on your credit report, which can temporarily lower your credit score a few points.

If you fill out several applications in the process of shopping for a new loan, credit scoring systems treat the credit checks related to those applications as a single event, as long as you make them within a few weeks of each other. Note that the various FICO® Score models will combine inquiries made within the same 45-day period and treat them as one event the VantageScore® system uses a rolling two-week window that resets each time you make a similar loan application within two weeks of the one that preceded it.

This allows you to shop around for the best possible terms without worrying that each credit inquiry will harm your ability to qualify for a new loan.

What Documents Are Needed For Mortgage Pre

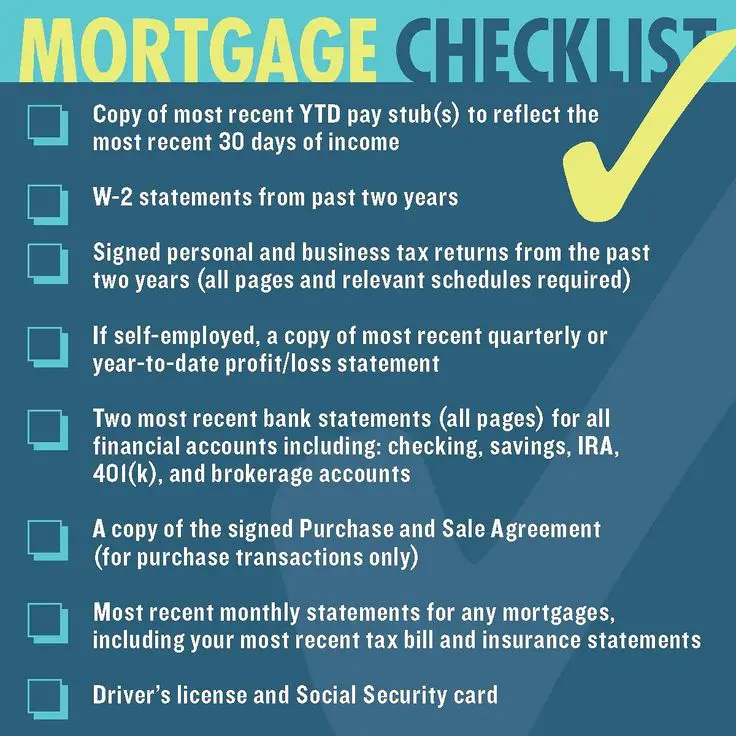

One way to stay organized through the process is to create a mortgage pre-approval checklist with all the documents needed for the mortgage pre-approval. Some of the items you need to have at your disposal include:

- Current bank statements and other investments accounts

- Social security numbers, income and employment details for two years

- Current pay stubs

- Most recent tax returns, including W-2s and 1099s

- Lists of any other assets or debts

Don’t Miss: What Is Better Fixed Or Adjustable Rate Mortgage

Get Your Finances Checked

In a traditional preapproval, your lender will pull your credit report to get a look at your existing debt and any negative items showing up that might have an impact on your mortgage approval.

Your gross monthly income is compared to the debts showing up on your credit report to determine what percentage of your monthly income goes toward debt payments. This is your debt-to-income ratio . In order to have the best chance of qualifying for the most mortgage programs, youll want to keep your DTI at 43% or lower. However, every mortgage option is different.

What Documents Are Needed For Mortgage Preapproval

If youre in the market for a home, you may have heard that you should get a preapproval before you apply for a mortgage. It can help you narrow down your search and let you know how much home you can afford. Not only that, but it can also make you a more appealing buyer to sellers.

Before you can apply for a preapproval letter, though, you need to get your affairs in order. Here are the documents needed for mortgage preapproval.

Don’t Miss: What Do You Need To Get A Second Mortgage

Learn What You Need To Speed Up The Approval Process

Home shopping often starts in a lender’s office with a mortgage application and not at an open house. Most sellers expect buyers to obtain pre-approval for financing and are commonly willing to negotiate with those who prove that they can obtain a loan.

Do I Need To Get Prequalified

You might ask, is a prequalification really necessary when buying a home? The short answer is no.

Theres no rule that says you must get prequalified before shopping for a home. However, a prequalification has its benefits.

Getting prequaligied gives you clues about potential eligibility for a mortgage loan, as well as an idea of your home buying budget. This is needtoknow information, especially if youre questioning whether your income is enough to afford a home purchase.

For example, after a review of your prequalification form, a lender might say you prequalify for a mortgage up to $150,000.

If you believe youre able to find a suitable property within this price range, you might proceed with the mortgage. But if not, you could postpone the mortgage and wait until your financial situation improves.

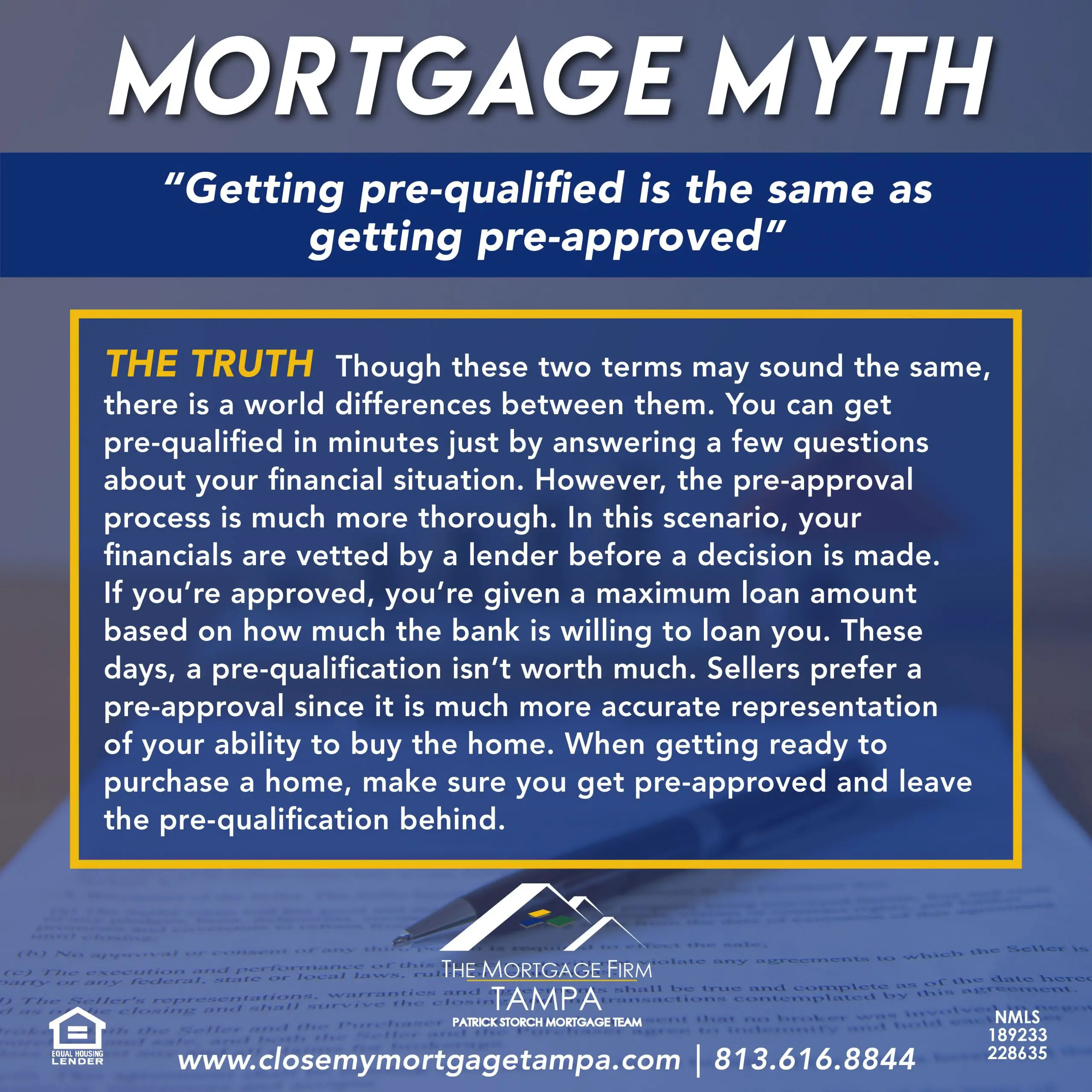

But although a prequalification is a helpful first step and provides information about budgets, it doesnt carry as much weight as a preapproval.

Also Check: How Much Mortgage Payment Can I Afford Calculator

How Long Does Prequalification Or Preapproval Take

Aside from their distinct roles in homebuying, prequalification and preapproval can take different amounts of time. Prequalifying at Bank of America is a quick process that can be done online, and you may get results within an hour. For mortgage preapproval, youll need to supply more information so the application is likely to take more time. You should receive your preapproval letter within 10 business days after youve provided all requested information.

Why Is It Important To Prequalify For A Home Loan

Prequalifying for a mortgage loan isnt only useful for getting a ballpark estimate of your budget. It can be the first step of your home-buying process and an opportunity to shop around and compare loan offers.

Keep in mind that a homes purchase price isnt the only thing that impacts affordability. Your mortgage rate also plays a big role in determining how much house you can afford and what your monthly mortgage payment will be. And you wont know your rate until youve talked to a lender.

Knowing your prequalified rate and loan amount is a crucial first step to house hunting because it ensures youre looking at homes and making offers within your price range.

Read Also: How Much Do You Need For A Mortgage

Selecting A Mortgage Lender

A first-time home buyer understandably might assume that all mortgage lenders offer the same thing: money to purchase a house. After all, mortgage lending is a competitive industry in which individual lendersespecially on the local levelrarely differentiate themselves in a publicly visible way.

Now that several large, national mortgage lenders have shifted the preapproval process online, buyers may feel tempted to proceed with the fastest or least-invasive option. Yet, small differences in mortgage lenders can help to avoid regrettable decisions and even secure meaningful savings over the long term.

A good mortgage lenders preapproval letter should carry significant weight with the real estate agent responsible for the property that the buyer most desires. The lender essentially builds this credibility through strong customer service. In this context, that means asking questions about why youre interested in homes at a particular price point, what monthly payment your budget can absorb and what else you may need your savings for.

Any lender can quickly preapprove a buyer for the maximum amount that their company permits based on certain variables. A listing agent will have learned over time, though, that these lenders customers are more likely to encounter issues before closing. This is one reason why real estate agents are a good source for finding a lender.

Copies Of Social Security Cards

Break open the safe. It is essential that you can provide your lender a copy of your social security card. Not only does this help verify that you are who you say you are and aid in preventing loan fraud, but it also helps to verify that you are indeed a U.S. citizen. Lending for foreign nationals is possible but extremely challenging, which is why foreign buyers usually have to purchase properties with all cash.

Read Also: Can You Reverse Mortgage A Condo

Mortgage Rates Where You Live

Mortgage or refinance rates depend on different factors, including where you live. To better understand what rates you may qualify for, including what the average mortgage or refinance rate is in your area, take a look at Credit Karmas marketplaces for mortgage rates and mortgage refinance rates as well as our latest state-specific guides.

Find A Mortgage Company To Pre

Mortgage pre-approvals are available for free through most mortgage websites with no obligation to proceed. Many home buyers get their mortgage from a different mortgage company that pre-approved them. So, dont overthink this step.

The critical part of getting your pre-approval is that you get it. Without a pre-approval, you cannot buy a home.

Recommended Reading: Who Offers 50 Year Mortgages

Profit And Loss Statements

Finally, if youre self-employed or own your own business, you will need to show two years worth of profit and loss statements. The lender may request additional items such as the businesses bank statements as well.

This list of items may seem like a huge mountain to climb, but dont fret. When you sit down and focus, you can easily gather all these items together in a matter of a couple of hours and begin smartly shopping for a home loan. Youll be able to start your home buying journey organized and prepared.

See how much house you can afford:

Whats The Difference Between Mortgage Pre

The difference between a pre-approval and pre-qualification is that mortgage pre-approvals get used to buy a home pre-approval cannot.

Home sellers accept pre-approvals as proof of a good offer because pre-approvals get backed by lenders and double-verified. They include credit verification and an assessment of monthly income. A pre-approved buyer can afford to buy a home. Learn more about the differences between pre-approvals and pre-qualifications.

They include no verifications or reviews by a lender. By definition, a pre-qualification is non-reliable as evidence of a buyers ability to buy. As a result, sellers dont accept offers from pre-qualified buyers.

Read Also: What Percentage Of Your Income Should Be For Mortgage

Ways To Increase Your Mortgage Pre

While you never want to be approved for a bigger home payment than you can handle, you dont want to miss out on funding unnecessarily either. Here are ways that you can increase your pre-approval amount.

1. Improve Your Credit Score

One way to make sure you receive the full financing possible is to improve your credit score. Your credit score is a numbertypically between 300 and 850that gives your financier an idea of your history of paying other obligations. It is based on your credit history, which takes into account factors like how many accounts you have open, how much you owe, and how promptly you pay your bills. If you find your credit score is low, check out these tips on how to get your credit ready for a mortgage.

2. Consider All Sources of Income

There are other ways beyond improving your credit score to increase the amount of financing you can qualify for. Dont forget income sources such as child support and regular bonuses. Also consider the pros and cons of tapping into a 401K, stocks, or bonds.

3. Increase Down Payment

If your down payment equals at least 20 percent of the purchase price, you wont have to pay for Private Mortgage Insurance each month. By getting rid of this monthly bill, you may qualify for more financing.

4. Add a Co-Applicant

Federal Tax Returns & Bank Statements

Other documents needed for mortgage pre-approval are federal tax returns and bank statements.

Lenders will usually request these documents going back at least two years.

For many filers, these come in the way of Form 1040s. You may also have different documents like Schedule C, Schedule C-EZ, Schedule SE or others, depending on your filing status.

For many borrowers, these are some of the easier files to gather among the documents needed for mortgage pre-approval.

Also Check: Does My Husband Have To Be On The Mortgage

Recommended Reading: Where To Get The Best Mortgage

S To Get Preapproved Vs Prequalified

A mortgage preapproval takes a more in-depth look at your finances than when you get prequalified. The lender will collect supporting documentation before issuing an approval.

Youll provide your lender with the following documents:

- Paycheck stubs for the last 30 days

- W-2s or 1099s for the past two years

- Tax returns from the previous two years

- Info on any other sources of income

- Bank account statements from the past 60 to 90 days

The lender must verify that your income is consistent and stable and that you have enough cash saved for your down payment and closing costs.

A mortgage preapproval also involves a closer look at your credit reports. The lender not only considers your credit score but also your recent credit history. Theyll look specifically at your payment history and your current debts.

Check Your Mortgage Eligibility

Before you can get serious about buying a home, you need to know whether youll qualify for financing and how much you can borrow. Mortgage prequalification will help you look for homes in your price range. And, when the time comes, your preapproval letter will give you the power to make a competitive offer on your dream home.

If youre ready to buy, dont wait on getting preapproved. Make sure youre eligible and check to see the types of loans and interest rates available to you.

Read Also: What Is Gift Money For A Mortgage