How To Choose A Mortgage Lender

You have many options when it comes to choosing a mortgage lender. Banks, credit unions and online lenders all offer mortgages directly, while mortgage brokers and online search tools help you compare options from different lenders.

Its important to make sure you feel comfortable with the broker or company youre working with because youll need to communicate with them frequently during the application processand in some cases, after the loan closes.

You may want to start with the banks or other institutions where you already have accounts, if you like their service. Also, ask your network of friends and family, and any real estate professionals youre working with, for referrals.

Details Of Massachusetts Housing Market

Home of Plymouth Rock and the famed Mayflower landing, Massachusetts has a long history as one of the 13 original colonies. Nicknamed the Bay State for its coastline, Massachusetts has 1,519 shoreline miles and 7,800 square land miles. According to the U.S. Census Bureau, the states population sits at almost 6.9 million. The largest cities by population include Boston, Worcester, Springfield, Lowell and Cambridge.

Currently, the median home value is $418,600. But the housing market is currently hot in certain areas, like in Suffolk County, home to the capital city of Boston, where the median home value is $496,500.

You May Like: Reverse Mortgage For Condominiums

Understand And Utilize Mortgage Points

Whenever people are curious about how much their mortgages cost are going to cost them, lenders will provide them with quotes that include loan rates and points. Stephanie McElheny, the Assistant Director of Financial Planning at Hefren-Tillotson in Pittsburgh, says that âone point is equal to 1 percent of the loan amount .â

McElheny adds, âthere are two kinds of points, discount and origination fees:

- Discount: prepaid interest on the mortgage the more you pay, the lower the interest rate.

- Origination fee: charged by the lender to cover the costs of making the loan.â

If you plan on staying in your home for the foreseeable future, it may be worth paying for these points since youâll end-up saving money on the interest rate of your mortgage. You could save that extra cash each month and put it towards your overall mortgage payment.

You May Like: What Is The Easiest Mortgage Loan To Get

Read The Best Book On Becoming Rich Happy And Free

If you want to read the best book on achieving financial freedom sooner, check out Buy This, Not That: How to Spend Your Way To Wealth And Freedom. BTNT is jam-packed with all my insights after spending 30 years working in, studying, and writing about personal finance.

Building wealth is only a part of the equation. Consistently making optimal decisions on some of lifes biggest dilemmas is the other. My book helps you minimize regret and live a more purposeful life.

Itll be the best personal finance book you will ever read. And I also have three chapters on real estate. You can buy a copy on today. The richest people in the world are always reading and always learning new things.

Financial Samurai is the leading independently-owned personal finance site in the world. It started in 2009 and receives over 1 million organic visitors a month. Sign up for his free weekly newsletter below.

The Ideal Mortgage Amount Is $750000

Updated: by Financial Samurai

The ideal mortgage amount was $1,000,000 before the Tax Cut & Jobs Act was passed for 2018 and beyond. Today, the ideal mortgage amount is $750,000, if your income can afford it.

The reason why $1,000,000 was ideal was because that was the mortgage limit for where you can write off the interest. Today, that ideal mortgage amount is $750,000 because $750,000 is the maximum mortgage you can take to be able to write off the mortgage interest.

Back in 2002, a $1 million mortgage cost around $50,000 to $65,000 a year in interest expense given mortgage rates were 5%-6.5% for a 5/1 ARM or a 30-year fixed. Multiply the annual interest expense by three, and you get $150,000-$195,000, the minimum annual income recommended to take out such a loan.

In 2022, a $1 million mortgage costs around $35,000 $55,000 a year in interest expense given mortgage rates are now 3.5% for an ARM and 5.5% a 30-year fixed. Interest rates plummeted to all-time lows in 2020 due to coronavirus fears. However, interest rates are finally ticking back up as the economy reopens and inflation is high.

Mortgage rates will likely stay low for the rest of our lives. As a result, Im still very positive on the housing market long term. If you plan to own a property for more than five years, I would buy. The housing market is softening and more deals will be had through 2023.

You May Like: Why Is My Credit Score Different For A Mortgage

Debt To Service Ratio

The debt to service ratio is an assessment of the buyers financial situation. It is a ratio of annual mortgage payments and other costs to the amount of combined annual household income. Most lenders look for ratios below 32%.

If you and your spouse have a combined income of $250,000 and the annual mortgage payment and related costs are $75,000, then your ratio would be 30% . If the annual costs are $100,000, then your ratio would be 40%, and you would likely struggle to find a loan.

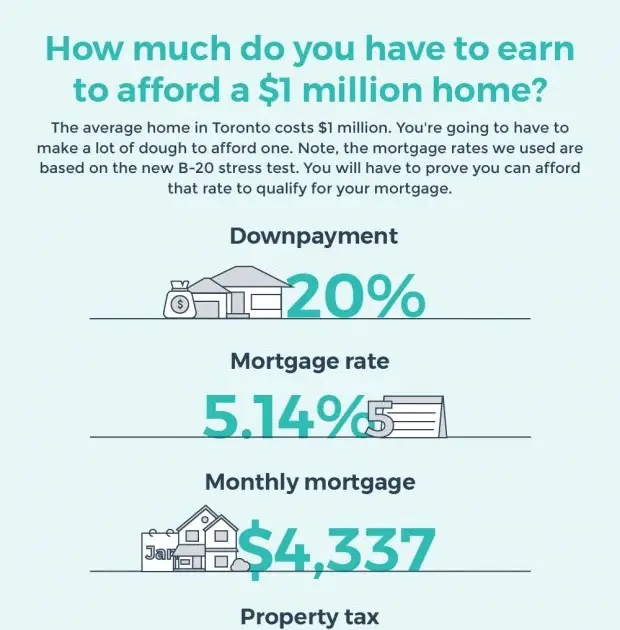

Can You Afford A Million Dollar Home

GeneralKonstantin Seroshtan 21 Jul

$1 million used to be enough money to set you up for life, but those days are long past. In some parts of Canada, youre lucky if $1 million will buy you a decent home, let alone fund your retirement. This couldnt be truer in cities like Kelowna, where the average property price currently hovers around $750,000.

So, if it costs $1 million to buy many homes in cities like Kelowna, are you one of the lucky Canadians who can afford it? Lets take a look at the factors that will determine if you can afford the average mortgage on a 1 million dollar home.

Don’t Miss: How Far Can You Fall Behind On Your Mortgage

Monthly Payments On A $1000000 Mortgage

At a 4% fixed interest rate, your monthly mortgage payment on a 25-year mortgage might total $5,260.20 a month, while a 15-year might cost $7,380.39 a month.

Note that your monthly mortgage payments may differ slightly depending on the type of interest rate , your mortgage term, payment frequency, taxes and possible other fees.

-

See your monthly payments by interest rate.

Interest

Why You Mathematically Should Not Pay Off Your Mortgage Early

Mathematically, it doesnt make sense to pay off your mortgage early. With historically low-interest rates , it seems almost foolish to spend extra money to pay off your home early.

Think about it you could invest your money in an S& P Index Fund in the stock market and make an average of 8% each year. Thats a 5% difference between spending the money to get rid of a 3% interest rate on a mortgage versus investing it and making 8%.

Figuring In Financial Independence And Financial Security

However, the above scenario focuses entirely on a mathematical perspective. The calculations make sense mathematically if you ignore the curveballs life throws at us. If you invest your extra money but lose your job and can no longer afford your mortgage, the mathematical formula goes out the window.

My wife and I chose financial security rather than increasing our net worth. We did this by maxing out our retirement fund first and then spending every extra cent on paying off the mortgage.

I would never advise you to pay off your mortgage before investing for retirement.

By going this route, we wasted five years of extra returns but now we have no mortgage and can delegate even more money into investments.

To top it off, if I suddenly lost my job, I could get a minimum wage job and still not have to worry about moving or affording our house payment. To us, this financial security is worth its weight in gold.

Also Check: How Much Do You Get Approved For A Mortgage

How I Paid Off $100000 Of Debt

- Feature Image By:Nicetoseeya | Shutterstock

I started 2019 with about $142,000 in debt. The debt was a combination of student loans, , an auto loan, and some debt in collections. I had been burying my head in the sand and pretending that the debt didnt exist, but after a long, hard conversation with my boyfriend about our future, I knew I had to get it under control.

Original debt breakdown by category:

- Car Loan: $12,381.66

Also Check: Rocket Mortgage Payment Options

Wait For The Benefits

When it comes to retirement, the longer you wait, the more you can get. For example, Medicare doesnt kick in until youre 65 years old. And, youll receive penalties if you withdraw your retirement income before 59 1/2.

When youre thinking about retirement, often times the best thing to do is wait until youre 65 so your benefits will immediately kick in.

But, if you want to retire early, youll need to make sure that you can fund your medical costs, bills, and other needs before you reach that age.

Also Check: What Does Gmfs Mortgage Stand For

Also Check: How To Buy A House Without A Mortgage

Expect To Need At Least $100k Of Income For A $1m Home

Theres no magic formula that says you need X income to afford a $1 million house. Because income is just part of the equation.

With a really strong financial profile high credit, low debts, big savings you might afford a $1 million home with an income around $100K.

But if your finances arent quite as strong, you might need an income upwards of $225K per year to buy that million-dollar home.

Wondering how much house you can afford? Heres how you can find out.

In this article

| 2.75% | $2,900 |

*Estimates based on 30-year fixed-rate loan, property tax rate at 0.97% annually, home insurance premium of $600 per year, and no HOA dues.Interest rates are for examples purposes only. Your own interest rate will be different.

A million dollars was once a lot of money to pay for a home, and unless you lived in Los Angeles or San Francisco, you probably would never consider purchasing one.

But as home values continue to skyrocket across the country, million-dollar homes are becoming more common outside of California and New York. The good news is that you dont need to be a millionaire to afford one. But you should have your personal finances in order to ensure you get the best rate.

Prime Borrower: $147000 Income Needed

Our first example looks at a traditional prime borrower . They have:

- A 20% down payment

- Only $250 in pre-existing monthly debts

- An excellent mortgage rate of 2.75%

This borrower can afford a $1 million dollar house with an annual salary of $147,000. Their monthly mortgage payment would be about $4,100.

Loan summary:

Recommended Reading: Should I Use A Mortgage Broker To Refinance

The Cost To Own A Three Million Dollar Home

When you own a $3 million house, remember that you will have more costs than if you bought a median-priced home. Were talking $36,000 $90,000 a year in property taxes alone, depending on the property tax rate by state. Hawaii has the lowest property tax rates while Illinois, New Jersey, and Texas have the highest property tax rates.

To maintain a $3 million home, theres also higher heating bills during the winter, higher home insurance, higher maintenance costs, higher cleaning costs, higher landscaping costs, higher mortgage, and so on. If youve got a leak in your roof, like I did during our Bomb Cyclone, it becomes much harder to find!

Therefore, dont think about the cost of a three million dollar house as just the initial purchase price. Think about the ongoing cost to maintain a three million dollar house. The opportunity cost of owning a $3 million home is also the cost of not renting it out.

One of the reasons why I sold my old house in 2017 for $2.75 million was because it had four-bedrooms and three-bathrooms for just my wife and me. The market rent was between $7,500 $8,200 a month at the time, which we werent willing to pay. Further, there were between $50,000 $100,000 in upcoming maintenance issues we may have needed to do. These included:

- Rewiring the entire house from knob and tube to ROMEX wiring: $50,000

- Replacing windows in the back of the house, which the new buyers did: $35,000

Do You Have Any Other More Expensive Debts

Expensive debts are those that cost a lot to pay off over time.

Other expensive debts could include unsecured loans, where the interest rate is much higher than the cost of your mortgage borrowing.

Always pay off more expensive debts before thinking about reducing your mortgage but be careful not to rack them up again.

Recommended Reading: How To Calculate Mortgage Amount Qualification

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

Here Are My Two Favorite Real Estate Investment Platforms:

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. There is no minimum income necessary to invest in Fundrise. Further, the investment minimum is only $10.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you earn a high salary or have a higher net worth, you can build your own select real estate portfolio with CrowdStreet.

Both platforms are free to sign up and explore. Real estate is the ultimate inflation hedge. Not only are rents expected to rise, so are property prices. Therefore, Ive invested $810,000 real estate crowdfunding. My investments now generate steady passive income so my wife and I can be stay at home parents.

I get the desire to own a $3 million home or thereabouts, especially if you have kids. After all, the best time to buy the nicest house you can afford is when your kids are still living with you. However, the key word is AFFORD. Dont put your financial life in jeopardy by stretching too much. Stay disciplined, especially as home prices have done so well.

Don’t Miss: What Is Needed To Get Approved For A Mortgage

Option : Make A Large One

While not everyone has the desire to make a lump sum payment on their mortgage, this is the option were considering right now. In the meantime, were also paying extra on our mortgage every month.

This decision isnt one were taking lightly, but its one that seems to make sense based on where we are in our journey to wealth and our eventual retirement.

Of course, I feel blessed to be in a financial position that we can take a lump sum on our mortgage without sacrificing our other financial goals. In the end, we decided we wanted to pay an extra $100,000 toward our mortgage in a single payment.

But, where is the money coming from exactly?

First off, its important to know that we have ample cash on hand to survive an emergency. In fact, we have around three to four years of spending and bills socked away, which should be more than enough to handle something like surprise medical bills or a drop in income. Im fine with all of that, and Im also unwilling to deplete our emergency savings in order to pay off our mortgage.

So, I started searching elsewhere. When I started looking at where I would feel most comfortable pulling our money from, I took a cold, hard look at some of our investments. I instantly knew I wanted to leave our crypto accounts alone, so that left me with a few other places to choose from.

First off, I own some Facebook stock in a joint account with my wife. My original purchase was in 2012, and I bought 250 shares for $25.97 each.

The Absolute Minimum Income Necessary To Buy A $3 Million Home

In this low interest rate environment, you can stretch to buy a home up to 5X your annual gross income. In other words, you can make as little as $600,000 to buy a $3 million home. However, without a cash buffer, you will feel stressed and a little paranoid during the initial years of ownership.

Having a $2.4 million mortgage is HUGE. At a 3% mortgage rate, were talking a monthly payment of $10,962. Thats $131,544 in yearly mortgage payments a year, and thats after paying taxes. If you pay a total effective tax rate of 30%, then you would need to earn $187,900 in gross income to pay $131,544 a year in mortgage payments.

Then of course, youve got everything else in your familys lives to pay for. Therefore, before buying a three million dollar home, you may want to come up with a larger down payment to reduce your overall mortgage size.

Luckily, I do think interest rates will stay low for the rest of our working lives. So buying a three million home with only a $600,000 income is doable, provided you keep your job.

Don’t Miss: Are Mortgage Rates Going To Rise