How To Get Your Credit Ready For A Mortgage

In the months leading up to your home purchase, you could take the opportunity to work on improving your credit. Your credit reports and scores can impact your ability to get a mortgage and your mortgage’s interest rate, and you want to be in the best position possible. Here are a few things you can do to prepare:

How Long Will A Pre

Because pre-approvals are hard inquiries that impact a home buyers credit score, they can stay visible on their credit reports for up to two years, according to Experian.

Your credit score is one of the most important factors a lender considers. Your lender accesses the score and documentation through credit bureaus.

However, the impact on a home buyers credit score declines as time passes, and the hard inquiry becomes less relevant.

Depending on a home buyers financial history, a few points can impact their credit score. However, many variables make up a home buyers creditworthiness and can influence the impact of the inquiry.

Learn more about buying a home, even if you have bad credit.

Shopping Around For A Loan

Once you know how much you may qualify for and you are ready to shop for a home, its time for the pre-approval. This is the next step in the process and this does affect your credit score. You will fill out a loan application and sign a disclosure allowing the lender to pull your credit. Each inquiry will then affect your credit score.

What if you want to shop around though? You can because recognize the need to shop around. It doesnt make sense to take the first loan that is thrown your way. Instead, most borrowers check with various lenders to see who offers the best interest rate and term.

As long as you do this within 30 days, your credit score will likely only be hit for one inquiry. The credit bureaus recognize that it is for the same type of loan. However, if you spread out your inquiries, it will hurt your credit score multiple times. Generally, one inquiry hits your credit score around five points. Sometimes its not just about the points, though. Future lenders that see multiple inquiries over a long period of time may become leery of your situation. They may wonder what other loans you took out or why you applied for so many different loans.

In the end, the pre-qualification does not hurt your credit score. Most lenders dont even pull your credit when pre-qualifying you for a loan. If you take it further though, know that it will affect your score. Shopping smart will help you avoid too much damage to your score.

You May Like: How To Become A Mortgage Loan Originator In Georgia

How Does Getting Prequalified Affect Your Credit Score

Prequalification usually involves a soft credit check, meaning it will not negatively affect your credit score. That said, getting prequalified is only the first step toward getting approved for a mortgage. To get preapprovedor approvedfor a loan, your lender will ultimately run a hard credit inquiry to get a more comprehensive picture of your creditworthiness.

Recommended Reading: What Is A 5 1 Arm Mortgage

If Im Prequalified Am I Guaranteed To Get The Card

Prequalification is definitely not a guarantee that youll be approved. Rather, think of it as an invitation to apply.

The good news? Based on the information the credit card company has on you, youre more likely to be approved for those offers you prequalify for. The catch? If you decide you want the card, youll still have to apply.

The credit card company will then perform a hard inquiry and decide whether to approve you for the card, and at what terms. It may be frustrating, but its important to know that its still possible to be rejected even though you prequalified.

On a brighter note, its also possible to be approved for a credit card even if you werent prequalified. This may be the case if youve worked to improve your credit over time or if youre relatively new to credit and your name has never been on a marketing list.

To help minimize your chances of being rejected for a card, you can check your VantageScore 3.0 credit scores from two major credit bureaus and your likelihood of being approved for certain cards on Credit Karma.

Don’t Miss: How To Estimate Your Mortgage Payment

Can A Mortgage Pre

Getting a mortgage pre-qualification is the first step in the mortgage process. Its not a pre-approval, so it doesnt hold a lot of weight with sellers. But, if you are unsure about how much mortgage you can afford, its a good first step.

Does the process hurt your credit score? Because the process does not require the lender to do a hard inquiry on your credit, it does not affect your score.

We discuss the details below.

A Mortgage Preapproval Is A Letter From A Lender Saying That Its Tentatively Willing To Lend You A Certain Amount For A House

Getting preapproved for a mortgage is a crucial first step in the home-buying process. It gives you an idea of how much you can borrow, which will help narrow down your search to houses in your price range. The preapproval process could also uncover potential issues that would prevent you from getting a mortgage, so you can work them out before setting your heart on a house.

A mortgage preapproval lets sellers know you have the borrowing power to back up an offer you make to buy their home, which could make your offer more competitive. It tells real estate agents, who work on commission, that spending time on you could well pay off with a transaction. And it alerts lenders that youre a savvy borrower who may soon be taking out a mortgage loan.

In short, getting preapproved for a mortgage signals that youre serious about buying a home.

Fortunately, getting preapproved is relatively quick and simple. Lets explore what you need to do for a mortgage preapproval and how it can benefit you during the home-buying process.

You May Like: Can You Refinance A Mortgage After Bankruptcy

Check Your Credit Score

The first place to start is reviewing your credit report and getting your credit score. Check with your bank or your credit card companies as they’ll often provide these for free. And each of the three national credit rating agencies, Equifax, Experian, and TransUnion are required to provide you with one free credit report per year.

You can request a report by going to annualcreditreport.com, or by calling the credit reporting agencies. If you’re planning to purchase the home with your spouse or another person, they need to request and review their credit reports as well. Review your credit reports for any incorrect information and, if you find any, contact the credit reporting agency to request a correction.

Check your , which is a number between 300 and 850. A higher score not only improves your chances of getting a mortgage loan, but may also help you qualify for a lower interest rate.

Don’t wait until you have found the home you want before looking for a mortgage. This will give you time to improve your credit score by reviewing your credit report for accuracy, paying your bills on time, and reducing your balances on your credit accounts.

Here Is Everything You Need To Know About Mortgage Preapproval

Getting a preapproval letter is one of the first steps you should take in the homebuying process.

Luke Daugherty

Luke Daugherty is a freelance writer, editor and former operations manager. His work covers operations, marketing, sustainable business and personal finance, as well as many of his personal passions, including coffee, music and social issues.

One of the first and most important steps of buying a home is getting mortgage preapproval. Getting mortgage preapproval gives you an idea of how much you’ll be able to borrow for a home loan, and shows that you’ve lined up the financing you need to close on a home. Without a preapproval letter, most sellers aren’t going to take your offer seriously, especially in today’s competitive housing market.

Here is everything you need to know about what it means to be preapproved, how to get mortgage preapproval, and why it’s a critical part of the homebuying process.

Don’t Miss: What Are The Fees For A Reverse Mortgage

What Can I Do About A Bad Credit Score

Think you have a bad score? Do not worry theres excellent news: credit history arent fixed! Your score will change when the info in your credit report changes. That indicates you can take control of your financial health now by making changes that will favorably affect your credit score over time. Heres a few things anyone can easily do to start:

Also Check: What Is Mortgage Debt To Income Ratio

Does Preapproval Affect My Credit Score

A mortgage preapproval can have a hard inquiry on your credit score if you end up applying for the credit. Although a preapproval may affect your credit score, it plays an important step in the home buying process and is recommended to have.

The good news is that this ding on your credit score is only temporary. If you keep paying your monthly bills on time and keep your credit card debt low, your score will recover quickly from whatever small drop it suffers.

You dont have to worry about shopping around for a mortgage, either. If you apply for a mortgage loan with several lenders in a short period, your score wont drop every time these lenders check your credit. Because you are searching for just one loan, each of the credit pulls from different lenders will count as just one hard inquiry. So even if you get preapproved with, say, three lenders, your credit score will drop by just a small number of points.

Just make sure to apply for all your preapprovals within a few days of each other. That way, each hard inquiry will be counted as a single inquiry for credit-scoring purposes.

And dont let that small credit drop prevent you from getting preapproved. The benefits of getting preapproved, such as knowing how much home you can afford, far outweigh the tiny drop your credit score will take.

Recommended Reading: Can You Get Reverse Mortgage With Bad Credit

How Does A Mortgage Pre

Hard inquiries will temporarily affect your and will stay on your credit report for about two years. Inquiries tell lenders how frequently you apply for credit.

Credit inquiries have a small impact on your credit score. While the impact will vary from person to person based on credit history, one inquiry will lower your score by up to five points, according to FICO. Inquiries play a minor role in assessing risk and only account for 10% of your FICO credit score.

Mortgage shopping is generally seen as a positive financial move by credit scoring models, and multiple credit checks from mortgage lenders within a 14 to 45-day window will only be recorded as a single inquiry. This allows buyers to shop around and get mortgage pre-approval from several lenders without their credit score taking a significant hit.

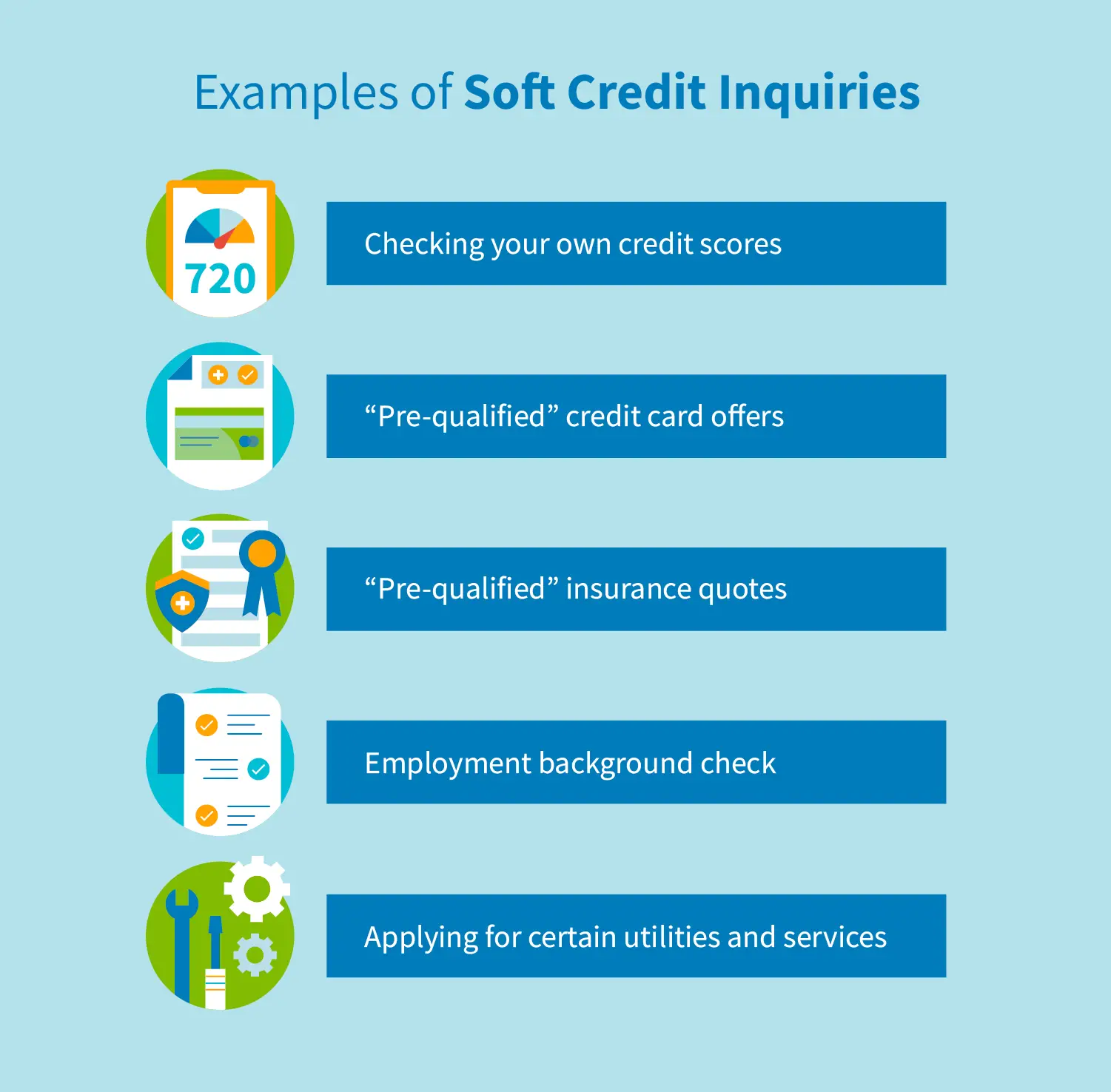

There are also soft inquiries, but these generally occur when a lender provides a rate quote or when you view your own credit report. Soft inquiries dont impact your credit score.

Find out if you qualify for a mortgage with Total Mortgage. We have branches across the US where you can talk to our mortgage advisors. Find a Total Mortgage branch near you.

How Long Does It Take To Get Pre

You can typically expect to get pre-qualified in a day or two, sometimes less. Depending on the lender, pre-qualification can happen in person, over the phone or online.

More from NerdWallet:

NerdWallet subscribes to the 28/36 rule of thumb, which means that monthly home-related expenses shouldnt be more than 28% of your gross income, and all of your monthly debts shouldnt account for more than 36% of your gross income.

Using the guideline that your home-related expensesshouldnt be more than 28% of your gross income, you should try to keep your monthly mortgage payment under $4,666 if you have a household income of $200,000 a year. If your monthly debts plus $4,666 are greater than 36% of your gross income, youll either need to reduce your monthly debts, put down a larger down payment or set your sights on a lower-priced home.

There are so many elements at play that can determine home affordability, and everyones financial circumstances are unique. NerdWallets mortgage payment calculator can help you determine what your monthly payments would be if you bought a $400,000 home, and it shows how this figure changes based on factors like your down payment and property taxes. Ideally, this monthly payment should be less than 28% of your gross income.

There are so many elements at play that can determine home affordability, and everyones financial circumstances are unique. NerdWallets

Also Check: Can You Get A Mortgage With A 620 Credit Score

Does Getting Preapproved Hurt Your Credit

Theres one key step you should take to boost your odds of landing your dream home: getting preapproved for a mortgage loan with a lender.

If you do this, sellers will view you as a more attractive buyer. If they receive multiple offers, sellers are more likely to choose buyers who are preapproved for a mortgage than they are those who have not yet obtained financing.

But does getting preapproved for a mortgage hurt your three-digit FICO credit score? Slightly, but the dip in your credit score will be temporary. And the advantages of getting preapproved far outweigh the small hit to your score.

Multiple Credit Inquiries For The Same Type Of Loan

Another way to protect your credit scores from too many inquiries is to limit your loan search to two weeks. When evaluating your credit, lenders realize that consumers want to shop around for different rates to get the best loan. So if you have several of the same type of inquiry listed in a two-week span, theyll actually only be counted as a single inquiry.

Recommended Reading: How Many Mortgage Lenders Should I Apply To

Do Pre Approved Credit Card Offers Affect My Credit Score

What exactly is a credit score and why is it important? Check out these 10 tips that will help you improve your credit score. How does prequalification affect your credit score? Prequalifying, or preapproval , won’t have any effect on your credit score that happens once .

A mortgage preapproval can have a hard inquiry on your credit score if you end up applying for the credit. Prequalifying, or preapproval , won’t have any effect on your credit score that happens once . There are two common types of credit inquiries that creditors run when evaluating . Do preapproval and prequalification offers impact credit score?

Pros Of Mortgage Prequalification

- Helps with budgeting: Getting prequalified for a mortgage can help prospective borrowers discover how much house they can afford.

- Manages borrower expectations: Likewise, mortgage prequalification can provide borrowers a more realistic expectation of what home ownership costs.

- Makes buyers more competitive: A prequalification letter demonstrates to sellers that a potential homebuyer is likely to qualify for a mortgage. This can make a buyers offer more competitive by demonstrating a higher likelihood that the sale will close.

- Informative: The prequalification process can expose prospective borrowers to various mortgage products early in the homebuying process.

Also Check: What Is Difference Between Rate And Apr In Mortgage

Can I Offer More Than My Pre

Yes, you may choose to make an offer that is more than what you were pre-approved for. If your offer is accepted and you go ahead with the purchase, you’ll need to find a way to finance your mortgage. If your offer is significantly more than your loan pre-approval amount, then you may need to make a larger down payment. If the difference is small, you may be approved for a larger mortgage when it comes time to apply for an actual mortgage.

Learn What You Need To Speed Up The Approval Process

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Home shopping often starts in a lender’s office with a mortgage application and not at an open house. Most sellers expect buyers to obtain pre-approval for financing and are commonly willing to negotiate with those who prove that they can obtain a loan.

Don’t Miss: What Is The Current Va Mortgage Rate