Where Are Mortgage Rates Headed This Year

Rates for home loans have soared this year, rising from 3.22% in early January to 6.39% this week for the most popular 30-year, fixed-rate mortgage. What happens next is anyones guess: a Forbes Advisor survey of experts predicts the year-end average anywhere from 5% to nearly 7%. If you are seeking a mortgage right now, consult multiple lenders and lock in a rate as soon as a competitive offer comes along.

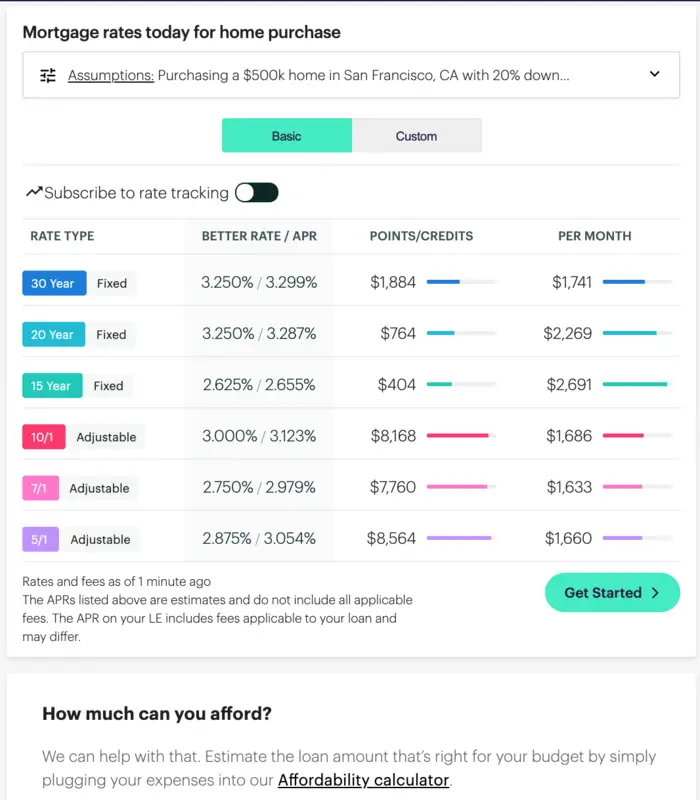

Best Mortgage Rates Inc Makes It Easy To Compare Mortgage Rates From Hundreds Of Lenders Across The Country

Looking for the best mortgage rate but dont know where to start? Best Mortgage Rates Inc. provides an easy-to-navigate system for searching mortgage rates across the country. Our system allows you to compare rates from hundreds of lenders in all 50 states. Search by rate, APR and payments to find the rate that best suits your home loan needs. Compare rates, read helpful mortgage rate information and save. Whether you are buying your first home or you are looking to refinance, Best Mortgage Rates Inc. is a helpful tool that can get you instant results.

Tip : Make A Higher Down Payment

A higher down payment at closing will get home buyers a lower rate. Putting down a significant portion of the purchase price lowers the relative risk for a lender. The lower your loan-to-value ratio , the more youre considered a good investment. The higher your down payment, the less a lender has to give you so you can afford the home.

Keep in mind, though, that using all your cash for a down payment leaves you vulnerable should some unforeseen circumstances arise. Lenders like to see you have reserve funds to cover up to three months of expenses, just in case.

Recommended Reading: What Is Considered Monthly Debt For Mortgage

Should You Plan To Buy A Home In 2023

If you have a steady job, a solid emergency fund, and plenty of money to put down on a home, then you may find that 2023 is a good time for you to buy — even if mortgage rates don’t come down at all. While borrowing rates may be higher than you’d like them to be, there’s a good chance housing inventory will increase in 2023. That could, in turn, bring home prices down a lot.

On the other hand, if you’re not in such a stable place financially at this point in 2022, then buying a home in 2023 may not be a good idea, regardless of what mortgage rates look like. So while it’s definitely not a bad idea to keep tabs on how rates are trending, a more important thing you should be tracking is your personal financial health. The last thing you want to do is buy a home when you’re not really ready — and struggle to keep up with it after the fact.

Use A Mortgage Calculator

A mortgage calculator estimates what your monthly payments might look like based on inputs you provide. Try different scenarios to find your optimal mortgage, with monthly payments you can comfortably affordand total interest costs you can live with. For example, you might find that you could swing higher payments with a 15-year mortgage if you make a larger down payment.

Recommended Reading: How To Process A Mortgage Loan

Jumbo Loan Interest Rate Goes Up +021%

The average jumbo mortgage rate today is 6.31 percent, up 21 basis points since the same time last week. Last month on the 20th, jumbo mortgages average rate was below that, at 5.89 percent.

At the average rate today for a jumbo loan, youll pay principal and interest of $615.07 for every $100k you borrow. Thats $15.52 higher compared with last week.

Best Mortgage Rates For Refinancing

The table below displays some of the 2-year fixed-rate home loans on our database that are available for home owners looking to refinance. This table is sorted by Star Rating , followed by company name . Products shown are principal and interest home loans available for a loan amount of $500K in Auckland. Before committing to a particular home loan product, check upfront with your lender and read the applicable loan documentation to confirm whether the terms of the loan meet your needs and repayment capacity. Use Canstars home loan selector to view a wider range of home loan products. Canstar may earn a fee for referrals.

Recommended Reading: How Many Years Can I Knock Off My Mortgage Calculator

Money’s Average Mortgage Rates For September 9 2022

Mortgage rate moved lower across all loan categories today. The average rate for a 30-year fixed-rate loan was down for the second day in a row, decreasing by 0.136 percentage points to 6.731%.

- The latest rate on a 30-year fixed-rate mortgage is 6.731%.

- The latest rate on a 15-year fixed-rate mortgage is 5.601%.

- The latest rate on a 5/6 ARM is 6.395%.

- The latest rate on a 7/6 ARM is 6.422%.

- The latest rate on a 10/6 ARM is 6.393%.

Money’s daily mortgage rates are a national average and reflect what a borrower with a 20% down payment, no points paid and a 700 credit score roughly the national average score might pay if he or she applied for a home loan right now. Each day’s rates are based on the average rate 8,000 lenders offered to applicants the previous business day. Your individual rate will vary depending on your location, lender and financial details.

These rates are different from Freddie Macs rates, which represent a weekly average based on a survey of quoted rates offered to borrowers with strong credit, a 20% down payment and discounts for points paid.

What Are Current Mortgage Rates

Mortgage rates have risen from the record lows seen in 2020 and 2021. That means its more important than ever to shop around for your best deal.

Comparing lenders and negotiating for a better mortgage rate can save you thousands of dollars even tens of thousands in the long run. So its well worth the effort.

Ready to get started?

1Top 50 mortgage lenders for 2021 based on 2020 Home Mortgage Disclosure Act data via Bundle Loan and 2021 data sourced directly from the HMDA data browser

2Rate and fee data were sourced from self-reported loan data that all mortgage lenders are required to file each year under the Home Mortgage Disclosure Act. Averages include all 30-year loans reported by each lender for the previous year. Your own rate and loan costs will vary.

You May Like: Is Rocket Mortgage And Quicken Loans The Same

Tips To Find The Best Mortgage Rates

This is not the time to let somebody else do the shopping for you. As we saw just now, the terms you get can make a sizable difference in what you pay to borrow the same amount of money.

How do you avoid paying more than you need to for your mortgage? Certainly, compare the offers you get by running them through your online mortgage calculator to see what your payments and interest will be. And as you door even before you dofollow the steps below.

The Best Mortgage Rates Ranked

The following banks and mortgage lenders have the best mortgage rates on average, based on nationwide data filed by lenders under the Home Mortgage Disclosure Act. These averages are from 2021, the most recent data available at the time of writing.

Rates have risen in 2022, and the average rates you see here do not represent mortgage interest rates on offer today. However, historical mortgage rates can be a useful guide to help you find the banks with the lowest mortgage rates on average. The lists below are a great starting point if youre shopping for a new home loan.

Also Check: Can I Apply For Mortgage With Multiple Lenders

How To Shop For Mortgage Rates

Its easy to compare mortgage rates and fees if you know what youre doing. There are five basic steps:

That last step comparing Loan Estimates is key to finding the best mortgage rate and most affordable mortgage overall.

For more information, see our complete guide to shopping for a mortgage.

How Much Can I Borrow For A Mortgage

The amount of money you can borrow is affected by the property, type of loan, and your personal financial situation.

During the mortgage preapproval process, the lender will look at your overall financial profile to determine how much it will lend to you. A big factor in this process is your debt-to-income ratio . Your DTI is calculated by dividing your total monthly debt payments by your monthly income. In most cases, the maximum DTI is typically 43%. So if you make $5,000 a month, your mortgage payment and other monthly debt payments cant exceed $2,150.

To protect its investment, a lender will typically only let you borrow a certain percentage of a propertys value. So the value of the property can also limit how much you can borrow. Most mortgage loans require a down payment of anywhere from 3% to 20%. You may be able to borrow 100% of the propertys value with certain government-backed loans, like Department of Veterans Affairs Loans or U.S. Department of Agriculture Rural Development loans.

Recommended Reading: How To Calculate Interest Payment On Mortgage

How Are Mortgage Rates Determined

Mortgage rates, in general, are determined by a wide range of economic factors, including the yield U.S. Treasury bonds, the economy, mortgage demand and the Federal Reserve monetary policy.

Borrowers have no control over the wider economy, but they can control their own financial picture to get the best rate available. Typically, borrowers with higher FICO scores, lower debt-to-income ratios and a larger down payment can lock in lower rates.

Related:How To Improve Your Credit Score

What Is A Good Mortgage Rate

Whats considered a good mortgage rate varies by loan type as well as whats happening in the economy . For instance, a good mortgage rate as of February 2021 is generally a fixed rate of 2.5% or less for a 15-year mortgage and 3% or less for a 30-year mortgage. However, interest rates change daily, so its important to keep an eye on the interest rate environment, especially if youre shopping for a mortgage.

In addition to the loan type and economic conditions, a good mortgage rate can also vary based on your credit score and the size of the down payment youre able to make.

For example, as of February 2021, the average rate on a 30-year fixed-rate mortgage with a down payment of less than 20% for borrowers with a FICO score better than 740 was 2.772%, compared to 3.087% with a FICO score less than 680. The average 30-year fixed-rate for those able to make a down payment of 20% or more was 2.785% for FICO scores better than 740 and 3.169% for FICO scores less than 680. These are all considered good mortgage rates.

Recommended Reading: Can I Add Someone To My Mortgage Without Refinancing

Why Do Different Mortgage Types Have Different Rrates

Each type of mortgage has a different rate because they have varying levels of risk. One of the primary sources of income for lenders is the money they earn from the interest you pay on your mortgage. For this reason, lenders consider the amount of risk associated with each loan when they set the interest rate. This is referred to as risk-based pricing and is premised on the idea that riskier loans like 30-year mortgages should carry a higher rate.

One of the reasons for this is that its easier to predict what will happen in the economy in the short-term than it is in the long-term. Similarly, theres more risk that something will happen to negatively affect your ability to repay the loan, for instance, if you lose your job or theres an economic downturn.

Save For A Larger Down Payment

Putting more money down on a homeaka lowering your loan-to-value ratio means a smaller loan amount and therefore less risk to the lender. If you can manage it, an LTV of 80% or less will mean that you dont have to pay private mortgage insurance .Saving for a down payment requires diligence and time just try not to fully deplete your cash reserves because youll need some money in the bank for future expenses.

Programs like FHA and VA have different standards when it comes to LTV, so work with a mortgage professional who can fully explain your options.

Don’t Miss: How Much Is Mortgage On 1 Million

Types Of Mortgage Interest Rate

There are several mortgage interest rate options that determine whether your rate changes in line with the Bank of England base rate.

The two key types are fixed-rate mortgages and variable-rate mortgages. As the names imply, fixed-rate mortgages give you an interest rate that is fixed for a set number of years, while variable-rate mortgages give you interest rates that are subject to change.

Getting The Best Possible Mortgage Deal

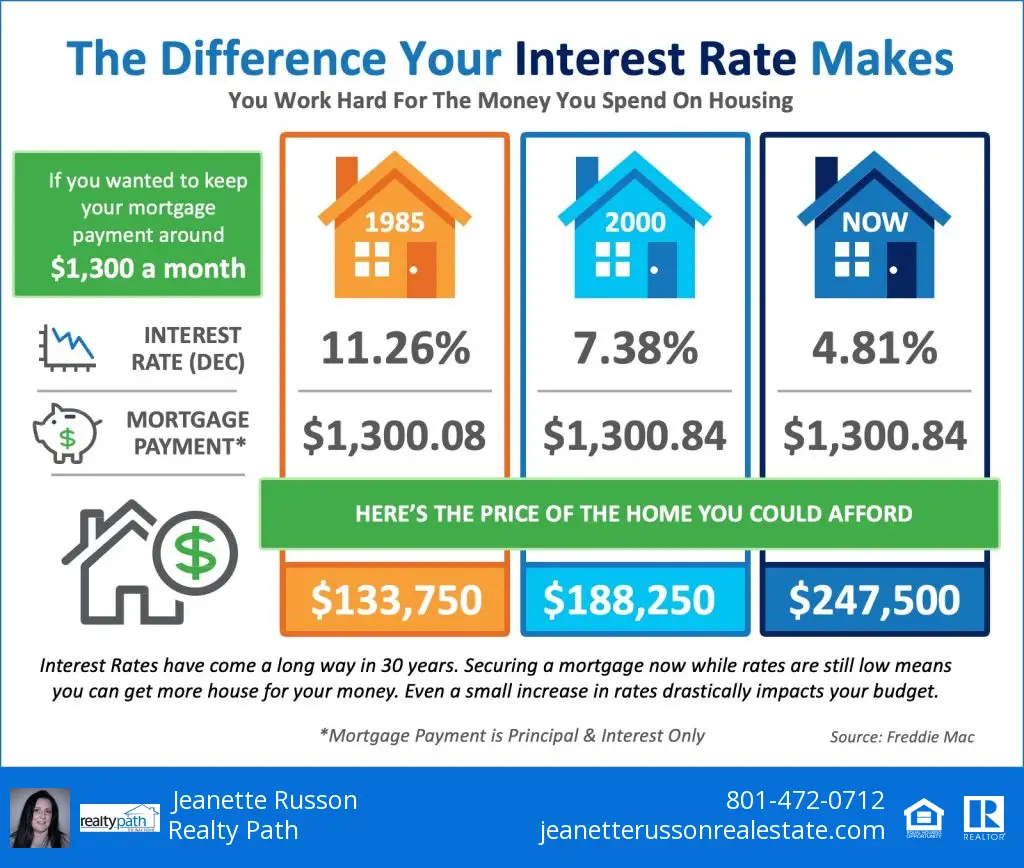

Obviously, the higher the interest rate, the more you pay each month, and the more you ultimately pay for your home. To compare, lets take a look at a 30-year fixed-rate mortgage for $200,000.

At the prime ratesay, 4.6% for this exampleyour monthly payment would be $1,025. Over the life of the loan, you would pay $169,103 in interest, so youd actually pay back a total of $369,103.

Now assume you get the same 30-year fixed-rate mortgage for $200,000, but this time you are offered a subprime rate of 6%. Your monthly payment would be $1,199 and youd pay a total of $231,676 in interest, bringing the total amount you pay back to $431,676. That seemingly small change in interest would cost you $62,573.

Just because a lender offers you a mortgage with an Alt-A or subprime rate doesnt mean you wouldnt qualify for a prime-rate mortgage with a different lender. It pays to shop around.

Lenders and mortgage brokers may be competitive, but they generally are under no obligation to offer you the best deal available. Its well worth the effort to shop around. Taking the time to find a better interest rate can save you tens of thousands of dollars over the course of a loan.

How To Get A Cheaper Mortgage

Also Check: How Are Mortgage Approvals Calculated

What Is A Mortgage Rate Lock

A mortgage rate lock means that your interest rate won’t change between the day your rate is locked and closing as long as you close within the specified timeframe of the rate lock, and there are no changes to your application. If your interest rate is locked, your rate won’t change as a result of market fluctuations, but it can still change if there are changes in your application – such as your loan amount, credit score or verified income.

Open Vs Closed Mortgages

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] Mortgage Rates & Payments by Decade [INFOGRAPHIC]](https://www.mortgageinfoguide.com/wp-content/uploads/mortgage-rates-payments-by-decade-infographic-keeping-current.jpeg)

If youâre wondering whether to get an open or closed mortgage, the answer is, while an open mortgage may make sense in certain circumstances, the overwhelming majority of Canadians opt for a closed mortgage. While open mortgages have extra flexibility that you might need, closed mortgages are by far the more popular choice not only due to their lower rates, but also because most home buyers do not intend to pay off their mortgages in the short term. Moreover, fixed-rate open mortgages do not exist and variable-rate mortgages are very rare. The most common type of open mortgage is the Home Equity Line of Credit . Below are some quick facts about the differences between open and closed mortgages, and you can also find more detailed information on our blog about open vs. closed mortgages.

Don’t Miss: What Does Refinancing Your Mortgage Mean

How Do You Shop For Mortgage Rates

First, start by comparing rates. You can check rates online or call lenders to get their current average rates. Youll also want to compare lender fees, as some lenders charge more than others to process your loan.

Thousands of mortgage lenders are competing for your business. So to make sure you get the best mortgage rates is to apply with at least three lenders and see which offers you the lowest rate.

Each lender is required to give you a loan estimate. This three-page standardized document will show you the loans interest rate and closing costs, along with other key details such as how much the loan will cost you in the first five years.