Preapproval Is The First Step To Buying A House

When youre ready to get serious about buying a house, the first step is to get preapproved for a mortgage. Preapproval shows you your home buying budget, interest rate, and future mortgage payment. And it tells real estate agents and Realtors youre a serious buyer.

In todays housing market, its crucial to get preapproved before you try to make an offer on a home or even start house hunting. Heres how to get preapproved for a mortgage in just a few steps.

In this article

Mortgage Rates Where You Live

Mortgage or refinance rates depend on different factors, including where you live. To better understand what rates you may qualify for, including what the average mortgage or refinance rate is in your area, take a look at Credit Karmas marketplaces for mortgage rates and mortgage refinance rates as well as our latest state-specific guides.

Fha Mortgage Loans Vs Other Low Down

If FHA loans arent your thing, here are some government-backed or conventional loan options to consider.

Government-backed loans: Active and former members of the U.S. Military, National Guard and Reserve, as well as spouses of veterans who died in service or as a result of a service-related injury, may take out a VA loan provided they meet the other eligibility requirements. With a VA loan, a borrower can purchase a house for little or no down payment and without having to pay PMI, although there are some trade-offs, including the need to pay certain closing costs.

Conventional loans: If youre purchasing your first house or have low to moderate income, your lender might be able to offer one of Fannie Maes My Community Mortgage loans for a down payment of as low as 3%. Like FHA loans, these loans require the borrower to pay PMI, but other conditions varymeaning that in certain cases, the loan could work out cheaper than an FHA loan.

Read Also: What Determines Your Mortgage Interest Rate

Mortgage Preapproval In Hindsight

Katerina Matsa ultimately closed on her first home purchase in late 2018. Looking back, she only now appreciates the critical financial role that her lender played in the home buying process.

If I could go through the preapproval process again, I would have more thorough conversations with the lender about our mortgage options. I would ask more questions and make sure I fully understand various details. Everything happened so fast. That was the downside of starting the process so late.

Whats The Difference Between Mortgage Pre

The difference between a pre-approval and pre-qualification is that mortgage pre-approvals get used to buy a home pre-approval cannot.

Home sellers accept pre-approvals as proof of a good offer because pre-approvals get backed by lenders and double-verified. They include credit verification and an assessment of monthly income. A pre-approved buyer can afford to buy a home. Learn more about the differences between pre-approvals and pre-qualifications.

They include no verifications or reviews by a lender. By definition, a pre-qualification is non-reliable as evidence of a buyers ability to buy. As a result, sellers dont accept offers from pre-qualified buyers.

Dont Miss: How Long Can You Go Without Paying Mortgage Before Foreclosure

You May Like: How Does Making Extra Payments On Mortgage Work

Maintain Your Financial Health

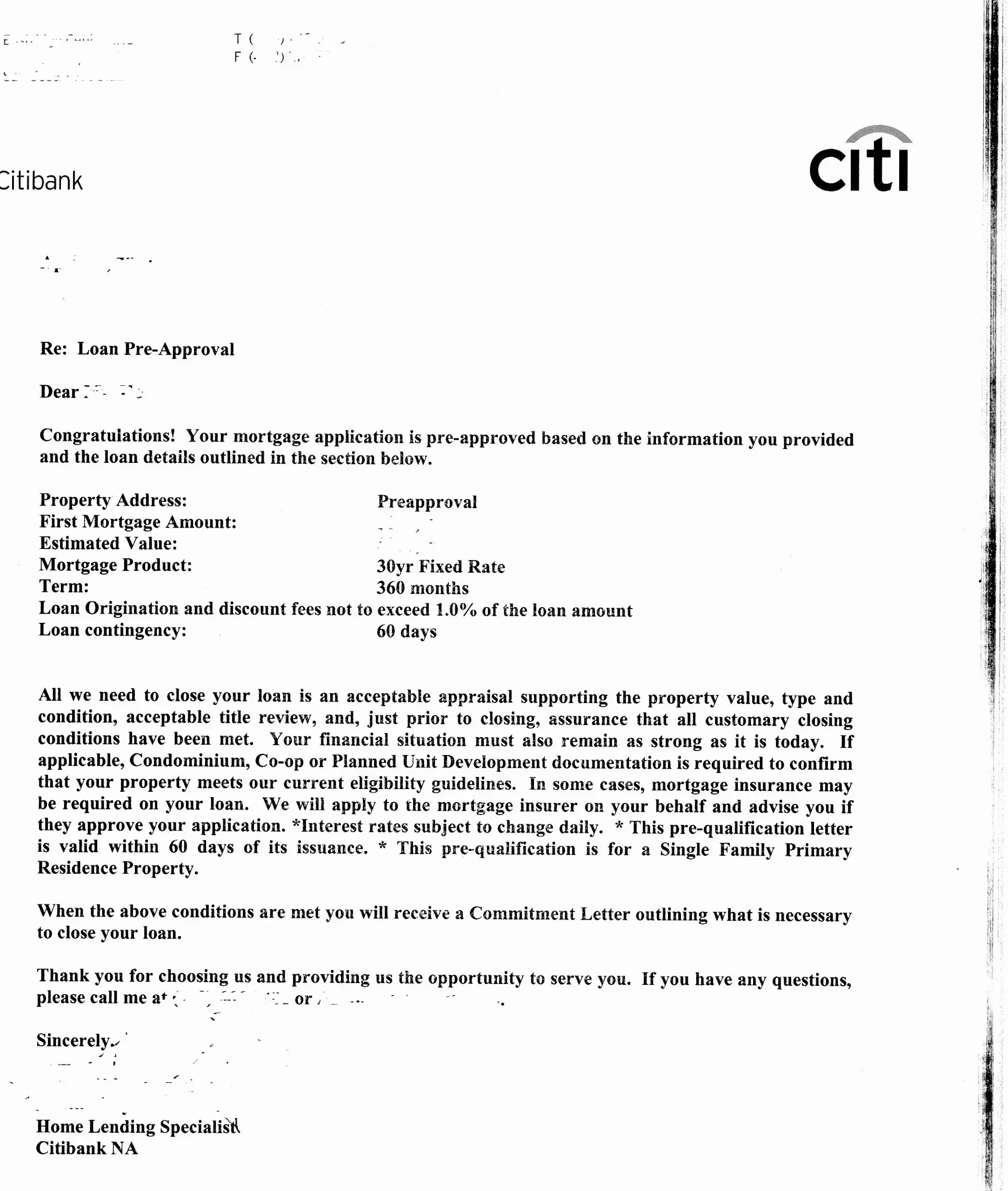

A preapproval letter is not a guarantee. The lender can decline to fund the loan if your financial situation or other conditions change before closing.

There are some mistakes you’ll want to avoid making after getting a mortgage preapproval. Don’t apply for new lines of credit, make large credit purchases, miss any credit card payments, or co-sign a loan for others these actions can hurt your credit score, and it can take several months or more to improve your credit.

If you can help it, don’t make any last-minute job changes that would require an underwriter to verify your new job and income, which could delay your loan’s underwriting and force you to delay closing.

Wait For You Lender To Process The Preapproval

Once youve filled out a preapproval application, turned in documents, and paid the application fee , your work is done. The last step, underwriting, is up to your lender. It will verify your financials and check your credit to make sure you can afford the home you want to buy.

Most lenders use a universal automated underwriting system to preapprove borrowers for home loans. This digital system lets lenders process preapprovals more quickly, so you dont have to wait for a human underwriter to read through all those documents and approve or deny you.

If approved, your lender will issue you a Loan Estimate within three business days. It will tell you whether you are preapproved and for how much. The document should also outline the type of mortgage, estimated interest rate, and estimated closing costs.

Read Also: Should I Split My Mortgage Payment

Get A Handle On All Of Your Mortgage Options

When getting a home loan, there are many options to choose from. Do you want a fixed rate, or will you settle for an adjustable-rate mortgage?

How about the length of your loan? Are you going for the standard 30-year mortgage, or will a shorter term satisfy your needs better?

If you are falling short of the twenty percent down payment, you may want to look into something different than a conventional loan.

You can put down as little as 3.5 percent with an FHA loan. VA and USDA loans offer no down payment options if you qualify. You’ll need to be a veteran for a VA loan and be purchasing in a rural area for a USDA loan.

It is essential to discuss your lifestyle and budget with your lender to identify the mortgage option that is most suitable for you.

How To Use Your Home Loan Preapproval

Once you have your preapproval letter in hand, you can shop for a house with confidence knowing that you can make a rock-solid offer.

Keep in mind, however, that preapprovals do have a time limit. At a certain point, the lender has to recheck your credit report and reverify your income and assets. This time limit varies from lender to lender, but preapprovals are typically valid for 90 days.

If youre already working with a lender, its important to make your preapproval work for you. Lets say you want to make an offer on a house for $150,000, but youre preapproved for $200,000. One of the things you can do is adjust the amount of your preapproval letter to be lower so it doesnt look like youre lowballing the seller by offering less than you can afford.

Recommended Reading: How To Become A Mortgage Closing Agent

Fha Loan Application Checklist

To make the FHA loan application process simpler and faster, the following is a list of the documents you will most likely want to have on-hand before applying for an FHA loan:

- address of place of residence

- social security numbers

- information on any open loans

- checking and savings accounts statements

- information on any real estate you already own

- approximate value of personal property

- current pay stubs and W2

- personal tax returns

When Should I Get A Pre

Once you have learned how to get pre-approved for a mortgage and gone through the process you need to think about timing.You can get pre-approved for a mortgage at any time, but generally, its better to do it as close to the time you plan to shop for a home as possible. There are two reasons for that.

First, mortgage pre-approvals dont last forever typically, theyre good for 60 to 90 days. Apply for a pre-approval too early and you run the risk of it expiring before youre ready to make an offer on a home. If that happens, you may have to start the pre-approval process all over because lenders are unlikely to renew your loan letters. If you have to get a second mortgage pre-approval after the rate-shopping window closes, your credit score may reflect at least one inquiry.

Second, mortgage pre-approvals result in a hard inquiry into your credit history. That means the inquiry gets factored into your credit score. Each new inquiry for credit has the potential to lower your score by a few points, but the credit agencies allow you some time to shop around for the best home loan. Heres how it works.

So, if you get a pre-approval done within a 30-day window, the inquiries should not affect your scores while youre rate shopping In addition, FICO Scores look at your credit report for mortgage inquiries older than 30 days.

You May Like: Is It Better To Get Mortgage From Credit Union

Activities To Avoid Between Mortgage Pre

This is a guest post by Blair Warner, senior credit consultant and founder of Upgrade My Credit

You’ve just found out you’ve been pre-approved for a home loan!

That’s great news! Whether you’ve found a home you want to buy or you’re still out there house shopping, there’s something you need to know now that you’ve secured the financial backing of a lender: it’s important to keep your credit in good standing from now until closing day. What does that mean, exactly? Follow our tips below to learn more:

Check Your Credit Before Getting Preapproved

Well before you begin the homebuying processideally six months to a year before you seek mortgage preapproval or apply for a mortgageit’s wise to check your credit report and credit scores to know where you stand, and to give you time to clear up any credit issues that might prevent your credit scores from being the best they can be when you’re ready to buy your new home.

Mortgage preapproval can give you an important strategic advantage when you’re buying a home in today’s red-hot real estate markets. Correct timing of your preapproval application is an important tactic in your homebuying game plan.

Recommended Reading: How Is Interest Applied To A Mortgage

Income And Employment History

When you apply for a mortgage, lenders go to great lengths to ensure that you earn a solid income and have stable employment. Thats why lenders request two years worth of W-2 tax forms and contact information for your employer. Essentially, lenders want to ensure that you can handle the added financial burden of a new mortgage.

Youll also be asked to provide salary information, so a lender has evidence that you earn enough money to afford a mortgage payment and related monthly housing expenses. Youll also have to provide 60 days of bank statements to show that you have enough cash at hand for a down payment and closing costs.

How To Get Pre Approved For A Mortgage Step : Organize Documents For Your Pre

If you are wondering how to get pre approved for a mortgage you will need certain documents. Get them organized and ready to go for a smooth pre-approval process. The paperwork your lender will need includes:

- Personal information: Youll need to provide your Social Security number and date of birth so the lender can order a copy of your credit report.

- Income information: Your lender will want to see documentation for all sources of income, such as W-2s, pay stubs, recent tax returns, and a profit-and-loss statement if youre self-employed, as well as additional sources of income, such as Veterans Administration benefits or retirement benefits. If you receive child support or alimony and want to use that income to qualify for your mortgage, you will need to provide the relevant documentation. You do not have to disclose income you receive from a current or former spouse if you dont want to rely on it to qualify for your loan.

- Asset information: Your lender will need copies of recent bank and investment account statements, as well as estimated values for any property you own, such as real estate or vehicles.

Read Also: What Is The Trend For Mortgage Interest Rates

What Is Instant Home Loan

Instant Home Loan is an instant sanction for our customers with pre-approved Home Loan offers. You can generate your Home Loan sanction letter online in just a few clicks. Steps for Instant Home Loan:

- View offer and select your Home Loan offer

- Pay a discounted processing fee

The sanction letter will be valid for a period of months from the date of generation of the sanction letter.

What Is The Difference Between Grants For First Time Home Buyers And First Time Home Buyer Programs

A first home buyer grant is a predefined amount of money that is given by the government or specific organization to a first-time home buyer for the specific purpose of assistance in buying a first home. Grants for first-time home buyers are usually available based on region.

A first home buyer program is an incentive offered by the mortgage lender which outlines special rates, terms, or benefits that are offered exclusively to first-time home buyers. These programs are highly unique to each lender.

Read Also: How To Pay Off Mortgage In 5 Years Calculator

Receive Your Mortgage Preapproval Letter

When you get preapproved, you usually get a preapproval letter. There are a few reasons the preapproval letter is important. First, real estate agents typically want to see your preapproval letter before they show you houses. This ensures they dont waste time showing you homes outside your budget.

Second, the preapproval letter is something you can share with the homes seller when you make an offer. It shows you wont have problems getting financed for the amount youre offering.

What Is The Average First

The size of mortgages nationwide is not tracked by whether the borrowers are first-time homebuyers. However, because FHA loans are so popular with first-time home buyers, the average size of an FHA loan is a good indication. For 2016, the average FHA loan was $190,000. Remember that housing prices and mortgages vary significantly throughout the country.

Don’t Miss: Can You Include New Appliances In A Mortgage

How Can I Increase My Mortgage Pre

Make sure that the prospective lender has accurate information, particularly on income and liabilities that you may have. You can ask to see the credit report that the lender used, and if you believe that it contains errors, you can contact the relevant credit bureau. Youll also need to contact the company that provided the information. You can also try other lenders, which might have different criteria. Remember, however, that multiple credit checks in a short time period can hurt your credit score.

What If I Don’t Get Pre

The first thing to do if you don’t get pre-approved for a mortgage is ask your lender why. Most lenders will provide you with an explanation and give you advice onhow to improve your chancesofgetting pre-approved. You may need to strengthen your employment history, improve your credit score or you save more money to cover the down payment and closing costs.

You May Like: How Long Does A Mortgage Take

Monthly Income And Combined Housing Expense Information

A listing of your base monthly income as well as overtime, bonuses, commissions, net rental income , dividends or interest, and other types of monthly income, such as child support or alimony.

Also, youll need an accounting of your monthly combined housing expenses, including rent or mortgage payments, homeowners and mortgage insurance, property taxes, and homeowners association dues.

Confidently Navigate This Process

The process of buying your first home is more manageable if you take steps to prepare for the purchase . Once first-time buyers get to the stage of applying for a mortgage loan, itâs important to be well-informed. These tips can help you navigate the mortgage loan application process.

Consider shopping for your mortgage loan firstâ¦before you find your house

Knowing your loan options before you start looking at houses will help you in your home search by providing the amount a lender will loan you to buy a house. This information will help you target homes in a price range you can afford. When you find a lender and mortgage thatâs right for your situation, you can get a preapproval for the loan, which will save time later when youâre ready to make an offer on a house, since lenders will have most of the information they need to move forward with the loan.

Find the mortgage that works best for you

There are many different types of mortgages to choose from, and an important aspect of the process is to choose the mortgage that works for you now and in the future. When shopping for a mortgage, consider the type of interest rate and whether a conventional loan or a government-guaranteed or insured loan is best for you.

Rates

Loan types

For suggestions on how to save money with worksheets to help you plan to save visit: Money Smart – Your Savings.

Loan estimate

Moving forward with the loan

Closing the loan

Additional resources

Read Also: Can I Refinance My Mortgage With Bad Credit

There’s No Need To Choose A Lender Just Yet

Getting preapproved is important because it helps you shop for a home. But at this stage, lenders arent in a position to give you enough information for you to make a decision about which lender offers the best deal. Getting a preapproval doesnt commit you to using that lender for your loan. Wait to decide on a lender until you’ve made an offer on a house and received official Loan Estimates from each of your potential lenders.

What Is The Difference Between A Fixed

Not all mortgage rates are created equal. There are different types, and each has their own benefits, including:

A fixed interest rate is one that remains the same throughout the entire time you are paying off the loan. The rate is predetermined, so if you like consistency and want to know exactly what youll be paying, this is the better option for you.

Variable rates fluctuate during the course of the loan based on the current index value. The rate can fluctuate, and go up or down depending on the market. People who want to try to save some money on their loan can opt for a variable rate. If the rate goes down, you’ll make a lower monthly payment for that period.

These rates are charged on an upward curve, meaning you pay less each month at the beginning of the loan and gradually increase your monthly payments as the loan progresses. The actual interest rate doesnt change, but the total amount you pay will decrease because you will be paying off more of the loan as time goes on.

Read Also: What Percentage Of Income Can Be Used For Mortgage