The Best Mortgage Lenders

Who’s this for? Rocket Mortgage is one of the biggest U.S. mortgage lenders and has become a household name. Most mortgage lenders look for a minimum credit score of 620 but Rocket Mortgage accepts applicants with lower credit scores at 580.

The lender even has a program called the Fresh Start program that’s aimed at helping potential applicants boost their credit score before applying. Keep in mind, though, that if you apply for a mortgage with a lower credit score, you may be subject to interest rates on the higher end of the lender’s APR range.

This lender offers conventional loans, FHA loans, VA loans and jumbo loans but not USDA loans, which means this lender may not be the most appealing for potential homebuyers who want to make a purchase with a 0% down payment. Rocket Mortgage doesn’t offer construction loans or HELOCs, but if you’re a homebuyer who only plans to purchase a single-family home, a second home, or a condo that’s already on the market, this shouldn’t be a drawback for you.

This lender offers flexible loan repayment terms that range from 8 â 29 years in addition to standard 15-year and 30-year terms.

On average, it takes about 47 days to close on a home through Rocket Mortgage. However, keep in mind that, in general, much of the closing timeline will depend on how quickly you can provide all the information and documentation that’s needed and whether or not they can be processed without a major hitch.

Using A Mortgage Broker For A Mortgage

Mortgage brokers were very common in the early 2000s. During the subsequent housing crash, most mortgage brokers disappeared. I have noticed a few popping up again over the past year or so. A mortgage broker will function much like a mortgage lender.

The difference is mortgage brokers and are strictly a middleman. They do not underwrite in house and do not close with their funds. They lose a little bit of control over the underwriting and closing process.

In general, I would suggest going to a mortgage lender rather than a mortgage broker just for those reasons.

Online vs Local Lender

Regardless of whether you use a bank or a mortgage lender to finance your next mortgage use a lender that you can meet with in person. Of course its very tempting to do it all online.

At the end of the day, the teaser rates that many online national lenders advertise are just that. They are rates that are offered to only very few and not the rate you will probably be given. The national mortgage companies run on huge advertising budgets they work with many thousands of people knowing many will not close but a certain percentage will. You are just a number to them.

Large national lenders rely on advertising and huge numbers of borrowers calling. A local lender is more of a relationship based experience. Dont get baited by the online teaser rates.

What To Know About Loans Fees

If you take out a mortgage, your decision should factor in the loans closing costs. The closing costs can be anywhere from 3-6% of the loan amount, including origination fees, prepaid interest, and property taxes.. One way to reduce your out of pocket costs, if to accept a higher interest rate in exchange for lender credits. There is a possibility that you will be selling your home or refinancing in five to eight years, so this strategy could save you money in the short-term.

Read Also: What Are Essential For Completing An Initial Mortgage Loan Application

Tips For Finding The Best Mortgage Lenders

Here are five tips to find the best lender for you.

1. Get your finances in good shape

The to get a mortgage varies by the type of loan and the lender. With a higher score, you’ll have more choices of loan programs and you’ll qualify for lower interest rates.

Before shopping for lenders, find out your credit score and make sure your credit reports are accurate. NerdWallet offers a free credit score and report, updated weekly, using TransUnion data.

You can receive free copies of your reports from each of the three major credit bureaus through the government-mandated AnnualCreditReport.com website. Check the reports carefully, and dispute any errors.

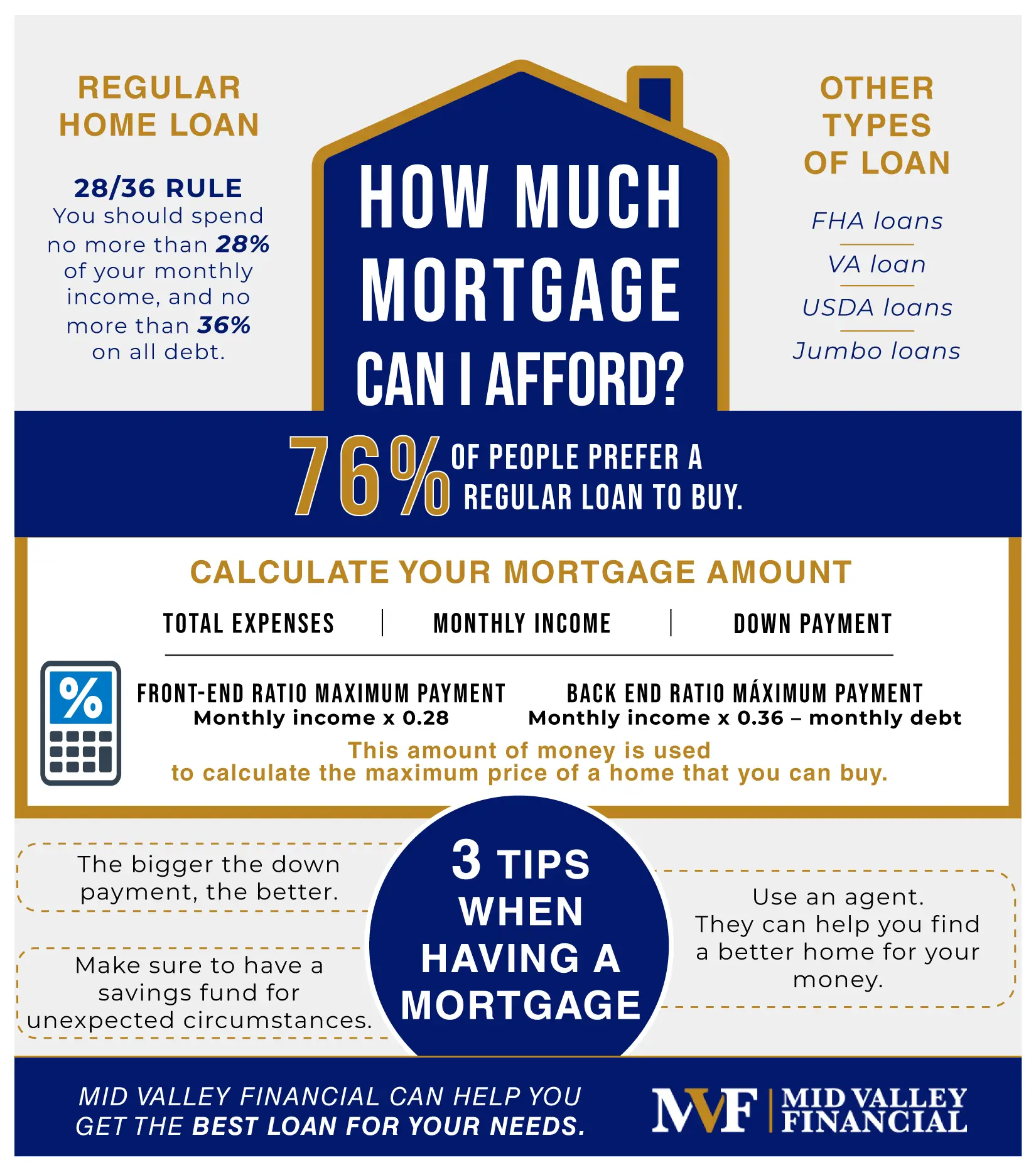

Next, work on improving your credit. Pay bills on time, and work on paying off credit card balances. Lowering your debt will also improve your debt-to-income ratio, or DTI, another key element that lenders evaluate. An ideal DTI ratio for a mortgage is under 36%. Reducing your debt payments will also free up money to save for a home down payment.

2. Learn what kind of mortgage is right for you

A variety of home loans are available to satisfy different needs. For example:

Home loans also vary by term length, such as 15 or 30 years, and by how the interest rate works. With fixed-rate mortgages, the interest rate stays the same for the entire loan term with an adjustable-rate mortgage, the interest rate periodically increases or decreases, after an initial fixed-rate period.

3. Compare rates from multiple mortgage lenders

Be Realistic About What You Can Afford

Just because you can get approved for a loan of a certain size doesnt mean you should close the loan and take on that amount of debt. Its important to be really straightforward with yourself about how much house you can really afford. You dont want to overborrow and cause your budget a bunch of strife to the point that one mistake could prevent you from being able to make your payments. You probably want a comfortable payment so that your finances arent stretched too far.

Read Also: How To Calculate Commercial Mortgage Payment

Choose The Right Time To Buy A House

The mortgage market fluctuates multiple times a day. If youre looking to make a purchase, you should keep an eye on the economy. Generally speaking, the daily news is the way to review the market. For instance, if the economy needs to be revamped, the Bank of Canada may permit low-interest rates on mortgages to encourage purchases. So, being in touch with Canadian and global markets will be a fair pointer about when to start shopping for a property.

Consider Other Associated Costs

As you go through the mortgage process, it’s important to think about the true cost of owning a home. Besides the costs required at closing and regular mortgage payments, there are other recurring costs such as property tax, home insurance, heating costs, condo fees and more. Even though pre-approval specifies an amount you may be approved for, consider a lower principal amount to reduce regular expenses while leaving money for other unforeseen expenses.

Recommended Reading: Does Mortgage Modification Affect Credit Score

What Are The Disadvantages Of Using A Mortgage Broker

The biggest disadvantage of using a mortgage broker is that they can use banks that may not be the absolute best for you because a certain bank may offer a better payment to the broker. This is best to discuss with the broker when you are sitting down with them in your first meeting, or even before you first meet.

Ready to get a jump start on your first place? Get our house hold items checklist. Its absolutely free!

How Mortgage Brokers Work

Mortgage brokers work with a variety of lenders, which gives them access to many products at many price points.

That means you can go to one mortgage broker and compare multiple loan programs. The broker will help you understand the interest rate, closing costs, and other details of each offer to find the best loan.

If you want to compare loan programs and rates from direct lenders, you have to apply with each one separately and evaluate them on your own.

However, this is not as intimidating as it might sound. All lenders use a standard Loan Estimate form detailing their offers, so mortgage options are easy to compare side by side.

Both banks and brokers can offer rebate pricing to help reduce closing costs when buying a home or refinancing.

This rebate is also called a Yield Spread Premium, or YSP. It involves accepting a higher interest rate in exchange for lower upfront costs.

For loans with lower rates, the borrower pays the brokers commission, usually about one percent of the loan amount.

Brokerages are often smaller than banks. And if you work with a broker, its likely youll have more human-to-human contact as the two of you work through your loan application.

Your real estate agent or Realtor can give you referrals for reputable brokers in your area if you want to go this route.

Also Check: How Long Would It Take To Pay Off My Mortgage

Should I Get A Mortgage From My Bank

For some reason, many people have a sense of security from dealing with a bank that makes them question using a mortgage broker. Many people tell me they want to use the bank theyve been using since they were a kid, the bank that their parents have been using for 30 years.

This may be easier, but it could end up costing you a lot more. Even a half of a percent higher interest rate can cost you tens of thousands of dollars over your mortgage. Bottom line: You can get a mortgage from your bank, but make sure its the best rate and terms you can get.

Best Mortgage Lender For Low Fixed Rates: Meridian Credit Union

One of the biggest debates when it comes to mortgages is whether to go with a fixed- or variable-rate mortgage. There are pros and cons to both, but individuals who choose fixed mortgage rates usually do so because they are concerned about affordability. They worry about the volatility of the market and want to best protect themselves.

Of course, part of protecting yourself and being mindful of affordability means you want to ensure that you get the best possible rates. After all, you will be locked in for a few years.

Fixed-rate mortgages will vary from lender and lender and your own personal financial situation will also play a big role in the types of rates you can get. However, if you are looking for the best mortgage lender for low fixed rates then take a look at Meridian Credit Union.

Meridian Credit Union is Canadas second-largest credit union. They are based in Ontario but offer services, including mortgage loans, across Canada . Meridian Credit Union offers some of the most competitive fixed rates on the market. At the time this article was published the current terms and rates offered by Meridian Credit Union are as follows:

Meridian fixed-rate mortgagesRead Also: Does Rocket Mortgage Require Appraisal

Comparing Mortgage Payment Frequency

| $134,166 | $134,009 |

There are slight interest savings to be had from increasing your mortgage payment frequency. This keeps your mortgage amortization the same, which is why you wont realize as much interest savings.

Many mortgage lenders offer accelerated payment frequencies, such as accelerated bi-weekly and accelerated weekly mortgage payments. With accelerated payments, you will be paying the equivalent monthly payments, which means that you will be making an extra payment per year. In the above table, a monthly payment would have been $2,117.

To calculate the accelerated bi-weekly payment amount, you would divide $2,117 in half to get $1,058.50. Your accelerated bi-weekly payments will be $1,058, higher than the regular bi-weekly amount of $977. This increased amount allows you to pay off your mortgage faster, which shortens your amortization and saves you interest.

Historical Context: What Does A Slowing Economy Typically Mean For Mortgage Rates

Historically, during the last recession in 2008, the financial system needed a bailout to fix. Thankfully, this bailout worked, and since that time, we have enjoyed lower interest rates but stagnant GDP growth. COVID-19, with its border closures and labour slowdowns due to safety measures, needed a much more significant bailout. Over the two years since COVID-19 started, we have enjoyed record-low rates and so much cash infused into the economy that Canadians could increase their spending on everyday items thus creating surging home prices.

The COVID-19 shutdown of the economy and supply chains has increased the demand for much-needed supplies. Our demand outstripped supply with lower interest rates and bigger cash flows, creating high inflation. As inflation is a lagging factor and Statistics Canada measures inflation differently for existing homes, it became apparent that inflation was quickly running. As the BoC started playing catch up, they started ramping up the federal key policy interest rate to curb inflation as soon as possible.

So as rates jumped from 10% to 20%, their impact doubled. However, now the effect might be many more folds magnified. An increase in rates from 0.25% to 4.50% on the BoCs Key Policy Rate could mean a magnification of 18x.

Read Also: What Is The Best Way To Apply For A Mortgage

Be Ready To Apply For A Mortgage

Once you have your deposit and your sights set on a property within your budget, get your payslips and legal identification ready.

Mortgage lenders are now required to make extra checks on your reliability and suitability to the product you are applying for. This involves checking how much credit you currently have to your name and how much debt you currently owe.

They will also check how much you spend on everyday items such as food and clothes, as well as what regular outgoings you have like a gym membership or a Netflix subscription.

Make a budget and see if you can cut down any of that spending and reduce any debts you currently have. This will improve your chances of being approved for a mortgage.

It is also worth taking a look at your credit report and seeing what you can immediately do to improve your current credit score. The higher your score, the better your chances are of being approved for the mortgage.

Applying For A Loan May Be Less Time

If youve never applied for a mortgage before, it goes something like this. The lender will hand you a stack of paperwork and a laundry list of documents that youre required to make copies of. Getting everything in order can take days or even weeks if youre chasing down bank statements or tax forms.

Online lenders can make the process less difficult to navigate. Instead of making copies of tax returns or other financial documents, you can just upload them to the lenders website. That can speed up the loan process and save you some headaches.

Don’t Miss: How Can I Legally Get Out Of My Mortgage

What Are The Advantages Of Getting A Mortgage From Your Bank

There are a two main advantages to getting a mortgage from your bank:

-

They may be a simpler application process

-

Possible perks with linking your current account or savings account to the mortgage

The application process is likely to be simpler, purely because you receive your salary and other income into your bank account. Your bank should be able to process the paperwork without you needing to gather all this information yourself to show to another lender.

However, your bank will still be strict about approving your application they’re just more likely to let you know in advance what your chances are. It’s worth bearing in mind that this means it may also be harder to “hide” your spending from your bank .

Some banks may also give you some kind of perk as they can link your bank account to the mortgage, which makes it easier to take payments each month. You might be able to get cashback, or a discount on some of the fees, for example.

You could also get an offset mortgage, which allows you to link your savings to your mortgage so you can overpay on your mortgage using your savings, which could potentially give you more in savings than you would get from your savings interest.

Can A Us Citizen Get A Mortgage Loan From A Foreign Bank To Finance Property Outside Of The Us

A US citizen can buy property abroad with a mortgage from a bank registered in a foreign country even if youre not a citizen of the country the where:

- Bank is registered.

- The property youre looking to buy is located.

For clarity purposes, lets use an example to illustrate the above statement. As a US resident, you can finance property in the UK with a mortgage obtained from a bank registered in China, even if you dont have citizenship in the UK or China.

Note: Generally, its easier to obtain a foreign mortgage to finance property abroad if the property is a popular tourist destination because such property is likely to retain its value over time. You will want to check with the best 1031 exchange companies to see if an exchange is possible outside of US territories.

Read Also: Where Do Mortgage Brokers Work

How Do Mortgages Work

A mortgage is a type of loan that you can use to purchase a home. It’s also an agreement between you and the lender that essentially says that you can purchase a home without paying for it in-full upfront â you’ll just put some of the money down upfront and pay smaller, fixed equal monthly payments for a certain number of years plus interest.

For example, you probably can’t pay $400,000 for a home upfront, however, maybe you can afford to pay $30,000 upfront a mortgage would allow you to make that $30,000 payment while a lender gives you a loan for $370,000 and you agree to repay that amount plus interest to the lender over the course of 15 or 30 years.

Keep in mind that if you choose to put down less than 20%, you’ll be subject to private mortgage insurance payments in addition to your monthly mortgage payments. However, you can usually have the PMI waived after you’ve made enough payments to build 20% equity in your home.