Decide Why Youre Refinancing

Refinancing is when you take out a new home loan to replace your old one. You might want to do that for a few reasons. If mortgage rates have dropped or your financial situation has improved significantly, you might be able to get a lower interest rate, meaning lower monthly mortgage payments. If your first loan was an FHA loan, you may have to refinance to a conventional mortgage to get rid of mortgage insurance. You may also want a cash-out refinance, in which you take out a loan for more money than you owe on the old loan to turn some of your equity into cash, maybe for home improvements or debt consolidation.

How Do Fed Rate Hikes Affect Mortgages

The Fed has been increasing the federal funds rate to try to slow economic growth and get inflation under control.

Mortgage rates aren’t directly impacted by changes to the federal funds rate, but they often trend up or down ahead of Fed policy moves. This is because mortgage rates change based on investor demand for mortgage-backed securities, and this demand is often impacted by how investors expect Fed hikes to affect the broader economy.

As inflation starts to come down, mortgage rates should, too. But the Fed has indicated that it’s watching for sustained signs of slowing inflation, and it’s not going to lower rates again any time soon though it has started opting for smaller hikes, starting with its 50-basis-point in December.

Mortgage Refinance Industry Insights

2020 and 2021 ushered in a refinance boom, when homeowners took advantage of rock-bottom rates. Those days are behind us now as current mortgage rates continue to rise, with refinances making up a small share of loans today. These have been mostly cash-out refinances, in which a homeowner replaces their existing loan with a new, bigger mortgage that includes the balance of the first plus a portion of their homes equity as cash.

Mortgage refinance rates have increased and are expected to continue to rise. Because of this, the refi window has closed for most borrowers, although with substantial equity, some might have an opportunity to benefit from a cash-out refinance or a home equity loan. Overall, refinancing will be a less attractive option as rates climb.

See Bankrates expert rate trend predictions.

Also Check: How To Get Approved For A Large Mortgage

Are Interest Rates Going To Rise

Mortgage rates have fallen since the beginning of 2019, for multiple reasons: trade tensions with China, a perception that the economy is slowing and persistently low inflation. The Federal Reserve cut short-term interest rates by a quarter of a percentage point in July and again in September. While lower short-term interest rates dont immediately affect long-term mortgage rates, they will compel longer-term rates to fall over time.

Mortgage rates are most likely to move higher in response to good economic or political news, and lower in reaction to bad news. The Fed is loosening the money supply because of lower-than-desired inflation and concerns that economic growth is slowing.

Can My Rate Go Up

Depends. When youre in the process of buying a house or refinancing, youll be offered opportunities to lock your rate. For a fee, this freezes your quoted mortgage rate for a set period of time, during which youre expected to get all your documents in order and close. Miss that window, and yes, your rate might go up to match current mortgage rate fluctuations.

If youre wondering what happens to your rate after you close, though, that choice is up to you. Most borrowers opt for a fixed-rate loan, which is exactly what it sounds likeyour interest rate stays the same for the life of the loan.

For those who live in the now, though, theres another option called an adjustable rate mortgage, or an ARM. This loan begins with a super low interest rate that may increase or decrease in the future at pre-specified intervals.

185 Plains Road – 3rd Floor – Milford, CT 06461

Don’t Miss: How Are Mortgage Approvals Calculated

What Is A Discount Point

Discount points are optional fees paid at closing that lower your interest rate. Essentially, discount points let you make a tradeoff between your closing cost fees and your monthly payment. By paying discount points, you pay more in fees upfront but receive a lower interest rate, which lowers your monthly payment so you pay less over time. Any discount points purchased will be listed on the Loan Estimate.

What Are Mortgage Rates

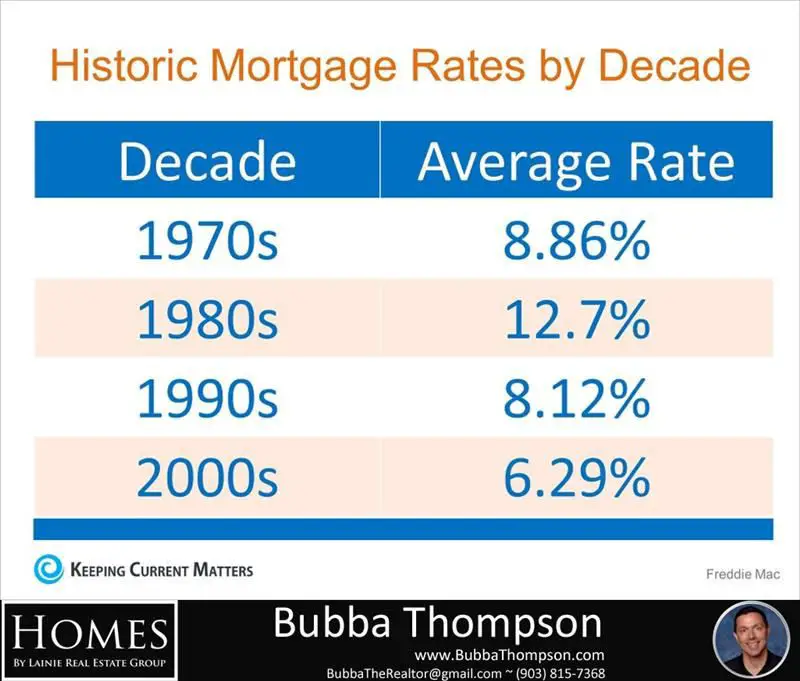

Mortgage rates are the costs associated with taking out a loan to finance a home purchase. Because properties cost so much, most people cant pay for them with cash, so they opt to stretch the payments over long periods of time, often as much as 30 years, to make the regular monthly payments more affordable.

When interest rates rise, reflecting changes in the economy and financial markets, so too do mortgage ratesand vice versa.

Read Also: What Is Mortgage Pmi Rate

What Actually Determines Your Interest Rate

Interest rates are based on the bond market and are typically standard across the industry. So, going with a low-rate lender is a bit of a misnomer since rates dont really fluctuate that much across lenders.

On any given day, there are a variety of factors that can impact your specific interest rate:

- Home price and loan amount: Your home price minus your down payment will determine how much youll borrow which helps determine how much the interest rate will be.

- Down payment: Generally, a higher percentage down payment equals a lower interest rate. The more money you put down, the more stake you have in the property.

- Loan term: Shorter terms generally have lower interest rates than a 30-year term.

- Interest rate type: Interest rates come in two basic types: fixed and adjustable. Fixed rates do not change over time. Adjustable rates, on the other hand, have an initial fixed period then go up or down based on the market. For example, a 5-year ARM loan will have a fixed-rate for the first 5 years and then the rate will fluctuate from the 6th year onward.

- Loan type: Different categories of loans have different rates.

- Primarily based on credit report information usually sourced from credit bureaus. Typically, this is called your FICO score and is based on your credit history. If you are debt-free, you will have a zero-credit score.

Look at the Real Numbers and Understand Your Options

What’s the Difference?

What Is The Difference Between Grants For First Time Home Buyers And First Time Home Buyer Programs

A first home buyer grant is a predefined amount of money that is given by the government or specific organization to a first-time home buyer for the specific purpose of assistance in buying a first home. Grants for first-time home buyers are usually available based on region.

A first home buyer program is an incentive offered by the mortgage lender which outlines special rates, terms, or benefits that are offered exclusively to first-time home buyers. These programs are highly unique to each lender.

Don’t Miss: Can You Undo A Reverse Mortgage

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Showing results for:

About These Rates: The lenders whose rates appear on this table are NerdWallets advertising partners. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a lenders site. The terms advertised here are not offers and do not bind any lender. The rates shown here are retrieved via the Mortech rate engine and are subject to change. These rates do not include taxes, fees, and insurance. Your actual rate and loan terms will be determined by the partners assessment of your creditworthiness and other factors. Any potential savings figures are estimates based on the information provided by you and our advertising partners.

Trends and insights

Data source: ©Zillow, Inc. 2006 2021. Use is subject to theTerms of Use

How Your Credit Score Affects Your Mortgage Rate

You dont need a high credit score to qualify for a home purchase or refinance, but your .

This is because credit history determines risk level.

Historically speaking, borrowers with higher credit scores are less likely to default on their mortgages, so they qualify for lower rates.

For the best rate, aim for a credit score of 720 or higher.

Mortgage programs that dont require a high score include:

- Conventional home loans minimum 620 credit score

- FHA loans minimum 500 credit score or 580

- VA loans no minimum credit score, but 620 is common

- USDA loans minimum 640 credit score

Ideally, you want to check your credit report and score at least 6 months before applying for a mortgage. This gives you time to sort out any errors and make sure your score is as high as possible.

If youre ready to apply now, its still worth checking so you have a good idea of what loan programs you might qualify for and how your score will affect your rate.

You can get your credit report from AnnualCreditReport.com and your score from MyFico.com.

Recommended Reading: How Do I Get Mortgage Insurance

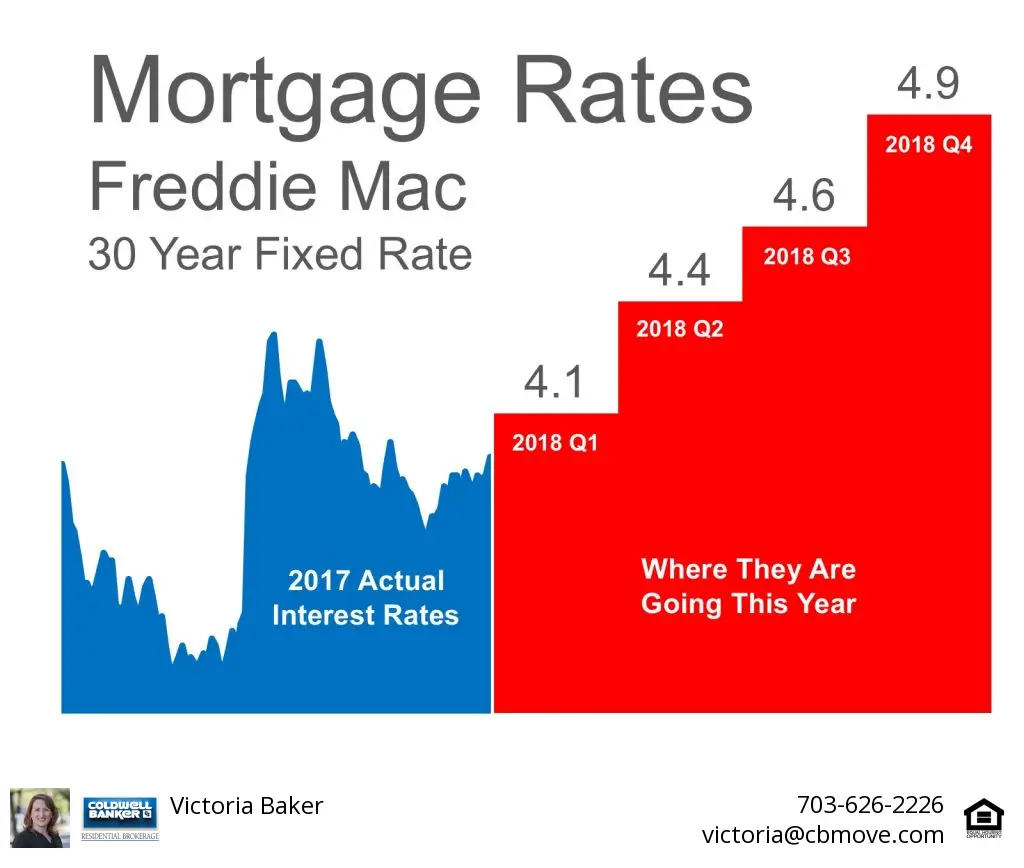

Current Mortgage Rate Trends

The average mortgage rate for a 30-year fixed is 6.74%, more than double its 3.22% level at the start of the year.

The average cost of a 15-year, fixed-rate mortgage has also surged to 6.07%, compared to 2.43% in early January.

In the current environment, ARMs might be more affordable than those with fixed rates. The average 5/1 ARM was 5.45% at the end of October.

Are Fha Loans Fixed

Though the vast majority of FHA loans are 30-year, fixed-rate mortgages, other options are available, including both shorter-term fixed-rate mortgages and adjustable rate mortgages . In recent years, fixed-rate mortgages have been much more common, as home buyers have sought to lock in low interest rates. But if you dont plan to stay in the home long, an ARM may be worth a look.

You May Like: Is It Hard To Get Approved For A Second Mortgage

How Your Mortgage Interest Rate Is Determined

Mortgage and refinance rates vary a lot depending on each borrowers unique situation.

Factors that determine your mortgage interest rate include:

- Overall strength of the economy A strong economy usually means higher rates, while a weaker one can push current mortgage rates down to promote borrowing

- Lender capacity When a lender is very busy, it will increase rates to deter new business and give its loan officers some breathing room

- Property type A primary residence, meaning a home you plan to live in full time, will have a lower interest rate. Investment properties, second homes, and vacation homes have higher mortgage rates

- Loan-to-value ratio Your loan-to-value ratio compares your loan amount to the value of the home. A lower LTV, meaning a bigger down payment, gets you a lower mortgage rate

- Debt-To-Income ratio This number compares your total monthly debts to your pre-tax income. The more debt you currently have, the less room youll have in your budget for a mortgage payment

- Loan term Loans with a shorter term typically have lower rates than a 30-year loan term

- Borrowers credit score Typically the higher your credit score is, the lower your mortgage rate, and vice-versa

- Mortgage discount points Borrowers have the option to buy discount points or mortgage points at closing. These let you pay money upfront to lower your interest rate

Remember, every mortgage lender weighs these factors a little differently.

When Should I Lock My Mortgage Rate

It can be tricky to time any market, and mortgage rates are no exception. If conditions are choppy, and interest rates are likely to at least stay the same, if not rise, it may be smart to lock in a rate that works with your budget and seems fair to you.

Be sure to ask your lender about the consequences of not closing within the timeframe specified in a rate lock agreement and also about what could happen if rates fall after you lock in a rate.

You May Like: What Are The Requirements To Get A Reverse Mortgage

What Should A First

A first-time home buyer is often at a disadvantage to more experienced buyers. You might have fewer funds available, student debt, or other financial issues that have held you back from buying your first home until now.

The good news is that first-time home buyers have some unique advantages, like first-time home buyer grants, too. For example, you might qualify for lower interest rates or a smaller down payment on your mortgage.

Mortgage interest rates have been dropping steadily for years and right now theyre lower than ever before. You can lock in an interest rate as low as 2.320% for a standard 30-year fixed-rate mortgage if you have good credit.

Even if your credit is less than stellar, first-time home buyers can find rates as low as 2.810%. You might also qualify for a first-time home buyer grant in the form of a government-backed mortgage which can lower your interest rate and down payment even further.

What Is A Cash

A cash-out refinance is a type of mortgage refinancing that allows you to take out cash as an additional amount to your original mortgage loan. As you make your monthly mortgage payments on your original loan, you build up equity in your home. A cash-out refinance loan allows you to utilize this equity while updating your repayment terms.

Common use cases for a cash-out refinance are to cover the costs of home improvements/renovations, school or college tuition, consolidation of debt, or to purchase an additional property.

You May Like: How To Calculate Mortgage Discount Points

What Are Closing Costs

Youll likely owe more when you close on the house than just the down payment on the mortgage. There are other expenses that have to be paid to make this big transaction go through. Closing costs often entail taxes and fees associated with the purchase that arent included in the sale price.

Expect closing costs to total around 3% to 6% of the purchase price, so youre looking at between $8,250 and $16,500. They might include fees charged by the lender like loan origination fees, points paid to get a lower mortgage rate, fees associated with the property such as an appraisal or inspection, or prepaid costs such as property taxes or homeowners association dues.

Find The Best Refinance Rates Today

It’s just as important to shop around when you refinance as it was when you applied for your first mortgage. Explore refinance offers from at least three mortgage lenders , and keep an eye on rates while you comparison-shop this can help you decide when to lock in a rate. Check out Bankrate’s lender reviews, as well, to help guide your decision.

Compare the best mortgage refinance lenders.

Don’t Miss: What Are Negative Mortgage Points

Examples Of Mortgage Rates

How much that mortgage will cost starts with the interest rate, you’re charged. Knowing the going rate will help you figure out how much you can afford to borrowand keep you from accidentally agreeing to a loan that is higher than it should be for its terms and your credit score.

The example mortgage rates below are hypothetical and are for informational purposes only. Loans above a certain threshold may have different loan terms, and products used in our calculations may not be available in all states. Loan rates used do not include amounts for taxes or insurance premiums. Individual lenders terms will apply.

The Impact Of A 01% On $1000

Even small changes in mortgage rates will make a difference in your payments. For every $1,000 of your mortgage, youll save even more by refinancing. A mere .1% change on a $300,000 mortgage would make a difference of $228 per year, reducing your payment by up to $684 over three years, and by up to $1,140 over five years.

You May Like: How To Borrow Money From Your Mortgage

Jumbo Loan Interest Rate Trends Down

The average jumbo mortgage rate today is 6.47 percent, down 4 basis points since the same time last week. A month ago, the average rate was lesser, at 6.46 percent.

At today’s average rate, you’ll pay $630.10 per month in principal and interest for every $100,000 you borrow. That’s lower by $2.63 than it would have been last week.

How Much Can I Save By Comparing Mortgage Interest Rates In Canada

Because of the significant amount of money being borrowed under a mortgage, even the slightest difference in the mortgage interest rate may result in you saving money over the course of a mortgage term, and even more over an entire amortization period. While the mortgage rate is a very important consideration, you should also be sure to evaluate the terms and conditions of each type of mortgage to make sure you choose the right one for you.

You May Like: Is Citizens Bank Good For Mortgages

Are Home Prices Going Down

Its early yet to decide if home prices are on a downward trend. While home prices tend to have a seasonal downward shift as summer wears on, this year the numbers were larger than the average. Usually we see a decrease of 2% from June through August, but this year that decrease was 6%. Seems promising for would-be buyers.

Still, its important to look at these numbers in context. In August 2022 prices were 7.7% higher than they were at the same time in 2021. From a longer-term perspective, home prices could still be rising. Well have to wait to see the Fall and Winter numbers to have more definitive answers.

Prices remain so high because there is a shortage of inventory. While new builds did increase 12.2% in August, we can attribute this partially to supply chain issues. Many builders were unable to get the supplies they needed to work on their projects, and many of these supplies finally made it to them at the tail end of summer in one big burst.

Just because we saw new builds go up last month doesnt mean theyre going to increase inventory for American families. The bulk of the increase in inventory will be in the commercial markets, would-be landlords looking to rent new units to tenants.

But sales on more expensive homes were down, too. Those with list prices between $750,000 and $1 million were down 3%.