Tax Return Issues For Self

There are several things that can trip up a self-employed borrower when applying for a home loan and providing tax returns to the lender. Here are some of the most common:

Expenses. A lender will consider what a business made in net profit, not gross profit. For instance, a pet shop owner pulled in $80,000 last year in revenue. Not bad, right? But the business also had to pay rent, supplies, utilities and insurance to the tune of $30,000 last year. So a lender will only consider $50,000 in profit as real income.

Sometimes, business owners write off too many expenses. A laptop here, business mileage there pretty soon the entire profit of the business can be written off. If your business makes $100,000 but you write off $90,000, guess how much the lender will say you made? Yep, $10,000 or just $833 per month. And you cant qualify for much house with that.

Writing off legitimate business expenses is a wise move yet there are occasions where there are so many write-offs the business appears to make no money at all. If you plan to apply for a mortgage in the next 3-4 years, dont go overboard on your write-offs.See how much of your income a lender will use for qualification

Your Side Business. Many people work full time, yet have a side business, for which they file schedule C on their tax returns.

When you apply for the mortgage, be sure to tell your loan officer about your side business, and how much it made or lost during the last 2 years.

- Year 1: $80,000

- Year 2: $40,000

Other Factors That Matter When Qualifying For A Mortgage

Youll need more than qualifying income to get approved for a mortgage application. Lenders look at a variety of factors. These include:

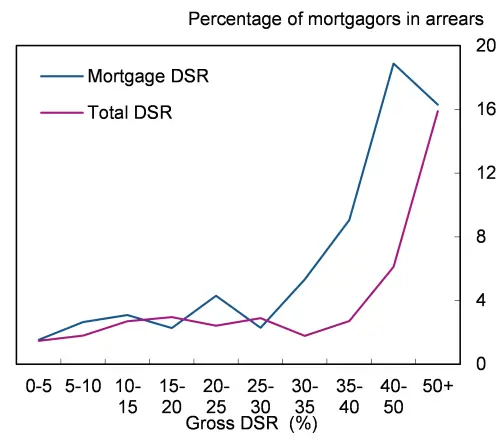

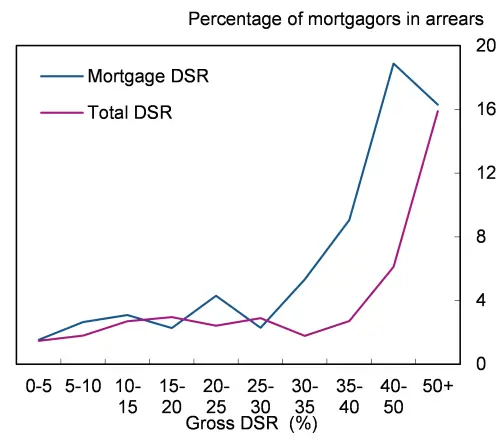

- Debt-to-income ratio : Lenders use your DTI ratio to compare your total monthly debt to your gross monthly income. This shows the economic burden on your household finances. Debt can include payments on car loans, student loans, and credit card payments, to name a few. The lower your DTI ratio, the better your chances of mortgage approval

- Youll generally need a of 620 or higher to qualify for a conventional loan, but some first-time home buyers can qualify for an FHA loan with scores as low as 580

- Down payment: Most borrowers will need at least 3% down for conventional mortgages and 3.5% down for FHA loans. Keep in mind that youll pay private mortgage insurance without 20% down on a conventional loan. And mortgage insurance premiums is required on an FHA loan, regardless of down payment amount. Both USDA and VA loans require no down payment whatsoever

- Asset and cash reserves: Many lenders and loan programs want buyers to have adequate cash reserves or emergency funds after closing on a new home. This shows that youll be able to make your monthly mortgage payments in the event that your income ceases

% Or More Ownership In A Business

Youre considered self-employed if you own 25% or more of a business. However, mortgage lenders will require you to provide additional documentation for the business to evaluate qualifying income.

As a sole proprietor, youll report your business income on Schedule C of your tax returns. And if you operate under a partnership, corporation, or S corporation, youll file your business tax returns and report the company on Schedule E of your personal tax returns.

Don’t Miss: Will Applying For A Mortgage Affect My Credit

Save For A 20% Down Payment

You dont need to pay for private mortgage insurance when you put 20% down on your loan. PMI can add quite a bit of money to your monthly payment, so avoiding it can significantly reduce what you pay each month. You may also be able to avoid paying for mortgage insurance if you qualify for a VA loan and pay the funding fee upfront .

When Could A Lender Use Gross And Net Business Income

Lenders use gross and net business income if you don’t qualify for a mortgage when they use a traditional income qualifying method.

Let’s look at 4 different non-traditional income qualifying situations:

- Good Credit, Insured Purchase with 10% down

- Good Credit, Purchase with 20% or more down

Let’s review each of these situations and how they work…

Read Also: How Much Would Mortgage Payment Be On 250 000

Do Mortgage Lenders Use Gross Or Net Income

For taxpayers who earn wages or a salary, mortgage lenders typically look at gross income. Thats your income before state and federal income tax deductions, health insurance premiums, and Social Security or Medicare taxes.

Its different for self-employed borrowers. Self-employed taxpayers usually reduce their tax liability by writing off work-related expenses: travel expenses, subscriptions, rents, etc.

This method saves money at tax time by lowering taxable income. But it can also have a negative effect on mortgage eligibility.

From a lenders point of view, a lower taxable income just looks like a lower income. A lower income raises the debt-to-income ratio one of the key factors lenders check.

Types Of Income That Count Towards A Mortgage Loan

Theres no definitive list of the income streams that qualify for a home loan. Each mortgage lender and loan program has its own requirements including the types of income that qualify and the length of time you must have earned that income to be able to use it. Keep in mind that lenders are required by law to make a reasonable, good faith determination of a consumers ability to repay the mortgage loan.

To give you a good idea of the types of income that can commonly be used on a mortgage, we looked at Fannie Maes rulebook. Fannie Mae sets guidelines for conforming mortgages, which are the most popular type of home loan. So these requirements will apply to many home buyers.

Don’t Miss: How To Find Out If A House Has A Mortgage

Refinow And Refi Possible

Fannie Mae and Freddie Mac recently came out with new refinance programs to help lower-income home buyers.

Fannie Maes RefiNow and Freddie Macs Refi Possible program are both ultra-flexible about qualifying borrowers with a high DTI. With RefiNow, borrowers may even qualify with a debt-to-income ratio as high as 65%.

If youre currently in an unaffordable mortgage but not sure youd qualify to refinance due to a high DTI, ask your lender about these two programs.

First: What Is A Mortgage Payment

Mortgage payments are the amount you pay lenders for the loan on your home or property, including principal and interest. Sometimes, these payments may also include property or real estate taxes, which increase the amount you pay. Typically, a mortgage payment goes toward your principal, interest, taxes and insurance.

Many homeowners make payments once a month. But there are other options, such as a twice a month or every two weeks.

Also Check: How To Pay Mortgage Online

Gross Pay Vs Mortgage

You can slide the bar up to an aggressive 50% dti ratio to see how much more home you can buy. However, be sure your budget can handle the extra debt lenders dont look at expenses like utilities, car insurance, phone bills, home maintenance or groceries when they qualify you for a home loan. Our calculator is pre-set to a conservative 28% dti ratio. Lenders may also require a higher credit score, or extra mortgage reserves to cover a few months worth of mortgage payments, if the high payment becomes unaffordable.

Guidelines For An Affordable Mortgage

Untaxable income includes certain disability and public assistance payments, military allowances and child support. Some income is exempt from federal taxes. For example, if your most recent tax rate was 25 percent, the lender would multiply child support payments you receive by 125 percent to come up with the grossed-up amount. To gross up, the lender multiplies the gross income amount by the tax rate used on your most recent tax return. The lender can add back a percentage of untaxable income or gross up making it higher.

Don’t Miss: Does Mortgage Pre Approval Hurt Credit

How Does Agi Impact Applying For A Mortgage

Related Articles

One of the most important factors involved in qualifying for a mortgage loan is the level of income you generate. Without sufficient income, it’s extremely difficult to find a lender willing to give you a mortgage. In mortgage lending, a loan applicant’s income is looked at in terms of the amount left over after deductions, otherwise known as adjusted gross income. It will be your AGI that determines just how much money your lender will loan you to buy your hoped-for home.

Tip

If you’re planning on applying for a mortgage in the future, consider taking a hit on the deductions you use when filing income tax returns and raising your AGI.

Using Business Assets For The Down Payment On The New Home

If you are withdrawing money from your business to cover your down payment or closing costs, the lender will have to evaluate the effect of that withdrawal on your business.

For example, the lender may request verification of all of your businesss financial assets to assess the impact of the withdrawal. The determination will be different in each case. For example, if your business has $100,000 in cash assets, and you need to withdraw $10,000, it may not be an issue. But withdrawing $80,000 could compromise the survival of your business.

> > MORE: Check Todays Rates

In that situation, the lender will likely request a written opinion from your CPA on the effect of the withdrawal on the business. If the CPA indicates that the withdrawal wont hurt the business, the lender may allow the withdrawal. But the lender may put the loan approval on hold if the CPA indicates any concerns, or refuses to comment.

If youre self-employed, its important to provide the necessary documentation and to do so as early in the loan process as possible. The lender isnt looking to hassle you or to decline your loan. But they will need your help in supporting their decision to approve your loan. Youre helping your own cause by being fully prepared to cooperate.

You May Like: Can You Refinance A Mortgage With No Money Down

How To Determine How Much House You Can Afford

Most people use a mortgage to buy a home, but everyoneâs income and expenses are different. Because of this, youâll want to calculate your potential monthly payment based on your current financial situation. Youâll need to calculate some figures like:

- Income: This is how much you earn on a monthly basis from your regular day job and any side hustles you have. Make sure you have gross and net numbers at the ready. You can find these on your most recent pay stub. If you have a fluctuating income, use your most recent tax returns for guidance.

- Debt: Debt consists of what you currently owe money on. This would include things like credit cards, student loans, car loans, personal loans and other types of debt. Debt isnât the same as expenses, which might fluctuate month-to-month .

- Down payment: This is how much cash youâll pay up-front for the cost of a home. A 20% down payment might remove private mortgage insurance charges from your monthly costs, but itâs not always required to buy a home. The higher your down payment, however, the lower your monthly mortgage payment will be.

- : Having good or excellent credit means you can get the lowest interest rate available offered by lenders. A high interest rate typically means a higher monthly payment.

Home Loan Alternatives For Self

Most home buyers who are self-employed use the same types of mortgages as everyone else. Whats different is the way self-employed borrowers document their income.

But self-employed people often write off expenses at tax time, lowering their adjusted gross income. If your net earnings arent high enough to qualify for the mortgage you need, you may have another option.

A bank statement loan could help solve your problem. These loans rely on deposits into your bank, instead of tax forms, to show your income.

But these loans have higher interest rates because theyre riskier for lenders they dont conform to Freddie Mac and Fannie Mae rules.

Other options: Apply with a co-borrower who is not self-employed. Or start a conversation with your loan officer about the inaccuracies in your earned income.

You May Like: Is A Timeshare Considered A Mortgage

Whats The Best Lender For Self

Most lenders work with self-employed borrowers. Once youve documented your income, the rest of your borrowing experience shouldnt be much different from anyone elses. Be sure to get quotes from at least three lenders since pricing for both fees and rates can differ a lot from lender to lender.

Magi For Education Tax Credits

There are two education credits that taxpayers might be eligible for.

American Opportunity Tax Credit

The American Opportunity Tax Credit is a credit for qualified education expenses paid for an eligible student for the first four years of higher education. A taxpayer can get a maximum annual credit of $2,500 per eligible student. If the credit brings the amount of tax you owe to zero, you can have 40 percent of any remaining amount of the credit refunded to you.

The amount of the credit is 100 percent of the first $2,000 of qualified education expenses you paid for each eligible student and 25 percent of the next $2,000 of qualified education expenses you paid for that student.

To claim the full credit, your modified adjusted gross income must be $80,000 or less .

Lifetime Learning Credit

There is a credit available for students pursuing undergraduate, graduate or professional degrees or skills needed to advance your career. You can get a credit for up to $2000 of qualified educational expenses, with no cap, if you meet the requirements.

You cant claim the credit if your MAGI is $69,000 or more .

Also Check: How Do I Calculate My Mortgage Payoff Amount

Additional Homeownership Costs To Consider

There may be additional costs that go along with owning and maintaining a home that you have not considered when calculating your monthly expenses, especially if you are a first-time home buyer. When trying to determine how much you can afford to spend on a mortgage, it is important to consider all of the expenses you may have, even if they dont apply yet. Some easily forgotten expenses that can accompany owning a home include:

- Lawn maintenance

- Home maintenance savings fund

The Difference Between Gross And Net Income When You Apply For A Mortgage

It is important to understand how gross and net income impact the mortgage process. First off it is important to define what gross income and net income are. Gross income is your income before deductions for taxes, social security, medicare and any health insurance or retirement account contributions you make. Net income, also known as your take home pay, is your income after all of these deductions.

In short, gross income is the figure at the top of your pay stub while net income is the actual amount you receive in your pay check. Knowing the difference between gross and net income helps you understand what size mortgage you qualify for and how lenders evaluate you when you apply for a loan.

Most borrowers think about how much of their net income they should spend on their monthly payment when determining what size mortgage they can afford. From the borrower’s standpoint, thinking about mortgage affordability in terms of gross income makes less sense because a significant portion of your earnings goes toward deductions.

- Use ourMortgage Qualification Calculatorto determine what size mortgage you can afford based on your gross income

The table below outlines the difference between gross and net income explains the role of both in the mortgage process.

- Monthly gross income is the amount of money you make before any deductions

- Your paycheck states a gross income for the period worked as well as all of the deduction that are subtracted from the gross income

You May Like: What Is Needed For Mortgage Approval

Make Yourself A Competitive Buyer

Don’t spend all your time daydreaming about listings you find on Zillow. Do research to learn what kinds of mortgage loans are out there, including FHA, conventional, VA and USDA loan programs. Get pre-approved by a lender before you start shopping, so you know your price range, and you’ll be ready to make an offer on the spot if need be.

It’s also important to know your credit score. Having a score of 760 or higher will qualify you for the best mortgage rates, so take a few months and build your credit if you can. And then do everything you can to keep it in good standing.

If you’re not sure where your credit score currently stands, sign up for a free or paid to check your score.

is a free credit monitoring service that anyone regardless of whether they are Capital One cardholder can use. Receive an updated VantageScore credit score from TransUnion every week and credit report updates from TransUnion and Experian in real time. Use the credit score simulator to check the potential effect that certain actions, such as paying off debt or closing a credit card, may have on your credit score. In the months leading up to applying for your mortgage, you’ll want to be extra careful about closing accounts and racking up debt, as it can decrease your score and make your mortgage more expensive.