What To Do If You Get Turned Down

If you get turned down for a loan, ask your loan officer what specific steps you need to take to qualify for a PNC mortgage. Common reasons for not qualifying include: low income, too much debt, income history is too short or too unstable, or credit score is too low. But itâs helpful to learn the specific reasons that apply to your situation.

If you donât want to wait, you could consider pricier or higher risk options. These include working with an alternative lender whose criteria are less strict, getting a co-signer or finding a co-borrower. Of course, asking someone to take on a mortgage with you is no small commitment, especially if this person wonât be living with you.

How much home can you afford? To get an idea of what you can afford, try our mortgage calculator.

Itâs also a good idea to apply with several mortgage lenders to see where you stand. Donât worry about hurting your credit score: Submitting multiple applications within 45 days will have the same impact on your score as submitting a single application, according to the Consumer Financial Protection Bureau .

Estimate Your Monthly Payments With Pnc Fixed

Its essential to figure out what your required payments will be before you agree to any loan, and this is particularly true when youre talking about a mortgage. Our PNC fixed-rate mortgage calculator will show you how much you can expect to pay each month and how many of those dollars go into paying the interest. Youll even get to see the total amount of interest paid over the course of the loan.

How Much Can I Borrow

There are few factors that determine how much you will be qualified to borrow: credit history, Debt-to-Income Ratio and Loan-to-Value/ down payment.

|

Specific credit requirements vary based on a range of criteria including loan-to-value, debt-to-income ratios, previous credit history, and assets used to qualify for the loan, but in general successful applicants will have average or better credit history. |

|

|

Debt-to-Income Ratio |

Specific debt-to-income requirements vary based on a range of criteria including loan-to-value ratio, assets used to qualify for the loan and credit history but typically a successful applicant will have a total debt-to-income ratio up to 36-45% of gross monthly income.* *percentages for certain programs vary |

| Loan-to-Value Ratio /Down Payment |

Conventional fixed rate mortgages can be used to buy a home with as little as 3% down payment when private mortgage insurance is purchased. |

You May Like: Can You Get A Mortgage With A 620 Credit Score

How Do Pncs Products Compare To Other Banks

PNC vs. Chase bank PNC Mortgage is a smaller bank than Chase, yet PNC Bank mortgage rates keep up with the financial giant. Chase loses the advantage because they charge a variety of ancillary fees like a rate lock, origination and underwriting fees. An advantage of PNC is the flexible qualifying terms. If refinancing is important to you, but your credit score needs a bit of work, and money is tight, PNC might be a good place to start your refinancing research.

PNC vs. USAA If you or your spouse served in the military, or if your parent or spouse is a USAA member you can begin to establish your eligibility. Because USAA only accepts a select population to their financial institution, they can offer exceptional terms, especially on VA loans. Because of their eligibility terms, USAA does not offer FHA or HELOC products. If you have your mind set on an FHA or HELOC, USAA will not be the best lender for you.

PNC vs. Nationstar PNC takes into consideration nontraditional credit, like rent payments, when determining a borrowers eligibility, whereas Nationstar does not. Also, Nationstar does not currently have branch locations, which can make it more difficult to experience a strong customer/lender relationship. Both banks do not currently let a borrower complete the entire mortgage program online. J.D. Power gives Nationstar Mortgage a score of 772 out of 1,000, which means of the 18 ranked lenders, they have one of the lowest overall satisfaction ratings.

What People Are Saying About Pnc Bank

PNC Bankâs Better Business Bureau rating is 1.1 out of 5.0 stars based on 440 reviews as of late-June 2022. The BBB had closed 934 complaints about the company in the last 12 months, and 3,086 complaints in the last three years.

The BBB gives PNC Bank an A+ rating, but this rating isnât based on customer reviews. Itâs based on how the company responds to complaints, its time in business, size and other factors.

The CFPBâs Consumer Complaint Database shows more than 1,100 mortgage complaints about PNC Bank from March 2019 through June 2022.

Most complaints were about conventional mortgages or FHA loans, and specifically, trouble during the payment process, struggling to pay the mortgage, applying for a mortgage or closing on a mortgage. The company provided a timely response to all complaints. The CFPB does not verify the accuracy of consumersâ complaints.

While these numbers may seem high, they are insignificant compared to how many customers use PNC Bankâs mortgage services.

Read Also: How Much Is A 400 000 Mortgage A Month

Average Mortgage Rates At Major Lenders

| PNC Bank | |

| Avg 30-Yr Interest Rate, 20211 | 3.08% |

| Median Total Loan Costs, 2021 | $3,820 |

| $1,330 | $0 |

Average rate and fee data were sourced from public rate and fee records required by the Home Mortgage Disclosure Act .

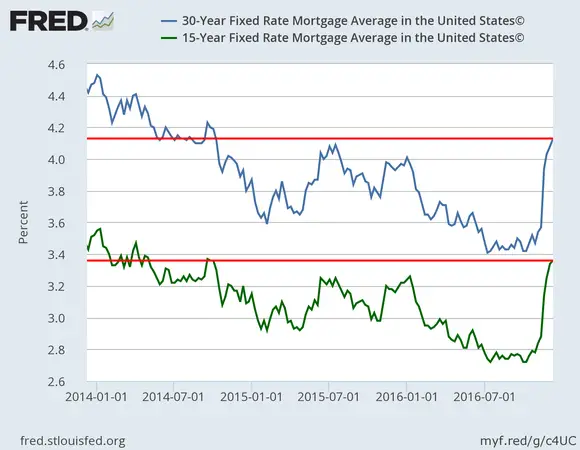

Mortgage interest rates have risen since 2021, and your rate will depend on factors such as your loan type, , and debt-to-income ratio. Be sure to compare quotes from three to five lenders before choosing the rate and fees that are best for your personal finances.

Refinancing Products Offered By Pnc

All lenders offer a variety of products. If youre looking to refinance, take a look at all of PNCs programs:

- 30- year fixed rate

- 15- year fixed rate

- 10-year fixed rate

As with all fixed rate home loans, the rate you agree to will not adjust over the life of your loan. A fixed-rate mortgage makes budgeting for your mortgage payment easier than with an adjustable rate mortgage. PNC offers terms ranging from 10 to 30-year fixed rates. Single family loan amounts will cap at $424,100 per the market limit. For PNC refinance rates, check their website directly.

- 3-1 ARM

- 7-1 ARM

- 10-1 ARM

ARM loans have a shorter term than most traditional fixed-rate mortgage terms but come with a tempting incentive. The shorter terms also mean lower interest rates. One downfall of an ARM is the higher monthly payments that accompany a shorter term.

The rate you lock will be set for the length of ARM you select. For instance, if you select a 5-1 ARM, the rate is set for a five-year period. After the initial five years, the loan will reset annually with a new rate that can be either higher or lower depending on market conditions at the time the adjustment occurs. Its ideal to accept a 5-1 ARM if your income may increase, you plan to live in the home for only a few years, you are coming to the end of your current home loan, or you expect interest rates to remain steady.

- FHA loans

- VA loans

Refinancing your home can save you money over the life of your loan

Don’t Miss: What Determines The Interest Rate On A Mortgage

Is There A Maximum Interest Rate For Arm

Yes, adjustable rate mortgages have three rate caps that restrict how much your interest rate can change. One cap restricts the amount the interest rate can change at the first adjustment, the second restricts the amount the interest rate can change every adjustment period after the first adjustment period, and the third cap restricts the maximum interest rate you can pay for as long as you have the mortgage.

Notice Regarding Adjustable Rate Mortagages: Interest is fixed for a set period of time, and adjusts periodically thereafter. At the end of the fixed rate period, the interest and monthly payments may increase.

Pnc Bank Mortgage Rate Transparency

PNC’s website displays current interest and annual percentage rates, along with estimated monthly payments, for a variety of loans and terms. You can enter different loan amounts and ZIP codes in the rate quote tool, but you can’t get customized rates according to credit score or down payment amounts. As part of its digital application process, PNC allows borrowers to lock in their rates from a mobile device or computer.

More from NerdWallet

Recommended Reading: How To Get Help With Mortgage

Which Mortgage Loans Does Pnc Offer

PNC offers many types of mortgage loans, including:

Fixed-rate loans

Fixed-rate loans are ideal for borrowers who want a predictable payment schedule. While the interest rate is initially higher than for adjustable-rate loans, your rate and payment will never change for the life of the loan.

Adjustable-rate loans

Adjustable-rate mortgages can be a good option for borrowers who need to start with a lower monthly mortgage payment. These loans start with a lower interest rate than fixed-rate loans, but present more of a risk, because the rate could adjust upward with the market rate.

Adjustable-rate mortgages have fixed rates for a limited period, such as five years, before the rate begins to adjust, usually annually. PNC offers options for ARM loans including 1/1, 3/1, 5/1, 7/1, or 10/1 loan terms.

Jumbo loans

Jumbo loans are made for a larger amount than conforming mortgage loans. They could help you purchase property in an expensive area, but are usually harder to qualify for because borrowing more means a higher monthly payment.

FHA loans

FHA loans are guaranteed by the U.S. Federal Housing Administration, and PNC Bank is an approved lender. The qualifying criteria are more relaxed for FHA loans, which are intended to enable first-time home buyers, lower-income buyers, and buyers with poor credit to get mortgage loans.

VA loans

USDA loans

Specialized loans

This lets you avoid private mortgage insurance while making a low down payment.

Earn The Highest Interest Rates On Savings Today

Fixed annuities are almost identical to Certificates of Deposit accounts and provide higher interest rates and penalty-free withdrawals for income.

| Term |

|---|

| 4.60% |

Disclaimer: This is a review. The Annuity Expert is not associated with a bank or credit union. However, fixed annuities are sold at most financial institutions. We aim to help you find the highest interest rates for your retirement savings. We may receive a small referral fee if you purchase something using a link in this article.

You May Like: What Is Mortgage On A 500k House

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

What Could Be Improved

Relationship discount

Many lenders offer a discount on the origination fee or the interest rate to customers who meet certain eligibility criteria. Relationship discounts on mortgages “may” be available but we think most customers won’t qualify for it. PNC Private Bank or Hawthorn customers who maintain at least $500,000 in balances can inquire about special pricing.

The wow factor

J.D. Power ranks PNC ninth in the 2020 U.S. Primary Mortgage Origination Satisfaction Study, with a score below the industry average. To be fair, PNC moved two places higher than in the previous year. Even so, PNC is squarely in the middle of the pack — not amazing, not dismal. Crossing the threshold of your new-to-you home is a champagne-worthy occasion, but the mortgage process isn’t an experience that makes most people dance with delight. In fact, it can be a frustrating and stressful time when you feel somewhat at the mercy of strangers who hold the key to your happy future. We all want to feel well cared for during this time, so there is something to be said for seeking out a mortgage lender whose service stands out.

Fee transparency

Also Check: What Is The Mortgage Payment For A 150k House

Pnc Mortgage Rates Seem Competitive

- PNC Mortgage openly advertises its mortgage rates

- Which not all home loan lenders tend to do

- They appear to be quite competitive relative to other lenders

- But note that they often assume a 70-80% LTV ratio among other things

Speaking of interest rates, lets talk about the rates at PNC Mortgage. First off, kudos to them for advertising their mortgage rates. Not all mortgage companies do.

My first impression theyre quite competitive, but as always, we have to consider the assumptions they make. And they make some pretty big ones.

For conforming loan amounts, they assume youre putting down 20% of the home purchase price, or that you have 20% equity in your home. Plenty of homeowners put down less when buying and/or have less equity.

They also expect you to have excellent credit, defined as a 740-credit score, and presume the property is a one-unit single-family home.

When it comes to jumbo loans, they make the same assumptions but base pricing on a 30% down payment, or 70% LTV.

While this isnt uncommon , you do have to pay attention to the assumptions to ensure you arent disappointed when you receive your actual rate quote.

Also take note of the lock period, which might be 30 or 60 days. If you accept a lower lock period you might be able to obtain an even lower mortgage rate.

Why You Can Trust The Annuity Expert

The Annuity Expert is a licensed annuity broker and insurance agency since 2008. We offer the largest selection of annuities in the United States. Information provided is written by a financial professionalnot a content writer with no financial experience.

We have been recognized as an authority of annuities and insurance by:

- Yahoo Finance!

- LegalZoom

Recommended Reading: How Much Income To Qualify For 200 000 Mortgage

Tips To Simplify The Mortgage Hunt

- Prior to applying for a mortgage, try to figure out which types of loans you’re most interested in exploring. This can help you quickly and significantly narrow down the lenders you’re looking at based on the specialties that each possess.

- Professional help is a quick way to become an “expert” in any financial area, including mortgages. There’s no quicker way to get paired up with a financial advisor than the SmartAsset financial advisor matching tool, which can set you up with as many as three in your area by taking the time to answer a few personal finance questions.

Pnc Mortgage Review: Customer

Find out if a PNC Bank mortgage is right for you. Mortgages 101

PNC Bank, which prides itself on providing customer-focused solutions to banking and investing, offers a variety of financial products and services, including mortgages. The banks efforts must be paying off, as evidenced by over 8 million consumers and small businesses all of which have made the choice to bank with PNC.

Take a look at what PNC Bank has to offer, so you can decide if its the answer to your search to find the best mortgage lender.

Read Also: What Is Balloon Payment Mortgage

Who Is Pnc Bank

- The companys roots are in Pittsburgh

- The name is based on two former predecessors

- Pittsburgh National Corporation and Provident National Corporation

- They acquired National City Mortgage during the housing crisis in 2008 to become a major mortgage player

The history of PNC Bank can be traced all the way back to the mid-1800s, though its unclear when they first began offering mortgages on residential properties.

But one thing is certain theyve been around a while and look to be growing larger as time goes on, especially in the home lending space.

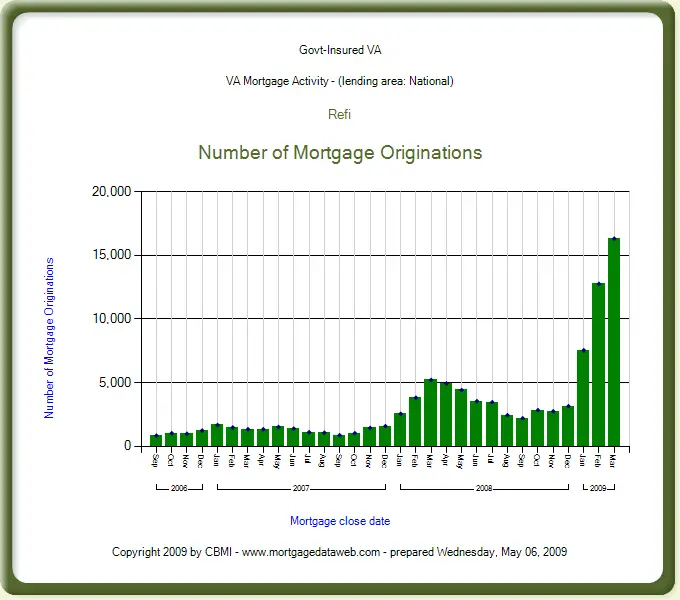

One major catalyst in their growth story had to do with their timely acquisition of National City Mortgage, which was a major home loan lender until the housing crisis hit in the early 2000s.

PNC Mortgage basically reinvented itself with the merger thanks to National Citys large mortgage presence. They were a top-10 mortgage lender up until the crisis.

However, PNC has yet to crack the top-10 lender list themselves, though its probably a matter of time if they continue on the same course.

Requirements: Are You Eligible

You must be a PNC Business Banking customer in order to apply online for any of its business lending products. If you dont have an established relationship, youll need to visit a physical branch to initiate the process.

However, you wont qualify for a loan if your company has any past late payments or charge-offs with PNC. Similarly, if your company has a checking account with PNC, theres very little tolerance for a history of overdrafting your account.

Heres an overview of the eligibility requirements:

- Minimum credit score: Not disclosed

- Time in business: 3 years

- Annual revenue: Not disclosed

PNC doesnt specify a set minimum credit score, but that doesnt mean theyll lend to you if you have poor credit. The lender requires its business borrowers to have a personal credit history of at least five years. It also wants your credit report to be clean, which means no recent late payments of 30 days or more, collection accounts, charge-offs, foreclosures, outstanding tax liens, lawsuits or judgements.

PNC will also pull your Equifax Commercial Credit Report to check that your business credit history is free of negative line items and youre not overleveraged.

While PNC also doesnt share specific annual revenue requirements, it does openly share that your business must be profitable, and your profit margins must be on an upward trend over the past several years. Otherwise, you wont qualify for its business lending products.

Also Check: How To Get A Higher Mortgage With Low Income