The Different Types Of Reverse Mortgages And How To Choose A Reverse Mortgage Lender

There is currently only one Reverse Mortgage type that is widely available the HECM Reverse Mortgage. This loan can be used on your existing home or to purchase a new home. Depending on how you take your loan amount, you can opt for either a fixed rate Reverse Mortgage or an adjustable rate Reverse Mortgage .

HECM programs are available from HUD-approved lenders. These lenders must adhere to the rules and regulations structured by Congress. The maximum fees and lending limits for the HECM are set by law.

Additionally, there are a growing number of proprietary products being offered directly by lenders, such as Jumbo Reverse Mortgages. These loan options typically do not have the same costs or restrictions as HUD HECM programs, and they allow high home value homeowners to access more of their home equity..

In most cases, the HECM is the most widely available and appropriate option. But, if you have a higher home value or perhaps want to access a reverse line of credit on top of your existing mortgage, you may want to consider proprietary offerings. Also, in some states there are proprietary options for higher value condominiums that are not FHA-approved for the HECM program.

What Are The Alternatives To A Reverse Mortgage

The most obvious alternative to a reverse mortgage is simply for a senior to sell their home and downsize to a cheaper property. This, of course, isnt practical in many cases.

Seniors should also consider lower-interest options, like a Home Equity Line of Credit .

HELOCs come with an interest rate thats usually 1.50 to 2.00 percentage points less and generally allow you to withdraw up to 65-80% of the value of your home.

The challenge with HELOCs is that theyre harder to qualify for, particularly for seniors on a fixed income. Theres also a chance the lender will freeze your HELOC borrowing if a spouse dies and/or you miss a payment and/or you never make any principal payments.

What Are The Disadvantages Of A Reverse Mortgage

- The interest rate on a reverse mortgage is usually higher than on a home equity line of credit. Be sure to compare solutions.

- Interest rates may increase or decrease over time.

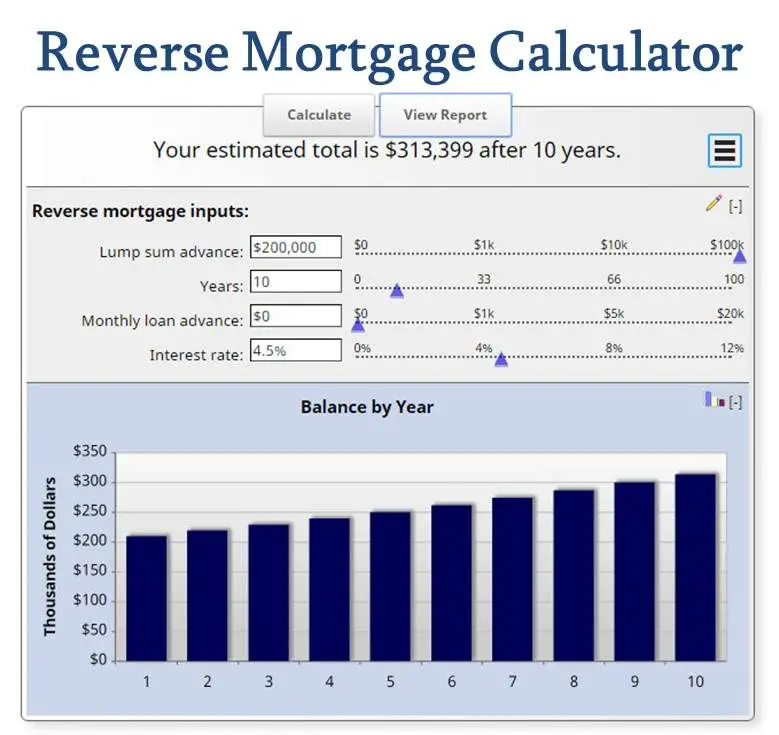

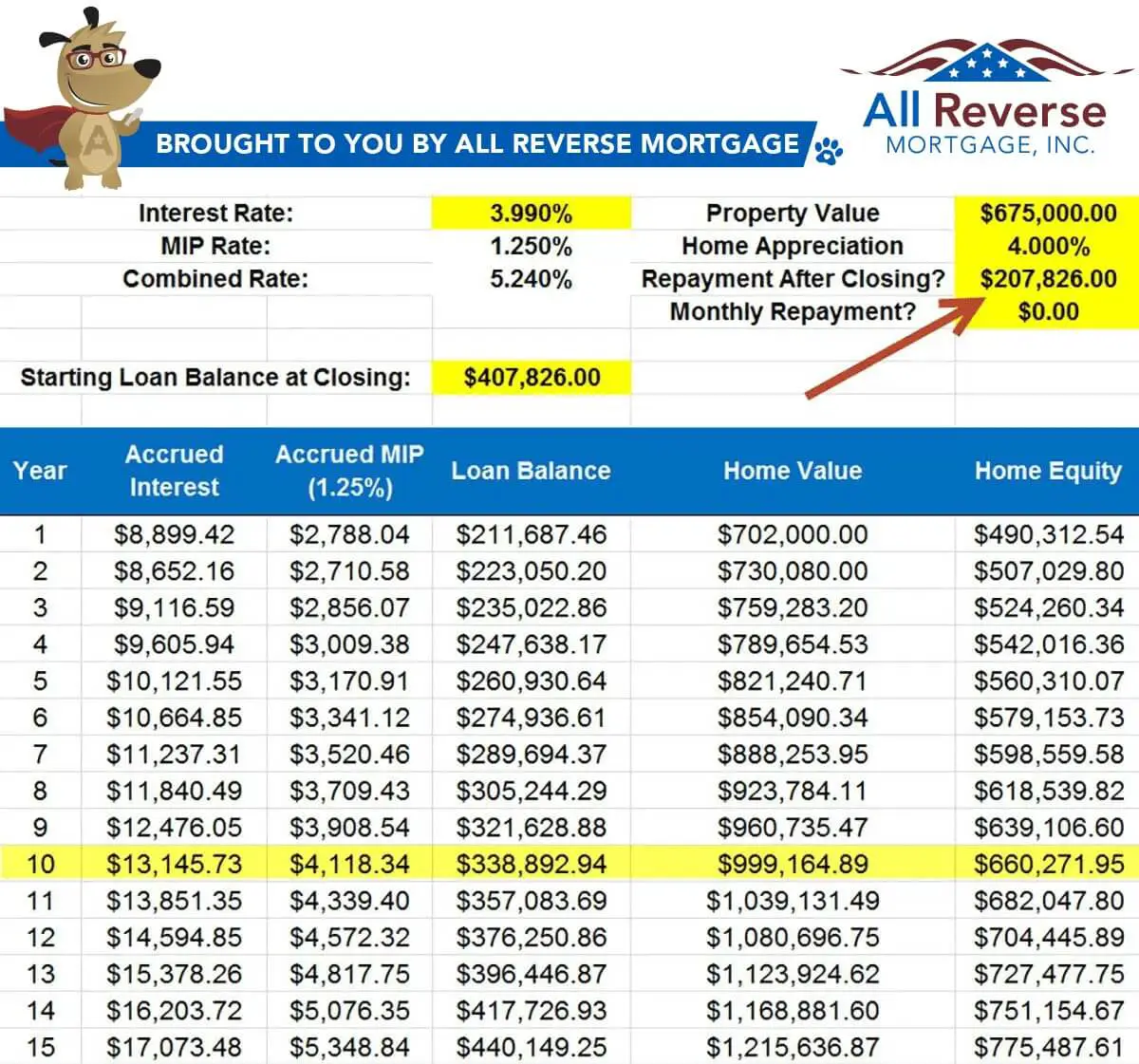

- Since you arent required to repay the loan before the maturity date, interest keeps accruing and can end up being a significant cost. Thats because interest is compounded, meaning you pay interest on the interest. As a simple example, if you borrow $50,000 through a reverse mortgage at an annual interest rate of 4.5%, then sell your home 10 years later, how much will it cost to repay the $50,000 loan plus the accrued interest? $77,648. If you wait another 10 years, it will cost $120,586.

- A reverse mortgage isnt the best solution if you want to leave the value of your property as an inheritance. Your debt accumulates and may grow to equal the value of your home.

You May Like: Why Is There Hazard Insurance On A Mortgage

Faqs On Sbi Reverse Mortgage Loan

The minimum processing fee applicable on this loan is Rs.2,000 + tax.

The maximum processing fee applicable on this loan is Rs.20,000 + tax.

The maximum tenure offered under this loan will depend on the age of the borrower. Therefore, depending on your age, you may be eligible for a maximum loan tenure between 10 years and 15 years.

There are no pre-sanction fees applicable on this loan currently.

Yes. The post-sanction fees that you will be liable to pay include the stamp duty charges for loan agreement and mortgage, the insurance premium for the property, and the CERSAI registration fee.

The CERSAI registration fee charged depends on the amount. A fee of Rs.50 + GST will be applicable for limits up to Rs.5 lakh and a fee of Rs.100 + GST will apply for limits above Rs.5 lakh.

How Often Does A Variable Rate Change

All variable rates are subject to reset to the market-based index rate at a predetermined frequency. How often the rate on your variable rate loan will change depends on the frequency you choose. Here are your frequency options:

- Yearly-Variable As the name suggests, a yearly variable rate changes to the market-based index once per year. It has these characteristics:

- Offers protection against steep and rapid rate changes.

- Offers lower principle limits.

- Rate changes may be no more or less than 2% at each yearly adjustment.

- The potential changes in interest rate over the life of the loan are typically capped at a 5%.

- Yearly variable rates are preferred by those borrowers who anticipate sharp or frequent increases in rates over the coming years.

Recommended Reading: How To Get Approved For More Mortgage

How Much Money Can You Access

The payout from a reverse mortgage depends on several factors:

- The market value of your home

- How much equity you have built up

- How up to date you are with other financial obligations like property taxes

- The purpose of the loan and the type of reverse mortgage youre using

- The current interest rates

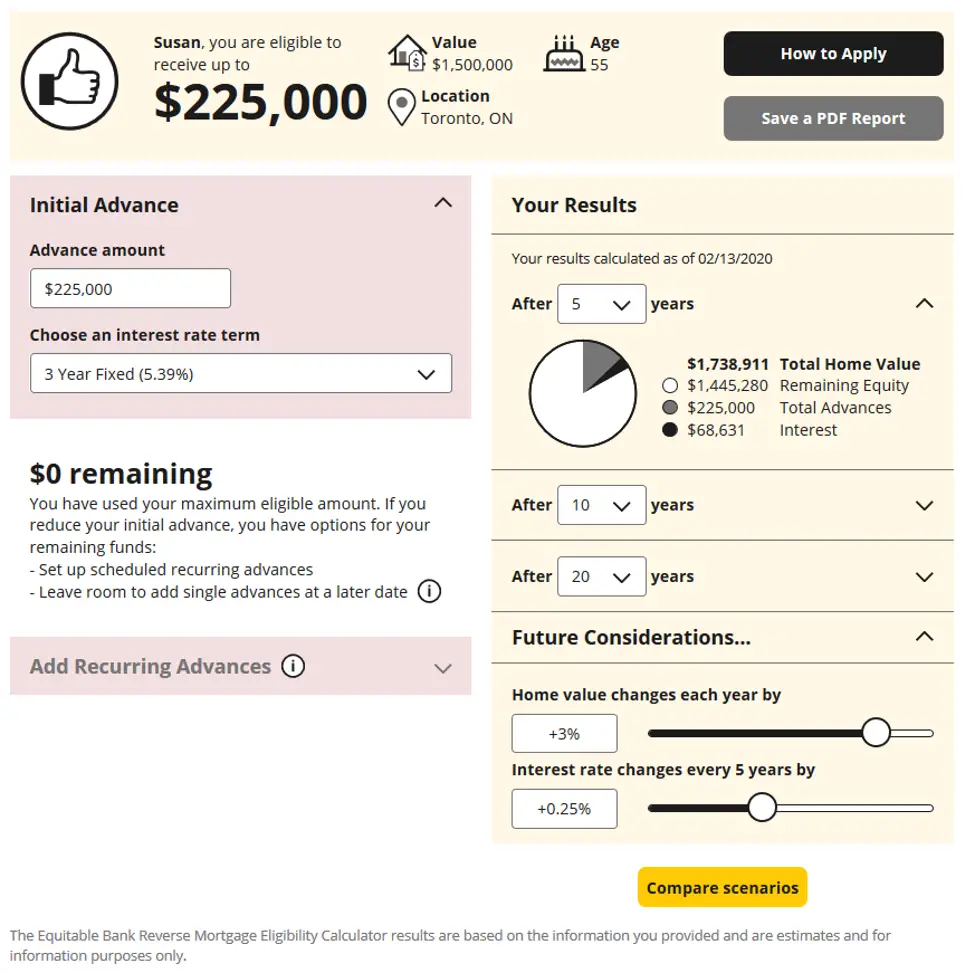

In general, borrowers who are older and have more equity in their home will receive more favorable loan conditions. Keep in mind, its very unlikely your lender will offer a reverse mortgage loan thats equivalent to the value of your home or the amount of equity you have in the property. Best-case scenario, you might get 75% of your homes market value, but you should expect an amount closer to 40%-50%.

There could also be maximum loan limits depending on the type of reverse mortgage you use. As of 2021, reverse mortgages backed by the government can not exceed $822,375.

How Refinancing Can Protect A Non

Couples often removed a younger spouse from title prior to 2015 to close a reverse mortgage when one of the two spouses were not yet 62 years of age. The loans borrowers closed with younger borrowers prior to 2015 must be repaid when the older spouse passes or is no longer living in the property.

By refinancing these loans with todays HUD guidelines, younger spouses would not have to refinance the loan or be forced to move when the older spouse passes if they do not have the means to refinance.

Even if that younger spouse is still under 62 years old, the couple can refinance the loan if they qualify under the current HUD program parameters using the eligible non-borrowing spouse designation.

As an eligible non-borrowing spouse, the younger spouse may remain on title and can also stay in the home for life under the terms of the existing loan without having to make a mortgage payment even if the older spouse should predecease the younger spouse.

Borrowers looking to refinance with the sole motivation of a lower interest rate may be disappointed but for some borrowers with high exiting rates, mortgage insurance renewals and servicing fees, there may be a good opportunity at this time.

In addition to possibly receiving more cash, you may be able to get a lower rate, possibly a lower margin and maybe even eliminate a fee such as a servicing fee which lowers the interest that you accrue over time.

You May Like: Can I Get A Mortgage With Student Loans

History And Current Market Outlook

Like all mortgage products, the jumbo lending environment changes based on many factors. Historically, there were many non-FHA reverse mortgages with different rates and terms. After the housing crash in 2008, most jumbos disappeared from the market. Based on low interest rates and changes to the FHA lending limit in recent years several jumbo products launched, offering a variety of rates, terms, and features.

If you are interested in a jumbo reverse mortgage, its important to ask about the specific terms offered by your lender, such as the amount that can be borrowed, the ways in which proceeds can be obtained, and the types of protections in place regarding non-borrowing spouses.

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowners income and the typical local home value.

You May Like: How Much Is Mortgage On 1 Million

Also Check: Can You Split Your Mortgage Payment

What Is A Reverse Mortgage Margin

The margin is the interest percentage that is added on top of the index , which provides the full IIR for your reverse mortgage.

The margin is not adjustable, which means that after your loan is originated, the margin will stay the same for the duration of the loan regardless of any changes to the index.

There is no index or margin for a fixed-rate HECM loan because the IIR is set for the life of the loan, so these elements apply only to the more popular variable-rate HECM loan.

Example 2 Variable Reverse Mortgage Interest Rate Term

Lets consider the same example: a home valued at $600,000 and $150,000 in CHIP money. For this example, you decide to take a variable term rate. Your initial interest rate will be the HomeEquity Bank prime rate plus the fixed spread all outlined in the table above. If the Bank of Canada changes its prime rate, then more than likely HomeEquity Bank prime will change. Your variable rate would then change to the new HomeEquity Bank prime rate plus the fixed spread, which is guaranteed for a five-year period.

If you have any questions about the CHIP Reverse Mortgage rates or if you are interested in understanding more about Reverse Mortgage, you can check this page on How a Reverse Mortgage Works. If you have any other questions, feel free to give us a call at 1-866-758-2447.

You May Like: Can You Get A Mortgage If You Filed Bankruptcy

Protection Against Rate Increases

Fixed interest rates are set at the time the loan is originated and dont change over the life of the loan. As a result, fixed-rate loans offer protection from future rate increases.

Variable-rate loans, on the other hand, fluctuate based on an index rate. If market interest rates rise in the future, so will the rates on reverse mortgages. This could result in borrowers having to repay more than they anticipated later on.

How Can I Get The Best Interest Rate On A Reverse Mortgage

To get the best reverse mortgage interest rate for your client, shop around. Getting a few quotes will give you a sense of what a reasonable rate looks like based on your clients circumstances, and if you get an outlier either very high or low you can ask the lender more detailed questions about the rate.

Some interest rate factors are beyond your clients control, such as their age, location, the appraised value of the home, and current market rates.

So, its important to control the factors you can influence, including shopping around and making an informed decision about how to structure the loan proceeds.

You May Like: 10 Year Treasury Yield And Mortgage Rates

Also Check: Should I Add My Spouse To My Mortgage

What Are The Advantages Of A Reverse Mortgage

- You continue to own your home. The lender cant ask you to sell or vacate it in order to repay the loan. You must, however, continue to pay the property taxes, maintenance costs and insurance.

- You can use the borrowed amount to maintain your lifestyle by, for example, paying yourself an annuity.

- The lender will not require any payments from you while you are living in your home. You may, however, repay some or all of the interest every year.

- As long as you comply with your mortgage obligations, including paying your municipal taxes and insurance, the lender will usually guarantee that youll never have to pay back more than the value of your property.

What Is The Best Reverse Mortgage Rate

The answer to that depends on what term you prefer. A 5-year fixed reverse mortgage rate, for example, is usually at least two-thirds of a percentage point greater than a variable or 1-year fixed. The longer the term, the higher the rate.

Given the same term, however, theres not much difference in rates between lenders . Thats because theres very little competition in Canadas reverse mortgage market. The two leaders in the industry, HomeEquity Bank and Equitable Bank, price very close to one another so as to maximize margins.

Below are some of the more frequently asked questions about reverse mortgages

You May Like: How Difficult Is It To Get A Mortgage

The Effect Of Interest Rates On Your Available Loan Proceeds

Interest rates have a direct impact on the amount of proceeds available to you on a reverse mortgage loan. The impact is seen on the principal limit. The principal limit is defined as the amount of money a reverse mortgage borrower can receive before expenses and payoffs are removed. The principal limit is calculated by multiplying the borrowers maximum claim amount by the principal limit factor .

The chart below shows a sample of PLFs for borrowers ranging from 62-95, assuming a 5.0% expected rate.

| Borrower Age |

|---|

What Is A High

A mortgage with a down payment below 20% is known as ahigh-ratio mortgage. The term ratio refers to the size of your mortgage loan amount as a percentage of your total purchase price.

All high-ratio mortgages require the purchase of mortgage loan insurance from either the CMHC, Sagen, or Canada Guaranty, since high-ratio mortgages generally carry a higher risk of default.

Don’t Miss: How Do You Apply For A Mortgage

Access To More Funds In The Future

The principal limit for a reverse mortgage is generally set at the time the loan is originated. For a variable-rate loan, the principal limit can increase over time, giving borrowers access to more money. But the principal limit on a fixed-rate loan wont increase. The lump sum the borrower received at the beginning of the loan term is the most they can receive.

Loan Amounts Available On A Typical Reverse Mortgage

In the following sections, we detail Reverse Mortgage loan amounts, fees, and interest expenses for a fairly typical homeowner.

Using the sample data listed above and rates at the time of article publication, a borrower may expect the following:

| Adjustable Interest Rate | ||

|---|---|---|

| Maximum Loan Principal : | $159,000* | $147,900* |

* On a $300,000 house owned by a 70-year-old retiree using Jul-2021 rates this is the gross amount available prior to deducting existing mortgages, the origination fee, mortgage insurance and other closing costs that vary based on company margin and current interest rates.

You May Like: How To Make My Mortgage Payment Lower

What Will Reverse Mortgage Counseling Cost

Borrowers taking out a HECM reverse mortgage loan, must receive counseling from a HUD-approved reverse mortgage housing counseling agency before receiving the loan.

Housing counseling costs will vary depending on the agency and your individual situation. The housing counseling agency must make a determination about your ability to pay, which should include factors, including, but not limited to, income and debt obligations. HUD approved housing counseling agencies may charge you a reasonable fee, but they cannot charge you a fee if you cant afford it and must explain all charges prior to counseling.

Current Mortgage Interest Rates On Dec 20 : Rates Recede

A few notable mortgage rates went down significantly over the past seven days. The average interest rates for both 15-year fixed and 30-year fixed mortgages were slashed. For variable rates, the 5/1 adjustable-rate mortgage also slid lower.

Mortgage rates have increased fairly consistently since the start of 2022, following in the wake of a series of interest rate hikes by the Federal Reserve. Interest rates are dynamic and unpredictable at least on a daily or weekly basis and they respond to a wide variety of economic factors. But the Feds actions, designed to mitigate the high rate of inflation, are having an unmistakable impact on mortgage rates.

If youre looking to buy a home, trying to time the market may not play to your favor. If inflation continues to increase and rates continue to climb, it will likely translate to higher interest rates and steeper monthly mortgage payments. As such, you may have better luck locking in a lower mortgage interest rate sooner rather than later. No matter when you decide to shop for a home, its always a good idea to seek out multiple lenders to compare rates and fees to find the best mortgage for your specific situation.

Dont Miss: What Accounts Have Compound Interest

Don’t Miss: Can You Cancel A Reverse Mortgage

Interest Rates For Reverse Mortgages

They tend to be higher than for other home loans

Taking out a reverse mortgage can be a convenient way to access your home equity. Unlike a home equity loan or a home equity line of credit , a reverse mortgage does not require any payments as long as you use the home as your principal residence. However, interest and fees can accrue on the balance thats payable once you sell the home, move out, or die. There are also unscrupulous lenders out there looking to take advantage of borrowers, so its important to tread carefully.