How To Use The Maximum Mortgage Calculator

Not sure where to start? Let us help you:

Recommended Reading: How Many Times Can You Pull Credit For Mortgage

How Much Should I Spend On A House

Anaffordability calculatoris a great first step to determine how much house you can afford, but ultimately you have the final say in what youâre comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three monthâs worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

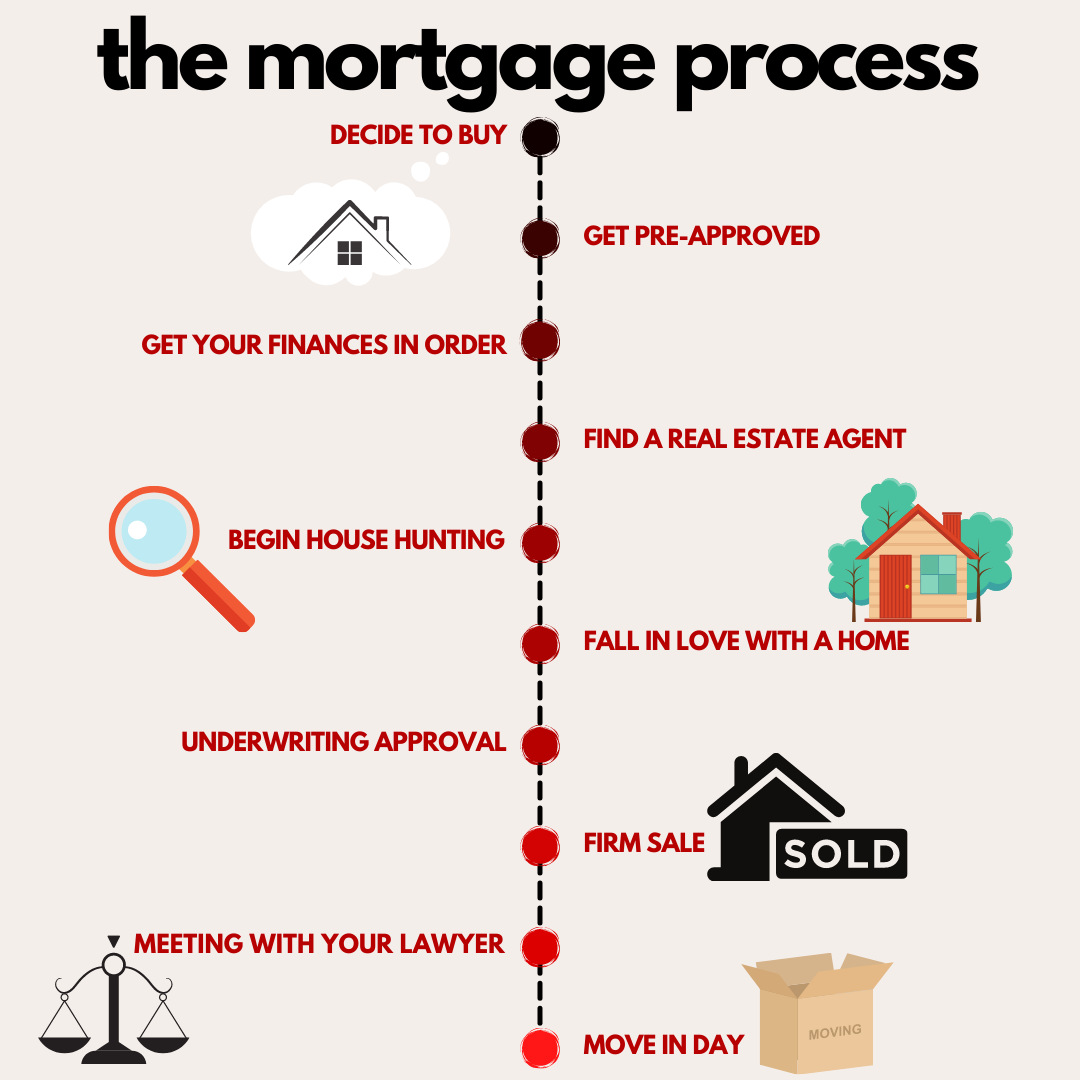

How Far In Advance Should I Get Pre

The best time to get pre-approved for a mortgage is at least one year before you decide to purchase.

As a home buyer, pre-approvals are for your benefit, so its never too early to get one.

Getting pre-approved early is an advantage because one-third of mortgage applications contain an error. These errors can negatively affect your interest rate and ability to buy a home. Pre-approvals uncover those mistakes and give you time to fix them.

Getting pre-approved also sets your price range. Pre-approved buyers are less likely to overspend or underspend! on their residence as compared to buyers who use online mortgage calculators.

Learn more about getting pre-approved before looking for a home.

Also Check: Does Discover Bank Do Mortgages

Save The Biggest Deposit You Can

A larger deposit won’t just help you get a mortgage – it can help you get a better interest rate, too.

Unless you’re taking out a guarantor mortgage, you’ll need a deposit of at least 5% to take out a home loan. But if you save more, you’ll be able to borrow at a lower loan-to-value ratio , which usually means paying a lower interest rate.

Find out more with our guide to how much deposit you need for a mortgage.

Best Lenders For Fha Loans In October 2022

FHA loans offer several benefits including lower down payments and more lenient requirements. Compare some of the top FHA lenders to find the right fit for your needs.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhereâs how we make money.

You might think all Federal Housing Administration lenders are the same. But when youre looking for an FHA loan, its always smart to shop at least three lenders. Their mortgage rates and fees can differ substantially, plus lendersâ requirements for approval for an FHA loan vary.

NerdWallet has picked some of the best FHA lenders in a variety of categories so you can quickly determine which one is right for you.

» MORE:Compare FHA mortgage rates

You might think all Federal Housing Administration lenders are the same. But when youre looking for an FHA loan, its always smart to shop at least three lenders. Their mortgage rates and fees can differ substantially, plus lendersâ requirements for approval for an FHA loan vary.

NerdWallet has picked some of the best FHA lenders in a variety of categories so you can quickly determine which one is right for you.

Read Also: Is There An Advantage To Paying Your Mortgage Bi Weekly

Misconceptions About The Mortgage Process That Are Not True

Here are some common misconceptions about mortgages, lenders, and the loan process:

1. Pre-qualified is the same as pre-approved.

While these two are related because you need a letter for either, they are very different. You can get pre-qualified online in minutes by answering a few questions about your financial situation. Typically the pre-approval process is much more thorough. Lenders take a look at your financials before a pre-approval decision is made. If approved, youre given a maximum loan amount based on how much the bank is willing to loan you. These days, a pre-qualification isnt worth much. Sellers prefer a pre-approval since thats a much more accurate representation of your ability to buy the home.

2. Being pre-approved guarantees that youll get a home loan.

There are thousands of stories of homebuyers who were approved for a mortgage only to find out later that theyve been denied. There are many reasons why a mortgage is denied after being approved. Some of the most common causes include changing jobs, adding additional debts, and not having enough money to cover the costs of getting the mortgage.

Its essential that once youre pre-approved for a mortgage that you dont make any rash decisions. If you are thinking about making another financial change after recently being pre-approved for a home loan, you should first consult with your mortgage advisor to make sure youre not sabotaging your pre-approval.

3. The mortgage process is difficult.

Avoid The House Poor Trap After Getting Preapproved

Unfortunately, its easy to become house poor. Essentially, those who are house poor have budgets that are stretched too thin by an outsized mortgage payment each month.

Instead of allowing your new home to take over your budget, sticking to the 28% rule is a good idea. This rule suggests that you spend no more than 28% of your gross income on your mortgage payment.

For example, lets say that your gross income is $5,000 each month. In that case, you could spend $1,400 on your mortgage each month while abiding by the 28% rule.

But you can choose to keep your mortgage payment lower than that. Its critical to avoid overburdening yourself with a mortgage payment that reduces your ability to save or invest for other important financial goals. Take the time to evaluate your budget to ensure that you dont buy a house you cannot afford.

Don’t Miss: What’s The Best Mortgage Loan To Get

Failing To Get Multiple Estimates From Different Lenders

Buying a home is the biggest purchase you likely will ever make. It is in your best interest to get estimates from multiple lenders to compare and get the best possible deal. Looking at different lenders allows you the chance to compare and contrast prices, closing costs, and guidelines for PMI. Shop around with a variety of lending institution types, from mortgage brokers and credit unions to larger and online lenders. Taking the time to get multiple estimates can result in significant savings.

Mortgage Preapproval: Everything You Need To Know To Get Preapproved

Getting that letter is one of the first and most important steps in the home-buying process.

Your home-buying journey starts with getting a loan preapproval letter.

Buying a home especially for the first time is a complicated process. One of the first and most significant steps of buying a home is getting your mortgage preapproval. Its proof that youve lined up the financing you need to close on the home. Without a preapproval letter, most sellers arent going to take your offer seriously.

Although some lenders have tightened their standards due to the pandemic, its usually not too difficult or complicated to get a home-loan preapproval. Lets look at how it works.

You May Like: How To Calculate House Mortgage

The Buyers Employer Or Job Title Changed

Changing jobs even for higher pay can ruin your pre-approved mortgage.

If you plan to make any of the following changes in your job or career, ask your mortgage lender before making the change:

- Becoming a partner in a company

- Starting a new business

- Switching from a salaried position to a salary + bonus position

- Changing industries

- Accepting payment in cryptocurrency

Its okay to make changes in your career. Be sure to speak with your lender to avoid unintended consequences.

Can I Get Mortgage Pre

Its unlikely. Initial qualification without a full credit check may be possible with some lenders at that point, they may be interested simply in whether you have both the income to pay back a mortgage and no credit red flags. But to get full-scale pre-approval will likely require a credit check.

Its important to know how long pre-qualification and pre-approval will be in effect. Different lenders assign different times for which their letters of pre-qualification or pre-approval are good, from 30 to as many as 120 days.

Remember that multiple checks for credit history can negatively affect your credit rating, so you dont want to have them repeated often. For the same reason, you shouldnt apply for it until youre ready to start seriously home shopping. Many lenders and real estate agents can help you get a range of what you can afford in a general sense, so that you can avoid going through the pre-qualification or pre-approval process only to learn that theres nothing in your market that you can realistically afford or want.

Also Check: Can You Use A Mortgage To Build A House

How Getting Mortgage Pre

When sellers accept an offer, they want the deal to go through. However, if the buyer isnt pre-approved for a loan, this can put the whole deal in jeopardybecause if the loan doesnt get approved, the buyer will likely be unable to follow through, says Chantay Bridges with TruLine Realty in Los Angeles.

As such, some home sellers wont allow buyers to tour their home without pre-approval, and some real estate agents wont take buyers on tours until theyre pre-approved.

What Are My Chances Of Getting Pre

The likelihood that you will get pre approved for a mortgage online depends on several factors, including:

- Your credit history

Bestmoney is a dba of Natural Intelligence Technologies Inc.

Natural Intelligence Technologies Inc. NMLS # 2084135

CT: Mortgage Broker only, not a mortgage lender or mortgage correspondent lender.

- Advertising Disclosure

This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on the site, which impacts the location and order in which brands are presented, and also impacts the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including pricing, which appears on this site is subject to change at any time.

Close

Also Check: What Are Mr Cooper Mortgage Rates

Where Do I Get A Mortgage

Finding a good mortgage lender is a lot like finding a good marriage partner with one notable exception: the mortgage vows shouldnt last more than 30 years.

Otherwise, the process is largely the same. You have your pick from suitors that include local and national banks local and national credit unions mortgage brokers and online lenders. Each of them offer inviting promises and each has faults that you must accept for better or worse.

The most important rule in choosing a lender is look around. Apply in at least three places and compare costs. An astonishing 71% of homeowners only apply for a loan in one place. A 2016 study by J.D. Power found 27 percent of first-time homebuyers more than one out of four! regret the choice of lender they made for a mortgage.

Most of their dissatisfaction stemmed from lack of communication and unmet promises. That could be because buyers dont realize all that goes into a mortgage loan.

The list of questions you need answered goes far beyond: Whats my interest rate and is this a 30-year or 15-year mortgage? There is a long list of fees involved and each one has a cost.

Some of the fees you could be charged at closing include:

- Loan origination or application

- Title insurance

Ask the lender to give you a dollar-figure for each of the fees, or at least an educated estimate. You are allowed to bargain between lenders over fees. Thats how you find out who really wants you as a customer.

Why You Might Be Denied

If something does not suit the scoring system or the Security Service, you will be refused without explanation. The requirements of different banks for borrowers may differ in numbers and details, but converge in the main points. Most often, even credit managers do not know the reason for the refusal. Ill tell you about the main reasons for the refusal.

Non-compliance with the requirements that the bank imposes on the borrower. Most often this is a small income, insufficient experience or inappropriate age.

Bad credit history. The bank may alert even a few missed payments on a credit card. If you have had more serious problems with payments or it has come to collectors, you will not be able to get a loan until you fix your credit history.

Most often, a delay of up to 30 days is considered technical and does not affect the credit history. But if this is repeated regularly, the bank understands that you are not very obligatory. But if you had delays for more than 3 months, this is a big reason for the bank to refuse you.

A few years ago, Svetlana took a loan for a vacation and miscalculated: she missed payments, delayed payments several times. As a result, she paid off the loan, but ruined her credit history. During this time, Svetlanas income has doubled, she has no debts, but the bank does not want to give her a mortgage because of past problems.

Debts on taxes and fines. A common case is people forget to pay taxes or traffic police fines.

Recommended Reading: Can You Switch Mortgage Companies Before Closing

Learn More About A Mortgage Pre

The first step in buying a property is knowing the price range within your means. You can get an estimate for this amount through a mortgage pre-qualification, or for more certainty, a mortgage pre-approval.

A mortgage pre-qualification is a rough estimate of your borrowing capacity to purchase a property. Its calculated based on your basic financial information such as your income and current debt. No credit check is involved, nor is it a guarantee of the approved financing which you may receive by National Bank.

A mortgage pre-approval certifies your borrowing capacity based on several criteria including your credit rating. It confirms the amount that National Bank agrees to lend you under certain conditions and protects the rate of this loan against potential rises for 90 days. A pre-approval demonstrates your seriousness to sellers and your real estate agent and does not impose any obligation for you to commit to the loan.

Recommended Reading: Can You Refinance Mortgage Without Closing Costs

How To Get A Loan With A High Debt

A high debt-to-income ratio can result in a turned-down mortgage application. Luckily, there are ways to get approved even with high debt levels.

1. Try a more forgiving program

Different programs come with varying DTI limits. For example, Fannie Mae sets its maximum DTI at 36 percent for those with smaller down payments and lower credit scores. Forty-five is often the limit for those with higher down payments or credit scores.

FHA loans, on the other hand, allow a DTI of up to 50 percent in some cases, and your credit does not have to be top-notch.

Likewise, USDA loans are designed to promote homeownership in rural areas places where income might be lower than highly populated employment centers.

Perhaps the most lenient of all are VA loans, which is zero-down financing reserved for current and former military service members. DTI for these loans can be quite high, if justified by a high level of residual income. If youre fortunate enough to be eligible, a VA loan is likely the best option for high-debt borrowers.

2. Restructure your debts

Sometimes, you can reduce your ratios by refinancing or restructuring debt.

Student loan repayment can often be extended over a longer term. You may be able to pay off credit cards with a personal loan at a lower interest rate and payment. Or, refinance your car loan to a longer term, lower rate or both.

3. Pay down accounts

Or you can reduce your credit card balances to lower your monthly minimum.

| Balance |

Don’t Miss: What Not To Tell Mortgage Lender

Preapproval Vs Prequalification: What’s The Difference

When you start looking for a mortgage, another term you might come across is “prequalification.” Though home loan preapproval and prequalification are often used interchangeably, the process and terminology varies among lenders.

In some cases, prequalification is based on your answers to a few initial questions and a soft credit check . It usually doesn’t include details about loan amount, interest rate or terms. As such, it’s less authoritative than a preapproval — but it’s a good way to get an initial idea of whether you’re in good enough financial shape to qualify for a mortgage.

“A true preapproval will verify assets, income and the ability to repay the loan,” Watters said. “Some lenders will offer a preliminary prequalification letter, but this only shows a borrower qualifying based off of the information they submitted in their application.”

When you’re ready to make an offer on a home, you’ll want to have an official statement from a lender — or, better yet, multiple lenders — that you can get the financing and terms you need to close on the deal. Whichever term your lender uses, make sure you have it before you make an offer.