Restrictions On The Relief Program

There are some restrictions on the GSE Mortgage Relief Program.

First, the program is not available to all homeowners. You must meet specific eligibility requirements to qualify for the program.

Second, the program may only be available for a limited time. The government has not announced how long the program will be available.

Third, the program may only be available to certain types of mortgages. The government has not announced which kinds of mortgages will be eligible for the program.

Your mortgage servicer is the best point of contact for questions about the GSE relief program or any other type of mortgage relief program. They will be able to tell you if you are eligible for the program and provide you with more information on how to apply.

Featured respres, CC BY 2.0 via Wikimedia Commons

- Opens in a new tab

- Opens in a new tab

- Opens in a new tab

- Opens in a new tab

Do You Already Have Loans

This is an important fact that all lenders will look for: are you already paying off a loan?

If you are, this could easily lead you to the doorstep to debt rather than the doorstep to your new home.

Having existing loans doesnt mean the lender will disqualify you from home loan eligibility. But it will minimize the amount of your loan. Its up to you to determine if this a smart decision for you or not.

Whether youre paying off a car loan or any other type of loan, hold off on that new home until your maturity date is over.

How Long Does It Take To Get Pre

You can typically expect to get pre-qualified in a day or two, sometimes less. Depending on the lender, pre-qualification can happen in person, over the phone or online.

More from NerdWallet:

NerdWallet subscribes to the 28/36 rule of thumb, which means that monthly home-related expenses shouldnt be more than 28% of your gross income, and all of your monthly debts shouldnt account for more than 36% of your gross income.

Using the guideline that your home-related expensesshouldnt be more than 28% of your gross income, you should try to keep your monthly mortgage payment under $4,666 if you have a household income of $200,000 a year. If your monthly debts plus $4,666 are greater than 36% of your gross income, youll either need to reduce your monthly debts, put down a larger down payment or set your sights on a lower-priced home.

There are so many elements at play that can determine home affordability, and everyones financial circumstances are unique. NerdWallets mortgage payment calculator can help you determine what your monthly payments would be if you bought a $400,000 home, and it shows how this figure changes based on factors like your down payment and property taxes. Ideally, this monthly payment should be less than 28% of your gross income.

There are so many elements at play that can determine home affordability, and everyones financial circumstances are unique. NerdWallets

You May Like: Which Credit Union Is Best For Mortgage

What Sort Of Mortgage Can You Get If Youre Eligible

If youâre eligible for a mortgage, there are several different types you can choose from. Two types you might have already heard about are fixed rate and variable rate mortgages.

- Fixed rate mortgages are mortgages where the interest rate stays the same for a fixed period . A fixed rate mortgage makes budgeting a bit easier, as you know your interest rate wonât change over that time.

- Variable rate mortgages are mortgages where the interest rate varies throughout the loan, either in line with the Bank of Englandâs base rate or the lenderâs standard variable rate . Choosing a variable rate mortgage could mean lower rates and fees, but itâs also a tad unpredictable.

Learn more about fixed rate and variable rate mortgages here.

For both types of mortgage, the interest rate youâre offered will depend on a few factors: the amount you want to borrow, the size of your deposit, and your credit score.

âGet an idea of what you could borrow with our handy mortgage calculator.

Alex Winn

Alex decided to become a mortgage broker after he used one to buy his flat. Was he inspired by the amazing service? No. He just figured he could do a much better job. Today, Alex leads one of Habito’s biggest teams of brokers, giving people the expert, savvy advice they need to make buying their homes a breeze.

Check Your Eligibility For A Mortgage

Posted by Oliver West, March 9, 2022

Mortgages come in all shapes and sizes, and not every option is suitable for everyone. To make sure that borrowers get a suitable mortgage they can afford, lenders set a list of rules that need to be met. These are called eligibility criteria and can include basic elements like having a certain deposit amount as well as more specific things like an apartment being situated below the 10th floor. Only borrowers that meet the lenders mortgage eligibility criteria will be considered.

Each lender sets its own eligibility criteria, which can vary between mortgage products. So youll want to make sure you read their criteria carefully before applying for a mortgage even if youre eligible for another of the lenders products. When you apply for a mortgage, the lender will ask for certain documents and may send a surveyor to your property to confirm eligibility.

You May Like: What Is The Typical Closing Costs For A Mortgage

How The Stress Test Can Impact Your Qualification

Federally regulated entities, like banks require that you pass a stress test to get a mortgage. This means that you need to prove you can afford payments at a qualifying interest rate. This rate is typically higher than the actual rate in your mortgage contract.

You need to pass this stress test even if you dont need mortgage loan insurance.

The bank must use the higher interest rate of either:

- the interest rate you negotiate with your lender plus 2%

If you already have a mortgage, youll need to pass this stress test if you:

- refinance your home

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

How Do Mortgage Lenders Verify Your Income

When youre applying for a mortgage, it sadly isnt as easy as just letting the lender know your annual salary. Youll need to prove you earn what you say you do so they can verify your income and work out what kind of a mortgage you can afford. Youll usually do this by submitting payslips, tax returns, or employer references. But there are a few differences in the way you prove your income depending on if youre employed by a company, or youre self-employed.

Don’t Miss: Does American Express Do Mortgages

Can I Get A Mortgage

Your ability to get a mortgage depends on a number of things, including the amount youre looking to borrow, the size of your deposit and your credit score. Some other things to consider include:

- your employment status and income

- your life stage

Before applying for a mortgage, its a good idea to work out your budget so you have an idea of how much you can afford to cover your deposit and monthly repayments, and still have enough money for any fees that come with the mortgage.

Its also a good idea to check your credit file before you apply to make sure it doesnt contain any errors even a small mistake like getting your date of birth wrong could affect your mortgage application.

You can get free credit checks from each of the three credit reference agencies Experian, Equifax and TransUnion.

Proving Your Eligibility For A Mortgage

Youll be able to find mortgage eligibility criteria on the lenders website. Or, if youre using a mortgage broker, theyll filter out products youre ineligible for on your behalf.

When applying for the mortgage, the lender will ask to see copies of certain documents for each applicants eligibility. These often include:

- three to six months of recent payslips

- two years of accounts

- your most recentP60

- three months of bank statements

- any benefits you receive

Additionally, the lender will run a credit check against all applicants. They may also send a surveyor to inspect your property or use an electronic conveyancing service that checks various data records to assess the value and condition of the property.

Checking your eligibility for a mortgage can take anywhere from 24 hours to a week, depending on the lender.

Also Check: Can I Combine My Mortgage And Home Equity Loan

How Does A Mortgage Lender Calculate Affordability

To calculate if you can afford to borrow what youâre asking for, lenders will look at:

- Your current income: Most lenders will ask to see your last three to six months of payslips. Others might ask for your most recent P60 too . If youâre self-employed, there are a few more hoops to jump through. Youâll need to provide at least two years of tax returns to prove your income. Some lenders may even ask for proof of upcoming work before lending to you. Sometimes, lenders might also consider other forms of income, like government benefits or child maintenance.

- Your current expenditure: In addition to what youâre bringing in, lenders want to know where your money is going. Youâll be asked about credit cards, outstanding loans, household bills, and other regular expenses like groceries, childcare, school fees, and work travel costs.Theyâll also want to know about your other living costs, like how much you spend on clothes or entertainment each month. Youâll need to provide your last three to six months of bank statements to back up the numbers in your application.

- Your future: Finally, lenders like to âstress testâ your future affordability. Theyâll run through a few common scenarios to see if you could still afford the repayments if those things happened.

If youâre applying for a joint mortgage, the lender will look at the income and outgoings of everyone whoâs applying.

What Documents Do You Need To Prove Your Eligibility For A Mortgage

When you apply for a mortgage, lenders wonât just take you at your word. You need to prove you are who you say you are â and that the figures in your application are accurate and up to date.

To do that, youâll need to gather several different documents. â

To prove your identity,youâll need to show your lender:

- Your passport or driving licence

- Proof of address

To prove your income, youâll need to give the lender:

- Payslips from the past three to six months

- Your most recent P60

- Evidence of any bonuses or commission, received or due

- Bank statements from the past three to six months for the account your salary is paid into

To prove your income from self-employment, youâll need:

- Two years of accounts

- Your SA302 tax calculations and tax year overviews for at least the last two years

- If youâre a contractor, youâll have to show proof of upcoming contracts

- If youâre a company director, youâll have to provide evidence of dividend payments or your share of net profits after corporation tax.

To prove your expenditure, youâll need:

- Three to six months of bank and credit card statements

- Information about any outstanding loans or credit agreements

Read Also: How Is A Mortgage Payoff Calculated

Eligibility Requirements For Va Home Loan Programs

Learn about VA home loan eligibility requirements for a VA direct or VA-backed loan. Find out how to request a Certificate of Eligibility to show your lender that you qualify based on your service history and duty status. Keep in mind that for a VA-backed home loan, youll also need to meet your lenders credit and income loan requirements to receive financing.

Percentage Of Income Toward Monthly Payment

While the 28% rule is a good starting guideline, there are other factors to think about. Lenders are legally obligated to learn about your assets, expenses and credit history before offering you a mortgage. How reliable your income is can also matter. If much of your earnings come from a source that varies from month to month, like commissions, a lender might not be willing to lend as much to you as it would to someone who earns a consistent salary.

Consider what you can comfortably afford to spend on a monthly basis without affecting other financial goals, such as saving for an emergency fund or investing toward retirement.

Read Also: Can You Do A Reverse Mortgage On A Condo

You May Like: What Is The Hiro Mortgage Program

How Our Mortgage Affordability Calculator Works

Our affordable mortgage calculator first uses your income, expenses, and down payment to arrive at a monthly payment your budget can support when buying a home. From there, it will calculate a mortgage you can afford, considering current interest rates, loan term, and additional factors.

Annual income: Enter your gross annual income from all sources. If you have a co-borrower, be sure to include their income.

Monthly debt:Total your monthly debt payments, including car loans, student loans, credit card payments, personal loans, and any court-ordered payments. Do not include recurring household expenses such as utility bills or the estimated home loan payment in the mortgage income calculator.

Down payment:Enter how much you have available for a down payment. Your lender may require a minimum down payment depending on the loan program youre applying for.

Debt-to-income ratio: To calculate your DTI ratio, divide your total monthly debt payments by your gross monthly income. Our affordability calculator mortgage DTI ratio is auto-populated with 36% however, some loan programs allow up to a 45% DTI ratio. And in some cases, lenders may approve a DTI ratio above program limits. If you know the maximum DTI ratio your lender allows or to enter your desired ratio, adjust this field accordingly.

Recommended Reading: Reverse Mortgage Mobile Home

What Are The Eligibility Requirements

To be eligible for the program, homeowners must meet specific criteria.

First, they must be current on their mortgage payments. Homeowners who are delinquent on their mortgage payments or have already gone through foreclosure are not eligible for the program.

Second, homeowners must have a financial hardship that has made it challenging to make their mortgage payments. Examples of difficulties that would make a homeowner eligible for the program include job loss, unexpected medical expenses, or divorce.

Finally, homeowners must live in the home that is being foreclosed on. The GSE Mortgage Relief Program is not available to investors or landlords. If you think you meet the eligibility requirements for the GSE mortgage relief program, dont hesitate to contact your mortgage servicer for more information.

Also Check: Do You Have To Pay Taxes On A Reverse Mortgage

Rbc Royal Bank Mortgage Affordability

Before you get a mortgage from RBC, it is important to know how RBC calculates your mortgage affordability. RBC takes into account the following factors:

- Your household income

- Your down payment

- Your monthly debt payments to loans and lines of credit including credit cards, car loans, student loans, and leases.

If your down payment is less than 20%, RBCs mortgage affordability calculator also considers your mortgage insurance premiums. Unlike some other mortgage affordability calculators, RBCs mortgage affordability calculator does not take into account your location for property taxes and utility costs.

RBC calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of 32% and a maximum total debt service ratio of 40%. These ratios are more strict than CMHC regulations, but you may still be able to get a mortgage with RBC even if you exceed these limits.

Another factor in determining your mortgage affordability is your down payment. According to RBC, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

Do Mortgage Companies Check Your Details With Hmrc

Yes, they can. The HMRC Mortgage Verification Scheme is being used more and more by lenders. The scheme aims to tackle mortgage fraud by allowing lenders to contact HMRC and check if the numbers on your application match their records.

However, if you’re a freelancer or contractor, this scheme could cause problems if you use your gross contract rate when applying for a mortgage with a company that doesn’t have the expertise of dealing with contractors. Youll need a specialist mortgage broker if youre looking to apply for a contractor mortgage. For more information on contractor mortgages, have a look at your Mortgages for Contractors page.

Don’t Miss: What Is A Modified Mortgage

Other Mortgage Requirements Changes Worth Knowing In 2022

There were some important changes that could affect your mortgage application in 2022.

New condo and co-op rules. After the collapse of a poorly maintained condo complex in 2021, Fannie Mae added additional requirements that bars any loans for condominium or cooperative units with significant deferred maintenance. The new requirements may result in additional hoops to jump through for condo or co-op buyers.

Self-employed borrower documents. Besides standard tax return requirements, self-employed borrowers will need to provide three months worth of business account statements, plus a profit and loss statement as additional proof of year-to-date earnings.

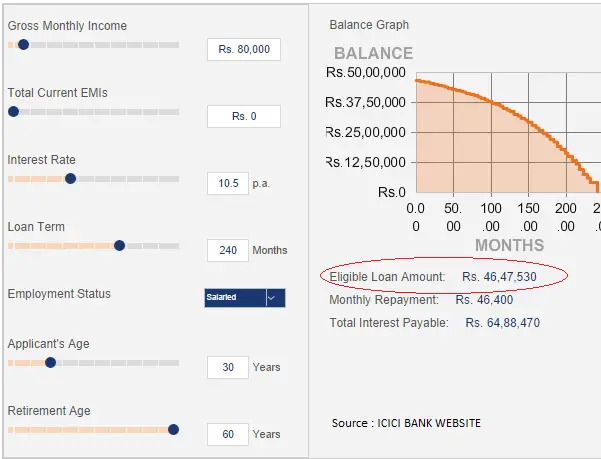

Calculate Eligibility For Home Loan

Using a Home Loan Eligibility Calculator is certainly one of the easiest ways to determine eligibility for a home loan. Lending institutions consider several factors such as monthly salary, loan repayment tenor, other source of monthly income, any other obligation and EMIs payable besides other basic information. With a housing loan eligibility calculator, one can quickly set the values or inputs to these fields and check their eligibility without any hassle. It will help buyers to make an informed choice and avoid loan application rejections, which can otherwise affect their credit behaviour and CIBIL score negatively.

Also, with the easy-to-use home loan eligibility calculator, you can avoid applying for a loan at multiple lenders.

Recommended Reading: Will Mortgage Rates Stay Low