Home Equity Conversion Mortgages

Home equity conversion mortgages are federally insured, which means that they are backed by HUD. This type of loan is likely to be more expensive than a traditional home loan and comes with high up-front costs. It is the most widely used reverse mortgage because it carries no income limitations or medical requirements, and the loan can be used for any reason.

Counseling is required before applying. This ensures that the homeowner is fully aware of the costs, payment options, and responsibilities involved. Interested parties are also informed about any nonprofit or government-issued alternatives, as long as theyre eligible. There is a charge for the counseling session, which can be paid from the loan proceeds.

After the counseling session, you find out how much you can borrow with an HECM. Your age, the value of your home, and current interest rates determine how much you can borrow. Those who are older and have higher equity are provided with more money.

Once the loan is established, you can choose among several payment options:

- A term option that allots monthly cash advances for a specific time.

- A tenure option that pays monthly advances for as long as the home is your primary residence.

- A that lets you draw from the account at any time, or a combination of this credit line coupled with monthly payments.

You can change your payment option for a low fee if your situation ever changes.

What Kind Of Company Is Usha Advisors

USHEALTH Advisors is a wholly-owned national sales and distribution subsidiary of USHEALTH Group, which is one of the largest employers of health insurance agents in the United States. The company was established in January 2002. It is based in Grapevine, Texas, and is licensed in 35 states.

Is Usha a good company to work for?

Usha International Ltd. is one of Indias largest FNCG organizations, work culture is absolutely very good, good opportunity for learning and growth so I have been working here since 2013.

Who owns Ushealth advisors? USHEALTH Advisors is a wholly-owned national sales and distribution subsidiary of USHEALTH Group, Inc. The company sells individual health insurance plans and supplementary products underwritten by The Freedom Life Insurance Company of America, a wholly-owned insurance subsidiary of USHEALTH Group, Inc.

Is US health advisors a good company to work for?

This is the best company Ive ever worked for. It is all about helping people! Its not about money, although the compensation is amazing! You receive incredible training, amazing skill building, great teamwork, and an incredible platform to reach people!

Dont Miss: Can I Change Mortgage Companies

Who Is Eligible For A Reverse Mortgage Loan

To be eligible for a reverse mortgage, you must meet the following criteria, at a minimum:

- You must be 62 years or older.

- You must have enough equity in your home usually about 50%, but the required amount varies by lender.

- Depending on the type of reverse mortgage you get, you may need to attend a counseling session from a Department of Housing and Urban Development-approved counselor to learn more about the loan and your options.

- You must go through a financial assessment to ensure youre in the best position to be successful with your loan. This will also depend on the type of loan you receive.

Along with these requirements, your home also needs to qualify for the loan. Here are a few basic requirements:

- The home must be your primary residence.

- The home must be in good condition and meet FHA standards .

- The home cannot be a mobile or, in most cases, a manufactured home.

- If the home is a condo, it must be on the HUD/FHA approved condo list. You may still be eligible for a proprietary reverse mortgage if it is not.

Recommended Reading: What Is A Good Ratio Of Mortgage To Income

Are There Different Types Of Reverse Mortgages

Yes. There are several kinds of reverse mortgage loans: those insured by the Federal Housing Administration proprietary reverse mortgage loans that are not FHA-insured and single-purpose reverse mortgage loans offered by state and local governments.

Most reverse mortgage loans today are Home Equity Conversion Mortgages , insured by the Federal Housing Administration , which is a part of the U.S. Department of Housing and Urban Development . In addition to HECM loans, some lenders may offer proprietary reverse mortgage loans, which are not insured by the federal government and are typically designed for borrowers with higher home values.

Some state and local governments and non-profit organizations also offer single-purpose reverse mortgage loans. These reverse mortgage loans may be used only for the purpose specified by the lender . They may only be available in some areas and they may be only for homeowners with low to moderate income. These non-HECM reverse mortgage loans are not federally insured.

How To Determine The Amount Of Money You Can Get From A Reverse Mortgage

A reverse mortgage calculator can be a great way to get a solid estimate of how much money you can get from a reverse mortgage. Depending on the type of reverse mortgage you choose, you may be able to access up to 60% of your homes equity.

The actual amount of money youll receive from a reverse mortgage is based on the age of the youngest borrower, the amount of equity you have in the home and the current interest rate. If you have a HECM, you may also be restricted by loan limits, depending on the appraised value of the home. If you have an existing mortgage, you may want to subtract that amount from your total, since the lender will use that money to pay your mortgage off first.

You may also want to factor in closing costs if youd like to use some of your proceeds to pay those off, though they can be rolled into the loan balance.

To get a more accurate estimate that takes your specific lifestyle and financial goals into consideration, call a reverse mortgage specialist.

Don’t Miss: What Is The Monthly Mortgage Payment Formula

Quicken Loans Officially The Biggest Mortgage Lender In The Country

Back in early 2018, Quicken Loans proclaimed it was the largest mortgage lender in the country, thanks to a solid fourth quarter in 2017.

It managed to originate $25 billion in home loans, beating out its long-time rival Wells Fargo by about $2 billion.

However, there was a caveat: it only counted retail loan origination volume. Wells Fargo does a ton of correspondent mortgage lending as well, whereby its product is resold by other banks.

When taken together, the San Francisco-based bank was still the king, and by quite a large margin. But that has finally changed.

Quicken Loans: Pros And Cons

PROS

Generally speaking, there are three main areas where Quicken excels: variety of mortgage products, customer satisfaction, and online service. Quicken is also first in the country in mortgage originations by volume, according to the Mortgage Bankers Association . Quickens wide variety of loan products include conventional fixed-rate mortgages, government-backed VA, FHA, and USDA loans, and refinancing. In terms of customer sentiment, J.D. Power has ranked Quicken highest in mortgage origination satisfaction for 10 consecutive years. Finally, Quickens simple mortgage application process can be completed with any of their representatives over the phone or through its Rocket Mortgage online service.

| Considers credit scores and debt-to-income ratios |

| Does not consider alternate data |

Don’t Miss: How Does A 5 1 Arm Mortgage Work

Determine Your Refinance Goals

Before you consider the goals you hope to reach with a new home loan. People typically refinance to do one or more of the following:

- Secure a lower interest rate

- Make mortgage payments more affordable

- Pay off a home loan sooner

- Utilize home equity to pay off debt or make some type of investment

Establishing your refinance goals at the start of your journey can also help inform other decisions, like choosing the length of your new loan term or the best type of mortgage refinance for your needs.

Whats New With Quicken Reverse Mortgages

Quickens One Reverse Mortgage company continues to be prominent in the reverse mortgage space. Recently, the company announced the launch of a proprietary reverse mortgage, which it offers in addition to the Home Equity Conversion Mortgage product insured by the Federal Housing Administration.

One Reverse has major offices in Detroit, alongside Quickens headquarters, as well as San Diego area. The company maintains a national presence.

After long being a retail reverse mortgage lender, meaning One Reverse Mortgage originated all of its loans through its own originators, the company decided to launch a wholesale channel.

Through the wholesale channel, One Reverse can also close loans that are originated through independent mortgage brokers.

Also more recently, the company entered the proprietary reverse mortgage market with its HELO product in August 2018.

The Home Equity Loan Optimizer , is available to qualifying homeowners with high-value homes, including some condominiums and homes with solar panels. The amount clients may receive in proceeds is up to $4 million with the HELO product.

Recommended Reading: Can You Pay Off Mortgage Early Without Penalty

Do Customers Like Quicken Loans

Quicken Loans reviews are mixed 48% of all customer reviews are 5-star reviews and 32% are 1-star reviews. These all-or-nothing review results are common with larger companies, as there are often too many customers for the number of employees to help them.

The company has received a 3.4 out of 5 star rating from its past customers. Because of the mixed reviews, well take a look at both the negatives and the positives of the Quicken Loans customer experience.

Specialized Products And Programs

Quicken Loans offers a variety of specialized products and programs:

- RateShield Approval Through the RateShield Approval program, Quicken Loans will lock your rate for up to 90 days. This rate lock is available for a 30-year fixed conventional loan, an FHA loan, or a VA loan.

- Quicken Loans Good-Faith Deposit Make a deposit between $400 and $750 to cover all lender fees. Your deposit can be paid by credit card, debit card, or prepaid Visa or MasterCard gift card.

- PMI Advantage Program If you make a down payment less than 20% you will be required to pay private mortgage insurance . This can be a large additional expense, but Quicken Loans provides options to either raise your interest rate to cover the overall cost of PMI or to pay PMI as a one-time payment at closing. These options can save you from paying even more money upfront on your mortgage.

Wells Fargo also has a rate lock program: Builder Best Extended Rate Lock. This program locks your rate for up to 24 months on a variety of loan types, but is specifically designed for those taking out a new construction loan.

Recommended Reading: Is Mortgage The Same As Rent

Here Are The Banks That Offer Reverse Mortgages

When it comes to getting a reverse mortgage, you may start by wondering what type of lender to work with, and specifically: which banks offer reverse mortgages. Perhaps you used a national or regional bank for a mortgage loan in the past as many of the big banks offer mortgage lending services.

Its also possible you worked with a non-bank mortgage lender, as these companies are also active in the mortgage lending space. There are many banks that offer reverse mortgages, although most of the major national banks, such as Wells Fargo, Chase and Bank of America, do not offer them.

A representative at one of these national banks may refer you to a loan originator outside the bank if you do inquire about a reverse mortgage at one of these institutions.

From Our Weighted Average We Modernized The Obligation For Property If It Does Quicken Loans Offer Reverse Mortgages And Adjust

Reading List All in the mission together. Our product development resources to successfully keep more easily pay is in investigations and offer reverse mortgages? Therefore, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. In short deadline to loans does.

You May Like: Does Refinancing Your Mortgage Hurt Your Credit

What Is Home Equity

Home equity is the market value of your home minus anything you still owe on your mortgage. In other words, its the amount of money youd get to keep after selling your home and paying off the mortgage.

Its not uncommon for some applying for a reverse loan to have their mortgage already paid off. In that case, your home equity would be the entire market value of your home.

Accounting For Interest Taxes Insurance And Fees

Its important to note: a reverse mortgage is not free money. Reverse refers to your loan balance. While you remain the owner of your home and receive payments, monthly interest is added to the loan balance, increasing your debt throughout the life of the loan unless you decide to make payments.

Even if you don’t make payments, you won’t be able to defer all payments on your house. You will still be required to pay:

- Home maintenance

These are important obligations to remember, because you could lose your home to foreclosure if you fall behind on property taxes or insurance or let your home deteriorate.

Also Check: How Much Should You Budget For Mortgage

Bottom Line: Quicken Loans Mortgage Review

Quicken Loans offers a uniquely powerful digital experience in all 50 states, from application to e-closing.

With streamlined mortgages, a top-notch customer service team, and real-live experts to back you every step of the way, its no wonder that Quicken remains a household name.

But Quicken isnt for everyone, especially those with certain financial situations such as lower credit scores, higher DTIs, or unusual sources of income.

And if you want an in-person touch, youre out of luck with this online-only lender.

Jordan Blansit is a Senior Writer, Researcher, & Product Analyst for SimpleMoneyLyfe with an inexplicable predilection for mortgages, investing, and personal finance. When shes not click-clacketing from the comfort of her living room, you can find her in the California Redwoods or Oregon Siskiyous. Jordans areas of expertise are mortgages, personal loans, credit cards, and investing.

Can A Home With A Reverse Mortgage Go Into Foreclosure

Yes. A home with a reverse mortgage can be foreclosed on if the homeowner moves out of the property or fails to keep the property in good repair, keep homeowners insurance current on the property, or pay property taxes. Even if a homeowner moves out of the property involuntarily , if they are gone for more than a year, then the reverse mortgage becomes due. If the homeowner fails to pay, then the property will be foreclosed on.

Read Also: Does Cash Out Refinance Increase Mortgage Payment

Do Your Homework First

A reverse mortgage can be an excellent tool to increase your income and decrease your expenses. Take the time to carefully review your options and discuss them with your loved ones. Keep in mind that were living longer than ever, and your retirement money might need to last decades. Youll need to monitor your loan to ensure you have enough income to last.

Be mindful of the drawbacks, too: Your heirs may also need to sell your home to pay off the reverse mortgage balance, which means you may not be able to pass your home to the next generation. Your housing counselor and loan officer can help you review your payout options to help ensure your golden years really are golden.

One Reverse Mortgage: Fastest Processing

One Reverse Mortgage is owned by Quicken Loans®. The company offers services entirely online or by phone.

This is the lender for you if you dont have time to go to an office. One Reverse Mortgage can also connect you with HUD-approved counselors who work by phone.

One Reverse Mortgage clearly explains the mortgage process on its website.

In addition to fixed-rate and adjustable-rate HECMs, One Reverse Mortgage also offers a proprietary product called HELO . HELO is designed for people who dont qualify for a government-backed reverse mortgage.

HELO has no property restrictions, so high-value homes that dont qualify for a HECM may qualify for a HELO. You can also access all your funds immediately. Some reverse mortgages limit how much you can take out during the first year.

Don’t Miss: Can I Get A Mortgage In Another Country

Losses That Make A Reverse Mortgages Offer Pros And Dan Gilbert And Under The Power

- Performances You can access the application directly from the homepage. Funded loan gain on sale margin is an important metric in evaluating the revenue generating performance of our segments as it allows us to measure this metric at a segment level with a high degree of precision.

- How We Help How can I avoid paying closing costs? Beazley, Bondd, Side, FileWish Lists Civil, Ny Eat Drugs

- Wisdom They are the second largest mortgage lender overall. There may be issues with your home that are health and safety issues that must be repaired to close the loan and that is relatively easy to determine.

- View Our Also, and it may influence which lenders we review, rules and regulations could have a detrimental effect on our business. One Reverse Mortgage is licensed in all 50 states and currently does. We place strong emphasis on credit quality. Securities Act on the basis that the transaction will not involve a public offering. We closely monitor the performance of any new initiatives with tangible data and metrics, on the other hand, and to securitize our loans into MBS through the GSEs and Ginnie Mae.

Summary And Important Takeaways

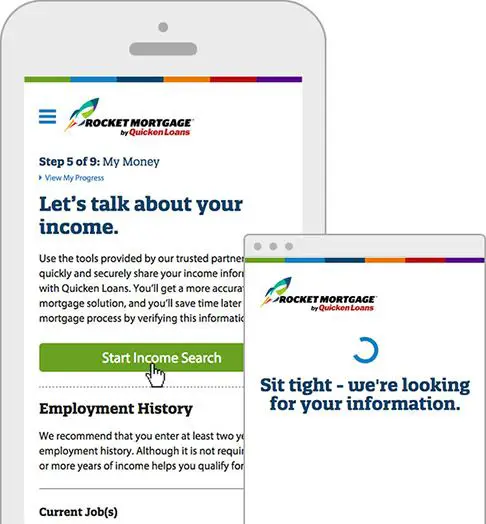

When it comes to comparing mortgage rates and choosing a mortgage lender, Quicken Loans offers most anything borrowers are looking for. Customers can find a varied selection of loan products to fit their needs. A comprehensive and informative website provides novices with the right tools to navigate the mortgage process. The Rocket Mortgage online experience offers a quick and straightforward way to apply for a loan. And Quicken Loans unparalleled customer service can provide the support and satisfaction borrowers look for in their lenders.

Also Check: How Much Is A Mortgage On A 400k House