Other Requirements For An Fha Loan

To qualify for an FHA loan, you must be purchasing the home for your own use as a primary residence. You may have non-occupant co-signers, such as your parents, to help you qualify.

You can use an FHA loan to buy a multi-unit property of up to four residences, as long as one of the units is for your own use as your primary home.

You must be 18 years old or older, be able to document steady employment and have at least two years with the same employer or running the same business.

As far as income, your debt-to-income ratio matters more than how much you earn each year. For an FHA loan, lenders generally want your total debt payments your FHA loan and all other payments on debts to be no more than 41 percent of your gross monthly income, though they may go as high as 50 percent for borrowers with excellent credit. Lower limits may be applied to borrowers with poor credit.

Your debts include payments on any money you have borrowed credit cards, auto loans, personal loans, etc. Your mortgage debt includes any expenses included in your mortgage payments, such as homeowners insurance, property taxes and mortgage insurance.

Before you can be approved for a loan, FHA requirements specify that the home must pass an inspection to ensure it is safe for habitation. Thats a step beyond the appraisal required for a conventional mortgage, which merely determines if the value of the home is enough to support the loan.

You May Like: Which Bank Is Best For Construction Loan

How Lenders View Student Loan Debt

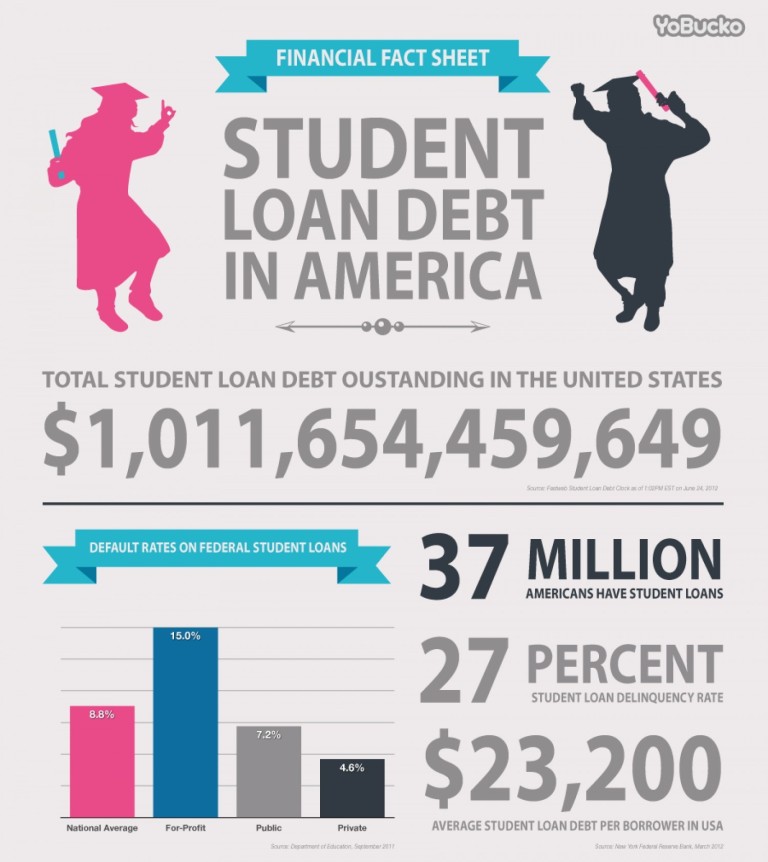

Bogged down by student loans? Youre far from alone.One in four Americans with a bachelors degree or higher has student debt, the Census Bureau reports. Collectively, borrowers in America owed $1.58 trillion in federal student loans at the end of 2021, according to the New York Federal Reserve.Student loan debt can affect your ability to qualify for a mortgage loan. Why? Because student debt impacts your debt-to-income ratio, or DTI.

What To Include In Your Dti Math

There are two types of DTI ratios back end and front end. Your back-end DTI ratio includes payments you make on all of your loan obligations, including your credit cards, housing payment and auto loan, as well as any other legally obligated payments, such as alimony and child support. Mortgage lenders focus on your back-end DTI.

The front-end DTI ratio provides a less complete picture of your finances. It only includes the ratio of your housing payment to your income.

Also Check: Will 15 Year Mortgage Rates Drop

How To Roll Student Loans Into Mortgage

If you do the math and determine that rolling your student loans into your mortgage is the right move for you, you have a few options:

- Fannie Mae Student Loan Cash-Out Refinance: While traditional cash-out refinance programs allow you to access cash to utilize for a number of purposes, this program is solely geared toward using that money to pay off your student debt. At closing, the money will go directly to the servicer of your student loan, and the entire loan must be paid back, not just a portion of it. You might receive some cash, too, but its limited to no more than 2 percent of the new loan, or $2,000, whichever is less.

- Cash-out refinance: You can also consider a standard cash-out refinance, which will allow you to access additional funds. You can contribute some toward your student loans and use the rest for other reasons, such as renovating your home or paying off high-interest credit card debt . Be sure you understand how a higher monthly mortgage payment and a lower student loan payment would impact your monthly budget.

- Home equity line of credit: A HELOC home equity line of credit is also an option for rolling your student loans into a mortgage. With this option, youll borrow against your homes equity to get the funds that will then go toward your student debt. Consider this option carefully HELOCs typically have variable rates, so the interest could increase, negating any headway you might be making.

What’s Included In Your Debt

Your student loan debt likely has an effect on your debt-to-income ratio , another number lenders use when determining whether to lend you additional money.

Your DTI is calculated by dividing all your monthly debt payments by your total monthly income. The more debt you have, the higher your DTI and the less likely you are to be approved for a mortgage.

Many lenders prefer your DTI to be below 36 percent, but you may be able to get approved for government-backed mortgages, like those from the Federal Housing Administration, with a DTI of up to 50 percent.

If you’re looking to decrease your DTI to qualify for a mortgage, you can either increase your income through a second job or a raise, or focus on lowering your debt. Before applying for a mortgage, try to pay down as much of your existing debt as possible and make sure you don’t add to your overall debt.

Read Also: How Do Mortgage Appraisals Work

Do You Have Questions About Qualifying

How Are Student Loan Payments Calculated For A Mortgage

If you are in a typical student loan situation, with simple payments of $x per month, that is the amount that will be included in your debt-to-income ratio.

But, increasingly, not everyone fits into that simple model. For example, you may have some kind of IBR based payment plan. These plans base their payments on your income, in other words, your ability to pay. That rate is reevaluated each year to determine the next years payment due.

Unfortunately, this causes a challenge for the underwriters considering your loan application. Some mortgage loans allow IBR-based payment amounts to be counted for your debt-to-income ratio calculation. Many, however, count the full amount you would normally be paying in your DTI ratio, even though you are not required to pay that amount.

This article talks about each of the different loan types and how this rule applies to that type of loan.

Now, lets get back to the question we started with:

Read Also: How To Become A Mortgage Loan Officer In California

Make A Plan Accelerate Debt Payments And Be Prepared To Wait

If education debt is making your debt-to-income ratio too high, consider looking for ways to pay off your student loans faster. Theres no penalty for prepaying student loans, so you can make extra payments anytime.

To achieve this, youll either need to find room in your budget through saving or making extra income. Small lifestyle changes could help you free up more of your monthly income. Alternatively, you could find a part-time job or start a side hustle for some extra cash. Driving for Uber, walking dogs in your neighborhood or finding freelance work online are all options for boosting your income.

Although lending rules can sometimes feel burdensome, they are there to protect you from taking on debt you cant afford to pay back. Spending a few more years getting your student loans or other debts paid down could allow you to qualify for a lower interest rate or higher mortgage amount in the future.

Plus, once you have a better credit score and longer employment history, you will even have more options when youre finally ready to take the leap into homeownership.

Should You Pay Off Your Students Loans Before Applying For A Mortgage

You can get a home loan with student loans. But should you?

As a student loan borrower, it can be difficult to know the best path forward. Should you pay off your student loans? Or should you apply for a mortgage with student loans on the books?

Here are some things to consider as you make this decision.

Don’t Miss: Why Get An Adjustable Rate Mortgage

Refinance Your Federal And Private Student Loans

Refinancing your federal and private student loans can be a useful option. If you can unlock a lower interest rate through a refinance, that could lead to a significantly lower monthly payment.

Refinancing private student loans with a lower interest rate is an easy decision. But when it comes to federal student loans, there are more factors to consider.

If you refinance federal student loans, you may lose access to income-driven repayment programs and any federal student loan forgiveness plans. Before moving forward with a refinance, make sure to research all of your options.

Calculating Your Debt To Income Ratio

The entire student loan debacle is being caused by confusion around how your debt to income ratios are calculated.

Your debt to income ratio is calculated as your proposed housing payment plus your monthly liabilities from your credit report, as a percentage of your gross income.

When using a Fannie Mae or Freddie Mac Conventional loan, the total housing payment plus monthly liabilities cannot exceed 50% of your gross income, or a 50% DTI.

Borrowers using an FHA mortgage have 2 DTI ratios. A front-end debt to income ratio is your housing payment as a percentage of your income. A back-end debt to income ratio includes your monthly liabilities from your credit report.

FHA will allow your housing payment to be as high as 46.99% front-end DTI, and a maximum 56.99% back-end DTI including your debts.

Student loans become confusing when no payment is reported on your credit report, or when your payment is an Income-Based Repayment payment.

Read Also: Who Is In The Rocket Mortgage Commercial

What Makes Debt Bad

In a nutshell, bad debt is borrowing money to pay for something that diminishes or drops in value over time.

Auto loans: Not only does potentially high interest add to the total amount of principal borrowed, but the car you bought is usually a depreciating asset. In this case, buying a car via an auto loan might just be adding extra interest costs on top of the maintenance, insurance and gas that normally add to the ongoing price of the car.

This can be a good form of revolving debt but might become bad if you let your balance build up, making the interest unmanageable. Although some cards come with rewards and perks, they may or may not be worth it if you end up paying a bundle in interest.

Payday loans and cash advances: Other debt like these products often come with insanely high interest rates that can eat your budget up alive. Likewise, big-ticket purchases that need to be financed like luxury items you dont need can be considered bad debt since they dont appreciate in value.

Debt is only bad when it becomes unmanageable, out of your budget and you can no longer pay it, said Tayne. It can also include debts that simply dont make sense or debt you didnt even intend to take on.

Mortgage Options For Homebuyers With Student Loans

If you have student loans, there are multiple mortgage programs you might qualify for.

- Fannie Mae HomeReadyloan A low-down payment option for lower-income borrowers, with cancellable mortgage insurance

- Freddie Mac Home Possible loan A similar low-down payment option for lower-income borrowers, with the flexibility to apply sweat equity toward the down payment or closing costs

- FHA loan Backed by the Federal Housing Administration and requires a down payment of just 3.5 percent

- VA loan For active-duty and veterans, with no down payment or mortgage insurance required

- USDA loan For borrowers in so-called rural areas you can check eligibility through the USDA website

Recommended Reading: How Does Co Signing A Mortgage Work

Should You Pay Off Debt Or Save For A Down Payment

The third major area to consider when applying for a mortgage when you have student loan debt is how that debt impacts your overall savings.

When you’re in the process of reducing your debt, a portion of your monthly income goes towards paying down your loans, which is money that might otherwise go toward saving for a down payment on a home.

Generally, having about 20 percent of the home’s purchase price saved for a down payment helps you get approved for a mortgage. However, there are ways around this, such as turning to the Federal Housing Administration and the U.S. Department of Veterans Affairs for mortgages that require smaller down payments.

Ultimately, it is possible to get a mortgage if you have student loan debt, but it may be harder. Consider the different factors outlined above and evaluate for yourself whether buying a home while still paying down debt is right for you.

Take Advantage Of New Fannie Mae Guidelines

In 2017, Fannie Mae had some changes to the way it looks at student loan debt. These changes are specific to people paying back student loans through an income-driven repayment plan. Here are the new guidelines, according to Fannie Mae:

- If the borrower is on an income-driven payment plan, the lender may obtain student loan documentation to verify the actual monthly payment is $0. The lender may then qualify the borrower with a $0 payment.

- For deferred loans or loans in forbearance, the lender may calculate

- a payment equal to 1% of the outstanding student loan balance , or

- a fully amortizing payment using the documented loan repayment terms.

Before 2017, lenders were instructed to always use 1% of the student loan balance when determining a buyers DTI instead of the actual student loan payments borrowers were making. For example, if you had $90K in student loan debt, a monthly student loan payment of $900 would be added to your DTI calculation, even if your payment was only $100 .

That difference was enough to push many borrowers DTIs beyond what was acceptable to lenders. The new guidelines should make it much easier for those on income-driven repayment plans to qualify for a mortgage loan.

Don’t Miss: What’s The Monthly Mortgage Payment

What Mortgage Loan Option Is Right For Me

Ultimately, if youre shopping for a home and have student loan debt, it’s always a good idea to talk to a lender. According to a 2015 study by Zillow, the relationship between student loans and homeownership is seemingly nonexistent. So student loans should be nothing to stop you. No matter how close you are to buying a home, at Better Mortgage our non-commissioned loan experts can help shine a light on your best path to homeownership. In as little as 3 minutes, Better Mortgage will show you how much youre likely to be approved for and match you with a loan consultant to talk through your options.

What To Look For In A Mortgage When You Have Student Loans

First, look at how much you currently pay for rent and how much you have left over each month. You want to make sure you can comfortably balance the new mortgage with your current student loans.

Your mortgage should never be more than your rent, unless you still have hundreds of dollars left over every month. Owning a house comes with extra costs that renters dont have to worry about. If the fridge breaks when youre a renter, the landlord is responsible for fixing it. If the fridge breaks when youre a homeowner, its all on you.

Go through your budget and see how comfortable you are with your finances. Is it ever stressful making rent? Do you wish you had more money each month for retirement or other goals? If so, consider applying for a mortgage thats less than your rent.

Most mortgages come in either 15 or 30-year terms. A 15-year mortgage has a lower interest rate and higher monthly payments. Some experts say you should always choose a 15-year mortgage because youll save tens of thousands on interest.

For people with student loans, flexibility may be more important than saving on interest. A 30-year mortgage will have a lower monthly payment, allowing you to pay extra on the mortgage if you can afford it or put any leftover funds toward the student loans.

Borrowers also need to decide what kind of down payment they can afford. FHA loans have a 3.5% minimum down payment, while conventional loans have a 5% minimum.

Don’t Miss: How Big A Mortgage Can I Get

Pay Off Your Other Debts

The most effective way to lower your DTI ratio is to pay off some of your outstanding debts. Each time you eliminate a debt from your balance sheet, you can reclaim that piece of your monthly budget. With an increased amount of free cash flow, youll lower your DTI.

Although paying off debt is easier said than done, consider tackling your smallest liability. Even eliminating one relatively small debt can make a big difference in your DTI.

Increase Your Credit Score

Your also plays a big role in your mortgage application, because lenders use it to evaluate how risky you are as a borrower. A higher score will typically mean an easier approval process and, more importantly, a lower interest rate on your loan.

Making consistent, on-time student loan payments is a good way to build credit and increase your score. You can also:

- Lower your credit utilization rate. Your credit utilization rate is essentially how much of your total available credit youre utilizing. The less youre using, the better it is for your score. Credit utilization accounts for 30 percent of your total score, and the easiest way to lower your rate is to pay down outstanding debts.

- Pay your bills on time. Payment history is another 35 percent of your score, so make sure to pay every bill on time, every time. Set up autopay if you need to, as late payments can send your score plummeting.

- Keep paid-off accounts open. The length of your credit history matters, too, accounting for 15 percent of your score. Leaving long-standing accounts open can help you in this department.

- Avoid new credit lines. Dont apply for any new credit cards or loans as you prepare to buy a home. These require hard credit inquiries, which can have a negative impact on your score.

Finally, make sure to check your credit report often. If you spot an error or miscalculation, report it to the credit bureau immediately to get it remedied.

Recommended Reading: What Do Mortgage Points Cost