Does Paying Off My Mortgage Affect My Homeowners Insurance

Whether your home is paid off or you owe money on it, your homeowners insurance policy will cost the same. By law, you arent required to have homeowners insurance if your home is paid off, but not having insurance is a horrible idea. Your home is your largest asset, and you want to make sure its protected.

Recap Of Ways To Pay Off Your Mortgage Faster

If you decide you want to pay off your mortgage early, ask your mortgage lender about:

Whatever you choose, make sure youve weighed all your options to find the best use for your hard-earned cash.

Send Payments As Principal Payments

Send in your extra payments separate from your regular payment and clearly designate them to apply to principal only. This will ensure your extra payments are not credited to unearned interest. Combining the payments can cause confusion for the servicer, particularly when you send it in for the first time. Keep copies of your checks, or records of your online payments. Track your extra payments using a payment calculator.

Tip

Use an online mortgage calculator that allows you to enter periodic or regularly occurring extra payments download it into your favorite spreadsheet program.

Round up your mortgage payment to the nearest $100. This little bit by itself can help shave months off your mortgage.

Refinance into a lower interest-rate mortgage, but keep making the old, higher payment amount to further accelerate your loans payoff date.

Warning

Making extra payments when they are not required can be challenging. Some people procrastinate sending the extra payment, even though it is within their budget. Refinance into a 10-year mortgage to force yourself to pay the extra money.

References

Also Check: Why Does My Mortgage Payment Keep Going Up

Should I Pay Off My Mortgage Or Invest

Investing is one way to raise money for a lump-sum payment. For example, you can invest your money in a tax-free savings account . Then pay a lump sum once your investment grows. Compare rates on your potential investment and your mortgage. If investing offers a higher rate of return than your mortgage, put your money in an investment and watch it grow. If not, put a lump sum on your mortgage instead.

Disadvantages Of Paying Off Mortgage Early

- Less money for higher-interest debt. If you have credit card or student loan debt, funneling your extra cash toward paying off your mortgage early can actually cost you in the long run. This is because these other types of debt likely have higher interest rates.

- Less money for savings. Putting all of your money toward your mortgage can also cut into what you can set aside in savings. If youâre going to focus on paying off your home loan early, itâs a good idea to make sure you have an adequate emergency fund first. Itâs usually recommended to save up enough to cover three to six monthsâ worth of expenses so you can manage any unexpected costs without having to go into debt.

- Could miss out on higher returns from investing. If you have the opportunity to invest your money for returns that are significantly higher than your mortgage rate, youâd be better served doing that than missing out on compounding earnings to get rid of your mortgage faster. For example, if your mortgage rate is 3.5% and your portfolio earns an average of 6% per year, youâd lose money by using extra funds to pay off the loan early.

Don’t Miss: What Of Salary Should Go To Mortgage

You Have No Other Savings

When unexpected expenses pop up, you want to be able to pay for them. That could mean replacing a flat tire on your car or paying a doctors bill when you get a bad case of the flu.

To make sure you have enough cash savings to cover these costs, start building an emergency fund. A fund worth at least six months will go a long way, though you probably need more if you have dependents.

How To Pay A 30 Year Mortgage In 10 Years

This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.There are 15 references cited in this article, which can be found at the bottom of the page. This article has been viewed 96,655 times.

A mortgage is often the largest loan an individual will take out over the course of their lives, and due to this, the interest costs over time can be staggering. One sure way to reduce these costs is by paying off a mortgage early. This reduces total interest costs substantially by reducing the term of the mortgage and therefore the length of time interest needs to be paid. While there are a few options available to pay your mortgage off early, the first question that needs to be answered is whether paying off a mortgage early is financially sound or not. Contrary to popular opinion, paying off a mortgage early is not always the best choice.XResearch source

Don’t Miss: What Mortgage Can I Get For 2000 Per Month

Losing The Benefits Of Interest Deductions

Before deciding to pay off a mortgage early, it would be a good idea to weigh the pros and cons. The interest charged on up to $750,000 of mortgage debt used to purchase a principal residence can be used as a deduction on taxes in the year that it is paid. Because most of the monthly payments in the early years of a loan are interest, this can really add up. The mortgage interest deduction to homeowners is a very popular subsidy. However, the benefit would be lost if the mortgage is paid off early. In years gone by interest paid on home equity loans or HELOCs was tax deductible, but that is no longer the case in 2018, as equity debt is no longer treated like mortgage debt unless it is obtained to build or substantially improve the homeowner’s dwelling.

What Happens If I Pay An Extra $1000 A Month On My Mortgage

Paying an extra $1,000 per month would save a homeowner a staggering $320,000 in interest and nearly cut the mortgage term in half. To be more precise, it’d shave nearly 12 and a half years off the loan term. The result is a home that is free and clear much faster, and tremendous savings that can rarely be beat.

Read Also: Are House Taxes Included In Mortgage

Not Putting Extra Payments Towards The Loan Principal

Throwing in an extra $500 or $1,000 every month wont necessarily help you pay off your mortgage more quickly. Unless you specify that the additional money youre paying is meant to be applied to your principal balance, the lender may use it to pay down interest for the next scheduled payment.

If youre writing separate checks for extra principal payments, you can make a note of that on the memo line. If you pay your mortgage bill online, you might want to find out whether the lender will let you include a note specifying how additional payments should be used.

Should You Pay Off Your Mortgage Early

Whether you should pay your mortgage off early depends on many factors, including the interest rate of your current loan and your personal risk tolerance.

Start by considering the opportunity cost. If you repay your mortgage ahead of schedule, youre putting money into the mortgage when you could have used those funds for other financial priorities. Youll save on interest, of course, but if you invested the extra payments elsewhere instead of putting them toward your mortgage, you might find youd have earned a higher return.

On the other hand, if you know youre likely to spend that extra money if you dont put it toward your mortgage, making additional payments can be a good idea. The peace of mind that you get from owning your home mortgage-free can also be worthwhile, and is important to consider.

Also, think about how much cash you have available for emergencies. You dont want to tie all of your money up in your home and have no way to access it quickly if you encounter a crisis.

Ultimately, with mortgage rates still low, its generally better in the long run to hold a mortgage with a low rate now and to invest your extra cash. Still, you can check Bankrates mortgage payoff calculator to see how much you can save by settling your mortgage early if youre set on doing so.

Recommended Reading: What Is Better Fixed Or Adjustable Rate Mortgage

Mortgage Payoff Calculator Terms & Definitions

- Principal Balance Owed The remaining amount of money required to pay off your mortgage.

- Regular Monthly Payment The required monthly amount you pay toward your mortgage, in this case, including only principal and interest.

- Number of Years to Pay Off Mortgage The remaining number of years until you want your mortgage paid off.

- Principal The amount of money you borrowed to buy your home.

- Annual Interest Rate The percentage your lender charges on borrowed money.

- Mortgage Loan Term The number of years you are required to pay your mortgage loan.

- Mortgage Tax Deduction A deduction you receive at tax time on the interest you pay toward your mortgage.

- Extra Payment Required The extra amount of money youll need to pay toward your mortgage every month to pay off your mortgage in the amount of time you designated.

- Interest Savings How much youll save on interest by prepaying your mortgage.

You May Like: Does Mortgage Modification Affect Credit Score

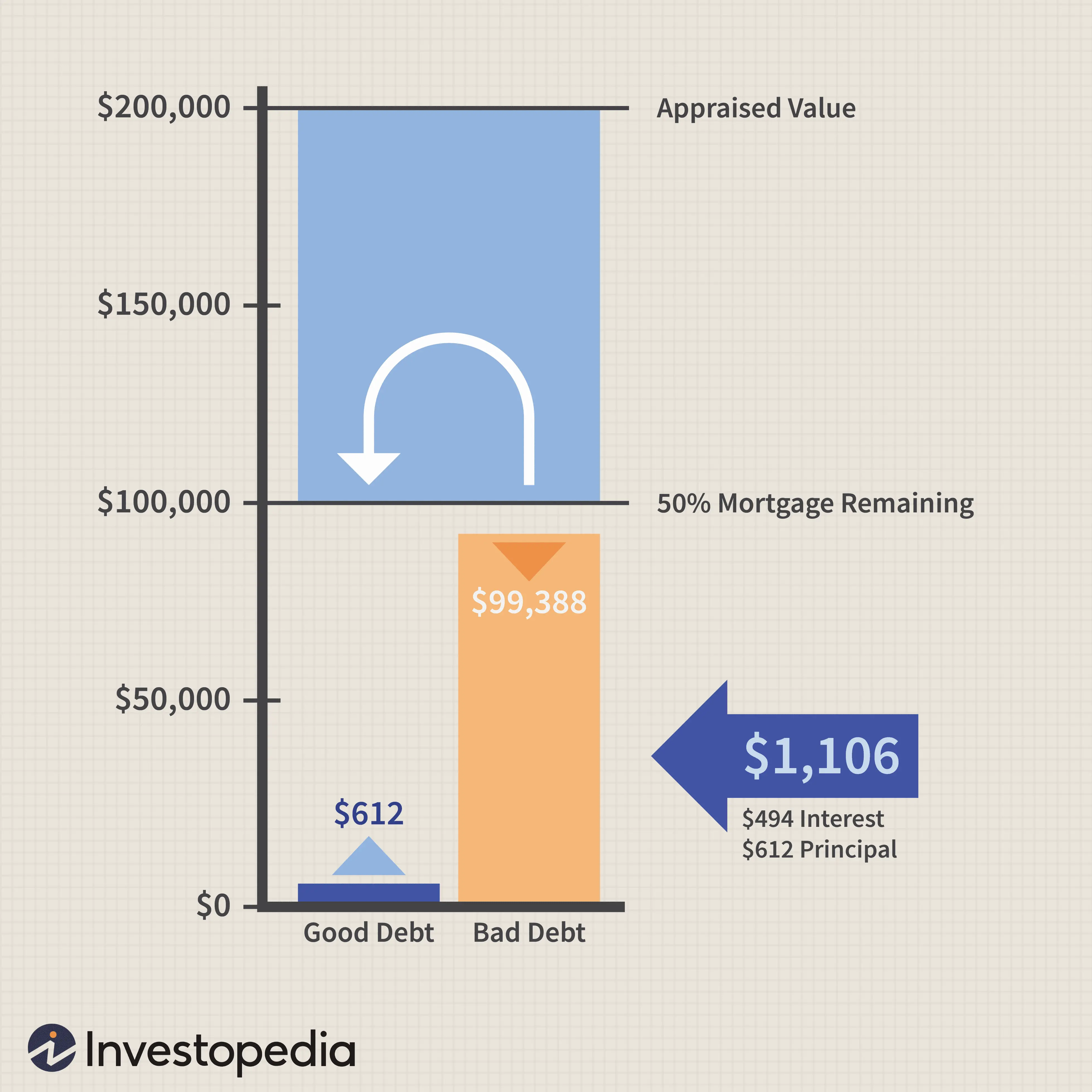

Extra Mortgage Payments Vs Investing

Assume you have a 30-year mortgage of $150,000 with a fixed 4.5% interest rate. You’ll pay $123,609 in interest over the life of the loan, assuming you make only the minimum payment of $760 each month. Pay $948 a month$188 moreand youll pay off the mortgage in 20 years, and youd save $46,000 in interest.

Now, lets say you invested that extra $188 every month instead, and you averaged a 7% annual return. In 20 years, youd have earned about $98,000$52,000 ahead of the sum you saved in intereston the funds you contributed. Keep depositing that monthly $188, though, for 10 more years, and youd end up with almost $230,000 in earnings.

So while it may not make a huge difference over the short term, over the long term, youll likely come out far ahead by investing in your retirement account.

Don’t Miss: Where Can I Find My Mortgage Account Number

Another Bonus You’ll Save Thousands Of Dollars In Interest

The Balance / Daniel Fishel

A large mortgage paymentone that accounts for 30% of your take-home pay or even morecan be a huge drain on the budget. It can prevent you from reaching other long-term financial goals, like an investment portfolio or saving for retirement. And that’s not to mention the interest you’ll pay over the life of the loan.

Paying off your mortgage early might be a worthy goal if you’re planning to live there for a long period of time, but there might be better uses for your extra cash if you’re planning to move on in a handful of years. That said, you have several options for paying your loan off early if you’re determined to live mortgage-free, from making an extra payment now and again to refinancing.

You Might Not Want To Pay Off Your Mortgage Early If

- You need to catch up on retirement savings: If you completed a retirement plan and find you aren’t contributing enough to your 401, IRA, or other retirement accounts, increasing those contributions should probably be your top priority. Savings in these accounts grow tax-deferred until you withdraw them.

- Your cash reserves are low: “You don’t want to end up house rich and cash poor by paying off your home loan at the expense of your reserves,” says Rob. He recommends keeping a cash reserve of three to six months’ worth of living expenses in case of emergency.

- You carry higher-interest debt: Before you pay off your mortgage, first close out any higher-interest loansespecially nondeductible debt like that from credit cards. Create a habit of paying off nondeductible debt monthly rather than allowing the balance to build so that you’ll have fewer expenses when you retire.

- You might miss out on investment returns: If your mortgage rate is lower than what you’d earn on a low-risk investment with a similar term, you might consider keeping the mortgage and investing what extra you can.

Also Check: How Do Points Work For Mortgage

Purchase A Home You Can Afford

âIf you want to finance a home, youâll need to get prequalified first,â writes Mike Timmerman, who paid off his mortgage in just two years. âThe bank will look at your overall financial picture and spit out an amount that youre likely to get a loan for. Some people use this number to set a housing budget, but not me.â

âThe bank is just guessing. I examined my monthly budget and determined what I wanted to spend on housing,â Timmerman adds. â It ended up being much less than what the bank told me I could afford.â

How To Calculate Mortgage Payments

Zillows mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The principal is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowners insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowners association dues , these premiums may also be included in your total mortgage payment.

You May Like: Can I Sell A House With A Reverse Mortgage

Paying Down Your Mortgage Example

So lets assume its still the early days for your mortgagewithin the first decade. Lets say you have a 30-year fixed $200,000 loan at a 4.38% rate that amounts to a lifetime interest charge of $159,485 if you pay the usual 12 times a year. Make that a lucky 13 payments each year, though, and you save $27,216 in interest overall. If you kicked in an extra $200 each month, youd save $6,000 in 10 years, $50,745 in 22½ yearsand youd have the mortgage paid off, too.

When Paying Off Your Mortgage Early Works

You might assume that you need to shell out hundreds of extra dollars each month to pay off your mortgage early. The truth is, even a very small monthly or one annual payment can make a major difference over the course of your loan.

Contributing just $50 extra a month can help you pay off your mortgage years ahead of schedule. You dont need to find a way to earn an extra $10,000 a year to pay off your mortgage.

If youre looking for a tool that can help you estimate what paying off your mortgage early would cost you, play around with our Rocket Mortgage® mortgage amortization calculator. Itll help you see for yourself how a small amount of money can impact your loan. Your result might surprise you. Most people can manage to save at least a few thousand dollars in interest with a small monthly extra payment. This is especially true if you start paying more on your loan in the early years of your mortgage.

The best candidates for early mortgage payoffs are those who already have enough money to cover an emergency. Youll want at least 3 6 months worth of household expenses in liquid cash before you focus on paying off your mortgage. This is because its much more difficult to take money out of your home than it is to withdraw money from a savings account.

You May Like: How To Afford Veterinary Care Without Mortgaging

Don’t Miss: Is It Worth Refinancing Mortgage

Make Larger Monthly Payments

The easiest and fastest way to pay down your mortgage is faster is larger monthly payments and extra money towards principal when available, said Ralph DiBugnara, president of Home Qualified and SVP at Cardinal Financial. A 10-year payment compared to a 30-year payment is going to cost a homeowner about $575 dollars extra a month per $100,000 borrowed. That $575 per $100,000 would need to be added to your principal payment monthly.

Drudging up extra money to pay down your mortgage can prove a difficult task. Another similar approach is to take any large sums of money received and apply them to the principal.

This can come in the form of a tax refund, bonus from work, salary increase or overtime earned, DiBugnara said. For every extra payment a year you make on a mortgage you can save between five and seven years. So three to four extra payments a year will get you to the 10 year mark for a payoff.

Helpful: 8 Insider Tips to Get Rich in Real Estate