What Is A Verified Approval Letter

At Rocket Mortgage®, we take your approval application very seriously. During our Verified Approval process1, well pull your credit and ask for documentation verifying your income and assets, including your W-2s, income tax returns, pay stubs and statements for any accounts you want to use as assets.

Because we take the time to verify the information you provide, our Verified Approval Letter is a strong indication that a borrower who has been approved will close on the mortgage. This Verified Approval Letter will separate you from the rest of the mortgage-seeking pack. In fact, if your application doesnt lead to a closing, well pay you $1,000.

Take the first step toward buying a house.

Get approved to see what you qualify for.

Pros And Cons Of Rocket Mortgage

Pros

- Instant verification. Find out how much you can qualify for in minutes, with a quote after you apply.

- Fully online process. Unlike more traditional lenders, Rocket Mortgages application, verification, documentation and funding are digital.

- No prepayment fees. Pay your loan off early without prepayment fees or penalties.

- Fast turnaround. Rocket Mortgage advertises loan closings within a week of application approval.

Cons

- High application deposit. You must put down a deposit to apply, which goes toward closing costs if you seal the deal on your new Rocket Mortgage home loan.

- Not all loan type available. You cant get a USDA-backed loan, a construction loan or a mobile home mortgage through Rocket Mortgage.

- Hard credit inquiry required. Applying for a mortgage requires a hard credit inquiry, which can lower your credit score.

Compare Rocket Mortgage to competitors

I worked with a mortgage broker to buy my first home, and he found that Rocket Mortgage through Quicken Loans offered the lowest interest rate and best terms for my situation. Because I was a freelancer at the time, my tax and employment documents were a bit more confusing than the average borrower. So, had I not worked with a broker, I would have had a tough time understanding the submitting process.

My loan application process was fast and hassle-free. My interest rate was locked in, I chose the loan terms that I wanted, and I can make extra payments without penalties or fees.

Rocket Mortgage Review 2023

Jeff Ostrowski covers mortgages and the housing market. Before joining Bankrate in 2020, he wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal.

Suzanne De Vita is the mortgage editor for Bankrate, focusing on mortgage and real estate topics for homebuyers, homeowners, investors and renters.

Read Also: Where To Get The Best Mortgage Loan

Should I Use Rocket Mortgage Instead Of Another Lender

- If speed and convenience are your top priorities

- Rocket Mortgage might be just the ticket

- But know that putting in a little time to shop around for a home loan

- Could save you a lot of money and provide a great ROI, even if it takes a tad longer

All in all, it appears that Quicken wants to keep up with all the tech-minded debutants entering the mortgage space, while also appealing to a new generation that demands instant gratification and doesnt want to talk to anyone, ever.

Of course, I think there will always be a place for traditional face-to-face correspondence in the mortgage world seeing how important and complex it is for most folks.

And like other tech-based solutions, Quicken Loans Rocket Mortgage will only be successful if borrowers answers are honest and accurate, much like a standard home loan application.

At the end of the day, its recommended that you still shop around as opposed to taking the easiest route to a mortgage. While the application process might be faster, saving thousands for even a few hours more work seems like a no-brainer.

Personally, Id rather take my time and pay less each month for the next 360 months, but thats just me.

Ultimately, while convenience is great, a lower mortgage rate with fewer fees is much better, even if it takes a little more time and legwork.

And lots of other lenders are catching up technology-wise, so you might be able to get a similar experience and snag a lower mortgage payment at the same time.

Benefits Of The Rocket Mortgage Platform

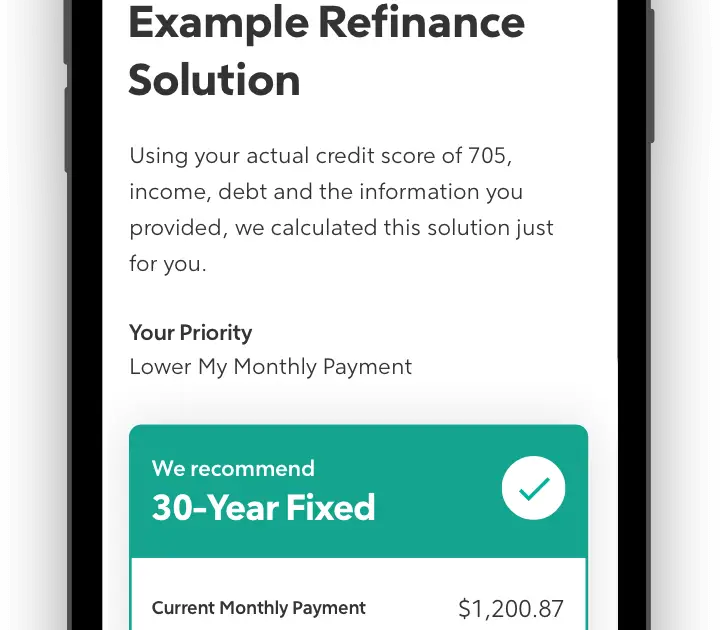

The Rocket Mortgage platform is one of Quicken Loans biggest selling points. The company says it saves users both time and money. Its certainly quick: Rocket Mortgage says it can approve a mortgage loan in just eight minutes.

Rocket Mortgage also allows you to apply for a loan from anywhere using a computer or mobile device, and it requires no physical paperwork. The site imports your financial data, so theres no need to fax, scan, or upload any financial documents. You can chat with your loan officer online, and e-signatures are accepted.

The company is also highly rated by past buyers. According to J.D. Powers 2018 U.S. Primary Mortgage Origination Satisfaction Study, Quicken Loans claims the highest customer satisfaction levels in the country and had for nine straight years as of 2018.

Recommended Reading: How To Recruit Mortgage Loan Officers

Regulatory Or Legal Actions

In the three-year period between July of 2019 and July 2022, there have been 1,863 complaints filed with the Consumer Financial Protection Bureau against Rocket Mortgage. Most of these complaints concern difficulties in applying for a mortgage or a refinance loan.

The CFPB keeps track of complaints filed against companies operating in the U.S. and records how those companies respond. The CFPB has marked most of the complaints against Rocket as being resolved in a timely manner by the lender.

Rocket Mortgage has also seen a total of 8 regulatory actions taken by the National Mortgage Licensing System between 2016 and 2022. The three most recent actions occurred in 2021 and were related to how the lender advertised its interest rates in marketing materials. All actions were resolved.

In August 2022, a class action lawsuit was filed against Rocket Mortgage alleging the lender sent unsolicited text and voice messages to consumers, which is a violation of the Telephone Consumer Protection Act. The case has yet to be heard.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Should I Get Prequalified For A Mortgage

Beware Of Payday Loans

You should think carefully about sacrificing advantageous loan terms in favor of an expedited loan disbursal. Ideally, you will find a lender who can get your loan to you quickly without charging unreasonable interest rates. You should also look at origination fees and repayment schedule requirements when making your decision.

Payday loans should generally be avoided if at all possible. Your interest rate or APR for payday loans will usually be around 400%. Borrowing $500 for just 2 weeks could mean you have to repay more than $600.

The Bottom Line: Preapproval Is The First Step Toward Homeownership

Buying a house is a major undertaking, and in the current market, itll take you about a year or more to go from your current home into a new one. The first step is getting preapproved to show agents and sellers that youre ready to buy.

Ready to become a homeowner? Start your Verified Approvalprocess today!

1 Participation in the Verified Approval program is based on an underwriters comprehensive analysis of your credit, income, employment status, debt, property, insurance and appraisal as well as a satisfactory title report/search. If new information materially changes the underwriting decision resulting in a denial of your credit request, if the loan fails to close for a reason outside of Rocket Mortgages control, or if you no longer want to proceed with the loan, your participation in the program will be discontinued. If your eligibility in the program does not change and your mortgage loan does not close, you will receive $1,000. This offer does not apply to new purchase loans submitted to Rocket Mortgage through a mortgage broker. This offer is not valid for self-employed clients. Rocket Mortgage reserves the right to cancel this offer at any time. Acceptance of this offer constitutes the acceptance of these terms and conditions, which are subject to change at the sole discretion of Rocket Mortgage. Additional conditions or exclusions may apply..

Get approved to see what you can afford.

Rocket Mortgage® lets you do it all online.

Also Check: Can You Get Rid Of Fha Mortgage Insurance

Whos Rocket Mortgage For

Do you have a good grasp on your finances and want to make the mortgage application process as simple as possible? Then Rocket Mortgage® might be the perfect lender for you.

You can cut down on the amount of physical paperwork required in typical mortgage applications by applying entirely online and finding out in minutes if youre qualified for a home loan. Because of the online nature of this lender, its much easier to use on the whole. Plus, this is the sort of lender you use when you simply dont have the time to chase meetings with an office-bound loan officer and the stack of papers they need you to complete and sign.

Rocket Mortgage® is also a great choice for you if you know you have a good credit score or large down payment saved and are ready to take the next steps toward homeownership. Youll also like Rocket Mortgage® if you want to explore the mortgage options youre eligible for on your own time its online tools make it easy to adjust your mortgage type by changing the loan term, moving between adjustable and fixed-rate loans and comparing different mortgage types.

Rocket Mortgage® doesn’t offer home equity loans or home equity lines of credit. Youll want to reach out to a conventional lender to view those options.

How Long Does It Take To Receive A Personal Loan

Typically, you can expect to wait 1 7 business days for a personal loan to go through. Approval will generally take 1 3 business days, while disbursal will typically take 1 5 business days. It is possible for a loan to take as long as 30 days to process.

Before getting a personal loan, you should contact several prospective lenders and find out how long you can expect the process to take . You should also ask them what their typical loan terms are. Be sure to ask about interest rate or , repayment schedules and origination fees.

Read Also: What’s The Interest Rate On A 15 Year Mortgage

Get Your Finances Checked

In a traditional preapproval, your lender will pull your credit report to get a look at your existing debt and any negative items showing up that might have an impact on your mortgage approval.

Your gross monthly income is compared to the debts showing up on your credit report to determine what percentage of your monthly income goes toward debt payments. This is your debt-to-income ratio . In order to have the best chance of qualifying for the most mortgage programs, youll want to keep your DTI at 43% or lower. However, every mortgage option is different.

Rocket Mortgage Pros And Cons

-

Entirely Online The entire application process can be completed entirely online without ever talking to another human being.

-

Approval in Minutes Because Rocket Mortgage asks you to connect your financial accounts, you can have your loan approved within a few minutes.

-

Real-time Transparency After completing the questionnaire, youll be able to see how buying points or adjusting the term of the loan can affect your payment schedule through real-time information.

-

Close Within a Week Your loan through Rocket Mortgage and Quicken Loans can close within a week, provided third-parties dont slow down the process.

-

For as much as it is an advantage, not having the opportunity to talk to a human loan officer could potentially be a disadvantage as well. Because of the DIY nature of Rocket Mortgage, consumers may lose out by applying for a mortgage that isnt necessarily the best choice for their situation. Qualified applicants usually have several mortgage options available to them. Since most consumers are not mortgage experts, this is certainly one area where a human loan officer could help steer their client in the right direction.

Recommended Reading: How To Find Mortgage Interest Rate

Average Days To Close Loan

After youre approved for a home loan and the buyer accepts your offer, youre ready to move into the closing process. This process includes your home appraisal, home inspection, mortgage underwriting, closing disclosure acknowledgment, final walkthrough and closing. Sometimes the type of mortgage plays a part in this process.

Rocket Mortgage® orders your home appraisal once your mortgage is approved to ensure your homes value is correct. After your appraisal is verified, you can schedule your home inspection to make sure your home doesnt have any significant problems or repairs that were not disclosed. While this is happening, Rocket Mortgage® underwrites your loan to complete your mortgage.

Next, youll receive a closing disclosure 3 days before your closing date, which youll need to acknowledge for the closing process to move forward. Then, youll do a final walkthrough of your property to confirm its in the condition agreed upon in your contract and that all required repairs were made.

The part youve been waiting for youll show up for closing with your proof of down payment, sign all necessary paperwork and get the keys to your new home. Most closings take an average of 30 days with Rocket Mortgage®.

Expect to complete some other steps that are important to protect your new home, like buying title insurance and finding homeowners insurance.

Rocket Mortgage Features And Benefits

Besides offering several loan options for borrowers, Rocket Mortgage also has some other features and benefits worth mentioning:

- Educational tools: Whether youre a first-time or experienced homebuyer, learning about the process can make it seem less daunting. The Rocket Mortgage Learning Center features hundreds of articles on mortgages, loan types, and home buying, as well as several calculators to help you budget.

- Faster-than-average closings: As of September 2022, the average time it took to close a mortgage loan was 50 days. Many lenders also offer 30- or 45-day closings, but Rockets average time to close is just 26 days.

- Online process: You can complete your mortgage application online with Rocket, which is convenient if you want to do things at your own pace and avoid spending a lot of time on the phone.

Read Also: How Much Is A Home Mortgage

Rocket Mortgage Vs Your Local Bank For Mortgage Loans: An Overview

Since the dot-com boom of the late 1990s, online mortgage companies have become an increasingly significant force in the home loan industry. Leading the charge is Rocket Mortgage, now the largest retail mortgage lender in the country. Rocket Mortgage was previously called Quicken Loans, but changed its name in May 2021 to align with its parent company Rocket Companies.

Does the growth of players like Rocket Mortgage, which offer an automated approval process through its platform, mean web-based firms have more to offer than your community bank down the street? Not necessarily. Where you go for a loan is largely a matter of what is comfortable for youand where you can get the best rates.

Both types of lenders offer mortgage pre-approval. Being pre-approved can sometimes help you have your offer on a home accepted. However, there are other significant differences between them that could shape which one you find preferable.

Whats The Difference Between A Heloc And A Home Improvement Loan

The biggest difference between a HELOC and a home improvement loan is that a HELOC borrows against the existing equity in your home, while the latter does not. Because of this, home improvement loans have a lower limit that you can borrow. These loans can also carry higher interest rates than HELOCs.

The money from HELOCs also doesnt have to be used for home improvement. It can be used in other ways, from debt consolidation to making major purchases.

You May Like: How Much Is A 280k Mortgage

Rocket Mortgage Rateshield Protection

One benefit of working with Rocket Mortgage is that it offers 90-day rate lock protection through its RateShield program.

Rockets RateShield allows home buyers to lock their preapproved interest rate for up to 90 days while they shop for a home. If rates fall during that time, the borrower can drop their rate once. But if rates rise, their rate wont increase. This can offer additional peace of mind when house-hunting in a rising-rate environment.

Summary Of Moneys Rocket Mortgage Review

Rocket Mortgage is the largest mortgage originator in the country for good reason. Borrowers can choose from a variety of standard loan options and flexible loan terms to best suit their financing needs. The online application has been streamlined and is easy to navigate on your own or with Rockets highly-ranked customer service team.

The mortgage rates offered on the website are competitive but you may find lower rates elsewhere. Youll also have to pay a deposit to submit your application, which you may not have to do with some other lenders.

Also Check: How Do I Get A Mortgage Credit Certificate