How Are Arms Calculated

Once the initial fixed-rate period ends, borrowing costs will fluctuate based on a reference interest rate, such as the prime rate, the London Interbank Offered Rate , the Secured Overnight Financing Rate , or the rate on short-term U.S. Treasuries. On top of that, the lender will also add its own fixed amount of interest to pay, which is known as the ARM margin.

What Is The Difference Between A Standard Arm Loan And Hybrid Arms

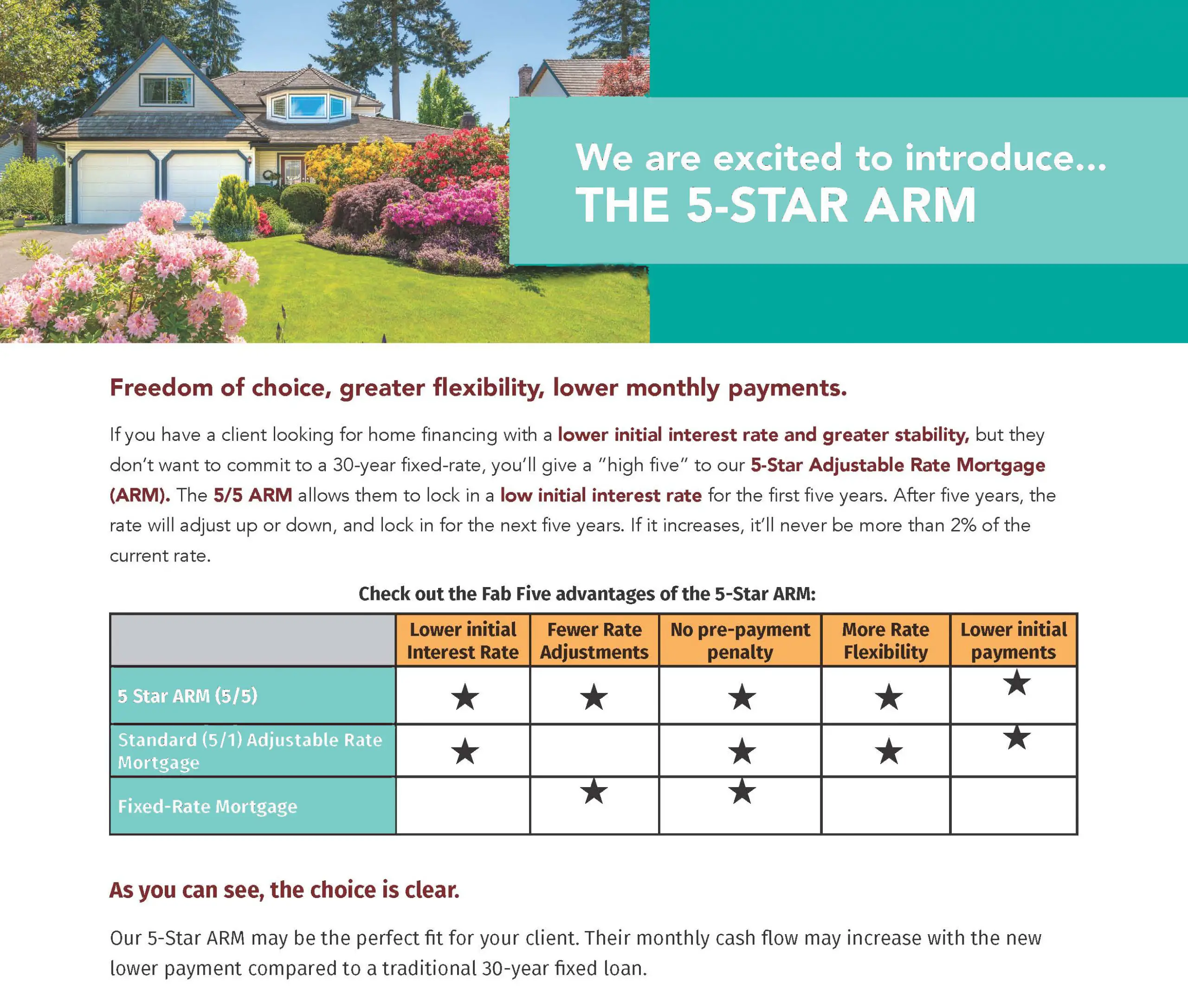

A hybrid ARM has a honeymoon period where rates are fixed. Typically it is 5 or 7 years, though in some cases it may last either 3 or 10 years.

Some hybrid ARM loans also have less frequent rate resets after the initial grace period. For example a 5/5 ARM would be an ARM loan which used a fixed rate for 5 years in between each adjustment.

A standard ARM loan which is not a hybrid ARM either resets once per year every year throughout the duration of the loan or, in some cases, once every 6 months throughout the duration of the loan.

Who Are Arms Good For

Likely Movers: Adjustable-rate mortgages are not for everyone, but they can look very attractive to people who are either planning to move out of the house in a few years. If your reset point is seven years away and you plan to move out of the house before then, you can manage to get out of Dodge before the costlier payment schedule kicks in.

Growing Incomes: Those who will benefit greatly from the flexibility of an ARM are people who expect a sizeable raise, promotion, or expansion in their careers. They can afford to buy a bigger house right now, and they will have more money to work with in the future when the reset date arrives. When the reset happens if rates haven’t moved up they can refinance into a FRM. Homebuyers working for a hot startup who are waiting for their stock options to vest also fit in this category. If you believe the home will appreciate significantly and your income will go up then you can refinance an ARM into a fixed-rate loan.

Home Flippers: Real estate investors who rapidly turn over homes plan on selling most homes before any ARM rate reset would take place, so opting for whichever loan offers the lowest rate is a prudent move if they are experienced and are certain they’ll sell the home soon.

Recommended Reading: How Long Does Refinancing A Mortgage Take

What Is A Fully Amortizing Arm

Adjustable-rate mortgages that are fully amortizing have a maximum interest rate which they cannot exceed. They are therefore different from standard ARMs, where the rate is fully adjustable according to the index rate at the time. ARMs are described by writing how long the rate is fixed for, and how often it will adjust for the remainder of the term. For example, a 10/1 ARM would be fixed for 10 years, and adjust every 1 year from that point onward.

What Are The Different Types Of Arms

There are different types of ARMs that lenders offer. The name of these ARMs will indicate:

- The duration of the initial period.

- How often in a year your rate can adjust during the adjustment period.

Lets look at an example: The most common adjustable-rate mortgage is a 5/1 ARM. This means you will have an initial period of five years , during which the interest rate doesnt change. After that time, you can expect your ARM to adjust once a year .

Most ARMS will also typically offer a rate cap structure, which is meant to limit how much your rate can increase or decrease.

There are three different caps:

- Initial cap: Limits how much your rate can increase when your rate first adjusts.

- Periodic cap: Limits how much your rate can increase from one adjustment period to the next.

- Lifetime cap: Limits how much your rate can increase or decrease over the life of your loan.

Lets say you have a 5/1 ARM with a 5/2/5 cap structure. This means on the sixth year after your initial period expires your rate can increase by a maximum of 5 percentage points above the initial interest rate. Every year thereafter, your rate can adjust a maximum of 2 percentage points , but your interest rate can never increase more than 5 percentage points over the life of the loan.

When shopping for an ARM, you should look for interest rate caps you can afford.

Read Also: How To Shop For Mortgage Loans

Adjustable Rates & The Mortgage Marketplace

When it’s time to buy a house, there are several things to take into consideration. It isn’t all “location, location, location” as the old real estate adage goes.

Not only does a perspective home owner have to determine how many bedrooms, bathrooms and square footage they want, or can afford, there is also the matter of how to pay for the home.

Looking as various ways to buy a house, at getting a mortgage, there are fewer choices available than there were a few years ago. During the days of the real estate boom, lenders across the country were more willing to give out loans that were out of the ordinary, and based on risky terms. Since the housing market collapse, however, mortgage lenders have returned to safe and traditional forms of home financing.

People interested in purchasing a home will find three basic types of mortgage loans: fixed rate, adjustable rate and interest only loans.

As with any loan, mortgages of each type include interest. Monthly payments will be based the type of loan, the terms of the loan and the interest rate the home buyer is able to get from the lender.

Mortgage interest rates go up and down in concert with the stock market. When the stock market is strong, interest rates are higher. When the stock market slows down, interest rates drop.

Mortgage rates most closely follow the 10 year Treasury bond, but this is not an exact science. This is only used as a benchmark.

When Should You Consider Refinancing To A Fixed

Switching from an adjustable-rate mortgage to a fixed-rate mortgage is one of the most common reasons homeowners choose to refinance.

You may want to refinance your ARM into a FRM if:

- Your ARM is scheduled to adjust soon. This is especially important if you cannot afford a higher monthly mortgage payment.

- Mortgage rates are low. This will help you lock in a low rate and take advantage of the stability of a fixed-rate mortgage.

Alternatively, if you plan to move soon, it may make financial sense to stick with an ARM.

Before you make plans to refinance later, its important to take into account the costs of refinancing which are similar to what you pay when you purchase a home and any penalties you may face if you refinance too soon.

Some ARMs may require you to pay fees or penalties if you refinance or pay off the ARM early, usually during the initial period of the loan. Prepayment penalties can total several thousand dollars. Its important to know about these potential extra fees before you take out an ARM.

Use our fixed- or adjustable-rate calculatorto better understand what mortgage may be right for you.

When it comes to mortgages, you have options. To determine the right mortgage for your situation,lean on your lenderor financial professional for guidance. Be sure you know the details of how and when this type of loan may change your monthly payments.

Recommended Reading: What Are Mortgage Rates Tied To

Don’t Forget Taxes Insurance And Other Costs

If you’re buying a home, you’ll also need to consider some other items that can significantly add to your monthly mortgage payment, even if you manage to get a great interest rate on the loan itself. For example, your lender may require that you pay for your real estate taxes and insurance as part of your mortgage payment. The money will go into an escrow account, and your lender will pay the bills as they come due. These costs are not fixed and can rise over time. Your lender will itemize any additional costs as part of your mortgage agreement and recalculate them periodically.

How Are Graduated Payments Calculated

Online loan calculators show what monthly payments will be. It is important to note that Investopedia requires writers to use primary sources such as white papers, government data, original reporting, and interviews with industry experts when writing about this topic. Additionally, they may reference original research from other reputable publishers where appropriate to produce accurate and unbiased content. By following these standards when calculating graduated payments, you can ensure that your calculations are reliable and precise.

Benefits of a Graduated Payment Mortgage

Graduated payment mortgages can offer homebuyers some advantages, including:

- Potentially easier qualification for a mortgage, based on income

- Lower payments initially, with payments that grow as your income does

- Flexibility with monthly budgetingy expenses

A graduated payment mortgage may help you purchase a home now rather than waiting until later when your salary is bigger.

Drawbacks of a Graduated Payment Mortgage

One significant drawback of a graduated payment mortgage is that it usually has higher costs than a traditional mortgage. Additionally, borrowers may find themselves only paying interest rather than paying down the loan, depending on the payment schedule.

You May Like: What Is The Rate Of Interest For Mortgage Loan

What Is A Hybrid Arm

Also contributing to the turnaround is the fact the lending industry is offering more palatable versions of the product to consumers. Todays hybrid ARMs offer a break on interest and a fixed payment amount for the introductory period before reverting to adjustable rates at the 3, 5, 7 or 10-year mark.

Right now, that break doesnt amount to much, given how low interest rates are for 15-and-30-year mortgages. But interest rates have risen steadily over the past year and are expected to continue rising, so the spread between a 30-year fixed rate mortgage and the first few years of an ARM may widen enough to make it even more appealing.

If you are just getting started in the workforce and homebuying market, every dollar counts and ARMs can save a few dollars, at least until the dreaded adjustment period kicks in.

Adjustable Rate Mortgage Calculator Example

Mr. Bean has taken a very short-term mortgage loan for five years, and the term is 3/1 ARM, which means that the rate of interest will remain fixed for three years and after that rate shall change for the remaining term annually. The initial interest rate was 6.75%. It will be reset by 0.10% on every reset date. Based on the given information, you must calculate the total mortgage installment amount at each reset date, assuming the initial loan amount was $100,000 and installments are paid monthly.

Solution:

As the first step, we will first calculate the monthly installments based on the initial loan amount.

The monthly interest rate will be 6.75% / 12, which is 0.56%, and the period will be five years x 12, which is 60 months.

EMI = ^N)/^N-1)

- = ^60) / ^60 1)

Monthly Installments based on the initial loan amount are shown below:

Now the rate of interest changes to 6.75% + 0.10%, which is 6.85% at the end of 3 years, and now the remaining period will be , that is 60 36, which is 24 months. Now we need to find out the principal balance at the end of year three which can be calculated below:

The monthly interest rate will be 6.85% / 12, which is 0.57%, and the outstanding principal balance is 44,074.69.

At the end of 3 years

New EMI = ^N)/^N-1)

- = ^24 ) / ^24 1)

Monthly Installments based on the initial loan amount are shown below:

At the end of 4 years

New EMI = ^N)/^N-1)

- = ^12 ) / ^12 1)

Monthly Installments based on the initial loan amount are shown below:

Recommended Reading: How Much Down Payment For Mortgage

What Is An Adjustable

An adjustable-rate mortgage is a home loan with a variable interest rate. With an ARM, the initial interest rate is fixed for a period of time. After that, the interest rate applied on the outstanding balance resets periodically, at yearly or even monthly intervals.

ARMs are also called variable-rate mortgages or floating mortgages. The interest rate for ARMs is reset based on a benchmark or index, plus an additional spread called an ARM margin. The typical index that is used in ARMs has been the London Interbank Offered Rate .

The Fully Indexed Rate

Recap: To calculate the mortgage rate on an adjustable loan, you would simply combine the index and the margin. The resulting number is known as the fully indexed rate, in lender jargon. This is what actually gets applied to your monthly payments.

Heres the calculation again:The fully indexed rate is the most important number to you, as a borrower. It determines the size of your monthly payments and the total amount of interest youll pay over time. But it also helps to know where it comes from, and how it gets calculated.

The lender should provide you with all of this information when you apply for the loan. In fact, they are required to do so. According to the Federal Reserves guide to adjustable-rate mortgages:

The information must include the index and margin, how your rate will be calculated, how often your rate can change, limits on changes , an example of how high your monthly payment might go, and other ARM features

So thats how adjustable mortgage rates are calculated. The index plus the margin equals the actual rate that you pay on the loan. Now lets look at some actual examples. This will help you comparison shop for the best deal.

Also Check: Can I Refinance My Mortgage Within A Year

Adjustable Rate Mortgage Analyzer

Does an ARM make sense for you?

Adjustable-rate mortgages typically feature lower rates during the initial period of the mortgage, meaning homebuyers have lower monthly payments. Adjustable-rate mortgages are typically offered on a 1-, 3-, 5- or 7-year basis. Once the initial period expires, the mortgage rate will reset at the current interest rate levels.

Resets can result in higher or lower monthly payments to the borrower, depending on the market. This adjustable-rate mortgage analyzer helps you understand the implication of your adjustable-rate terms by showing what your monthly payment will be under different scenarios.

Other Mortgage And Financial Calculators

In addition to the standard mortgage calculator, this page lets you access more than 100 other financial calculators covering a broad variety of situations. Choose from calculators covering various aspects of mortgages, auto loans, investments, student loans, taxes, retirement planning and more.

All rights reserved. Mortgageloan.com® is a registered service mark of ICB Solutions, a division of Neighbors Bank, Equal Housing Lender Member FDIC, NMLS # 491986 ICB Solutions or Mortgageloan.com does not offer loans or mortgages. Mortgageloan.com is not a lender or a mortgage broker. Mortgageloan.com is a website that provides information about mortgages and loans and does not offer loans or mortgages directly or indirectly through representatives or agents. We do not engage in direct marketing by phone or email towards consumers. Contact our support if you are suspicious of any fraudulent activities or if you have any questions. Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. Mortgageloan.com is not responsible for the accuracy of information or responsible for the accuracy of the rates, APR or loan information posted by brokers, lenders or advertisers.

Also Check: Can I Prequalify For A Mortgage Online

How Is An Adjustable Mortgage Rate Calculated

By Brandon Cornett | Copyright © HBI 2022 | All Rights Reserved

True to its name, an adjustable-rate mortgage loan has a mortgage rate that will change or adjust over time. This makes it very different from a fixed mortgage, which instead carries the same rate of interest over the entire term or life of the loan.

Weve covered ARM loans many times in the past, and you can learn more about them in this in-depth guide. Today, Id like to explain how the mortgage rate assigned to an ARM loan gets calculated. We will talk about the index, the margin, and the fully indexed rate three very important factors.

Why it matters: This is an important topic for anyone considering an adjustable mortgage product, because it affects the monthly payments as well as the total amount of interest paid over time.

Current Local Mortgage Rates

The following table shows current local 30-year mortgage rates as that is the most popular choice by home buyers across the United States. If you would like to compare fixed rates against hybrid ARM rates which reset at various introductory periods you can use the menu to select rates on loans that reset after 1, 3, 5, 7 or 10 years. By default refinance loans are displayed. Selecting purchase from the loan purpose drop down displays current purchase rates.

The following table shows current 30-year mortgage rates available in Los Angeles. You can use the menus to select other loan durations, alter the loan amount, or change your location.

Read Also: How Much Is A Mortgage On A 500k House

How To Calculate An Arm Loan

- To calculate an ARM once it goes adjustable

- Simply combine the preset margin and the current index price

- Then multiply it by the outstanding loan amount

- Be sure to use the remaining loan term in months to determine the correct payment

Now that youve seen the many ARM loan options available, you might be wondering how to calculate an ARM adjustment.

After all, theres a chance you might face a rate adjustment if you hold onto your mortgage beyond the fixed period.

Fortunately, its not too difficult to calculate, you just need a few key pieces of information.

This includes the fully indexed rate , the outstanding loan balance, and the remaining loan term.

For example, if you took out a 5/1 ARM with a rate of 2.5% and a loan amount of $200,000, the monthly payment would be $790.24 for the first 60 months.

After 60 months, the principal balance would be $176,150.87.

Now lets assume your margin is 2.25 and the index is 1.50. Together, thats a new rate of 3.75%

We then have to apply that new rate of 3.75% to the remaining balance of $176,150.87 over the remaining term, which would be 300 months .

That results in a monthly payment of $905.65, at least for the 12 monthly payments during year six.

The loan will then re-amortize again at the start of year seven, and the monthly payment will be generated using the new outstanding balance and interest rate at that time. And so on down the line