Pay Off Your Mortgage Faster

Try to pay more each month:

- Increase your regular payment amount. Pay $675 rather than $652, for example.

- Make lump sum payments to your mortgage principal. An extra $1,000 here and there can make a big difference.

- Make accelerated payments. Instead of making 2 payments per month , make payments every two weeks .

- Speak to your mortgage professional about other options.

Loan Term And Adjustable Vs Fixed Rate Mortgage

Loans with short terms usually have lower interest rates than loans that are paid off over a longer period of time.

An adjustable-rate mortgage might have a lower rate than a fixed-rate mortgage at first. But over time, the rate on an adjustable-rate mortgage could go up by a lot, while the rate on a fixed-rate mortgage would remain the same.

Dti Isn’t A Full Measure Of Affordability

Although your DTI ratio is important when getting a mortgage, the number doesn’t tell the whole story about what you can afford.

DTIs don’t take into account expenses such as food, health insurance, utilities, gas and entertainment, and they count your income before taxes, not what you take home each month.

Youll want to budget beyond what your DTI labels as affordable, and consider all your expenses compared with your actual take-home income.

» MORE: How much house can you afford?

Read Also: What Is P& i In Mortgage

How Much House Does Dave Ramsey Say I Can Afford

For decades, Dave Ramsey has told radio listeners to follow the 25% rule when buying a houseremember, that means never buying a house with a monthly payment thats more than 25% of your monthly take-home pay on a 15-year fixed-rate conventional mortgage.

At Ramsey Solutions, we also teach people they cant afford to buy a house until they:

- Are completely debt-free

- Have an emergency fund of 36 months of expenses

- Have a down payment of 20% or more

Why is all this important? Because when life happens, an unexpected expense or a job loss could crush someone financially if theyre also trying to get out of debt and pay a mortgage. We dont want that to happen to you.

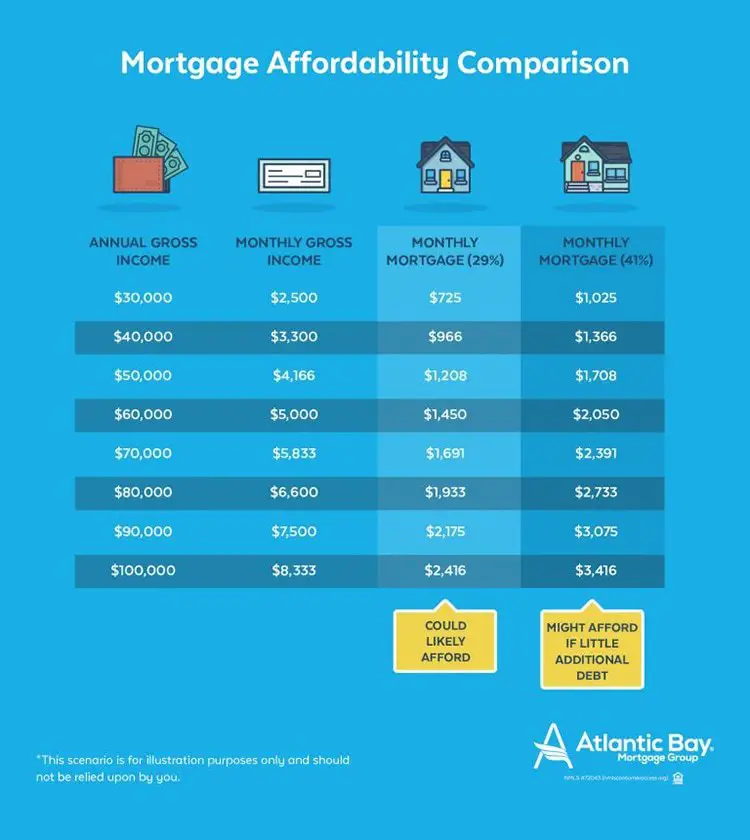

How Much Of My Income Should Go Towards A Mortgage Payment

Most people dream of owning a home, whether its a small one in the city or a rural one with a huge property. However, affording a home is difficult and saving up enough money can be challenging. Obtaining a mortgage is a big step, and you likely have many questions. One important thing you will need to know is how much of a mortgage you can afford based on your income. You can use a few different guidelines to discover what percent of your net income should go toward mortgage payments each month.

Don’t Miss: Can You Write Off Mortgage Payments

Our Take: Somewhere In Between

Not everybody is as debt-averse as Ramseyand following his one-size-fits-all advice has risks. You just have to remember: The more you spend on your home, the less you have available to save for everything else. You may be able to afford a housing payment that is 35% of your pretax income today, but what about when you have kids, buy a new car, or lose your job?

Another reader put it this way:

- Your mortgage payment should be equal to one weeks paycheck.

- Your mortgage payment plus all other debt should be no greater than two weeks paycheck.

Thats on the conservative side, too. One weeks paycheck is about 23% of your monthly income.

If I had to set a rule, it would be this:

- Aim to keep your mortgage payment at or below 28% of your pretax monthly income.

- Aim to keep your total debt payments at or below 40% of your pretax monthly income. Note that 40% should be a maximum. We recommend an even better goal is to keep total debt to a third, or 33%.

As some commenters have pointed out, while it may be possible to buy a decent home in a small midwestern town for $100,000 , workers in New York or San Francisco will need to spend five times that amount just to get a hole in the wall. Yes, people tend to earn more in these high-cost-of-living areas, but not that much more. Does it mean they shouldnt buy a home? Not necessarily. Theyll simply have to make trade-offs to buy in those areas.

Dont Forget To Factor In Closing Costs

All right, dont freak out here. But a down payment isnt the only cash youll need to save up to buy a home. There are also closing costs to consider.

On average, closing costs are about 34% of the purchase price of your home.1 Your lender and real estate agent will let you know exactly how much your closing costs are so you can pay for them on closing day.

These costs cover important parts of the home-buying process, such as:

Dont forget to factor your closing costs into your overall home-buying budget. For example, if youre purchasing a $200,000 home, multiply that by 4% and youll get an estimated closing cost of $8,000. Add that amount to your 20% down payment , and the total cash youll need to purchase your home is $48,000.

If you dont have the additional $8,000 for closing costs, you should hold off on your home purchase until youve saved up the extra cash or shoot a little lower on your home price range.

Whatever you do, dont let the closing costs keep you from making the biggest down payment possible. The bigger the down payment, the less youll owe on your mortgage!

Also Check: What Is The 30 Year Fha Mortgage Rate

How Much Mortgage Can You Afford Based On Your Salary Income And Assets

There are signals that U.S home prices may be falling– a drastic difference from trends prospective homebuyers were seeing during the coronavirus pandemic. But while these price cuts may tempt you to snatch up a house quickly, you should still stop to consider what your price range is and prepare a home buying budget.

Think about questions like: How much can you afford to pay for your mortgage each month? What price point does that payment equate to? What mortgage rates do you qualify for?

In order to get a better idea of what mortgage you can afford, you should first check your rates. An online marketplace can help you find out what you qualify for and calculate the potential savings over the life of your loan. Check your rates today!

Understanding these numbers can help you set realistic, manageable expectations and keep your home search on track. Here’s how to determine them.

What Salary Do You Need To Buy A $400000 House

Now lets take what weve learned and put it into an example. Lets say you want to buy a $400,000 house. First, youll need to do the hard work of saving up $80,000 in cash as a 20% down payment. Or if you already own a home, make sure you have enough equity to pay off your current mortgage and cover your down payment when you sell it.

With a 15-year mortgage at a 5% interest rate, your monthly payment would be around $2,500 . To cover that payment, youd need to earn a monthly take-home pay of at least $10,000 .

So, to buy a $400,000 home, your annual take-home salary would have to be more than $120,000 . But youd actually need more than that after adding in the cost of property taxes and home insurance.

If that doesnt sound like you, dont worry. You have a few options. You could save a bigger down payment to lower your monthly mortgage until its no more than 25% of your take-home pay. Or look for a smaller starter home in a more affordable neighborhood.

Recommended Reading: Can You Buy Two Properties With One Mortgage

What Portion Of Your Income Should Go To Your Mortgage

Many lenders and mortgage experts adhere to the 28% limit meaning your monthly mortgage repayments should not exceed 28% of your gross monthly income or the amount you earn before taxes are deducted.

This percentage also puts you below the mortgage stress threshold of 30%.

According to some experts, if you are spending more than 30% of your pre-tax monthly income on mortgage payments, then you may be at risk of mortgage stress.

To illustrate, the average weekly income of full-time working adults in Australia is $1,714, according to last Mays seasonally adjusted figures from the Australian Bureau of Statistics .

To get the median monthly income, we need to multiply this number by four the number of weeks in a month then multiply the product by .28 to get the 28% limit and .3 to find the mortgage stress threshold.

$1,714 x 4 x 0.28 = $6,856 x 0.28 = $1,919.68

$1,714 x 4 x 0.28 = $6,856 x 0.3 = $2,056.80

Given these, an average working Australian should ideally allocate about $1,920 to their monthly mortgage repayment and not pay more than $2,057 to avoid falling into mortgage stress.

However, it is worth noting that each persons financial situation is different and there are some who can allot more than 30% of their income to their monthly mortgage and still live comfortably.

Recommended Reading: How Much Is The Average House Mortgage

What Is The 28/36 Rule Of Thumb For Mortgages

When mortgage lenders are trying to determine how much theyll let you borrow, your debt-to-income ratio is a standard barometer. The 28/36 rule is a common rule of thumb for DTI.

The 28/36 rule simply states that a mortgage borrower/household should not use more than 28% of their gross monthly income toward housing expenses and no more than 36% of gross monthly income for all debt service, including housing, Marc Edelstein, a senior loan officer at Ross Mortgage Corporation in Detroit, told The Balance via email.

It’s important to understand what housing expenses entail because they include more than just the raw number that makes up your monthly mortgage payment. Your housing expenses could include the principal and interest you pay on your mortgage, homeowners insurance, housing association fees, and more.

Read Also: How Does A Retired Person Qualify For A Mortgage

How Much House Can I Afford With A Usda Loan

USDA loans for qualifying rural areas are much more flexible than regular loans. They dont require a down payment and can include the mortgage insurance fee in the loan. This means you can actually finance 102% of the value of the house and avoid paying this fee upfront.

Keep in mind, however, that there are parameters for income eligibility and for the price and size of the house itself. Even if you can afford a certain amount, the eligibility might be for a less expensive home.

In order to see these requirements in detail, you can go to the USDA website and look at the qualifying areas and income by county.

How Does Your Down Payment Affect Mortgage Affordability

Your down payment plays a big role in your mortgage’s affordability. The size of your down payment affects the amount of the monthly payment you’ll be making to cover the rest of the mortgage amount a bigger down payment decreases your monthly payment and vice versa. So, if you’re worried about your DTI affecting your mortgage eligibility, coming up with a larger down payment can help you qualify.

For example, if you’re buying a $250,000 home with a 4% interest rate over 30 years, a $20,000 down payment would give you a monthly principal-and-interest payment of $1,098. But if you put down $40,000, your monthly payment would drop to $1,003and you’d also save nearly $35,000 in interest over the life of your loan.

While a 20% down payment is a standard recommendation from mortgage experts, it’s not a requirement. In fact, many lenders allow down payments as low as 3% or 5% of the loan amount.

If you don’t have a lot of cash for a down payment and you’re a first-time homebuyer, there are several programs and grants that can provide you with down payment assistance or even loans with no down payment requirement.

Consider more than just your monthly payment as you decide how much money to put down. For example, if you drain your savings for a down payment, you could experience some difficulties if you have a financial emergency in the near future.

Recommended Reading: What Is The Current Mortgage Default Rate

Check Your Credit Score

Its important that you request your credit report before you start the application process and find out your credit score.

Your is a three-digit summary of your creditworthiness. Borrowers with high credit scores will typically be offered the lowest interest rates, while those with low scores will be offered the most expensive rates.

You can get a free once per year from each of the three major . You may also access your credit report for free under certain conditions, for example, if youre the victim of identity theft.

Additionally, thanks to the CARE Act, you can now access free weekly reports from the three major credit bureaus, at least until April 2022.

How To Get Your Finances Ready To Buy A House

Take stock of your finances to see if youre ready to apply for a mortgage. Make sure that you can provide evidence of at least two years worth of regular income, and figure out your total assets, debt and monthly expenses.

Check your credit reports. If you want to apply for new credit cards or other loans, keep in mind that these applications may add inquiries to your credit history and could lower your scores. Plan to apply for other types of credit well in advance of applying for a mortgage or wait until after youve closed on your home loan.Home affordability calculator

Ask lenders what information they need from you to issue a mortgage preapproval letter, and confirm that you have the documents on hand.

Recommended Reading: What Is A Funding Fee On A Mortgage

Save For A 20% Down Payment

You dont need to pay for private mortgage insurance when you put 20% down on your loan. PMI can add quite a bit of money to your monthly payment, so avoiding it can significantly reduce what you pay each month. You may also be able to avoid paying for mortgage insurance if you qualify for a VA loan and pay the funding fee upfront .

Learn About Other Types Of Loans

Most of these guidelines are in relation to conventional loans, but you may qualify for another type of loan. There are a few mortgage programs that allow people with low credit scores or savings to still purchase a home. VA loans and FHA loans have less strict requirements than conventional loans, so its worthwhile to look into them if you dont think you will qualify for a conventional loan.

Read Also: How To Get 0 Down Mortgage

What Mortgage Payment Can You Afford

After youve done some basic bookkeeping, you can begin to determine a potential monthly mortgage payment that makes sense for you and your family. In addition to what your budget can afford, an important rule to keep in mind is the debt-to-income ratio, or the back-end ratio. To make sure your total debt isnt more than your income can support, lenders consider all your debt payments for things like your home, car, credit cards and any other loans. If a paying a mortgage would mean your total monthly spending on paying down debt is higher than 36 percent of your income, you may have trouble getting approved for the loan. Some lenders may allow a higher debt-to-income ratio based on compensating factors like additional cash reserves.

What Percentage Of Your Income Should Go Towards Your Mortgage

Your salary makes up a big part in determining how much house you can afford. On one hand, you may want to see how much you could afford with your current salary. Or, you may want to figure out how much income you need to afford the house you really want. Either way, this guide will help you determine how much of your income you should put toward your mortgage payments every month.

Read Also: What Is The Current Mortgage Loan Interest Rate

How Much Can You Afford To Borrow For A Mortgage

Before applying for a mortgage, you need to think about more than just whether you can afford the monthly repayments. Mortgage providers will look at your income and outgoings to see if you can keep up with repayments if interest rates rise or your circumstances change.

Whats in this guide

Also Check: What Is Loan To Value Mortgage

How Much Of A Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford .

Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Also Check: How To Take A Mortgage Loan