What Is An Escrow Account

In most cases, a portion of a homeowners mortgage payment every month is deposited into an account designated for mortgage-related expenses like property taxes and insurance. This account is called an escrow account. Escrow accounts are traditionally established at the time a person takes out their mortgage loan.

In some cases, homeowners are not required to have an escrow account. But much of the time, lenders insist on them to ensure that these required payments get made. Should you not have an escrow account, you are still expected to cover the cost of homeowners insurance and property tax payments.

Can My Monthly Mortgage Payment Ever Change

Once you close on your loan, youll start making monthly mortgage payments to your mortgage lender. For the most part, your mortgage payment will be the same throughout the life of your loan . However, depending on your loan type and a few other variables, you should be prepared for the possibility of some fluctuation in your bill.

Understanding The Escrow Process

People new to homeownership commonly ask why their lender is collecting property taxes and insurance premiums rather than their local government or their insurance agent. Lenders do it because they want to protect their investment. As long as your mortgage is outstanding, your lender is as much an owner of your home as you are, and the lender wants to make sure its investment is protected.

Ensuring that the home is properly insured against calamity and that the tax man is properly paid gives the lender that protection. Your lender collects a portion of your annual tax and insurance costs each month. It sets the money aside in a special account — called escrow — and then pays the bills on your behalf when they arrive.

Don’t Miss: How To Find An Old Mortgage Account Number

Why Did My Escrow Payment Go Up

As we previously mentioned, if your escrow payment goes up, its typically due to an increase in insurance costs or taxes. However, if you dont already have an escrow account, adding one will come with some new costs.

Adding an escrow account will increase your mortgage payment, in order to cover your monthly tax and insurance payments. Youll also have to put in a little bit extra upfront in order to set up the account. The good news is that it wont be more than one-sixth of your total escrow expenditures for the year.

If you miss a tax or insurance payment, your state or local government may choose to initiate a foreclosure or impose fines. To avoid this, a lender or servicer may require that an escrow account gets set up following a missed payment, to make sure the payments are made going forward.

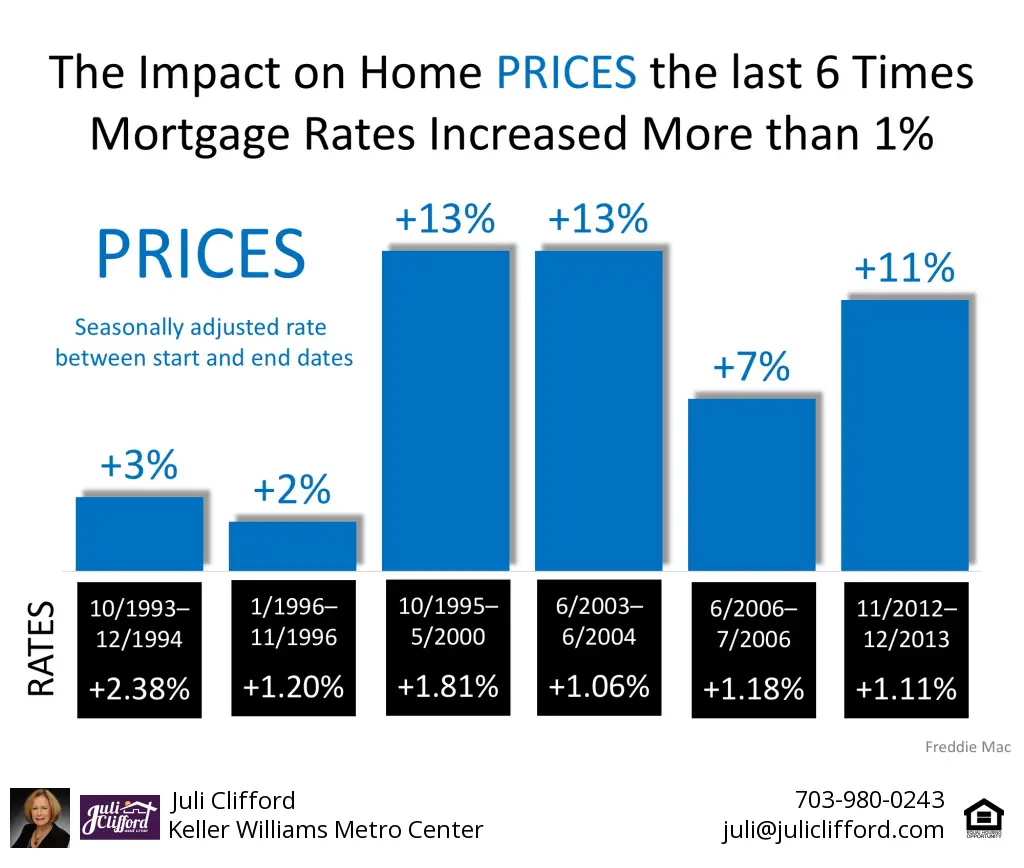

How Much Interest Can Cost

Your interest rate and how its calculated affects your regular mortgage payments. A mortgage is usually a large amount of money. Therefore, small differences in the interest rate can have a significant impact on your costs.

Figure 1: Example of monthly mortgage payment for a mortgage of $300,000.00 with an amortization of 25 years at various interest rates

| Interest cost over 5 years | Interest cost over 25 years |

|---|---|

| 2.50% | |

| $73,097.91 | $233,738.23 |

Make sure your home is within your budget. Consider if youre comfortable with the possibility of interest rates increasing. Determine if your budget could handle higher payments. If not, you may be overextending yourself.

Also Check: How To Get A Higher Mortgage With Low Income

Mortgage Rates And The Pandemic

It looked like a puzzle: As the COVID19 pandemic spread, central banksincluding the Bank of Canadaquickly cut interest rates to cushion the blow. But rates on new mortgages didnt decline much, and some actually went up. Why?

Remember that your lenders funding cost determines most of the mortgage rate. The cost of funding jumped in the early days of the pandemic as investors became nervous. Many simply wanted to hold on to their cash given how uncertain everything was. So, the funding that is normally easy for lenders to get slowed to a trickle. This drove up the funding cost, even as the Bank of Canadas policy interest rate fell.

The Bank of Canada has taken many steps to help financial markets work better during the pandemic, along with the federal government and other public authorities. The goal is to ease strains in funding markets, so lenders can keep supplying credit to households and businesses.

These steps include launching programs to make sure lenders can access the funding they need. As a result of these actions, funding costs fell and some mortgage rates on new loans started to decline.

Keep in mind: existing mortgages didnt become more expensive during the pandemic. They either have an interest rate that is fixed until its next renewal, or a variable interest rate that declined along with the Bank of Canada policy rate.

Who Can Help Me Choose The Right Product

Given the impact this could have on your current and future finances, its wise to explore and consider various options before choosing a product. Everyones situation is unique it’s about whats right for you and your loved ones.

The good news is this isnt a decision you have to make alone. A mortgage expert will consider your personal circumstances, including current and future affordability, and recommend the most appropriate deal for your financial goals.

Recommended Reading: Is It Difficult To Refinance Your Mortgage

Mortgage Rates Are Falling But What Does 2023 Have In Store

Despite soaring above 6 per cent last autumn, fixed-rates mortgage deals are starting to improve.

But with interest rates predicted to continue rising this year, will mortgage rates follow suit? And how can borrowers choose the right deal?

Anyone keeping close tabs on the property market may have noticed the tide starting to turn.

After two and a half years of soaring growth, UK House prices have fallen four months on the bounce, including a 1.5 per cent drop in December, while mortgage approvals recently slumped to their lowest level since the pandemic emerged.

The reason for this shift is mortgage rates, which is impacting buyer affordability. In October, the average two-year fixed rate hit 6 per cent for the first time in 14 years.

Though rates have nudged down in recent weeks, and are forecast to continue falling throughout 2023, the picture is clearly unsettling.

With things changing so quickly, its no wonder current and budding homeowners are finding it increasingly difficult to choose the right mortgage deal.

Here we make sense of whats going on.

The Basics Of Taking Piti

The typical monthly mortgage payment has four elements, referred to by the acronym PITI: principal, interest, taxes and insurance. Principal is the money you borrowed with each payment, you pay off a portion of the principal. Interest is the money you pay to your mortgage lender for the privilege of using its money for 15 or 30 years.

Taxes are the property taxes you pay on your home, and insurance is your homeowners’ insurance premiums. In some cases, such as for borrowers with a small down payment or bad credit, insurance also includes mortgage insurance, which pays the lender in case the borrower defaults on the loan.

You May Like: When Is It Worth To Refinance A Mortgage

Qualifying For A New Mortgage May Be More Difficult

Higher monthly payments are likely to make it harder for people to qualify for home loans they could have otherwise afforded before the recent rate hike, even if the home price is the same. That’s because a higher home price skews your debt-to-income ratio , a major factor lenders consider during the mortgage approval process. Generally, lenders want your housing payment to account for no more than 28% of your gross monthly income and all of your monthly debt payments to represent no more than 36% of your gross income.

Will My Fixed Rate Mortgage Payment Fluctuate Throughout The Life Of The Loan What Is A Fixed

A fixed-rate mortgage is a home loan option with a particular interest cost for the entirety of the loan. Even if you have a fixed-rate mortgage the monthly payment amount may fluctuate during the life of the loan. A fixed-rate loan offers a fixed term as well as a fixed interest rate, so the monthly amount for the payment of principal and interest will not change during the term of the mortgage. However, your monthly mortgage payment may also include interest, taxes, and insurance. While your principal and interest amounts will not change, the amount needed for taxes and insurance may.

Once a year, on the anniversary date of the mortgage, Mortgage Center will perform an escrow analysis to determine if current monthly deposits balances will provide sufficient funds to pay property taxes, hazard insurance and other bills when they come due. Please be aware that property taxes may go up considerably on purchase transactions from what the previous owner paid. The municipality where the property is located reassesses the taxable value of the property when it transfers ownership. As the propertys taxable value is no longer governed by the rate caps used when the property remains under the same owner, the required property taxes may increase considerably. If your payment amounts have fluctuated, Mortgage Center will have to adjust the amount needed in your escrow accounts to compensate for these changes.

Go back

Don’t Miss: How To Pay Off 200k Mortgage In 10 Years

Why Did My Mortgage Payment Go Up

Your mortgage payment may have increased due to an increase in your taxes and/or insurance bill. The escrow portion of your payment is based on the last tax and/or insurance payment made from your escrow account prior to your analysis. Please see the most recent escrow analysis you received from Peoples United Bank for details.

What To Consider Before Prepaying Your Mortgage

Prepaying your mortgage is a great goal to work toward, but before you do, make sure youve met these financial milestones first:

Once those bases are covered, prepaying a mortgage comes down to discipline and comfort level. Do you want to be completely debt-free, or would you prefer your money working harder for you in other ways? Ideally, you want to pay off your mortgage before retirement so you dont have those monthly payments to worry about if your income becomes more limited.

Don’t Miss: What Is A Good Interest Rate For A Home Mortgage

What To Do If Your Escrow Account Is Short

Addressing an escrow shortage is simple. When your escrow account is short, you will be given notice indicating that an increase in property taxes or insurance is the cause. As a homeowner, even if the shortage isnt your fault, you are still responsible for the payment.

Depending on the lender, your options for covering the cost of this shortage include:

- Paying the full amount of the shortage

- Starting to make a higher monthly payment to cover the shortfall

Failure to pay your property taxes can result in a lien on your home, foreclosure, fines and penalties. In addition, when homeowners insurance is not paid, you are at risk of being liable for damage to your home. Ultimately, if a borrower who does not have an escrow account does not make payments, lenders can open an account and charge them for the unpaid balance or add the unpaid balance to the total loan amount.

If the increase of the escrow payment is not manageable, one solution is to lower your mortgage payments to allow room in your budget for the additional money that will be needed for escrow. This can be done by refinancing or extending your repayment term. With a lower interest rate or more time to pay back your loan, youll generally have smaller payments every month.

Dispute Your Property Tax Bill

If your home loan includes an escrow account, property taxes may make up a noticeable chunk of your monthly mortgage payment. As a homeowner, you can appeal a tax assessment with your local, county or regional tax board. Common reasons to appeal are errors in square footage, zoning or amenities.

Consult with a tax attorney to learn the deadlines for a property tax appeal. Ask about property tax exemptions if youre a senior or have a disability, you may be eligible for one.

Read Also: Can You Consolidate Your Debt Into Your Mortgage

You Eliminated Your Private Mortgage Insurance

If you put down less than 20% of your home’s purchase price at the closing table, you’re required to pay private mortgage insurance every month until your loan-to-value ratio reaches 80%.

Once you reach 20% equity in your home, you are eligible to reach out to your lender and request a cancellation of your PMI policy. Otherwise, your lender will automatically cancel PMI when you reach 22% equity in your home.

The removal of PMI would affect your mortgage payment by shaving some money off of it every month.

Keep in mind private mortgage insurance applies to borrowers with conventional loans who put down less than 20% for their home purchase. Most FHA borrowers who put down less than 10% will pay mortgage insurance as welloften referred to as a mortgage insurance premiumbut this product operates somewhat differently from PMI.

Why Did My Mortgage Payment Increase

The payment amount may have changed for several reasons, such as:

- Escrow: If your mortgage is escrowed, the monthly payment may change to reflect increases or decreases in taxes and/or insurance.

- Adjustable-rate mortgages : The interest rate charged may increase or decrease at a specific time and periodically, as agreed upon at the inception of your loan.

- Interest-only mortgages: These allow you to only pay interest on the loan for a preset, very specific amount of time. Once that time has elapsed, youâll be responsible for making full payments, including the principal.

- Buy-down clause: If the terms of your mortgage include a buy-down clause for a specific period where the interest rate is subsidized by a third party, your payments could change. Over time, payments adjust so that you pay an increasing percentage of the original interest rate as defined in your loan.

For U.S. Bank:Equal Housing Lender.Deposit products are offered by U.S. Bank National Association. Member FDIC. Mortgage, Home Equity and credit products offered by U.S. Bank National Association. Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rates and program terms are subject to change without notice.U.S. Bank is not responsible for and does not guarantee the products, services or performance of U.S. Bancorp Investments, Inc.

Don’t Miss: When Is The Best Time To Close On A Mortgage

What’s In My Monthly Mortgage Payment

Your monthly mortgage payment includes more than just the price of your home. [Principal, interest, taxes, and insurance are the components of your monthly payment, and its important to understand each element so you know what youre paying for.Principal is the amount you borrow and have to pay back, which may include the sales price of your home, minus your down payment. If you put $15,000 down on a $150,000 loan, your principal balance is $135,000.Interest is a percentage of your principal balance. You pay interest back to your lender, who charges you for borrowing money from them.Taxes, specifically, property taxes, are charged for real estate property , and are determined by your local government.Insurance includes your homeowners insurance, private mortgage insurance if its required, and any supplemental insurance, like flood insurance, if it applies to your property. Insurance protects both you and your lender from potential losses.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Also Check: How Much Interest You Pay On A Mortgage

The Bank Notified Me That There Was A Shortage In My Mortgage Escrow Account And Increased My Monthly Payments Is This Legal

Yes. If your bank determines that there will not be sufficient funds in your mortgage escrow account, it may raise your payment by the amount of the shortage. The bank may offer you the choice to repay the amount in one lump sum or spread the payments over a 12-month period.

Review your mortgage loan contract for policies specific to your bank and your account.

Refer to 12 CFR 1024 “Real Estate Settlement Procedures Act .”

Last Reviewed: April 2021

Please note: The terms “bank” and “banks” used in these answers generally refer to national banks, federal savings associations, and federal branches or agencies of foreign banking organizations that are regulated by the Office of the Comptroller of the Currency . Find out if the OCC regulates your bank. Information provided on HelpWithMyBank.gov should not be construed as legal advice or a legal opinion of the OCC.

Reasons Your Escrow Payment Might Be Going Up

Your lender will recalculate your escrow payment every year, and it is possible that your escrow payment will change. Common reasons your escrow payment might be going up include:

- An increase in homeowners insurance premium

- An increase in property taxes in your area

- Your servicer miscalculated fees

Any changes made to your monthly payment will be explained to you in the yearly escrow analysis, which is provided by your mortgage servicer.

Read Also: Can I Get A Mortgage With A 675 Credit Score