Should I Refinance To A Higher Interest Rate

Now that you understand the reasons why a refinance can be beneficial to a homeowner, its time to discuss why youd choose to refinance at a higher rate. Its the elephant in the room these days, as 85% of homeowners have a rate of 6% or lower.

Given that data, the best way to understand why youd refinance to a higher rate is to look at one of our savings sheets.

What Is A Good Mortgage Interest Rate Right Now

What makes a “good” mortgage interest rate? Well, that answer depends on your financial health, your goals, and the current housing market.

As you likely already know, interest rates vary throughout the year. They can also differ from one borrower to another. If you’re hoping to buy or refinance a home, it’s important to pay attention to what’s going on in the overall market. The rates available today may seem high but really may be favorable depending on where things are headed in the near future.

Lets consider the following loan types and their current interest rates as examples. Data is from November 2022 and courtesy of Freddie Mac.

-

30-year Fixed-Rate Conventional Loans 6.95%

-

15-year Fixed-Rate Conventional Loans 6.29%

-

5/1 Adjustable Rate Mortgage Loans 5.95%.

As you can see, you can access a lower interest rate if youre able to consider a shorter-term fixed-rate loan or an adjustable-rate mortgage . However, those loans can come with higher monthly payments.

So how do you know if current mortgage rates are right for you? It depends on many factors. Continue reading as we take a closer look at today’s rate environment.

How Are My Home Loan Interest Repayments Calculated

How much you pay each month will depend on numerous factors, including what type of rate youâre paying, how often your interest is calculated and how long your home loan term is for. One of the important factors in determining how your interest rates are calculated is whether your home loan is an interest only or principal and interest loan. Hereâs the difference:

- Interest only loans

With an interest only loan your monthly repayment consists of only the interest for the loan, and not the loan amount itself. The monthly savings can be significant if youâre not paying any of the principal loan amount, which might be a great short term solution if youâre running on a tight budget. The downside is that you wonât be making any progress toward actually owning your home.

Interest only loans are popular for investors, because theyâre often counting on the value of the home increasing enough to sell the property, pay off the loan and make a profit.

Remember that you will eventually have to pay off the total loan amount, so while an interest only loan might be affordable in the short term, you should have a long term repayment plan in place.

- Principal and interest loans

Our awards

Read Also: Should I Refinance My 30 Year Mortgage

What Is A Home Loan Interest Rate

When you take out a home loan, your bank or lender applies an interest rate to the amount borrowed. This is expressed as a percentage, known as the Annualised Percentage Rate , which represents the annual cost to borrow a sum of money.

To illustrate how this works, say you want to borrow $500,000 to purchase a home. Your lender agrees to lend you the money and charges an interest rate of 3% p.a. The amount of interest paid in this scenario is determined using the following formula:

÷ time = interest

So if we multiply $500,000 by 0.03, then divide it by 365 , we would get $41.10. This is the amount of interest you would be charged in a day. However, this will change as you chip away at your principal over time. To work out how much you would pay over the life of a loan, use our home loan repayments calculator.

How To Find The Best Mortgage Rate For You

Different lenders will look at your financial circumstances in different ways.

For example, a lender that specializes in FHA loans will rarely raise an eyebrow if your credit score is in the 580 to 620 range. But one that caters to super-prime borrowers likely wont give you the time of day.

Ideally, you want a mortgage lender that is used to dealing with people who are financially similar to you. And the best way to find your ideal lender is by comparing loan offers. Heres how to do that.

You May Like: Can You Buy A House Without A Mortgage

What This Means For Home Buyers

While experts predict mortgage rates will eventually decline in 2023, the Fed isn’t done raising rates. Though these may taper to 25 basis points, until the central bankers genuinely believe inflation is slowing, interest rates should remain elevated.

Unless the economy takes a sharp turn into a recession, which would force the Fed to back off. That would be bad news overall but potentially good news for mortgage rates. Without the Fed’s upward pressure, rates could meaningfully fall.

However they happen, lower interest rates could be the key to getting the housing market moving again. And while inventory might not increase enough to create competition among sellers, at minimum, buyers would have more options because there’d be more homes for sale and paying less interest would give their budgets more leeway.

While these major forces shape the housing market, they probably don’t determine whether you’ll buy or sell in the coming year. “Focusing on your own situation and what you can afford is the best strategy,” Frick said. “If you think home prices and rates are too high now, waiting for both to drop may be your best bet.”

Your goals and employment outlook should matter more than what the Fed does.

A previous version of this article misstated Robert Fricks title. He is a corporate economist at Navy Federal Credit Union. This article has been corrected.

Gather Info On Your Income And Employment History

Lenders generally want to see two consecutive years of steady income and employment to ensure you can afford your mortgage payments and repay the loan over the long haul. If youre a salaried employee, lenders ask for W2 forms and federal tax returns for the past two years to verify your income. Lenders also check with your employer to verify how long youve worked there. If your earnings have gone down or youve had gaps in employment in the last two years, lenders are skeptical of your ability to afford a mortgage and you might have trouble getting a mortgage preapproval.

Similarly, self-employed borrowers have to jump through more hoops to get a mortgage. If you are self-employed, expect to pay higher interest rates than what you see online those rates are for borrowers who are considered more creditworthy because of their steady, verifiable incomes and excellent credit scores. Lenders also generally have stricter rules for verifying self-employment income. Not only will you need to provide federal tax returns for two years, youll also need to submit a signed statement from an accountant, a profit/loss sheet, and other documentation to show sufficient business income.

Recommended Reading: What Is Needed For A Mortgage Loan

What Is A Mortgage Rate Lock

A mortgage rate lock is a guarantee that the rate youre offered in your mortgage application acceptance is the one you will eventually pay, assuming you close within a normal period of time and make no changes to your application.

In a period of rising or volatile interest rateslike the current oneit may be wise to lock in a rate that seems affordable for you.

Potential For Muted Impact On Mortgage Rates

Experts are mixed on how much higher mortgage rates could go in 2023. “We expect mortgage rates to rise back above 7% for the first part of the year, and then decline as the economy slows,” Robert Frick, corporate economist for Navy Federal Credit Union, said in an email.

Others think the days of 7% interest rates for 30-year fixed-rate loans are in the rearview mirror. Mortgage rates “may have peaked,” Nadia Evangelou, senior economist and director of real estate research for the National Association of Realtors, commented via email. “Rates are still more than double those of a year ago, but if inflation continues to slow down, rates may stabilize near 6%.”

The good news? Though it will likely take time, the consensus is that rates will eventually go down. That would be a welcome shift for home buyers priced out of the market by rising interest rates. In October, despite a slight drop in home prices, the monthly principal and interest payment on a median-priced home topped $2,000, according to data from the National Association of Realtors, or NAR. That’s beyond the reach of a household earning the median income and over $800 more than one year prior. Lower rates would help buyers’ budgets go further.

Also Check: What Income Needed For Mortgage

How Are Mortgage Rates Determined

Mortgage rates, in general, are determined by a wide range of economic factors, including the yield U.S. Treasury bonds, the economy, mortgage demand and the Federal Reserve monetary policy.

Borrowers have no control over the wider economy, but they can control their own financial picture to get the best rate available. Typically, borrowers with higher FICO scores, lower debt-to-income ratios and a larger down payment can lock in lower rates.

Related:How To Improve Your Credit Score

How Does A Mortgage Interest Rate Work

Mortgage interest rates can vacillate, depending on larger economic factors and investment activity. The secondary market also plays a role.

Fannie Mae and Freddie Mac bundle mortgage loans. They sell them to investors who are looking to make a profit. Whatever interest rate those investors are willing to pay for mortgage-backed securities determines what rates lenders can set on their loans.

-

There are dips or insecurities in foreign markets.

-

Inflation slows.

-

Unemployment increases or jobs decrease.

-

The stock market is strong.

-

Foreign markets are strong and stable.

-

Inflation is up.

-

Unemployment is low, and jobs are increasing.

This chart illustrates how 30-year fixed-rate mortgage rates have changed since 2000.

Interest rates aresimply cited and agreed-upon percentages. The amount of interest you will pay each month will decrease as you pay off the principal balance you borrowed and as that number also decreases. Your percentage interest rate applies to that remaining balance.

You May Like: How Large Of A Mortgage Can I Get

Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan terms, interest rate types , down payment size, home location and loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Can I Afford The Monthly Mortgage Payment

Many lenders don’t advertise this, but it’s important to note that just because they might be willing to give you a higher loan, doesn’t mean you have to accept the full amount. In other words, it’s your responsibility to decide what’s an affordable loan to take on and where your comfort level is. Your comfort level might be somewhere below the loan amount set by a lender.

Even so, many first-time homebuyers need guidance. It’s often recommended that borrowers should spend no more than 28%-30% of their gross monthly income on a mortgage payment.

Read Also: How Do I Make My First Mortgage Payment

What Is A Mortgage

A mortgage is a type of secured loan used to purchase a home. You pay back the lender over an agreed-upon amount of time, including an additional interest payment, which you can consider the price of borrowing money.

Because a mortgage is a secured loan, it means you put your property up as collateral. Should you fail to make your payments over time, the lender can foreclose on, or repossess, your property. Learn more about how a mortgage works here.

Is The Job Market Still Hot

But Powell said that while goods inflation has cooled as supply snarls have improved, the price of services such as health care, education and restaurant visits have shown little sign of easing. Powell pointed to persistent worker shortages that have spawned sharp wage increases in service industries. He noted that most of the baby boomers who retired early during the pandemic are unlikely to return to the workforce.

“The labor market continues to be out of balance, with demand substantially exceeding the supply of available workers,” Powell said. “We still have a ways to go” before the demand for workers wanes, moderating price increases for services. “We may have to raise rates higher to get where we want to go.”

Employers added a healthy 263,000 jobs in November and average annual wage increases picked up to a vibrant 5.1% from 4.7% the prior month.

Job gains have been robust in recent months, and the unemployment rate has remained low, the Fed said in its statement Wednesday.

Higher labor costs typically prompt companies to raise prices to maintain profits.

Strong spending:$11.3 billion in holiday shopping: Cyber Monday spending breaks all-time record, per report

Another reason for the Feds tough stance on rates is that it has been locked in a sort of tug-of-war with financial markets. The last two CPI reports boosted stock markets and pushed down long-term interest rates, bolstering the economy, partly on hopes they would mean fewer rate hikes.

You May Like: What Is A Pre Qualified Mortgage

How We Determine Mortgage Rates

To get an idea of where mortgage rate may move, we rely on information collected by Bankrate, which is owned by the same parent company as NextAdvisor. The daily rates survey focuses on home loans where the borrower has a 740+ FICO score, a loan-to-value ratio of 80% or better, and lives in the home.

The mortgage interest rate data listed below and based on the Bankrate mortgage rate survey:

Average mortgage interest ratesWhy Are Mortgage Interest Rates Important

Your mortgage interest rate determines how much the balance of your loan will grow each month. The higher the interest rate, the higher your monthly repayments.

Interest rates are always calculated as a percentage of your mortgage’s balance.

If you have a repayment mortgage – which most people do – you’ll pay a set amount of your balance back each month plus interest on top of that. Those with interest-only mortgages pay interest but none of the -capital.

You May Like: How To Calculate House Mortgage

What Is A Good Interest Rate For A Private Loan

Whenever you are exploring your financing options, you need to understand what kind of interest rate you should expect from different lenders. For example, when trying to buy a home banks will generally have the lowest interest rates on the market, so they should be your first option for financing. The only problem is that they turn away the vast majority of applicants they receive due to their strict lending guidelines. If you find your loan applications keep getting rejected by banks, you will then need to work with private lenders to get the funds you need.

While banks and other financial institutions will set their interest rates close to the prime rate set by the Bank of Canada, private lenders set their own interest rates based on an array of different factors when determining what interest rates to set for each borrower. Here we are going to explore private mortgage and loan interest rates, what you can expect and what should be considered a good interest rate for your private loan.

Average Mortgage Interest Rate By Type

There are several different types of mortgages available, and they generally differ by the loan’s length in years, and whether the interest rate is fixed or adjustable. There are three main types:

- 30-year fixed rate mortgage: The most popular type of mortgage, this home loan makes for low monthly payments by spreading the amount over 30 years.

- 15-year fixed rate mortgage: Interest rates and payments won’t change on this type of loan, but it has higher monthly payments since payments are spread over 15 years.

- 5/1-year adjustable rate mortgage: Also called a 5/1 ARM, this mortgage has fixed rates for five years, then has an adjustable rate after that.

| 5.57% |

Read Also: How To Prequalify For A Home Mortgage

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinance if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage points . It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money you’d save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you’d pay off your house sooner.

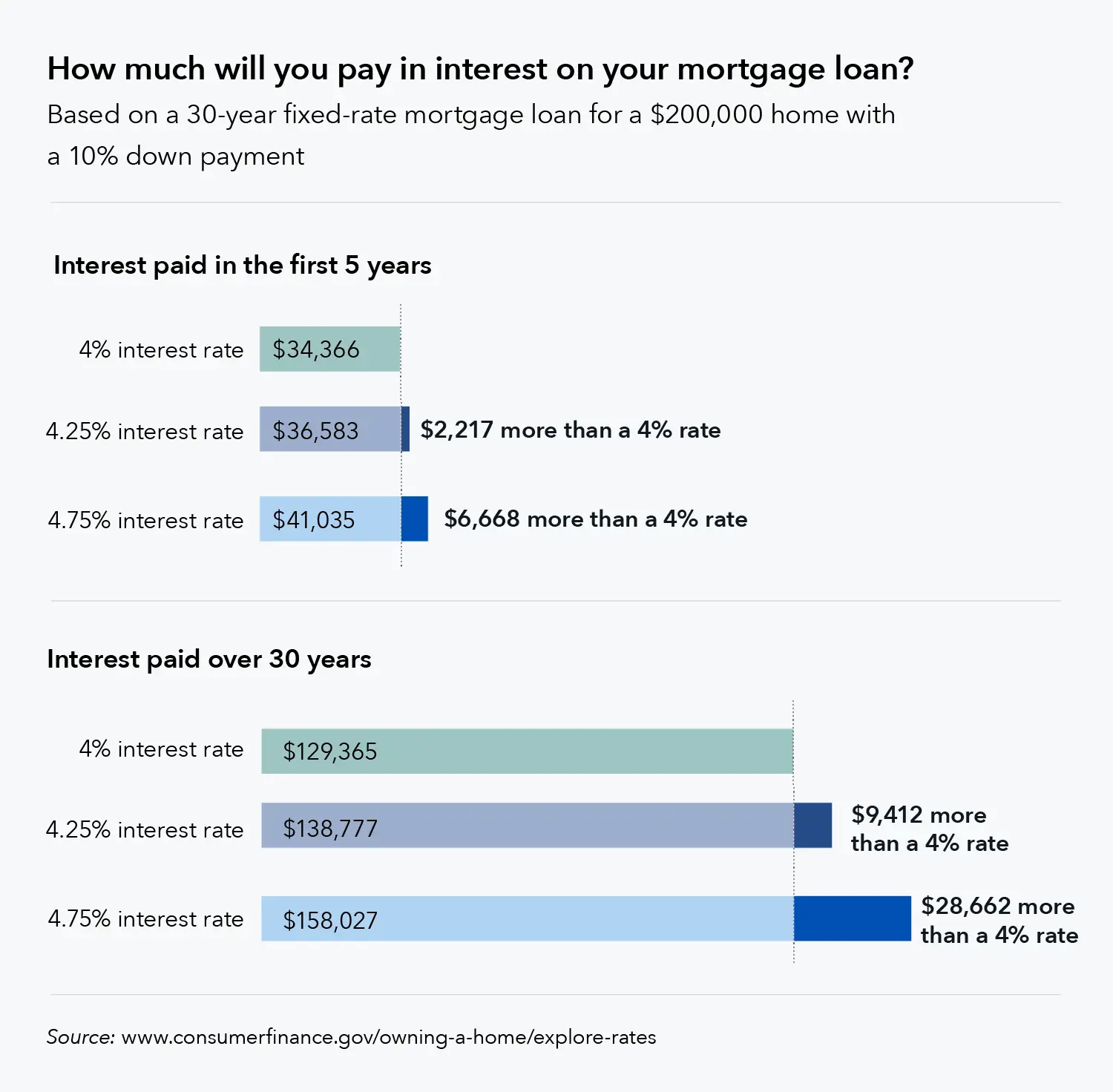

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.