Should You Refinance Your Mortgage To Pay Off Student Loans

You can pay off student loans by refinancing your mortgage, but its not always the best choice

Student loans can be a burden to pay off. You might be considering using a low-rate mortgage refinance to pay off your student loans if you can get a lower interest rate. You should only consider this if you have more than 20% home equity, as it may allow you to lower your payments and take advantage of additional tax deductions or credits.

Before paying off your student loans with a mortgage refinance, make sure to consider the risks and potential alternatives. Youre basically reshuffling your debt. Plus, you wont have your home equity for another need or as a cushion if housing prices decrease. Additionally, youll lose potential federal student loan benefits, like income-driven repayment plans and loan forgiveness.

If you want to pay off your student loans faster and preserve your homes equity, rather than refinancing them into your mortgage, you could pay more than the minimum each month or make two payments a month instead of one. Carefully consider the benefits and risks before refinancing your mortgage to pay off your student loans.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How is this page expert verified?

At Bankrate, we take the accuracy of our content seriously.

Expert verified means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

Arrow Right Arrow Right Arrow Right

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

Pros Of Rolling Student Loans Into Mortgage

It could lower your interest rate: If you pay a higher interest rate on your student loans and current mortgage vs. a new Cash-Out Refi, consolidating may help reduce how much you pay in overall interest.

It could lower your monthly payment: If you qualify for a lower interest rate and choose a longer repayment period with the new loan, it may significantly lower the total amount you pay each month for your mortgage and student loans combined. Keep in mind that extending the life of the loan may mean you pay more in interest in the long-term.

It simplifies your finances: Having a single monthly payment might make your finances easier to manage. The fewer monthly payments you have to keep track of, the better. If you have multiple student loans, rolling them into your mortgage can make your life easier.

You May Like: Can Seniors Get A Mortgage

Should I Refinance My Student Loans And Does It Matter If I Want To Buy A House Soon

Interest rates are as high as weve seen since 2007. Combined with the velocity at which the Fed has raised rates including four consecutive 0.75% interest rate hikes for the first time 1980 Americans are having to adjust to a much different financial landscape.

That includes anything tied to interest rates, including savings accounts, , mortgage rates and student loans. New loans are especially impacted. But so are previous loans with variable interest rates.

Is it a good time to refinance student loans with variable interest rates? And do credit inquiries impact ones ability to get approved for a mortgage?

Thats what a listener of the Clark Howard Podcast recently asked.

Refinancing Student Loans With Sofi

If you are interested in consolidating your student loan debt at a lower interest rate but dont want to roll them into your mortgage, you may instead want to consider student loan refinancing. With SoFi student loan refinancing, you can refinance your private or federal loans with no application fees, origination fees, or prepayment penalties. And you still get the benefit of consolidating your loans to one payment, with a new interest rate and loan terms. Keep in mind that refinancing any federal loans will eliminate them from federal programs and borrower protections such as income-driven repayment plans or deferment options.

Read Also: How Much Income To Qualify For 200 000 Mortgage

How Do I Refinance Student Loans

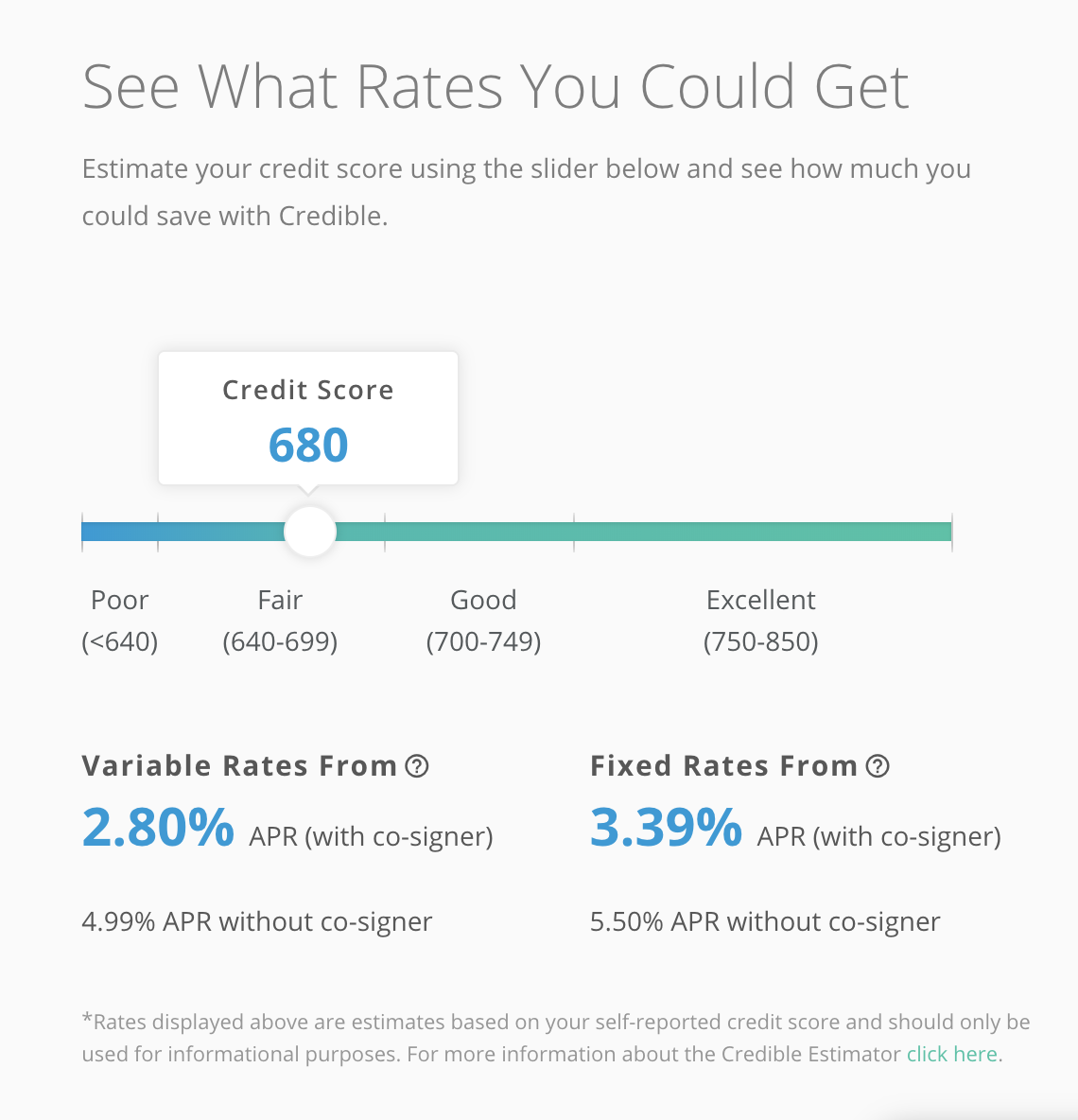

If youre not sure how to refinance student loans, the process is pretty straightforward. First, check your credit score and take any necessary steps to improve it before you apply. Then, do some comparison shopping and get offers from multiple lenders. You can compare the interest rates, loan terms and repayment options offered by each.

Once youve chosen your top lender, submit a formal application and wait for approval. Your new lender should pay off your old loan directly, and then youll start making regular payments to your new lender.

Pay Attention To The Term

The length of your new mortgage loan will impact your long-term costs, so make sure you take this into account when considering your options. For example, refinancing into a 30-year mortgage loan may mean a lower monthly payment and interest rate now, but when you calculate the amount of interest paid over 30 years, it actually comes out to much more than youd pay on your student loans as-is.

Also Check: How Much Income Do I Need For A 50k Mortgage

How To Roll Student Loans Into A Mortgage

If youve decided youre ready to roll your student loans into a mortgage, heres what you need to know.

First, make sure it makes sense to refinance your debts into your mortgage. In a low interest rate environment, its an easy decision. If you have higher student loan rates, you can refinance the debt into your mortgage and save money on interest.

But this comes at a cost. If you stretch out the loan term, such as a 30-year term, make sure the total interest youll pay wont exceed what your student loans would have cost. To get the best interest rates and mortgage loan terms, youll need good credit, low debt ratios and proof that you can handle the higher loan amount.

Then there are the closing costs. Ensure they arent so high that they defeat the purpose of refinancing your student loans into your mortgage.

If rolling student loans into your mortgage does make sense, you can use a conventional or FHA cash-out refinance or the Fannie Mae Student Loan Cash-Out Refi loan.

In a traditional cash-out refinance , you borrow enough money to pay off your student loan, receive the proceeds and pay the student loans off yourself. You have a new, higher mortgage loan and only one payment each month.

How Much Of Student Loans Is Counted For A Mortgage

Student loans are evaluated as a part of your overall debt-to-income ratio. In general, lenders avoid lending to borrowers with a debt-to-income ratio greater than 43%.

SoFi Loan ProductsSoFi loans are originated by SoFi Bank, N.A., NMLS #696891 . For additional product-specific legal and licensing information, see SoFi.com/legal. Equal Housing Lender.

SoFi Student Loan RefinanceIf you are looking to refinance federal student loans, please be aware that the White House has announced up to $20,000 of student loan forgiveness for Pell Grant recipients and $10,000 for qualifying borrowers whose student loans are federally held. Additionally, the federal student loan payment pause and interest holiday has been extended beyond December 31, 2022. Please carefully consider these changes before refinancing federally held loans with SoFi, since the amount or portion of your federal student debt that you refinance will no longer qualify for the federal loan payment suspension, interest waiver, or any other current or future benefits applicable to federal loans. If you qualify for federal student loan forgiveness and still wish to refinance, leave unrefinanced the amount you expect to be forgiven to receive your federal benefit.

Read Also: Will My Mortgage Payment Go Down

When It Makes Sense To Refinance Student Loans

Is refinancing your student loans the right choice for you now? Seriously consider it if:

Your credit score is strong enough to qualify for a lower interest rate than your current one. You may qualify for student loan refinancing with a FICO score of about 650, but a higher score can get you a better rate and possibly more cash flow. “If refinancing an existing loan allows the borrower to have more access to money for their current lifestyle, future retirement or pay down more expensive debt, it’s worth considering,” says Hopkins.

Your private student loan has a variable interest rate, and you want to refinance to a fixed-rate loan. With a variable-rate loan, at some point you could see your interest rate go up as market rates change. If that happens, a new fixed-rate loan might be cheaper. The same goes if you have a private loan with a high interest rate.

“Borrowers who have older private student loans with high balances and higher interest rates may find an opportunity for savings with a drop in the rate,” says McClary.

You want to release a co-signer. If you can refinance a private student loan in your name alone, you could free a co-signer from liability for your debt. However, some lenders offer a co-signer release only after a number of consecutive on-time payments, up to four years. You’ll also need to meet certain credit criteria after you’ve made the required number of payments.

Should You Refinance Your Home To Pay Down Your Student Loans

Homeowners have gained considerable equity in their homes in recent years. Median home prices rose 22 percent when comparing the second quarter of 2021 with the second quarter of 2020, according to ATTOM Data Solutions, an Irvine, Calif.-based property data firm.

For homeowners with student loan debt, the combination of low mortgage rates and increased home equity makes refinancing to pay down or eliminate their student loan debt tempting.

One more incentive for refinancing now is the recent elimination of a special refinance fee. In July, the Federal Housing Finance Agency announced that loans purchased by Freddie Mac and Fannie Mae would no longer require an extra fee. The adverse market refinance fee was added to loans at the end of 2020 to cover projected losses from foreclosures related to the coronavirus-pandemic-induced recession.

However, since the housing market remained strong and the anticipated wave of foreclosures has not occurred, the refinance fee was eliminated as of Aug. 1. The fee was estimated to add $1,400 in costs on an average $300,000 loan.

Q: Are homeowners with student loan debt considering refinancing and taking out their equity to pay off that debt?

Q: What are the advantages of using home equity to pay off student loan debt?

Q: What are the disadvantages of using home equity to pay off student loan debt?

Q: How much can someone borrow with a cash-out refi?

Read Also: How Much Is A Mortgage On A 650k House

Is Now The Best Time For You To Refinance

Refinancing might be good for many borrowers, but take a step back before making this move. If you have federal student loans, the government has temporarily paused payments through Aug. 31, 2022. Because of this, refinancing federal student loans is doubly risky now if you refinance, youll need to start making payments immediately.

If you have private student loans and excellent credit, however, you might qualify for a lower interest rate than what youre currently paying, since the coronavirus has caused refinancing rates to plummet. With that said, you may want to refinance sooner than later. Interest rates will likely start to rise as the Federal Reserve attempts to control inflation. If youve been on the fence about refinancing, get a few prequalified offers now before interest rates climb.

Who Should Consider Refinancing Student Loans

When youre weighing your refinancing options, make sure your credit is in tip-top shape. To see if refinancing is worth it, consider your:

- Current loan interest rate. If you have high-interest private student loans, you may want to lower your interest rates to lower your monthly payments, as well as your total loan amount. High interest is relative based on what youre paying if you can stand to get a lower interest rate, refinancing might be worth it.

- Savings. Refinancing might not be a good idea if you cant significantly save on your interest rate, monthly payments, overall loan payment or a combination of them all. In your refinancing calculations, make sure youll be able to cut costs in some way.

- . If you have a solid credit history, youll likely be eligible for more types of student loan refinancing. A good credit score is around 670, according to FICO, but the higher your credit score, the more lenders youll qualify to work with, and at the lowest rates offered.

- Immediate credit needs. Since new credit applications trigger a hard credit inquiry, youll need to limit applying for new types of credit, like a credit card, an auto loan or a mortgage.

Read Also: Can I Buy A Second House With A Mortgage

Transferring Parent Plus Loans

In order to pay for their children to go to college, some parents will get a Parent PLUS loan to cover the cost. Its important to note that there is no direct process to transfer Parent PLUS Loans to your child, but you can refinance them to your child. Refinancing Parent PLUS Loans may also offer you the opportunity to consolidate other debt associated with financing your childs education. If you have Parent PLUS Loans and have also cosigned private student loans for your child, your Parent PLUS Loans and their private student loans that you cosigned can be consolidated together by refinancing with a private lender like ELFI.

When You Want To Reduce Your Monthly Payments

Refinancing could make sense if youre looking to free up some cash in your monthly budget.

Lenders usually allow you to choose the length of your repayment, typically between five and 20 years. Generally speaking, the longer the term, the lower you pay each month.

Keep in mind that this strategy could cause you to pay more over the life of your loan, but it can be a savvy move if youre trying to improve your debt-to-income ratio. For example, having more cash freed up in your monthly budget may make it easier to finance a large purchase like a house or car.

Read Also: Can You Write Off Mortgage Payments

How To Pay Off Student Loans By Refinancing Your Mortgage

Paying off your student loans by refinancing your mortgage can be a way to lock in a lower interest rate for up to 30 years, reduce your monthly payments and improve your cash flow. Follow these steps if you decide that this might be the right decision for you:

Giovanni Acosta, a mortgage loan originator for the direct lender Equity Now, said, If the student loan is paid directly by the lender, you may qualify for a student loan cash-out refinance, which has better pricing than a traditional cash-out refinance.

Why I Refinanced My Student Loans Six Times

Refinancing your student loans essentially does two things: It can consolidate your student loans into one concise payment and gives you the potential to lower your interest rate with the latter potentially saving you lots of money.

It’s important to know that this solution isn’t right for everyone, especially if you already have a low interest rate through public loans or are potentially eligible for student loan forgiveness. If you refinance your government loans, you’ll lose protections like loan discharge or forgiveness in the case of death or permanent disability.

But if your rate is high, or you’re unable to qualify for federal loans, you may want to consider private student loans and refinancing them like I did.

In many cases it doesn’t cost anything to refinance student loans. Plus, the process is quite simple: Once you apply and are approved, the new lender will send the current lender the funds for the full amount of the loan. And from there, you begin paying the new lender at your new interest rate.

You May Like: How To Refinance A Seller Financed Mortgage

Other Ways To Make Your Student Debt More Bearable

If you decide a cash-out mortgage refi is not for you, you do have other ways of reducing the pressure on your budget from your student loan debt.

First, you’ll want to explore refinancing your student debt separately, into a new loan with a lower interest rate. Student loan rates have hit all-time lows, so moving your debt to a cheaper loan could help you pay off your balance more quickly.

Also, look for ways to cut your other expenses, including what you’re paying for homeowners insurance. Before your current policy expires, shop around for a lower price before automatically renewing your coverage.

And if your existing mortgage isnt brand-new, you could leave your student debt alone and check to see if you can score a super-low interest rate on a traditional mortgage refi, without the cash-out angle.

Refinancing could save you hundreds of dollars per month, especially if youre willing to do some comparison shopping.

The higher your credit score, the better the interest rate youre likely to get. If you havent seen your score in a while, today its easy to get a free credit score online.

Finally, explore some methods for adding to your income. Find a side gig, or easily earn some returns in the record-breaking stock market by using an app that helps you invest your “spare change.”