How Much Should You Put Down

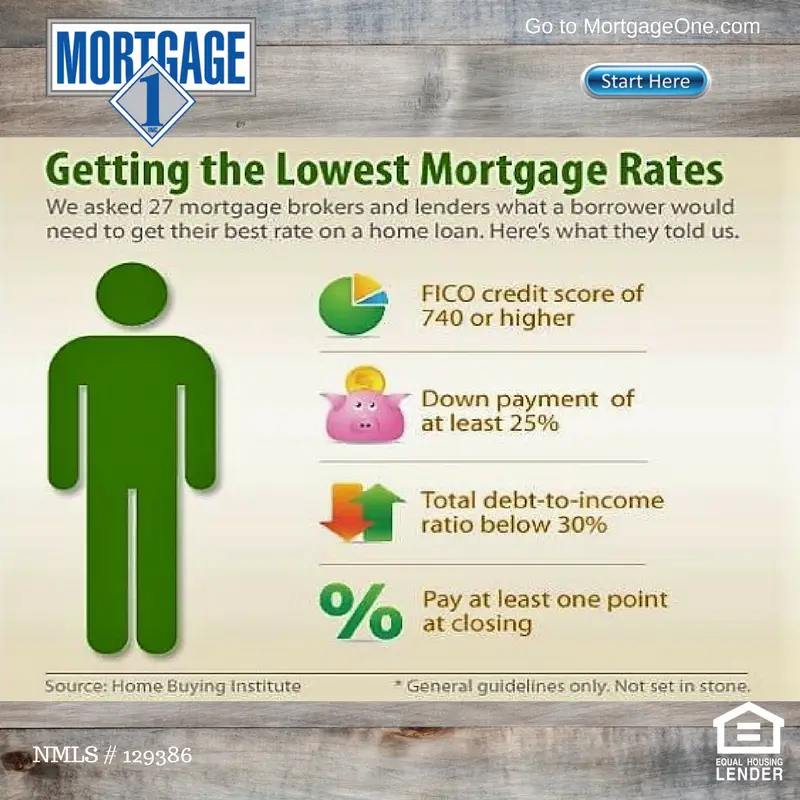

As seen previously with FHA loans you need at least a minimum payment of 3.5% of the homes value. But otherwise, there is conventional consensus that a mortgage needs a 20% down payment. This helps reduce the risk of property price fluctuations and it will reward you with all the added benefits of making a sizeable down payment .

Youll have to speak to your lender and ask if 20% is enough. Some borrowers may be required to make a larger down payment before they qualify for a mortgage. It depends on your creditworthiness and the policies of your lender.

Do I Need A Credit Card For A Mortgage

If you have had at least two lines of credit, such as a phone contract and a registered bank account, then having a credit card isnt absolutely necessary.

Having two lines of credit should give you enough credit history to get a mortgage. That being said, each lender has its own criteria, so its always worth checking with an advisor before applying for a mortgage.

If you do approach a lender before consulting an advisor, you may be declined. Any application for credit, including a mortgage will leave a footprint on your credit file. If youve just started building your credit history, the last thing youd want is a failed application.

What Credit Score Do I Need For A Conventional Loan

Lenders issuing conventional mortgages have considerable leeway in determining credit score requirements for their applicants. Lenders may set credit score cutoffs differently according to local or regional market conditions, and they may also set credit score requirements in accordance with their business strategies. For example, some mortgage lenders may prefer to deal only with applicants with credit scores above 740considered very good or exceptional on the FICO® Score scale range of 300 to 850, while others may specialize in subprime mortgages aimed at applicants who have lower credit scores. Many lenders offer a catalog of mortgage products designed for applicants with a range of credit.

All that considered, the minimum FICO® Score required to qualify for a conventional mortgage is typically about 620.

Read Also: How To Check Credit Score On Usaa

Don’t Miss: How Much Of My Net Income Should Go To Mortgage

Have A Large Down Payment

Mortgage lenders may be more inclined to overlook a poor or nonexistent mortgage history if youre willing to make a large down payment. Typically, youd need a down payment of at least 20%. The more money you put down, the more skin you have in the game. Therefore, your lender might see you as more likely to make your monthly payments so that you dont lose your investment

How To Improve Your Credit Score To Buy A House

Before you look at houses, its smart to check your credit score and pull your credit reports from the three major credit agencies. Addressing credit issues early on can help you raise your score before you apply for a mortgage.

If your credit score isnt great, there are still options. Instead of settling for the mortgage rates you currently qualify for, consider postponing homeownership and working to boost your credit score and improve your options. Here are some quick tips to help:

Recommended Reading: Why Do I Pay Escrow On My Mortgage

Why We Celebrate The No Credit Score Loan

For over 25 years Churchill Mortgage has been on a mission to lead our clients to the ultimate American dream debt-free homeownership. We believe debt-free individuals with no credit score should have the same access to a smarter mortgage as individuals who have a FICO® Score. Being debt-free is a big deal and should be celebrated!

How do you get a mortgage without a credit score or FICO® Score?

A lot of weight is put on a FICO® Score because its an easy way to do a quick risk assessment. If you dont have a FICO® Score it can make qualifying for a mortgage a little more difficult, but not impossible. At Churchill, our Home Loan Specialists are professionally trained to help you get a smarter mortgage that can be paid-off quickly, so you can return to a debt-free lifestyle as soon as possible.

All home loans go through an underwriting process, but no score loans need to go through a manual underwriting process. This means an underwriter will review your application including documents such as bank statements, pay stubs, and monthly bill payments. There is more documentation involved when applying for a no credit score loan, but once approved the process is as seamless as any traditional home loan.

I’m debt-free and looking to buy a homewhats next?

Congratulations on being debt-free! Heres 5 easy steps to getting a no credit score loan:

Churchill Mortgage

If Your Credit Score Is Between 500 And 580

FHA loans arent just great for people with a low down payment. Theyre also a viable option if you have a low credit score. All you need is a credit score of 580 to get an FHA loan combined with a lower down payment. However, youll have to make up for it with a larger down payment if your credit score is lower than 580. You may be able to get a loan with a credit score as low as 500 points if you can bring a 10% down payment to closing. The minimum credit score with Rocket Mortgage is 580.

You May Like: How Much Should You Put Down On A Mortgage

What Are Some Reasons You Might Not Have A Credit Score

In order to have a , you must actually have credit that can be scored by the major credit bureaus. This can come in a number of forms, including student loans, credit cards, auto loans and charge cards.

The credit agencies use an algorithm that examines these accounts in a number of ways. The most important is payment history. But the score also includes how many accounts you have open, how often you pay them, how much you pay each month and the types of accounts you have. The resulting credit score is a reflection of how you paid current and past credit obligations, and serves as a benchmark for how likely you are to manage new credit.

And So The Manual Underwriting Saga Began

Heres a tip: If youre going to tackle the world of manual underwriting, organize your financial documents.

At minimum, the manual underwriter is going to want to see:

- several years worth of tax returns,

- the last twelve months of all bank statements,

- non-retirement investment accounts statements,

- and pay stubs to show proof of continuing income

In addition, you will need to show that you are credit-worthy using different means. For me, that meant providing payment history from three different sources. I gave the underwriters my payment history for my rent, my electric bill and my cell phone.

They initially wanted letter of credit from the companies stating that my account was in good standing and that I did not have any late payments over the past year. The only company that was able to provide that information was my utility company. The underwriters were OK with that.

Be ready to have your information scrutinized for any unusual activity and to write letters explaining the activity.

After combing through my bank accounts, the underwriter questioned a rather large deposit that had hit my bank account. The deposit was for a GoFundMe campaign we ran for my uncle who was in a car accident. I wrote a letter to explain what happened and included a list of the expenses we paid from that deposit.

I also had to explain a few address changes.

Don’t Miss: How Do I Get My Mortgage Fico Score

What If I Cant Fix My Credit Score

Its important to keep in mind that your credit score isnt the only thing that mortgage lenders look at. If you are not able to improve your credit score and dont want to consider a private mortgage lender, you can consider other options. Making a large down payment can make it easier to be approved for a bad credit mortgage. If you can find a co-signer, their credit score will be considered as well. This is helpful if they have a strong credit score or more income.

If you are over 55 years old, you are eligible forreverse mortgages. Reverse mortgages have no income or credit score requirements, and there are also nomortgage paymentsrequired either. This is particularly useful for seniors as a source of income during retirement.

Renting instead of buyinga home might also be a temporary solution in the meantime. If there is a particular property that you would like to purchase, but cannot afford to do so currently,rent-to-own homeprograms allow you to rent the home for a period of a few years, with a portion of your rent payments going towards your eventual down payment on the house. This allows you to save up money until you canafford a mortgage.

Should You Take Out A Mortgage Or Increase Your Credit Score

So how badly do you want that house? Or, better yet, how badly do you need that house?

Because if youve got some time at least six months, preferably a year you can take steps to increase your credit score by 100 points. The first two steps are

- Start making on-time payments every month

- Stop using your credit cards until you paid them all off

Paying on time accounts for 35% of your credit score. Credit utilization how much of your available credit you use every month accounts for another 30%.

If you are on time with at least the minimum payment every month and use cash or checks to pay all bills , you are taking positive steps to address 65% of the factors that determine your credit score.

Is it easy? No, but its certainly doable if you really want that house at a payment level you can afford for the next 15-30 years.

Recommended Reading: How Long Is A Credit Report Good For Mortgage

If You Can’t Get A Credit Card

But what if you can’t find any financial institution willing to give you a loan? How to improve your credit score then? You still have options for credit builder loans . Your bank might be willing to give you a secured credit card. Such cards are tied to an account where you have deposited a certain amount of money.

With a secured card, you’ll have a credit limit that is a certain percentage of your account balance. You use it just like a regular credit card and make monthly payments, except youre your bank has the funds in your account as a guarantee in case you fail to keep up your payments.

You can also sign up to be an authorized user on the existing credit-card account of a family member. If you do this, you’ll be able to use the credit card and slowly build your credit and improve your credit score. But you won’t be responsible for paying any of the debt on such an account. That responsibility falls to the main account holder.

You can also sign up for a joint credit-card account with a spouse or family member who has a stronger credit history. Using your joint credit card will slowly help you with building credit. You will, though, be just as responsible for the debt generated on the account as the person you team with to take out the card.

Hard Credit Check Will Impact Credit Rating

Hard credit checks can have an impact on your and score. The hard credit check vs soft credit check distinction lies in the inquirys purpose. For hard checks, the purpose is always to evaluate a credit application you started, whether thats for a credit card, car loan, mortgage, or other credit product. Just one inquiry usually wont have a big impact on your credit rating. However, if you apply for a bunch of new unsecured loans or credit cards at once, then the multiple hard inquiries will signal to lenders that you might be under financial pressure, thus having a greater impact on your rating.

An important exception to the negative impact of multiple hard credit checks is when youre shopping around for the best mortgage and car loan rates. Because this suggests that youre doing your due diligence, all the hard credit checks for a mortgage or car loan are counted as just one credit check so long as they are all done within a specific time frame. This time frame is described by Equifax as ranging from 14 â 45 days. To stay on the safe side, try to have all hard credit checks done within 2 weeks of each other. Also remember that this does not apply to credit card applications.

Also Check: How To Refinance A Seller Financed Mortgage

No Credit Doesnt Equal Low Credit

Its important to understand that having no credit is not the same as having a low credit score.

You can get a mortgage without a credit score, but dont expect to qualify for a loan with a 350 score!

A low credit score indicates that youve been reckless or irresponsible with credit. It is indicative of poor financial management and hardships.

Lenders will be unlikely to let you borrow unless your score is above 620.

When you have no credit, this lets lenders know youve never been in debt.

So, how can you qualify for a loan without a credit score?

Are There Home Loans For Bad Credit

Home buyers are often surprised by the range of bad credit home loans available today.

Many lenders will issue government-backed FHA and VA loans to borrowers with credit scores starting at 580. Some lenders even offer FHA loans with a credit score as low as 500, though this is far less common.

With a credit score above 600, your options open up even more. Conventional mortgages require only a 620 score to qualify. And with a credit score of 680 or higher, you could apply for just about any home loan.

In this article

Also Check: Can I Get A Mortgage Without Tax Returns

If Your Credit Score Is 500 580

FHA loans arent just great for people with a low down payment. Theyre also a viable option if you have a low credit score. All you need is a credit score of 580 to get an FHA loan combined with a lower down payment. However, youll have to make up for it with a larger down payment if your credit score is lower than 580. You may be able to get a loan with a credit score as low as 500 points if you can bring a 10% down payment to closing. The minimum credit score with Rocket Mortgage® is 580.

Recommended Reading: Is Citizens Bank Good For Mortgages

Whats A Good Credit Score To Buy A House

Generally speaking, youll need a credit score of at least 620 in order to secure a loan to buy a house. Thats the minimum credit score requirement most lenders have for a conventional loan. With that said, its still possible to get a loan with a lower credit score, including a score in the 500s. How?

Recommended Reading: Does The Va Offer Reverse Mortgages

Tips To Improve Your Credit Report Before Home Buying

Bad credit doesnt necessarily mean you wont qualify for a mortgage. But borrowers with good to excellent credit have the most loan options. They also benefit from lower rates and fees.

If you can polish up your credit report before shopping for a mortgage, youre more likely to qualify for the best loan terms and lowest interest rates. Here are a few tips to improve your credit report and score before applying:

Removing inaccurate information can increase your credit score quickly. Developing better credit habits will take longer to produce results.

If youre looking to buy or refinance and know you may need to bump your credit score, it can be helpful to call a loan advisor right now even if youre not sure youd qualify.

Most lenders have the ability to run scenarios through their credit agency providers and see the most efficient and/or cost-effective ways to get your scores increased. And this can be a much more effective route than going it alone.

How To Buy A House With No Money Down

*As of July 6, 2020, Quicken Loans is no longer accepting USDA loan applications.

Many potential home buyers wonder how much money theyll need to buy a house and save in order to get a mortgage. But did you know its possible to buy a home without needing the upfront funds of a down payment?

In this article, well take a look at some options you have when you want to buy a home without a down payment. Well also show you a few alternatives for low down payment loans as well as what you can do if you have a low credit score.

Read Also: Can I Get A 30 Year Mortgage

Can You Get A Mortgage With No Credit

It isnât uncommon to hear advice when you have no credit including that you should build up your credit by getting a car loan or credit card. Theyâll tell you not to close your accounts or run up your balances. In other words, these individuals will advise you to go into debt without telling you how to get out. Additionally, theyâll let you know this is the only way you can obtain a mortgage loan. While lenders like to see a history of accounts being paid down on time each month, this isnât the only way to establish trust.