How To Obtain A Mortgage For A Purchase

Multiple mortgage options are available for purchasing a house that needs work. You can borrow the entire amount needed to renovate your home with some of these mortgages.

Before you begin looking for the perfect fixer-upper mortgage, make sure you do some background checks to ensure that lenders will approve.

Lenders may consider a property in such dire need of repairs that it is no longer mortgageable. Your mortgage application could also be affected by the property.

Other Financing Options For A Fixer

One alternative if youre relying on sweat equity is to use a personal loan to fund your rehab project and then refinance that using a home equity loan or home equity line of credit , both of which are second mortgages.

This strategy has pros and cons.

- Pro: Home equity products tend to have much lower interest rates than personal loans

- Con: Home equity loans tend to have higher closing costs, although a few banks may offer HELOCs with no closing costs at all

If you can get enough cash this way, it tends to be the simplest way to finance repairs, says Jon Meyer, The Mortgage Reports loan expert and licensed MLO. But you need to ensure you can get enough cash for the projects.

As with all mortgages and loans, be sure to shop around between multiple lenders and compare quotes to identify the best overall deal.

Whether you can qualify for a HEL or HELOC will depend on how much value your rehab project has added to your home. Many lenders want the combined balances on your main mortgage and second mortgage to be no more than 80% of your homes market value. And theyll get an appraiser to check.

But some lenders allow you to borrow up to 85% or even 90% of the market value. So, search out one of those if this is an issue for you.

Added Supervision And Appraisals

Renovation loans often require extra consultations, inspections and home appraisals designed to protect the lenders investment as well as your own.

A standard FHA 203 loan, for example, requires you to hire a Department of Housing and Urban Development consultant wholl approve your plans, manage contractor payments and inspect the property after each phase of work is complete.

Using the CHOICERenovation loans sweat equity provision means you could go through multiple appraisals. The appraiser will confirm that workmanship and materials match whats promised in the contract and that the newly renovated home lives up to its estimated value.

These additional hurdles can be frustrating, but they help to ensure the work is on time, on budget and adds value to the home.

» MORE:Whats involved in a home inspection

Also Check: Who Do I Pay My Mortgage To

Learn More About The Pros & Cons

Weve all seen those home improvement shows where they buy an old house that needs work and transform it into an amazing home. And houses that need fixing up are usually more affordable than homes which are move-in ready.

Is buying a fixer upper home right for you? Check out these pros, cons, and tips and decide for yourself!

Conventional Loans For Fixer

Other home buying options for rehabbing include a conventional mortgage which you can put as little down as 5 percent and then use the savings you might have used to make a bigger down payment for some of the repairs.

A lot of people still believe you have to put down 20 percent. But you dont, she says.

She warns people to not go overboard when rehabbing. You dont want to make a 3-bedroom home into a mansion when the whole neighborhood is average family homes, she says.

Tim Lucas

Editor

Also Check: How Does A 5 1 Arm Mortgage Work

Can You Deal With Months Of Renovations

In the big picture, you deal with renovations for a short period of your life. Then you can go on to enjoy a great customized home. However, thats little comfort in the event that the renovations get in the way of your daily life. If you are buying a home that requires top to bottom renovations and theres no untouched part of the house, you may want to consider adding rental or mortgage funding into mortgage loan options you look into, while you wait for renovations to complete.

The Work Needed And Your Budget

Theres less-than-perfect shape and then theres total disrepair, says Carolyn Morganbesser, senior manager of mortgage originations at Affinity Federal Credit Union in New Jersey. Before buying a fixer-upper home, hire a professional contractor to estimate the cost of all the work thats needed before you make an offer. The house thats right for you depends on your skills, schedule and the way you plan to finance the improvements.

» MORE: How to flip a house

If you get a traditional mortgage, youll have to pay for upgrades with cash, a credit card or a personal loan. These bootstrapped financing options might put a low ceiling on your budget and limit you to one project at a time, so a home that needs simpler repairs may be right for you.

A renovation loan can expand your budget and allow you to tackle larger projects simultaneously.

A renovation loan like those listed above can expand your budget and allow you to tackle larger projects simultaneously, which may make it more reasonable to buy a house that needs a lot of work. But these fixer-upper mortgages may place limits on what kinds of renovations you can undertake and who can complete the improvements.

And whether you DIY or hire a pro, dont be surprised if there are roadblocks along the way. It always takes longer than you thought it was going to take because thats the nature of remodeling, Bawden says.

» MORE:See the best mortgage lenders for home improvement loans

Don’t Miss: How Long Is A Mortgage Rate Good For

Cons Of Buying A Fixer

The biggest drawbacks to buying a fixer-upper are the risks. One is the possibility of your budget running away with you. But the main one is that you could buy a place with hidden defects.

Suppose you miss sinkage under the foundations or the fact the roof needs replacing or areas of hidden termite damage. You could find yourself with an unsellable property with repair costs that could run to tens of thousands of dollars more than you budgeted.

With an older home, you cant eliminate those risks altogether. But you can minimize them by having a professional home inspector, a reputable contractor and, if necessary, a licensed pest controller take a good hard look before you commit.

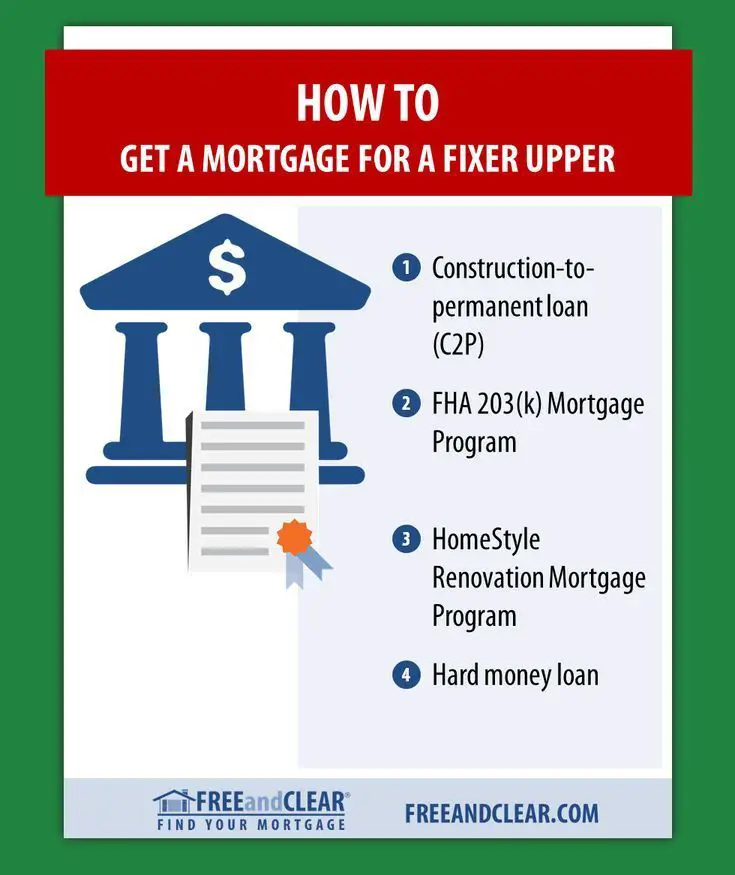

What Are The Different Types Of Fixer

Basically there are four different options for you when it comes to rehab loans. The one that works best for you will depend on the projects youre facing and how much money you want to donate to the cause.

- Limited 203: Best for smaller repairs and upgrades, as it caps at $35,000.

- Standard 203: Better for extensive home upgrades and requires that you hire a consultant to oversee the project.

- Fannie Mae HomeStyle Renovation Mortgage: This can be used to purchase or refinance a home, as a primary, secondary or rental property. The price of this loan depends on the renovation plans and the contractors bids for the planned work. Also, you cannot live in the home during the renovations. Nor would you want toew, sawdust.

- Home equity loan: This is a one-time line of credit with non-flexible payments for the lifetime of the loan, also called a second mortgage. This loan is only beneficial if you have enough equity in your home for the remodel youre looking to do.

- Cash-out mortgage refinance: Similar to the home equity loan, here youre also using your home as collateral. Youll basically refinance your house with a whole new mortgage and the difference will be given to you in cold, hard cash. To qualify for a cash-out mortgage refinance, you need at least 20% equity in your home.

But if words arent your thing, heres a chart. Enjoy!

Recommended Reading: What Documents Are Required For A Mortgage Loan

The Challenges Of Financing A Fixer Upper

A big challenge in financing a fixer upper is calculating the total cost of the project to make sure youre not losing money before putting in an offer.

To do this, youll want to start with a budget totaling the costs to renovate your property based on a thorough analysis of the condition of the home – including materials and labor.

Next, youll want to subtract that from the homes estimated after renovation value + 10% of the renovation cost for unforeseen extras and mishaps. Whats left should be your offer.

Heres an example:

Youre looking at a 4br/4b home nearby, and you know youll need to redo the floors, paint, remodel the kitchen, and knock down a few walls. All of this is going to cost around $200,000. After the renovation, you think the home will be worth about $600,000. If you subtract $220,000 from $600,000, you end up with $380,000. If you dont want to lose money on the renovation, you shouldnt pay more than $380,000 on the home.

However, youll also need to account for other hidden renovation expenses, like temporary accommodations, storage space, new furniture and interior design work, inspections, permits, and more.

Renovating an entire home doesnt come cheap.

In fact, its not uncommon for an entire renovation wishlist to cost $100k or more, and the challenge that many home buyers face is financing this on top of the house purchase when buying using a traditional mortgage.

Purchase The Home For Its Current Fair Market Value First

If you decide to not use the construction to permanent , FHA 203, HomeStyle Renovation or CHOICERenovation programs, the first step to getting a mortgage for a fixer-upper is to buy the property based on its current fair market value, before any remodeling or improvements are factored in. Without using one of the fixer-upper mortgage programs outlined above, most banks do not offer borrowers a mortgage that includes the cost of improvements.

For example if you want to buy a fixer-upper that is worth $200,000 and make $50,000 worth of improvements, the bank will most likely only give you a mortgage based on the $200,000 value of the property before improvements. It is important that you only pay for the property based on what is worth today even though it will be worth more after you fix it up, because this is the way the bank thinks about your mortgage.

Recommended Reading: A& m Mortgage Merrillville Indiana

Making The Value Of Your Home Renovation

Whether youâre undertaking renovation costs in your mortgage or simply just looking to increase the ROI, itâs essential to know what areas of your house are worth investing in. Understanding the best renovations for the greatest ROI will help you prioritize your to-do list. Itâs also good to do some research and understand what types of remodelling mistakes can decrease your homeâs value.

So the next time you walk into a home needing work, donât get scared off immediately if you donât have the funds readily available to renovate. Whether you use renovation mortgage financing or borrow against an existing mortgage, your dream home may be more achievable than you think.

Looking to enter the market or understand the current value of your home? Contact a local RE/MAX Agent to help get you started.

Can You Get A Buy

Yes, there is a product called a buy-to-let refurbishment mortgage, although this is aimed primarily at light renovations rather than building work and you only have six months to complete works. An alternative while you carry out renovations could be a bridging loan, secured loan or refinancing another property to release equity. Once work is complete you can switch to a standard buy-to-let mortgage.

Ask a quick question

We can help!We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in Fixer Upper MortgagesAsk us a question and we’ll get the best expert to help.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

*OMA Mortgage Approval Guarantee is subject to you providing satisfactory documentation. See T& Cs.

Recommended Reading: How Much Difference Does Mortgage Rate Make

And Then Get A Construction Loan

After you purchase the property at its fair market value you can obtain a construction loan to finance the remodeling and improvements you want to do. A construction loan is typically a six-to-twelve month loan that charges a higher interest rate than your mortgage, but usually only requires you to pay interest, so the monthly payment is lower. Not all banks offer construction loans but many do and the bank that you use for the mortgage on the property may provide construction loans.

A borrower must qualify for both the mortgage to purchase the property as well as the construction loan based on the borrowers income and debt so it is important to understand what size mortgage and construction loan you qualify for before you start the home purchase process — the last thing you want to do is buy a fixer upper and then not have the ability to finance the remodeling. You should have the construction loan lined-up and ready to go before you buy the property so that you can begin remodeling immediately after the purchase closes and there are no issues financing the renovations.

Use our Mortgage Qualification Calculator to determine what size loan you can afford based on your gross income and debt

Predict Your Market Value

Another important step in how to buy a fixer-upper is to calculate the value of your fully renovated home. Free online tools like Zillow or Trulia can help you figure out the ballpark, but they can also be wildly off-base and shouldnt be relied on as a final answer. A good way to estimate your after-repair value is by looking at comparable houses in the neighborhood.

If youre financing the purchase of your fixer-upper, your lender will use a special type of appraisal for a home being renovated. After the appraiser visits the property, theyll complete a report that explains how they calculated the future value of home. You can use the dollar amount they provide or use their research to do your own assessment.

Also Check: How Much Is A 280k Mortgage

Put Together A Renovation Plan

Many renovation loan programs require you to provide a construction plan for mortgage approval. This will usually include a construction cost breakdown and a contract between you and a licensed contractor to supervise the work until its finished. Programs like the FHA 203 may also require an inspection from the Department of Housing and Urban Development to make sure the project meets government guidelines.

Mortgage Loans For A Fixer

There are two basic mortgage loan options. A standard mortgage loan covers the sale price of the home and the seller receives it in one portion. The homes price is based on its appraised value and that of comparable properties surrounding it. The funding you receive only covers the cost of the home it does not include any extra funding.

A renovation mortgage loan covers the cost of the homes sale price and renovations. The loan consists of two parts. The first pays for the homes sale price, much like a standard mortgage loan. The second portion is the amount for the renovation funding, and it sits in an escrow account. After the mortgage lender conducts a successful inspection of the renovation project by the mortgage lender, they send the money to the contractors doing the work.

The total loan amount that you get depends on the type of renovation mortgage you select, the scope of your work, and the completed appraised value of your home following all planned renovations.

Recommended Reading: Which Credit Reporting Agency Is Used For Mortgages

How To Pay For Renovations When Buying A Home

Renovation mortgage financing is one of the most popular renovation financing options for new homebuyers. It allows you to add renovation costs to your mortgage when you purchase your new home. So if your mortgage was $500,000 to cover the purchase price and you needed $60,000 for the renovations, you would assume a mortgage of $560,000.

Though it goes by other names like a purchase plus improvement mortgage, renovation mortgage financing allows you to pay for the renovation with minimum down payments as low as five per cent.

Essentially, when you apply for your mortgage, you will also estimate all the costs associated with your renovations and add those to the mortgage. This can be a smart option for first-time homebuyers as they may not have enough saved to purchase the house and immediately take on a substantial renovation project.

Sometimes, you donât even know everything that needs to be taken care of until you begin a large renovation project. Thatâs why you should always put aside some extra for the âunknown.â This might even just be upgraded appliances or furniture when the renovations are through, but having some money set aside is never a bad thing.

An advantage of adding the renovation costs to your mortgage is that you will almost certainly get a better interest rate than you would with a line of credit or a credit card. Furthermore, you pay for your mortgage and renovation with a single payment.