Are Fha Loans Fixed

Though the vast majority of FHA loans are 30-year, fixed-rate mortgages, other options are available, including both shorter-term fixed-rate mortgages and adjustable rate mortgages . In recent years, fixed-rate mortgages have been much more common, as home buyers have sought to lock in low interest rates. But if you dont plan to stay in the home long, an ARM may be worth a look.

Strategies To Get A Lower Interest Rate

Heres a recap of the best strategies to get a lower interest rate and save on your mortgage loan:

And, if you have time before you plan to buy or refinance:

- Boost your credit score before you apply

- Reduce your debts before you apply

- Save a bigger down payment. The higher your down payment, the lower your mortgage rate is likely to be

With those last three, theres only so much you can do. Few of us could save more at the same time were paying down debt.

But prioritize areas where you think you have the most room to grow as a borrower. And just do what you can. Because even a little can sometimes help a lot.

About Our Data Source For This Tool

The lenders in our data include a mix of large banks, regional banks, and credit unions. The data is updated semiweekly every Wednesday and Friday at 7 a.m. In the event of a holiday, data will be refreshed on the next available business day.

The data is provided by Informa Research Services, Inc., Calabasas, CA. www.informars.com. Informa collects the data directly from lenders and every effort is made to collect the most accurate data possible, but they cannot guarantee the datas accuracy.

Also Check: What Does A 400k Mortgage Cost

How Do I Compare Current 30

The more lenders you check out when shopping for mortgage rates, the more likely you are to get a lower interest rate. Getting a lower interest rate could save you hundreds of dollars over a year of mortgage payments and thousands of dollars over the life of the mortgage.

With NerdWallets easy-to-use mortgage rate tool, you can compare current 30-year home loan interest rates whether youre a first-time home buyer looking at 30-year fixed mortgage rates or a longtime homeowner comparing refinance mortgage rates.

Comparison Of Mortgage Rates

Compare fixed, adjustable & interest-only mortgage payments side by side.

Fixed rate mortgages are best for individuals who intend to remain in their homes for the duration of the loan. The interest rate may be higher than an ARM however, there will be no hidden mortgage increases over the duration of the loan.

During the fixed rate period of a hybrid ARM, the consumer can enjoy the low interest rates and low mortgage payments. However, individuals who are not prepared may see an increase in their mortgage premiums that they cannot afford.

ARM mortgage interest rates change each month with the Federal Reserve. This loan is typically recommended for a short term investor who will sell quickly.

Fixed rate loans are by far the safest loans for consumers over a period of time.

Also Check: How To Find The Cheapest Mortgage Rates

Current Mortgage Rates Can Be Deceptive

Its important to understand that shopping around means actually applying with multiple lenders and getting personalized quotes. It does not mean simply looking online and picking the lender with the lowest advertised rates.

Why? Because lenders tend to base their advertised rates on ideal borrowers. They often include discount points, too, which lower your mortgage interest rate but increase your upfront fees.

So unless you have great credit, a big down payment, and dont mind paying extra closing costs, you probably wont get those advertised rates.

The same applies to average rates. By definition, some borrowers will qualify for lower rates and some will get higher ones. What youll be offered will depend on your situation and personal finances.

Why Save Up For A Large Down Payment If The Mortgage Rate Is Higher

In most cases, a high-ratio insured mortgage will have a mortgage rate that is lower than a low-ratio mortgage with a down payment greater than 20%. Why bothersaving up for a large down paymentif you can make a small down payment and get an even lower mortgage rate? The answer lies in the cost of the mortgage default insurance, which isnât free.

CMHC insurance premiumscan add thousands of dollars to the cost of your mortgage. The cost of this mortgage default insurance will either need to be paid upfront or it will be added to your mortgage principal balance. Adding the cost of the mortgage insurance to your principal means that you will be paying interest on the insurance over time, adding on to the cost of your mortgage. The CMHC insurance premium will depend on the size of your down payment.

Read Also: Can You Wrap Closing Costs Into Mortgage

How Are Mortgage Rates Determined

Mortgage rates, in general, are determined by a wide range of economic factors, including the yield U.S. Treasury bonds, the economy, mortgage demand and the Federal Reserve monetary policy.

Borrowers have no control over the wider economy, but they can control their own financial picture to get the best rate available. Typically, borrowers with higher FICO scores, lower debt-to-income ratios and a larger down payment can lock in lower rates.

Related:How To Improve Your Credit Score

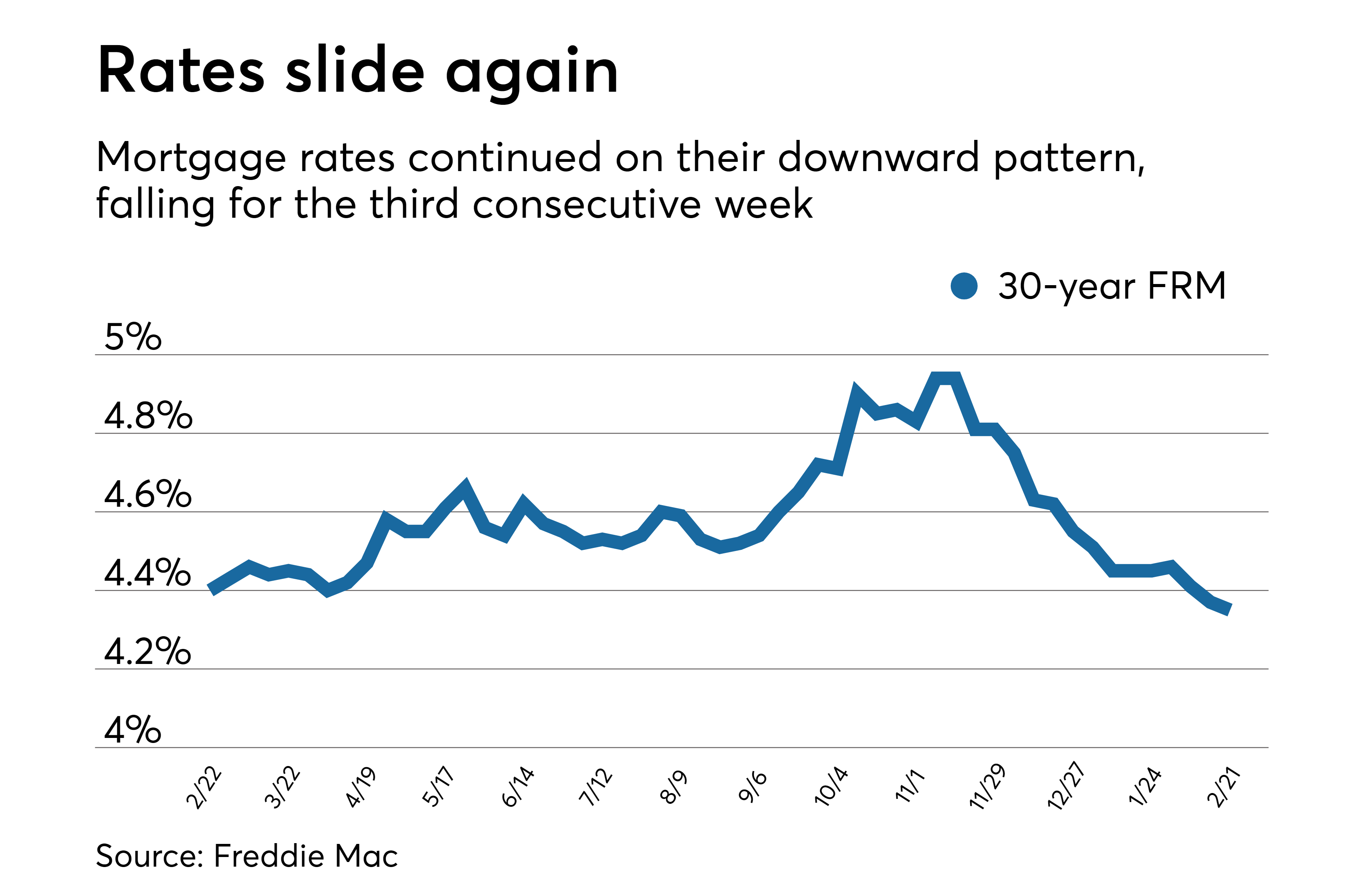

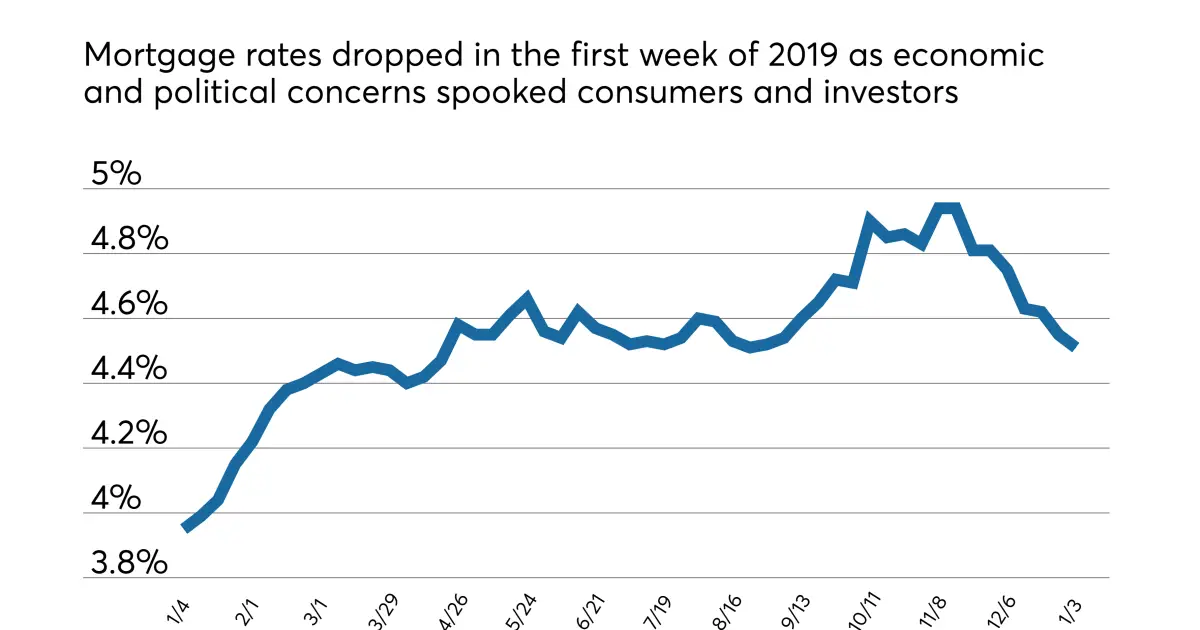

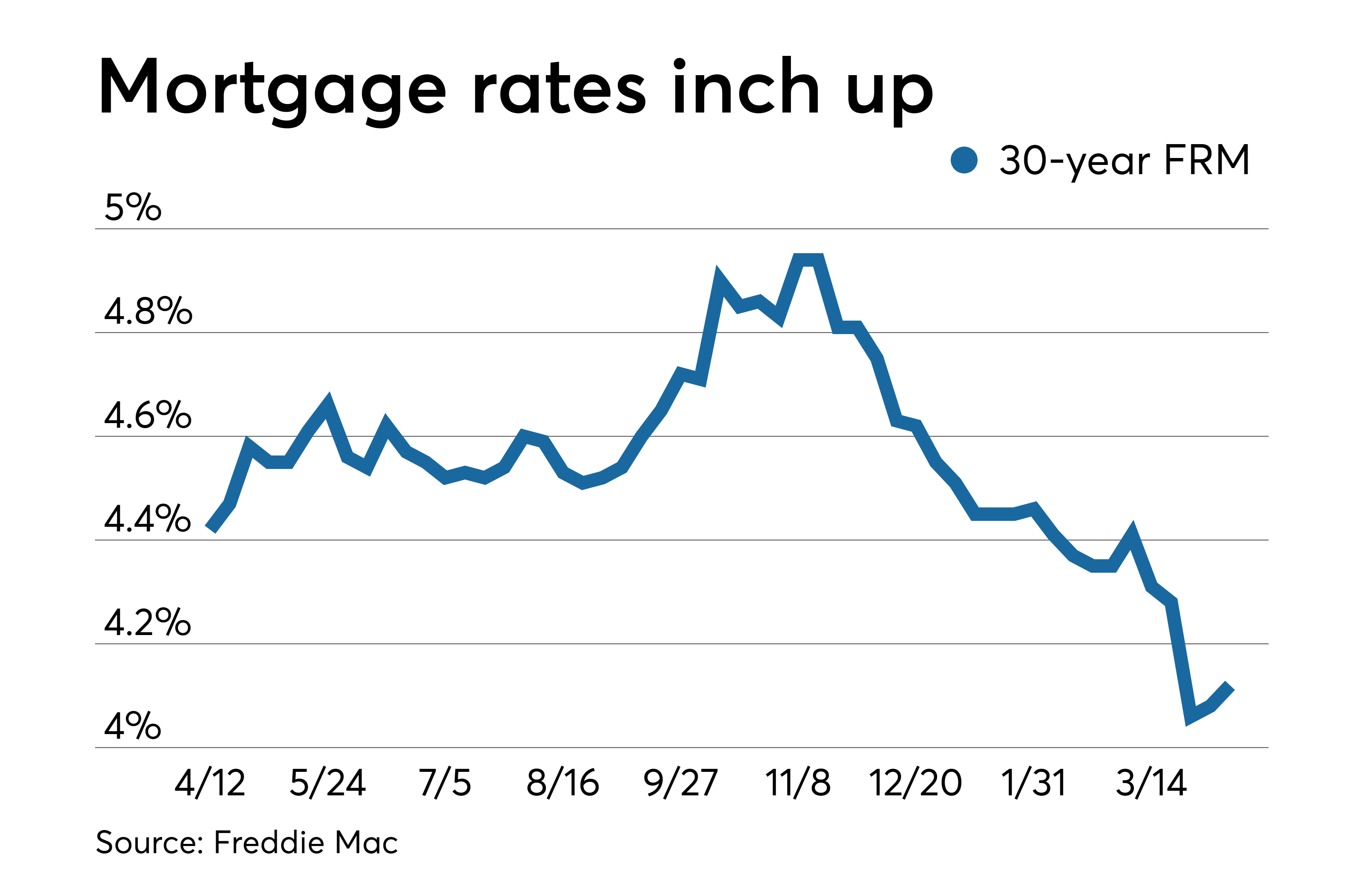

Current Mortgage Rate Trends

The mortgage or refinance rate you get depends a lot on your personal finances, and well explain why below. But overall mortgage rates provide the context for your personal rate.

Average mortgage rates have been low for months. This climate has allowed the most qualified borrowers to access historically low rates. But theres no guarantee rates will remain low in 2022 and beyond.

To see where 30year mortgage rates may be going, lets check where theyve been:

Average mortgage rates by loan type

| 3.13% |

Where will rates go from here? No one can predict the future, but most experts including Freddie Mac and Fannie Mae anticipate a gradual increase in rates going into 2022.

Read Also: What To Look For Mortgage Loan

Mortgage Rates Drop Below Five Percent

Mortgage rates remained volatile due to the tug of war between inflationary pressures and a clear slowdown in economic growth. The high uncertainty surrounding inflation and other factors will likely cause rates to remain variable, especially as the Federal Reserve attempts to navigate the current economic environment.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey.

Opinions, estimates, forecasts, and other views contained in this document are those of Freddie Macs economists and other researchers, do not necessarily represent the views of Freddie Mac or its management, and should not be construed as indicating Freddie Macs business prospects or expected results. Although the authors attempt to provide reliable, useful information, they do not guarantee that the information or other content in this document is accurate, current or suitable for any particular purpose. All content is subject to change without notice. All content is provided on an as is basis, with no warranties of any kind whatsoever. Information from this document may be used with proper attribution. Alteration of this document or its content is strictly prohibited. ©2022 by Freddie Mac.

Average Mortgage Interest Rate By Type

There are several different types of mortgages available, and they generally differ by the loan’s length in years, and whether the interest rate is fixed or adjustable. There are three main types:

- 30-year fixed rate mortgage: The most popular type of mortgage, this home loan makes for low monthly payments by spreading the amount over 30 years.

- 15-year fixed rate mortgage: Interest rates and payments won’t change on this type of loan, but it has higher monthly payments since payments are spread over 15 years.

- 5/1-year adjustable rate mortgage: Also called a 5/1 ARM, this mortgage has fixed rates for five years, then has an adjustable rate after that.

Here’s how these three types of mortgage interest rates stack up:

| Mortgage type |

Also Check: How To Report Mortgage Payments To Credit Bureau

Money’s Average Mortgage Rates For August 5 2022

Interest rates on almost all loan categories are starting the day lower than yesterday. Borrowers looking for a 30-year fixed rate mortgage can expect to see rates averaging 6.231% with no points paid, down 0.395 percentage points.

- The latest rate on a 30-year fixed-rate mortgage is 6.231%.

- The latest rate on a 15-year fixed-rate mortgage is 4.823%.

- The latest rate on a 5/6 ARM is 5.73%.

- The latest rate on a 7/6 ARM is 6.124%.

- The latest rate on a 10/6 ARM is 6.182%.

How Much Will I Need For A Down Payment

The minimum youll need to put down will depend on the type of mortgage. Many lenders require a minimum of 5% to 20%, whereas others like government-backed ones require at least 3.5%. The VA loan is the exception with no down payment requirements.

Generally, the higher your down payment, the lower your rate may be. Homeowners who put down at least 20 percent will be able to save the most.

Also Check: How To Get A Higher Mortgage With Low Income

The Ontario Housing Market

The Ontario housing market is greatly skewed by Toronto and Ottawa. The Greater Toronto Area is Canadaâs largest population centre, and Toronto is one of the most expensive cities in the world to buy a home. Ottawa, as Canadas capital city, has more inflated prices than most comparable cities. Outside of these two cities, Ontarioâs housing market is more similar to the rest of Canada.

| 2016 |

Source: Canadian Real Estate Association

Within the Toronto census metropolitan area , only 59% of families owned their primary residence in 2016, slightly lower than the national average of 63% . Once you exclude Toronto and Ottawa, Ontario homeownership rises to 70%. This is probably due to the high cost of real estate in Toronto.

Dont Miss: How Does The 10 Year Treasury Affect Mortgage Rates

Other Factors Besides Your Credit Score

Remember, FICO is looking only at the difference your credit score makes in the chart above.

Lenders will check more than your credit history when you apply for a new mortgage loan. They will also need to know your:

- Debt-to-income ratio This ratio measures how much of your income goes toward existing monthly debts

- Income stability Homebuyers need to show W-2 forms or pay stubs to prove a steady income. If youre self-employed, you can provide tax forms or even bank statements

- Down payment Most loans require a minimum down payment amount . Putting more than the minimum down could help lower your interest rate

- Home equity for refinancing Mortgage refinance lenders will check your home equity which, measures how much your home value exceeds your mortgage debt. Having more equity can lower your rate

In short, the better your personal finances look, the lower your mortgage interest rate will be. Taking steps like raising your credit score or savings for a bigger down payment before you buy can help you get the best rates available.

Read Also: What Does Buying Points On Mortgage Mean

Comparing Mortgage Payment Frequency

| $134,166 | $134,009 |

There are slight interest savings to be had from increasing your mortgage payment frequency. This keeps your mortgage amortization the same, which is why you wonât realize as much interest savings.

Many mortgage lenders offer accelerated payment frequencies, such as accelerated bi-weekly and accelerated weekly mortgage payments. With accelerated payments, you will be paying the equivalent monthly payments, which means that you will be making an extra payment per year. In the above table, a monthly payment would have been $2,117.

To calculate the accelerated bi-weekly payment amount, you would divide $2,117 in half to get $1,058.50. Your accelerated bi-weekly payments will be $1,058, higher than the regular bi-weekly amount of $977. This increased amount allows you to pay off your mortgage faster, which shortens your amortization and saves you interest.

How Long Can You Lock In A Mortgage Rate

Locks are usually in place for at least a month to give the lender enough time to process the loan. If the lender doesnt process the loan before the rate lock expires, youll need to negotiate a lock extension or accept the current market rate at the time.

Even if you have a lock in place, your interest rate could change because of factors related to your application such as:

- A new down payment amount

- The home appraisal came in different from the estimated value in your application

- There was a sudden decrease in your credit score because you are delinquent on payments or took out an unrelated loan after you applied for a mortgage

- Theres income on your application that cant be verified

Talk with your lender about what timelines they offer to lock in a rate as some will have varying deadlines. An interest rate lock agreement will include: the rate, the type of loan , the date the lock will expire and any points you might be paying toward the loan. The lender might tell you these terms over the phone, but its wise to get it in writing as well.

Also Check: What Is The Mortgage Rate On Investment Property

What Are Points On A Mortgage Rate

Mortgage points represent a percentage of an underlying loan amountone point equals 1% of the loan amount. Mortgage points are a way for the borrower to lower their interest rate on the mortgage by buying points down when theyre initially offered the mortgage.For example, by paying upfront 1% of the total interest to be charged over the life of a loan, borrowers can typically unlock mortgage rates that are about 0.25% lower.

Its important to understand that buying points does not help you build equity in a propertyyou simply save money on interest.

How Big A Mortgage Can I Afford

In general, homeowners can afford a mortgage thats two to two-and-a-half times their annual gross income. For instance, if you earn $80,000 a year, you can afford a mortgage from $160,000 to $200,000. Keep in mind that this is a general guideline and you need to look at additional factors when determining how much you can afford such as your lifestyle.

First, your lender will determine what it thinks you can afford based on your income, debts, assets, and liabilities. However, you need to determine how much youre willing to spend, your current expensesmost experts recommend not spending more than 28 percent of your gross income on housing costs. Lenders will also look at your DTI, meaning that the higher your DTI, the less likely youll be able to afford a bigger mortgage.

Dont forget to include other costs aside from your mortgage, which includes any applicable HOA fees, homeowners insurance, property taxes, and home maintenance costs. Using a mortgage calculator can be helpful in this situation to help you figure out how you can comfortably afford a mortgage payment.

You May Like: What Makes Mortgage Rates Go Down

How To Compare 30

If you compare loan offers from mortgage lenders, youll have a better chance of securing a competitive rate. Heres how to compare:

How To Use Our Mortgage Rate Table

Our mortgage rate table is designed to help you compare the rates youre being offered by lenders to know if it is better or worse. These rates are benchmark rates for those with good credit and not the teaser rates that make everyone think they will get the lowest rate available. Of course, your personal credit profile will be a significant factor in what rate you actually get quoted from a lender, but you will be able to shop for either new purchase or refinance rates with confidence.

Read Also: Does Refinancing Your Mortgage Hurt Your Credit Score

Should I Get An Open Or Closed Mortgage In Ontario

With an open mortgage, you can pay down as much of your principal as you want in a given year without restriction. However, open mortgage rates are higher. So you are essentially paying more for flexibility.

With a closed mortgage, prepayments are restricted and interest penalties are enforced on any overpayment, but your rate will be lower than an open mortgage rate.

In Ontario, closed mortgages are the more popular option as most people donât expect to pay more than their monthly mortgage payment. However, an open mortgage could be a good choice if youâre planning to move soon or expect to receive a lump sum of money during your mortgage term.