Make Extra Or Lump Sum Payments

Making extra and lump sum payments towards your principal amount can have a significant effect on reducing the overall interest charged, especially during the early stages of your loan term. So if you have some spare savings or fortunate enough to receive an unexpected windfall, you could find it beneficial to use at least some of it to make an overpayment.

Before you borrow, ask your lender if its possible to make extra repayments towards your mortgage. Generally speaking if you have a variable rate mortgage, its possible to make additional repayments.

Our home loan repayment calculator is a useful tool to calculate how additional lump sum and extra repayments affect your home loan.

At loans.com.au , you can make unlimited extra repayments and lump sum repayments on your variable rate home loan and up $10,000 extra repayments per year on your fixed rate loan.

How Your Credit Rating Affects Your Interest Rate

Lenders look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a mortgage. If you have good credit history, you may be able to get a lower interest rate on your mortgage. This can save you a lot of money over time.

Improve Your Credit Score

Regardless of the loan you choose, youre likely to get a better mortgage rate if you have a higher credit score. Similar to making a bigger down payment on your mortgage, a high credit score can help you qualify for better rates and lower monthly payments.

To a lender, your credit score is indicative of your riskthe lower the score, the higher the risk. That’s why lenders may charge higher interest rates to applicants with lower credit scores. If you apply for a loan and have a good credit score, you’re more likely to be offered a low interest rate. However, if you already have a loan, its not too late to improve your credit score and qualify for better rates with a mortgage refinance.

To improve your credit score, first go over your credit report to see if you have any outstanding balances. Consider paying those and be sure to make your payments on time every month. Also look for and correct any errors on your credit report as these can negatively impact your credit. While a high credit score is ideal for mortgage approval, some affordable lending programs do accept lower credit scores.

Recommended Reading: How Many Points Can I Buy On A Mortgage

Below Are Some Handy Tips For Paying Off Your Mortgage Faster So You Can Enjoy Your Home Even More

If youre looking for home finance it pays to talk to a Loan Market mortgage adviser who can help you understand what your home loan options are as well as set up your savings scheme with the right bank for you.

1. Make extra repaymentsBoth consistent and ad-hoc additional repayments such as bonuses and tax returns work to reduce the principal on your mortgage faster. The earlier in the loan term you begin making additional repayments, the greater the benefit in terms of time and money saved.

2. Make your first repayment on settlement dateYour first home loan repayment will generally fall due one month after settlement. Making your first repayment on your settlement date reduces the principal before the first lot of interest accrues on the amount you have borrowed.

3. Make extra repayments right from the startRegular additional repayments made right from the beginning of your loan term will have a much greater effect on the overall time and cost of your loan than starting five or ten years into the loan. Even if you are already more than five years into your loan term, you can still make a considerable saving by starting to make additional repayments now.

6. Pay loan fees and charges up frontPay establishment fees, legal fees and Lenders Mortgage Insurance up front rather than capitalising them into your loan. This will save your thousands of dollars in interest over the loan term.

Related content

Mistake #: Not Asking If Theres A Prepayment Penalty

Mortgage lenders are in business to make money and one of the ways they do that is by charging you interest on your loan. When you prepay your mortgage, youre essentially costing the lender money. Thats why some lenders try to make up for lost profits by charging a prepayment penalty.

Prepayment penalties can be equal to a percentage of a mortgage loan amount or the equivalent of a certain number of monthly interest payments. If youre paying off your home loan well in advance, those fees can add up quickly. For example, a 3% prepayment penalty on a $250,000 mortgage would cost you $7,500.

In the process of trying to save money by paying off your mortgage early, you could actually lose money if you have to pay a hefty penalty.

You May Like: What Is A Future Advance Mortgage

Also Check: Is 4 A Good Mortgage Rate

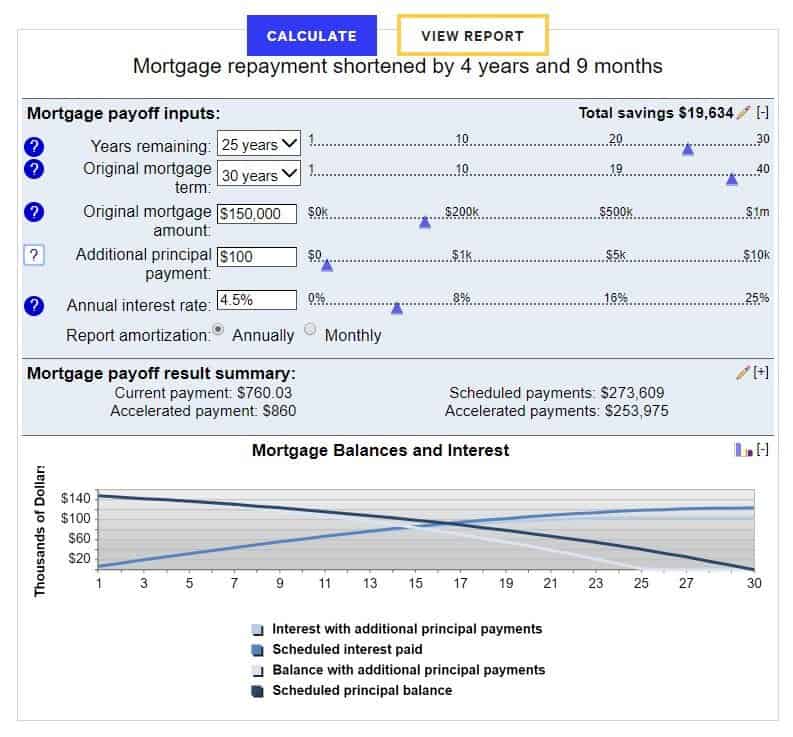

What Happens When I Pay An Extra $100 Per Month On My Mortgage

Payments of $100 to your current mortgage payment are the simplest way to reduce your mortgage balance. And in reducing the outstanding loan balance, the amount of interest you pay will be less. To boot, you will pay off the loan early, faster than its original loan term.

Borrowers pay smaller lump sum payments to reduce the outstanding mortgage balance. This, too, helps because, over time, the interest due on the mortgage is reduced, although at a slower rate.

The amount you can save will vary and be based on the amount and frequency of your extra payments as well as the existing loan balance.

See What Goes Towards Your Principal

When you buy your first home, you may get a shock when you take a look at your first mortgage statement: Youll hardly make a dent in your principle as the majority of your payment will apply toward interest. Even though you may be paying over $1,000 a month toward your mortgage, only $100-$200 may be going toward paying down your principal balance.

The amount that you pay in principle each month depends on a number of variables, including:

- Amount of the loan

- Length of the loan

- How many months you have already paid in to the loan

The reason that the majority of your early payments consist of interest is that for each payment, you are paying out interest on the principle balance that you still owe. Therefore, at the beginning of your loan, you may owe a couple hundred thousand dollars and will still have a hefty interest charge. With each payment, you will reduce the principle balance and, therefore, the amount of interest you have to pay. However, since your loan is structured for equal payments, that means that youre just shifting the ratio, not actually paying less each month. With each successive payment, you are putting in a little more toward principle and a little less toward interest. By the end of your loan term, the majority of each payment will be going toward principle.

Making Extra Payments Early

Also Check: Bofa Home Loan Navigator

Read Also: How To Find A Cosigner For A Mortgage

When To Pay Off Your Mortgage Early

It may seem like a good idea to pay off your mortgage early as soon as you have the right amount of money to do so, but there is more to consider. If you have a strong financial reason to pay off your mortgage earlier than expected then it makes a lot of sense. For example, if you want to retire earlier than expected then you dont want a mortgage in your retirement years.

However, paying off your mortgage early, no matter how you choose to do it, ties up a significant amount of liquidity that you could use to invest and build more wealth, or save for unexpected hard times. You also wont be eligible for some tax deductions any longer that youre able to take when you are actively paying on your mortgage.

Ultimately, the right time to pay off your mortgage early really comes down to your personal financial situation. It needs to be a time that wont hurt you financially and that benefits you over the long haul. We recommend working with your financial advisor to determine when that time is for your situation.

How Do Repayment Mortgages Work

In the first few years of your mortgage term, a bigger proportion of each monthly payment goes towards the interest, and a smaller part towards the capital. With time, the balance shifts, with less going towards interest and more towards paying off your loan.

This can make your first few years’-worth of mortgage statements depressing reading, as you won’t feel like you’re making much of a dent in your debt.

But don’t lose heart: over time the balance will shift, with each payment clearing more of your loan until the end of the term, when you’ll be mortgage-free.

You’ll also be able to access deals with lower interest rates as you build up more equity .

- Find out more: Which? Mortgage Advisers’guide to remortgaging

Don’t Miss: How Much Do I Need To Earn For 300k Mortgage

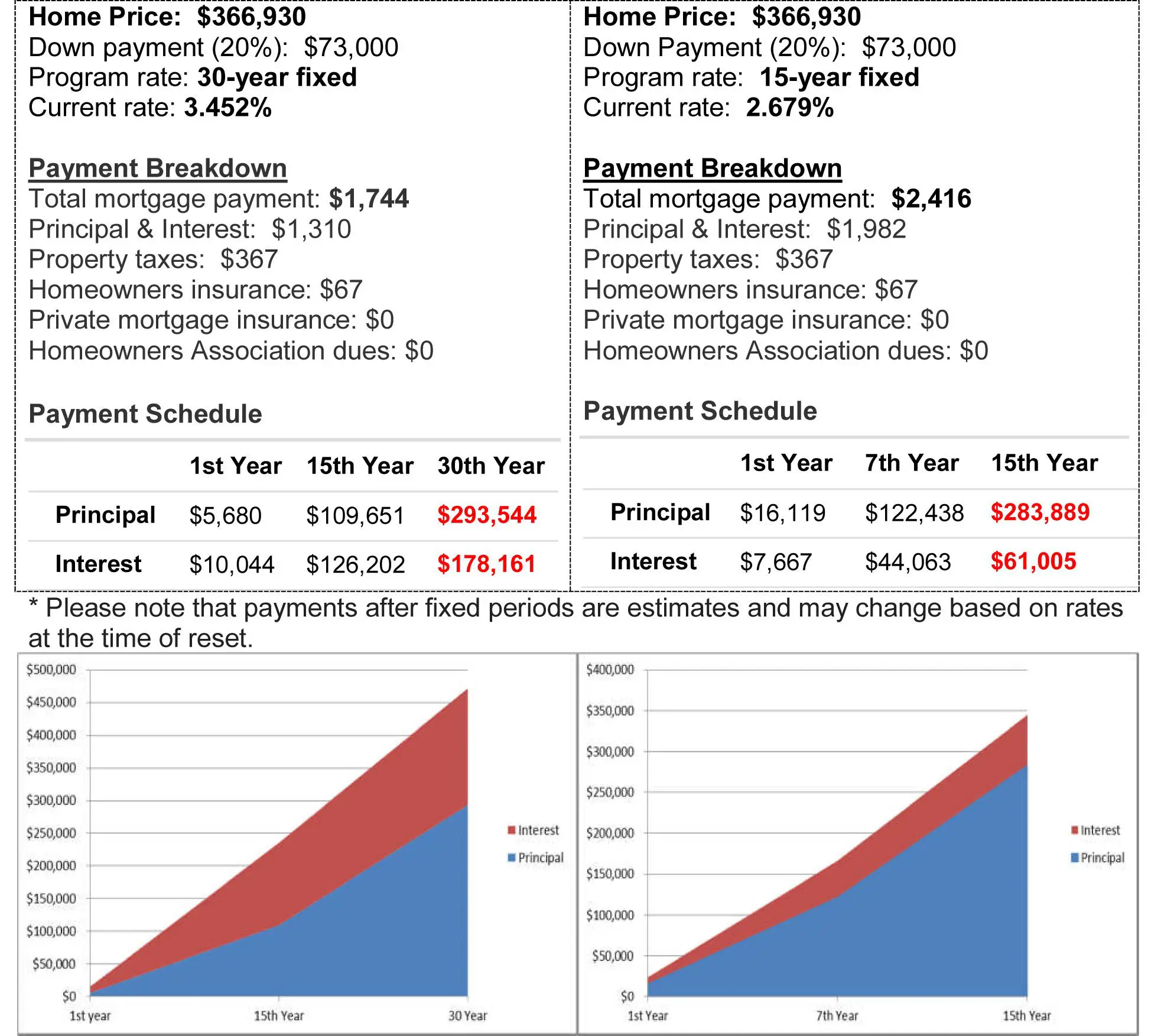

Choose Your Loan Term Carefully

Short-term loans are less risky and, as a result, have lower mortgage rates. The trade-off for these kinds of loans are larger monthly payments since you’re paying off the principal in a shorter time. With a longer-term loan, you spread the payments over a longer period of time, leading to lower monthly payments with a higher interest rate.

Short-term loans will generally save you more money in the long run, but long-term loans may leave you with more disposable income every month. If you’re looking specifically for low mortgage interest rates and savings over the life of the loan, a short-term loan is your best bet.

How Long Have You Had Your Mortgage

If youve had your mortgage for several years, moving to a shorter term could cost you more in interest up front than you would save in the long run. Mortgage payments are front-loaded with interest. With a typical 30-year mortgage, for the first 10 years, youll pay about half of the total interest.

If youve already paid on the loan long enough to more significantly bring the principal down each month, you may want to keep your current mortgage.

Also Check: What Is Current Fixed Mortgage Rate

Are You Putting Money Into A Pension Scheme

Pensions are a tax-efficient way to save because the government tops up your contributions with tax relief.

And, if you have a workplace pension your employer should pay into the scheme too.

Find out more about workplace pensions in our guide Automatic enrolment an introduction

If you dont have a pension and have money to spare, its important to think about paying into one.

The earlier you start, the sooner your retirement pot will start to grow. With employer contributions and tax relief from the government, you might get more for your money in a pension than youd save in mortgage interest.

Find out more in our guides:

Check my pension and the progress of my retirement savings

Key Questions To Ask Before You Pay Off Your Mortgage

Before you decide to pay off your mortgage early, ask yourself these questions:

If you can answer yes to all three, paying your mortgage off early may be a good financial move. Just keep in mind that some lenders charge a prepayment penalty if yours does, be sure to factor in that cost, too.

Read Also: Are There Closing Costs When You Refinance A Mortgage

Convincing The Lender To Lower The Interest Rate

Check lender websites to find out what rates are being offered for the terms and conditions youre interested in. Note down the best rates.

When you go to the financial institution, explain that youre starting your search and youre going to shop around to get best available rate. Want to make things easier for yourself? Deal with a mortgage broker.

Reviewing Your Budget With Your New Debt Payments

If interest rates rise and your debt payments increase, you may need to review and adjust your budget.

To prepare yourself, try the following:

- talk to your lenders to find out by how much your payments will increase

- look at how the higher payments will impact your budget and your ability to save for your goals

- if youre out of your comfort zone, see how you can reduce expenses or earn more money to pay off your debt faster

Use the Budget Planner to create or review your budget.

If after reviewing your budget if you expect challenges in making your payments, be proactive and dont wait to seek help. Talk to talk to your financial institution to discuss your options. They may be able to offer temporary accommodations such as making special payment arrangements, mortgage deferrals or allowing you to skip a payment on your loan.

Also Check: How To Be Mortgage Underwriter

Dont Pay For Mortgage Insurance Twice

Mortgage loan insurance is insurance that protects your lender in the event youre no longer able to repay your loan. You pay for the insurance in a single instalment, but you can add this cost to your mortgage loan .

When you change lenders, if your loan amount and amortization period dont increase, you could avoid paying a new mortgage insurance premium. Ask your former lender for the insurance certificate number and give it to your new lender so that the new lender knows youve already paid for mortgage insurance.

Get A Loan Modification

If your mortgage payments are unaffordable but you want to get back on track and potentially pay the loan off early, consider a home loan modification. Generally reserved for borrowers experiencing financial hardship, a loan modification entails the lender adjusting the interest rate or loan term to help bring the loan current.

With this option, you could save on interest and pay the loan off faster. There could be consequences for your credit, however, depending on how your lender or servicer reports it to the credit agencies, so be sure to discuss this with your lender upfront.

You May Like: Where Do You Get A Mortgage

How To Pay Less Interest By Shortening Your Mortgage

What’s in this article?

If you think about the interest costs that will build throughout your 30-year mortgage, it can start to feel like there are better ways to use your money. In the end, you might pay as much interest as you would pay in principal. One path to eliminate these long-term interest costs is to refinance your mortgage and shorten the length in order to pay the interest for less time.

But is it that simple? Lets dig into the trade-offs of short-term mortgages compared to long-term ones, as well as how to determine if shortening your loan will make your home more affordable.

Refinance For A Different Term

A 30-year mortgage is not the only option to finance a home. Mortgages with 15-year terms are widely available, and the interest rates are lower than for 30-year loans. The amount of interest paid on a 15-year mortgage is significantly less than on a 30-year loan. For a $300,000 mortgage at 6 percent, the total amount of interest paid drops from $347,500 to $155,700, a savings of over $190,000. The principal and interest payment of the 15-year loan is $2,531 compared to $1,798 for the 30-year mortgage.

You May Like: Should I Refinance My Mortgage Or Not

Refinance To Get Rid Of Mortgage Insurance

If you made less than a 20% down payment on a conventional loan or took out an FHA loan, youre likely paying for mortgage insurance. You could easily be paying hundreds of dollars monthly toward mortgage insurance premiums, depending on the amount you put down and your credit score when you bought your home.

The good news is you can get rid of or reduce your monthly mortgage insurance cost with these refinance tips:

Refinance your conventional mortgage. If home values in your area are on the rise and you have a conventional mortgage, you may be able to remove or at least lower your monthly private mortgage insurance premium. If you have at least 20% equity, you wont need PMI at all. Even if you dont, your mortgage premium will drop based on how much equity you have now compared to when you bought your home.

Refinance an FHA loan to a conventional mortgage. The most effective way to stop paying FHA mortgage insurance is to refinance your FHA loan to a conventional loan. However, check your credit scores first conventional mortgages require higher credit scores than FHA loans.

Refinance and pay down your principal. A little extra cash may help you pay your balance down to 80% of your homes value and avoid mortgage insurance altogether on a conventional loan.

Refinance For Permanent Relief

When the rates are right, refinancing your mortgage can lock in payment relief for the life of your loan. Have you noticed? In the spring of 2020, rates have never never, never, NEVER! been better.

If it seems the forces of nature and human discontent aimed to knock the economy off its axis, one of the areas it missed is mortgage interest rates. As billions of dollars seeking safety in the COVID-19 storm poured into 10-year U.S. Treasury notes, the return sank to record-low territory, hovering much of the time below 0.7%.

Mortgage rates, which are tied to the 10-year Treasury, tumbled, too. Week after week through late winter into June, Freddie Mac, Fannie Mae, and the Mortgage Bankers Association reported one record-low rate after another. The upshot: Refinancing accounted for two-thirds of all mortgage activity.

And, reported Freddie Mac Chief Economist Sam Khater, the average refinanced loan balance shrunk in May by $70,000 meaning its not just high-end homeowners who see the benefits of refinancing this coronavirus share-the-wealth plot twist means opportunity for homeowners of modest means, too.

Whether rates will drop even further or suddenly rebound is anybodys guess. It bears noting, however, that with plummeting interest rates and surging applications to refinance, lenders are ramping up their qualifying standards. Expect to encounter tighter income, credit-score, and down-payment conditions.

A variety of ways exist to refinance. Lets have a look.

Don’t Miss: What Do They Look At For Mortgage Approval