Va Funding Fee Refund

Similarly, the VA funding fee is refundable under a few conditions. If you qualify for a refund, the money will be sent to you in the same form in which you paid it, whether that be through cash or through financing the fee into the loan balance. Additionally, its the borrowers responsibility to request a refund if they feel they deserve one. Veterans who qualify for a refund include those who:

- Are disabled but whose disability compensation was pending when they closed on the loan

- Were overcharged

How Much Is Mortgage Insurance

Mortgage insurance is calculated as a percentage of your home loan. The lower your credit score and the smaller your down payment, the higher the lenderâs risk, and the more expensive your insurance premiums will be. But as your principal balance falls, your mortgage insurance costs will go down, too.

For borrower-paid monthly private mortgage insurance, annual premiums from MGIC, one of the countryâs largest mortgage insurance providers, range from 0.17% to 1.86% of the loan amount, or $170 to $1,860 for every $100,000 borrowed, on a fixed-rate 30-year loan. Thatâs $35 to $372 per month on a $250,000 loan.

Some PMI policies, called âdeclining renewal,â allow your premiums to decrease each year when your equity increases enough to put you in a lower rate bracket. Other PMI policies, called âconstant renewal,â are based on your original loan amount and donât change for the first 10 years.

On an adjustable-rate loan, your PMI payment can go as high as 2.33%. Thatâs $2,330 for every $100,000 borrowed, or $485 a month on a $250,000 loan. PMI also is more expensive if youâre getting a mortgage on a second home.

The most likely scenario with an FHA loan is that youâll put down less than 5% on a 30-year loan of less than $625,500 and your MIP rate will be 0.85% of the loan amount per year. MIPs on a 30-year loan range from 0.80% to 1.05% annually, or $800 to $1,050 for every $100,000 borrowed. Thatâs $167 to $219 per month on a $250,000 loan.

What Are Va Loan Assumption Requirements

For VA mortgage assumptions to occur, these conditions need to be met:

- The current loan has to be current. When not, any past due amount should be paid before or at closing.

- The new buyer has to qualify according to VA income and credit standards.

- The buyer has to assume all the mortgage obligations, which include repayments to the VA should the loan go into default.

- The new owner or original owner is required to pay the funding fee of 0.5% of the current principal-loan balance.

- Processing fees should also be paid up in advance .

Recommended Reading: What Are The Current Best Mortgage Rates

Does The Va Home Loan Require Mortgage Insurance

My husband and I are looking to purchase a home and as a veteran, I figured I should take advantage of the VA home loan. For the most part I know how it works but Iâm wondering, does the VA home loan require mortgage insurance?

The VA home loan doesnât require any mortgage insurance

What Is A Va Mortgage Loan

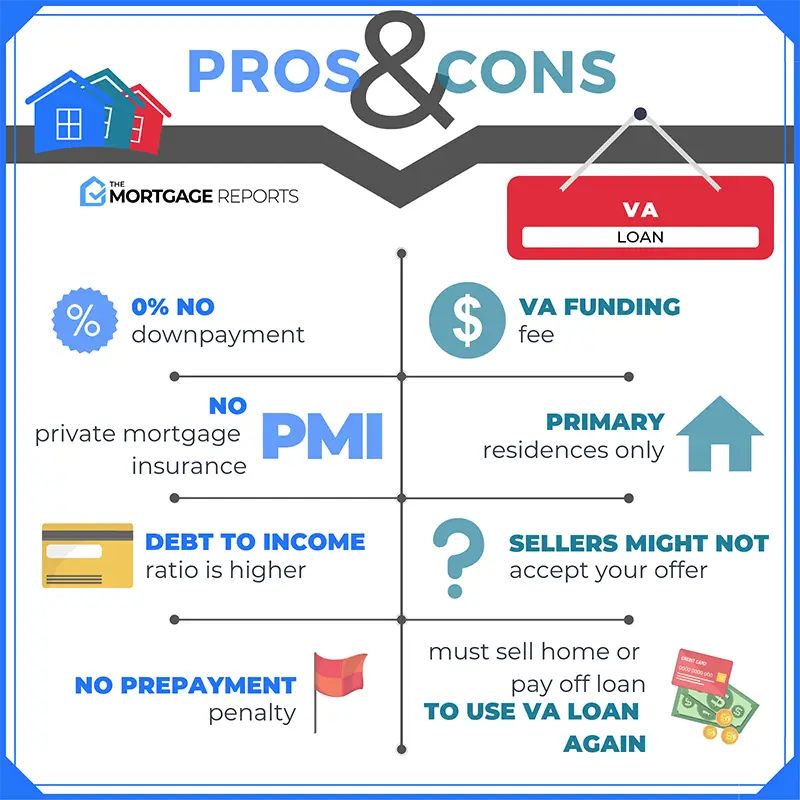

A VA mortgage loan is one of the most exclusive benefits for those who have served or are presently serving in the U.S. Military. Based on your Certificate of Eligibility, you can use a VA loan to purchase or refinance a home that you occupancy without having to make a down payment. The Veterans Administration backs the VA loan only for veterans, and there is no private mortgage insurance requirement.

Recommended Reading: Are Taxes And Insurance Included In Mortgage

How To Qualify For A Va Home Loan

To qualify for a VA home loan, you must be active duty military, an honorably discharged veteran, or a military service member of the reserves or National Guard. Eligible surviving spouses of service members may also apply for a VA loan. To get approved, you must purchase a primary residence and obtain a valid Certificate of Eligibility from the VA. This form confirms your VA loan eligibility.

How Va Home Loans Work

If you are not familiar with the VA loan program, you should know that this type of mortgage is offered to qualifying service members and their families. It is not available to all consumers and requires a minimum time in service to qualify .

VA mortgages are a military benefit, but access to the VA loan program does not guarantee loan approval. All applicants must financially qualify the same as for any mortgage loan transaction. VA loans allow the borrower to apply for a no money down mortgage in most cases, and the zero percent down option is a big incentive for many first-time home buyers.

Also Check: How Long Does A Mortgage Approval Last

What Are The Va Loan Benefits For Surviving Spouses

A surviving spouse has additional benefits and is exempt from VA funding fees. This means that the monthly payments and the loan balance are usually lower.

Surviving spouses also become eligible for VA Streamline Refinance if they match up to these guidelines:

- The surviving spouse was still married to a veteran when he/she died

- The surviving spouse appears on the original VA loan

- VA Streamline Refinancing is usually not made available if the veteran that passed away was the sole applicant on the original VA loan, even when he/she married after purchasing the home.

In these instances, a surviving spouse may still qualify for a VA cash-out loan or non-VA refinance. The cash-out mortgages through the VA require that the spouse of a military member matches the eligibility requirements of a home purchase. In these cases, surviving spouses are allowed to access the equity of the home to raise money for any purposes, or to even pay a conventional or FHA loan off to do away with mortgage insurance.

How Does Mortgage Insurance Work

You bear the cost of mortgage insurance, but it covers the lender. Mortgage insurance pays the lender a portion of the principal in the event you stop making mortgage payments. Meanwhile, youre still on the hook for the loan if you cant pay, and you could lose the home in foreclosure if you fall too far behind.

This is different from mortgage life insurance, which pays off the remaining mortgage if the borrower dies, or mortgage disability insurance, which eliminates the mortgage if the borrower becomes disabled.

Also Check: How Much Will We Get Approved For A Mortgage

Fha Mortgage Insurance Premium

FHA loans feature minimum down payments as low as 3.5% and have easier credit qualifications than with conventional loans. Most FHA home loans require an upfront mortgage insurance premium and an annual premium, regardless of the down payment amount. The upfront premium is 1.75% of the loan amount, and the annual premium ranges from 0.45% to 1.05% of the average outstanding balance of the loan for that year.

You pay the annual mortgage insurance premium, or MIP, in monthly installments for the life of the FHA loan if you put down less than 10%. If you put down over 10%, you pay MIP for 11 years.

» MORE: Is an FHA loan right for you?

How Does A Va Loan Work

One common source of confusion about VA loans is the origination of the loan. Many people assume that the U.S. government issues the loans directly to borrowers. While there are VA direct loan programs, most VA loans come from private lenders.

Private lenders, including banks, credit unions and mortgage companies, issue the loans to eligible veterans or active-duty service members with a guarantee from the Department of Veterans Affairs. If the borrower should stop making payments, the VA guarantees the loan and will step in and make the payments.

Having the VAs guarantee doesnt mean the borrower is free and clear if they have to default on their mortgage or fall behind on payments. Their credit score will still take a hit, and it is possible to foreclose on the home if the borrower cant get current on their payments.

Instead, the VAs guarantee helps protect the lender. The company issuing the loan can feel confident that the VA will step in and make the payments if the borrower falls behind. The VAs guarantee reduces the lenders risk, meaning it can offer better interest rates to borrowers.

You May Like: Why Are Mortgage Rates Lower Than Prime

A Va Loan Is More Forgiving With Credit Scores

Since the VA backing reduces lenders risk, they can be more flexible with their terms, such as credit score minimums and ranges. The minimum will vary vary from lender to lender, but most are looking for a of 620 or above. However, Atlantic Bay can potentially qualify down to a 580 credit score, with additional requirements.Credit ranges are much more broad as well, and interest rates are not based heavily on credit scores. For example, if you have an average credit score, you may get the same interest rate as someone with an excellent score.In addition, the VA program is more lenient with things like previous bankruptcy, short sales, and foreclosures than a conventional loan program.

Va Mortgage Loan Options

Purchase loan:

If you are a conventional home buyer, you will most likely be looking to secure VA-backed purchase loans. This loan will help you buy, build, or improve a home with a competitive interest rate and the option to put no money down without restriction.

Interest Rate Reduction Refinance Loan :

If you already have a VA home loan and would like to reduce your monthly mortgage payment or interest, an Interest Rate Reduction Refinance Loan could be the right choice for you.

Cash-out refinance loan:

A VA-backed cash-out refinance loan can help you take cash out of your home equity. This loan will replace your current loan with a new VA loan under different terms. You can also use a VA cash-out refinance to refinance a non-VA loan into a VA-backed loan.

We would also like to mention that the VA offers a Native American Direct Loan . If you are veteran, and either you or your spouse is Native American, you may qualify for this loan. Because the VA directly backs this loan, you do not need to contact a private lender the U.S. Department of Veterans Affairs will serve as your lender.

Read Also: Does Applying For A Mortgage Affect Your Credit Score

Do I Need Mortgage Insurance For A Va Loan

The VA verifies your eligibility for the program by filling out the necessary paperwork. A VA loan also provides you with what is known as your entitlement, which is a dollar amount guaranteed. A lender might be willing to lend you four times the amount you are entitled to.

Its possible to qualify for a VA loan without putting any money down if all of these things are in place. In addition, VA loans do not require mortgage insurance, but you will have to pay a VA funding fee when you close, which is a percentage of the total loan amount. The VA funding fee keeps the program running for future borrowers.

Your Home Must Qualify For Va Loan

This is one of the harder aspects of VA loan restrictions to explain. Before you can purchase your home using VA loans, your property must qualify. The VA will send a specially appointed VA appraiser to assess the house. Here is a good breakdown of the VA property requirements but in general, your home must be a conventional home in good working condition.

Read Also: What To Look For When Applying For A Mortgage

Native American Direct Loan

The Native American Direct Loan program helps eligible Native American veterans finance the purchase, construction, or improvement of homes on federal trust land. Reductions in interest rates also come with these loans.

U.S. Department of Veterans Affairs. Purchase Loan. Accessed Nov. 26, 2021.

How Is A Va Loan Different From Other Government

A VA loan differs from other government-backed mortgages, such as an FHA loan or USDA loan, in a few different ways. Like VA loans, FHA and USDA loans are guaranteed by the federal government either the Federal Housing Administration or the U.S. Department of Agriculture.

The main difference between VA loans and FHA loans is that FHA loans usually require a borrower to take out mortgage insurance. The borrower has to pay the mortgage insurance for the life of the loan. FHA loans also have higher down payment requirements than VA loans.

A significant difference between VA loans and USDA loans is the type of home you buy. USDA loans are designed to encourage homeownership in rural or suburban areas. If you apply for a USDA loan, you cant buy a house in the city or a highly developed area.

The source of the loans can also vary. Some USDA loans come directly from the government, while private lenders generally issue VA and FHA loans.

Don’t Miss: Can I Add Someone To My Mortgage Without Refinancing

Can I Use A Coe I Used Before

You may be able to restore an entitlement you used in the past to buy another home with a VA direct or VA-backed loan if you meet at least one of these requirements.

At least one of these must be true:

- Youve sold the home you bought with the prior loan and have paid that loan in full, or

- A qualified Veteran-transferee agrees to assume your loan and substitute their entitlement for the same amount of entitlement you used originally, or

- Youve repaid your prior loan in full, but havent sold the home you bought with that loan

To request an entitlement restoration, fill out a Request for a Certificate of Eligibility and send it to the VA regional loan center for your state.

Va Home Mortgage Limits

You might be wondering exactly how much house can you buy with a VA loan. According to the VAs loan limit documentation, eligible veterans, service members, and survivors with full entitlement no longer have limits on loans.

With that being said, it is still up to your lender to determine how large of a mortgage you can borrow. Your mortgage banker will determine the size of loan you can afford by assessing your credit history, income, and any assets you may be holding.

Read Also: How To Get First Mortgage

Department Of Veterans Affairs

If you get a Department of Veterans Affairs -backed loan, the VA guarantee replaces mortgage insurance, and functions similarly. With VA-backed loans, which are loans intended to help servicemembers, veterans, and their families, there is no monthly mortgage insurance premium. However, you will pay an upfront funding fee. The amount of that fee varies based on:

- Your type of military service

- Your down payment amount

You May Like: Loan Originator License California

Do You Need Mortgage Insurance For A Va Loan

Some lenders require a borrower to take out private mortgage insurance in certain situations, such as a conventional loan when a person puts down less than 20% or an FHA loan. PMI protects the lender, as it backs the loan and will cover payments if a borrower defaults.

When a person puts down a smaller down payment, the lender considers them a riskier borrower. PMI helps to mitigate that risk. In the case of a conventional loan, PMI is no longer required once a person has made enough payments to build up 20% equity in their home. FHA insurance payments are for the life of the loan.

There are no VA loan PMI requirements, fortunately. Even with zero percent down, a VA loan borrower can skip the PMI because the VA is essentially acting as mortgage insurance.

Recommended Reading: Is A Home Loan A Mortgage

Do Veterans Pay Homeowners Insurance

The importance of homeowners insurance goes beyond just protecting your home. In order to close a VA loan, you must have sufficient homeowners insurance.

Usually, veteran borrowers will need to pay their first years insurance premiums when they close. Sellers may have to cover the cost when negotiating closing costs in Maryland and concessions for VA loans. It is considered a seller concession if the seller pays for or reimburses you for this upfront premium payment.

As part of their regular mortgage payment after this first year, homeowners typically pay a portion of their homeowners insurance premium each month. Generally, mortgage lenders in Columbia MD or servicers will escrow these portions and pay the annual bill on your behalf.

Mortgage Insurance Protects The Lender Not You

Mortgage insurance, no matter what kind, protects the lender not you in the event that you fall behind on your payments. If you fall behind, your credit score may suffer and you can lose your home through foreclosure.

There are several different kinds of loans available to borrowers with low down payments. Depending on what kind of loan you get, youll pay for mortgage insurance in different ways:

Also Check: Are Mortgage Rates Going Down

Why Is The Va Loan Funding Fee Assessed

VA loans are guaranteed by the Department of Veterans Affairs. This means that if a borrower defaults on the loan, the lender is partially protected from the loss because the government insures the loan. The funding fee helps with this cost and others related to the VA home loan program and ensures that the program remains sustainable.

What Type Of Property Can You Buy With A Va Loan

You need to use a VA loan to buy a property youll live in. You cant use the mortgage to buy a second home or investment property. However, you can buy a property with up to four units and rent out some of the units. You can also buy a property such as a condo, as long its in a VA-approved development.

resources

You May Like: Who Offers 10 Year Mortgages