How Much Of A Mortgage Can I Afford

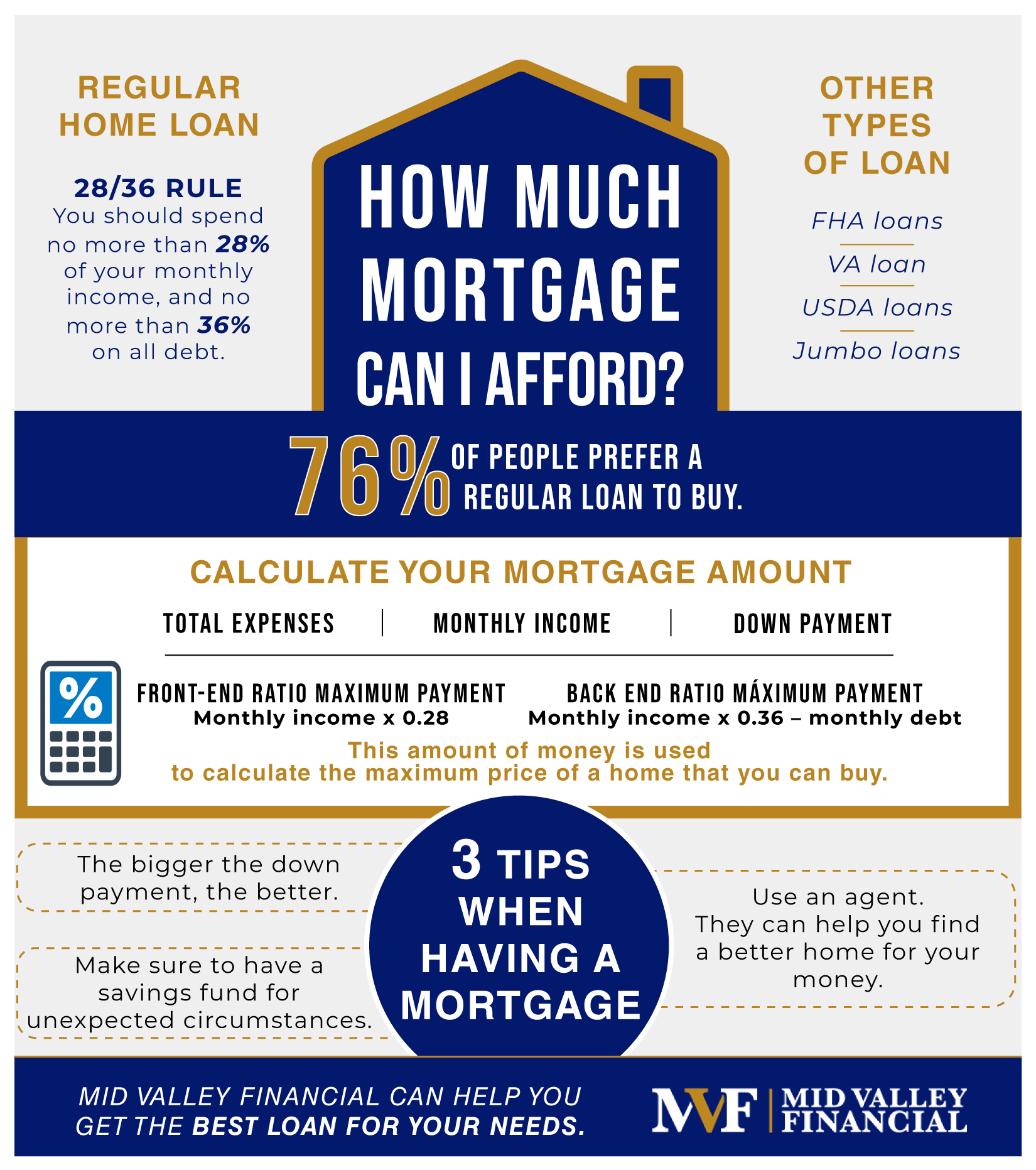

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford .

Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

How To Check Home Loan Eligibility

Individuals can easily check their home loan eligibility criteria on the official website of their preferred lending institution. Although most key requirements are usually the same, certain eligibility criteria may differ from lender to lender. These eligibility criteria are basically a set of parameters based on which a lender can assess a borrowers creditworthiness and past repayment behaviour. It depends on several factors, including credit history, age, credit score, financial obligations of an individual along with FOIR and financial status.

Another easier and quick way to determine loan eligibility is to use an online home loan eligibility calculator. One can use this calculator to work out a personalised quote that can possibly meet the loan amount requirement on favourable and affordable means.

How To Use This Mortgage Calculator

This mortgage payment calculator will help you find the cost of homeownership at todays mortgage rates, accounting for principal, interest, taxes, homeowners insurance, and, where applicable, homeowners association fees.

You should adjust the default values of the mortgage calculator, including mortgage rate and length of loan, to reflect your current situation.

You can use the mortgage payment calculator in three ways:

Read Also: Does Debt To Income Include Mortgage

How Much Home Loan Can I Get On My Salary

You can usually get a home loan that is 60 times your salary. However, lenders do not generally consider your in-hand salary when determining the loan amount. Your in-hand salary may include the list below.

- House rent allowance

- Other allowances, etc.

Now, a lender will not consider allowances like medical and leave travel when assessing your income. These allowances are provided only for the designated use hence, financial institutions exclude them.

Assume your in-hand salary is Rs. 60,000, and after excluding medical allowance, LTA, etc., it goes down to Rs. 49,000. It is upon this amount will your home loan amount be calculated.

Considering you are a resident of Bangalore of 30-year-old with all financial obligations and current EMIs Nil, The Following table illustrating the home loan eligible based on salary:

|

Net monthly income |

Tips For Buying A Home

In order to help ensure that you can afford your home and maintain it over time, there are some smart measures you can take. First, save up a cash reserve in excess of your down payment and keep it in reserve in case you lose your job or are unable to earn income. Having several months of mortgage payments in emergency savings lets you keep the house while looking for new work.

You should also look for ways to save on your mortgage payments. While a 15-year mortgage will cost you less over the loan’s life, a 30-year mortgage will feature lower monthly payments, which may make it easier to afford month-to-month. Certain loan programs also offer reduced or zero down payment options such as VA loans for veterans or USDA loans for rural properties.

Finally, don’t buy a bigger house than you can afford. Do you really need that extra room or finished basement? Does it need to be in this particular neighborhood? If you are willing to compromise a bit on things like this, you can often score lower home prices.

Don’t Miss: What Are Current Mortgage Rates In Oregon

How Much Does A Bank Lend For A Mortgage

To determine how much a bank will lend for a mortgage, an underwriter will evaluate your debt-to-income ratio, the value of your property and your credit history. The lending bank will also want you to satisfy the three Cs of credit history — capacity, capital and character — which demonstrate your ability to repay the loan, sufficient assets to repay the loan in the absence of income and your bill payment history as illustrated by your credit report.

What Factors Impact The Amount You Can Borrow

Lenders consider several factors in determining the amount you qualify for, including:

-

Your debt-to-income ratio. Our How much can I borrow calculator? depends on an accurate input of your income and recurring debt. Youll want to really hone those figures down to a fine point, because lenders will be using them too.

-

Your loan-to-value ratio. This ratio is a function of the amount of money you put down. If you want to drill down on this calculation, use NerdWallets loan-to-value calculator.

-

Your credit score. This number impacts the pricing of your loan, more than how much youll qualify for. But thats really important. If you dont know your score, get it here.

Also Check: How Large A Mortgage Can I Qualify For

Use Our Mortgage Affordability Calculator

Use our Mortgage Affordability Calculator to estimate how much you can borrow.

They must also assess the monthly payment you can afford, after looking at your outgoings as well as your income.

This is called an affordability assessment.

The lender must also look ahead and stress test your ability to repay the mortgage.

This is to make sure youll still afford repayments if the interest rate rises or there is a change to your lifestyle, such as:

- having a baby, or

- taking a career break.

If the lender thinks you wont be able to afford your mortgage payments in these circumstances, they might limit how much you can borrow.

Work out your possible monthly repayments with our Mortgage calculator

Comparison websites are a good starting point for anyone trying to find a mortgage tailored to their needs.

Some of the biggest mortgage comparison websites are:

How Much Personal Loan Can I Get

When thinking about taking out a loan the first question in your mind is – How much loan can I get? Other than the key question of maximum personal loan, it is also a matter of clearing all the required eligibility criteria.

The eligibility criteria differ for salaried as well as self-employed individuals. The eligibility criteria for applying for a personal loan is as follows:

- The applicant must be an employee of a private or a public enterprise with a basic minimum turnover as per the company policy.

- The applicants age must range between 21 to 60 years.

- The income should be at least Rs. 25,000 in Mumbai and Delhi and Rs. 20,000 in other parts of India.

- A self-employed person can avail of a loan calculated on the profit after tax based on the industry and should be in business for a minimum of 5 years.

- The applicant should have a minimum of 1-year experience and 6 months in the present company.

Read Also: Which Bank Is Best For Mortgage

How Much Will A Bank Lend On A Property

Generally, we can expect a lender to lend up to 80% of the value or price of a house .

Often, lower percentages are loaned on properties outside urban areas and on apartments. These figures are sometimes called the loan to value ratio, or LVR.

It is possible to borrow up to 95% of a propertys value in some cases. But thats a big risk for both the borrower and the lender.

What Does It Mean To Be House Poor

House poor is a situation where most of your wealth is tied up in your house and much of your income goes toward servicing the mortgage debt and related expenses. An example would be if you had $100,000 in savings and used all of it to finance a $500,000 property with a $2,500 monthly mortgage payment when your net income is $3,000 per month.

Such a situation can give the illusion of economic prosperity but quickly unravel to foreclosure if things turn sour.

You May Like: What Is The Current Trend In Mortgage Rates

Find Out How Much You Could Borrow And What It Could Cost

You’re new to NatWest mortgages, considering a mortgage for your first home and looking to see our mortgage rates.

You’re new to NatWest mortgages, considering a mortgage for a home move and looking to see how much you could borrow.

You’re new to NatWest mortgages, considering a mortgage for a home move and looking to see ourmortgage rates.

You’re new to NatWest mortgages, considering a remortgage for your home and looking to seeour mortgage rates.

You’re new to NatWest mortgages, considering a mortgage for a buy to let property and looking to see our rates.

You’re new to NatWest mortgages, considering a remortgage for a buy to let property and looking to see our rates.

You’re an existing NatWest mortgage customer, considering a change in mortgage for your buy to let property and looking to see our rates.

You’re an existing NatWest mortgage customer, considering changing the mortgage and borrowing more for your buy to let property and looking to see our rates.

You’re an existing NatWest mortgage customer, considering a remortgage for a buy to let property and looking to see our rates.

You’re an existing NatWest mortgage customer, wishing to buy a new buy to let property and looking to see our rates.

You’re an existing NatWest mortgage customer, wishing to remortgage your buy to let property, looking to see our rates.

How Piti Affects Your Mortgage Qualification

When lenders assess whether or not you can afford a mortgage loan, theyll compare your estimated PITI with your gross monthly income .

Your PITI, combined with any existing monthly debts, should not exceed 43% of your monthly gross income this is called your debt-to-income ratio .

Your DTI is a primary factor in whether or not youll qualify for a mortgage.

Recommended Reading: What Determines Your Mortgage Rate

What Are The Factors Affect Home Loan Eligibility

Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately 41%.

The amount a borrower agrees to repay, as set forth in the loan contract.

Read Also: What Is A Mortgage Company

Factors Affect Home Loan Eligibility

Some of the key factors that affect an individuals housing loan eligibility are stated below:

- CIBIL score: Applicants possessing an ideal CIBIL score above 750 are more likely to avail of a home loan at affordable terms that make repayment comfortable

- Fixed obligations to income ratio: Lenders are likely to offer housing loan options at favourable terms to individuals with a low FOIR. A low FOIR value indicates a higher disposable income, thereby increasing the chances of the borrower repaying the loan amount timely

- Age of the applicant: The age of the borrower dictates the tenor of loan repayment. An extended repayment tenor will have smaller EMIs, thereby making it easier for the individual to repay the loan without defaulting

Apart from these, employment status, monthly income, property details and loan-to-value ratio also affect home loan eligibility.

How To Apply For A Mortgage Loan

You can apply for a mortgage loan through the banks official website or by visiting the nearest branch. For an online application, go to the lenders website and choose the product you wish to apply for. If they entertain online applications, you will find an Apply Now option on the page. Depending on the process, you may have to fill an online application form and submit the details.

You can also go to the nearest branch, request for an application, and submit it along with the required documents.

Heres a look into the application process for a mortgage loan:

- Document collection to process the loan

- Verification of personal/business information provided

- Sanction letter delivered via post and email post approval

- Request for disbursal

- Evaluation of your property and its documents

- Post successful verification, disbursement cheque delivered

Also Check: Is Paying Mortgage Like Paying Rent

What Does ‘ltv’ Mean

The deals you’re offered when applying for a mortgage will usually be affected by the loan-to-value ratio or ‘LTV’ – ie the percentage of the price that you’re borrowing compared to how much you’re putting in yourself.

This means that if you have a 10% deposit, your LTV will be 90% as your mortgage will need to cover 90% of the property price. With a 15% deposit, your LTV will be 85%, and so on.

Lenders will set a maximum LTV for each deal they offer – for example, a particular interest rate may only be available to those with an LTV of 75% or below.

In general, the lower your LTV , the lower the mortgage rate, and the cheaper the overall deal.

More On How To Improve Home Loan Eligibility

- You can enhance your eligibility for a home loan by:

- Adding an earning family member as co-applicant.

- Availing a structured repayment plan.

- Ensuring a steady income flow, regular savings and investments.

- Furnishing details of your regular additional income sources.

- Keeping a record of your variable salary components.

- Taking actions to rectify errors in your credit score.

- Repaying ongoing loans and short terms debts.

Don’t Miss: What Credit Company Do Mortgage Lenders Use

Calculate Eligibility For Home Loan

Using a Home Loan Eligibility Calculator is certainly one of the easiest ways to determine eligibility for a home loan. Lending institutions consider several factors such as monthly salary, loan repayment tenor, other source of monthly income, any other obligation and EMIs payable besides other basic information. With a housing loan eligibility calculator, one can quickly set the values or inputs to these fields and check their eligibility without any hassle. It will help buyers to make an informed choice and avoid loan application rejections, which can otherwise affect their credit behaviour and CIBIL score negatively.

Also, with the easy-to-use home loan eligibility calculator, you can avoid applying for a loan at multiple lenders.

Home Loan Eligibility Based On Age

Age is another determining factor when it comes to loan tenor. The maximum tenor that you can avail is 20 years.

You will be able to avail a longer repayment tenor if you are of a lower age. You can also avail a home loan of higher value provided you have a high income.

Salaried applicants have to be between the ages of 23 and 62** years to apply for a home loan. Self-employed applicants have to be within the age bracket of 25 and 70 years to avail one.** Maximum age considered at the time of loan maturity.

The following table shows the maximum tenor individuals are eligible for based on their age:

|

Maximum tenor for salaried applicants |

Maximum tenor for self-employed applicants |

|

|

25 Years |

||

|

20 Years |

Recommended Reading: How Does Home Appraisal Affect Mortgage

Apply For A Home Loan And Calculate Your Home Loan Eligibility

Once you get an indication of your eligibility and EMI amount by using the calculator, you can apply for a home loan online from the comfort of your living room easily with Online Home Loans by HDFC.

To apply for a home loan online with HDFC,

In case you would like us to get in touch with you, kindly leave your details with us. HDFC also offers a facility of a pre-approved home loan even before you have identified your dream home.

These calculators are provided only as general self-help Planning Tools. Results depend on many factors, including the assumptions you provide. We do not guarantee their accuracy, or applicability to your circumstances.

How Lenders Assess What You Can Afford

Mortgage lenders base their decisions on whats known as the loan-to-income ratio the amount you want to borrow divided by how much you earn.

The most you can borrow is usually capped at four-and-a-half times your annual income

Have you had mortgage advice?

You can get advice directly from a lender who will discuss their own products, or from a broker wholl be able to look at mortgages from a range of providers.

Read Mortgage advice: should you use a mortgage adviser? for details of where to get advice.

Also Check: What Would A Mortgage Payment Be On 175 000