Key Facts About Mortgage Points

The terms around buying mortgage points can vary significantly from lender to lender so consider the following carefully.

-

The lender and marketplace determine the interest rate reduction you receive for purchasing points so its never fixed.

-

Mortgage points and origination fees are not the same things. Mortgage or discount points are fees paid in addition to origination fees.

-

You can potentially receive a tax benefit from purchasing mortgage points. Make sure to contact a tax professional to learn how buying points could affect your tax situation.

-

Mortgage points for adjustable-rate mortgages usually provide a discount on the loans interest rate only during the initial fixed-rate period. Calculate the break-even point to determine if you can recoup what you paid for in points before the fixed-rate period expires.

-

Crunch the numbers if youre on the fence on whether to put a 20% down payment or buying mortgage points. If you choose to make a lower down payment, you may be required to carry private mortgage insurance so factor this additional cost because it could offset the interest savings earned from purchasing points.

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

When To Pay Points

Origination points typically arent charged on most loans and typically company specific. For example, traditional banks that happen to do mortgages often charge origination points on every loan. This is how they make additional money. In contrast, most mortgage bankers dont charge origination points.

Discount points are more specific to the loan and can be charged for a variety of reasons. The most common instances where discount points are charged are when escrow are waived, when credit scores are low, or when someone wants to buy down the interest rate.

A Guide To Mortgage Points

As a savvy homebuyer, you already know the importance of shopping around for the best mortgage rate and negotiating prices. What if we told you there was another step you could possibly take to make your rates even more competitive? Hopefully, your ears have perked up now. Today we will be discussing mortgage points.

Mortgage points are a way to pay extra money upfront during closing to lower your monthly payments and interest rate.

Recommended Reading: How To Get A Mortgage After Bankruptcy

How Many Mortgage Points Can You Buy

Theres no one set limit on how many mortgage points you can buy. However, youll rarely find a lender who will let you buy more than around 4 mortgage points.

The reason for this is that there are both federal and state limits regarding how much anyone can pay in closing cost on a mortgage. Because limits can change from state to state, the number of points you can buy may vary slightly.

According to a survey of lenders conducted weekly by Freddie Mac, for about the last 5 years, the average number of points reported on a 30-year fixed conventional loan was between 0.5 0.6 points.

Its important to note you dont have to pay for a full point to get a lower rate. Points are sold in increments all the way down to 0.125%.

What Are Origination Points

A different type of mortgage point that you might have to pay is an “origination point.” Origination points won’t reduce your interest rate they’re fees you pay to the lender for agreeing to provide and process your loan. Sometimes origination points are called an “origination fee.” These points vary from lender to lender and are sometimes negotiable, but not usually.

This article focuses mainly on discount points.

Don’t Miss: How Are Points Calculated On A Mortgage

Buying Points Can Be A Valuable Option Heres Exactly Who Should And Should Not Buy Mortgage Points

Homes and condominium tops against a blue sky

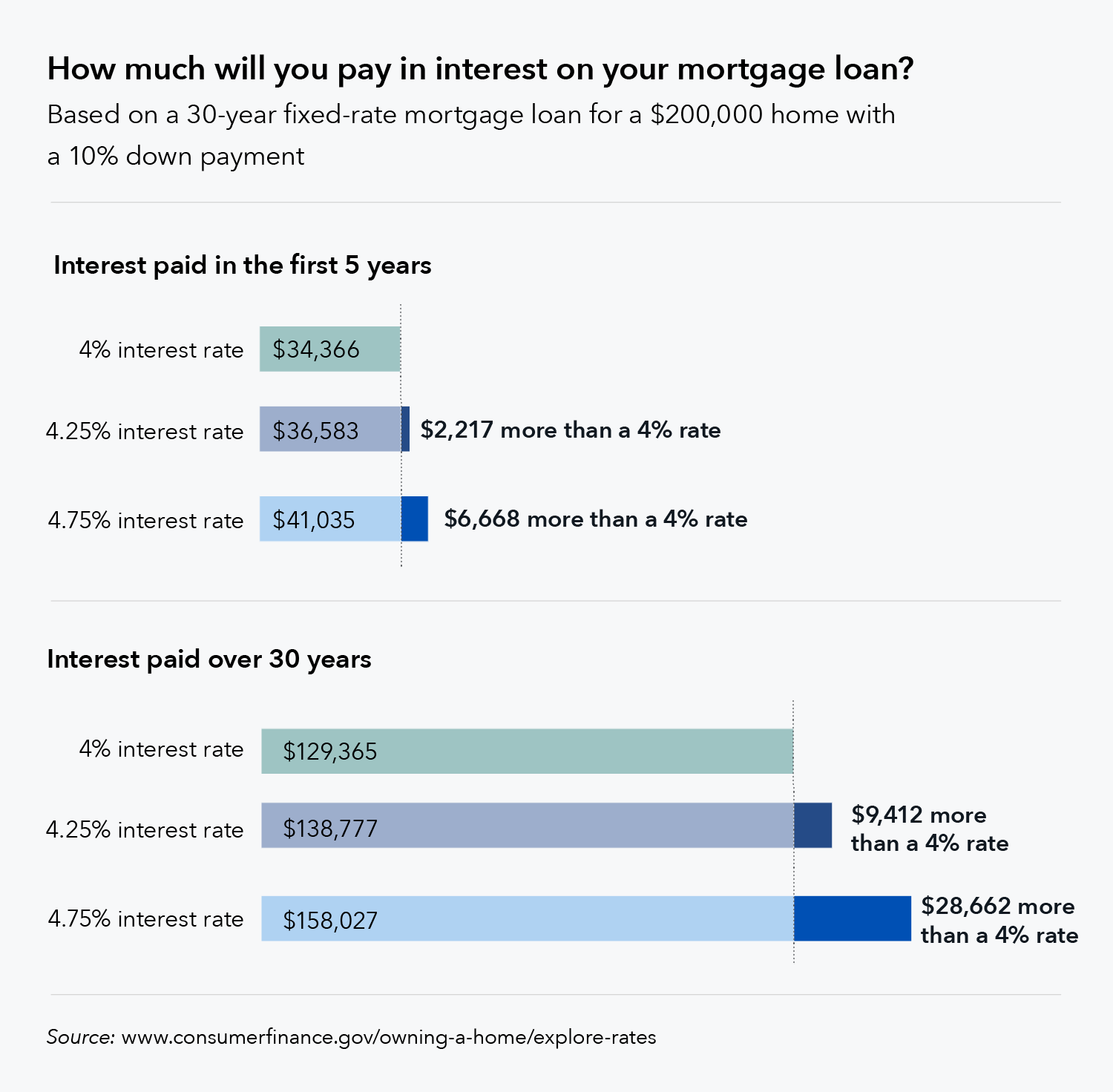

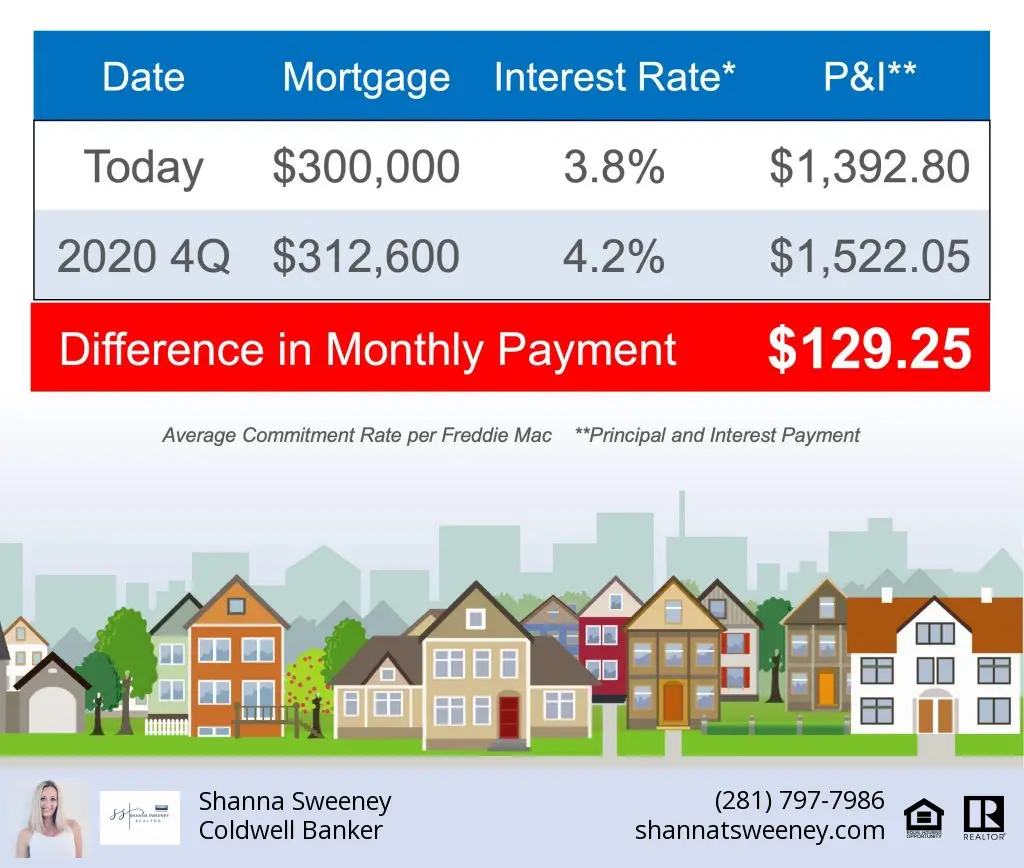

Mortgage points, also sometimes called discount points, are essentially fees a borrower pays a mortgage lender to reduce the interest rate on their loan, which also lowers their monthly payment. Each point purchased costs 1% of the mortgage amount, so one point on a $400,000 mortgage would cost $4,000 borrowers can also often buy fractions of a point as well. Each point typically lowers the rate by about 0.25%, though this varies so for example, buying one point might lower a mortgage rate from, say, 4% to 3.75% for the duration of the loan. Though that may seem like a small fraction that difference in interest rate can save you tens of thousands of dollars over the life of the loan.

When taking out a mortgage for a new home purchase, buying points can be a valuable option for a borrower to help lower their interest rate and ultimately lower their monthly payment, says Jonathan Lee, senior director of mortgage sales for Zillow Home Loans.

Who does, and does not, benefit from buying mortgage points?

If you plan on leaving the home before you hit the breakeven point, then buying discount points wont be worth it as youll end up spending more than you save, says Jacob Channel, senior economist at LendingTree.

Other things to know about buying mortgage points

The advice, recommendations or rankings expressed in this article are those of MarketWatch Picks, and have not been reviewed or endorsed by our commercial partners.

What Are The Costs To Buy Down Points For A Mortgage Loan

Home buyers sometimes get a lower mortgage rate by “buying down” the rate. A mortgage lender will offer loans at different rates, along with a corresponding cost in “points” to get a loan at the lower quoted rates. Home buyers or refinancing homeowners may be willing to pay these points in order to get a specific rate so that they can save on interest or have a specific monthly payment. The extra cost for the lower rate is paid at the closing of the new loan.

Don’t Miss: What Are The Current Mortgage Rates In North Carolina

About Negative Points And Fractional Points

Negative discount points are an option a lender may offer to reduce closing costs. They work just opposite of positive discount points instead of paying money to receive a lower rate, you are essentially given money in return for a higher rate.

These are often a feature of no closing cost mortgages, where the borrower accepts a higher rate in return for not having to pay closing costs up front. This Mortgage Points Calculator allows you to use either positive or negative discount points.

Fractional points are commonly used by lenders to round off a rate to a standard figure, such as 4.75 percent, rather than something like 4.813 percent. Mortgage rates are typically priced in steps of one-eighth of a percent, like 4.5, 4.625, 4.75, 4.875 percent, etc., but the actual pricing is more precise than that. So lenders may charge or credit a fractional point, like 0.413 points or 1.274 points to produce a conventional figure for the mortgage rate.

The Bottom Line: Mortgage Points Can Save You Money

Though mortgage points and prepaid interest are right for some borrowers, they dont make financial sense for everyone. To determine whether you can save with discount points, you have to crunch the numbers.

Sit down and assess your budget, down payment, loan terms and future plans before you close. Determine your breakeven point and your likelihood of staying in the home to understand if discount points will save you money in the long run when refinancing or buying a home.

If youre ready to buy a new home or need to refinance your existing home loan, dont wait. Apply online with Rocket Mortgage®.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Don’t Miss: When Is A Mortgage Payment Considered Late

When To Buy Mortgage Points

Buying mortgage points might make sense if any of the following situations apply to you:

- You want to stay in your home for a long time. The longer you stay in your home, the more it makes sense to invest in points and a lower mortgage rate. If youre sure youll have the same mortgage for the long haul, mortgage points can lessen the overall cost of the loan. The longer you stick with the same loan, the more money youll save with discount points.

- Youve determined when the breakeven point is. Do some math to figure out when the upfront cost of the points will be eclipsed by the lower mortgage payments. If the timing is right and you know you wont move or refinance before you hit the breakeven point, you should consider buying points.

How To Calculate Your Breakeven Point

Lets run through a quick example using the numbers referenced earlier.

If you have a $200,000 loan amount, going from a 5.125% interest rate to a 4.75% interest rate saves you $46 per month. As mentioned earlier, the cost of 1.75 points on a mortgage with a $200,000 loan amount is $3,500. If you divide the upfront cost of the points by your monthly savings, youll find that your breakeven point is about 76 months , which is equal to roughly 6 years and 3 months. So, if you plan to stay in your house for longer than that amount of time and pay off your loan according to the original schedule, it makes sense to buy the points because youll save money in the long run.

When Discount Points Are Worth It

Katherine Alves, executive vice president of Homeowners First Mortgage, says you want to ensure that purchasing discount points will result in a financial advantage.

To do so, you need to calculate the cost versus savings over time. This is done by comparing rates with no points to a loan with points and reviewing the overall annual savings in the monthly payment, recommends Alves.

Then, you need to decide if you are going to remain in your home or the current mortgage loan long enough to recoup the costs of your discount points, she explains. This is known as the breakeven point.

Take a look at an example.

Assume a borrower named Steve purchases a home and takes out a 30year mortgage for $400,000. Hes offered a 3.25% fixed interest rate.

- If Steve purchased one discount point a $4,000 upfront cost he would save about $108 on each monthly payment

- It would take Steve 37 months to reach his breakeven point and recoup the $4,000 he paid upfront

If Steve held onto the loan over its full 30year term, he would save around $35,000 overall in interest by purchasing that single discount point, Killinger says.

Here, the assumption is that Steve will stay put in his home and not refinance or sell until more than three years have passed. In this case, paying for a discount would be well worth it.

You May Like: Reverse Mortgage On Condo

You May Like: Where Are Mortgage Interest Rates Going

Mortgage Points Vs Origination Fees

As mentioned above, mortgage points are tax deductible. Loan origination fees are not.

Loan origination fees can be expressed in Dollar terms or as points. A $200,000 loan might cost $3,000 to originate & process. This can be expressed either in Dollars or as 1.5 origination points.

Origination fees are negotiable but they help a lender cover their basic overhead & mitigate the risk a consumer may pre-pay their mortgage before the overhead is covered. On conforming mortgages this fee typically runs somewhere between $750 to $,1200.

These fees are typically incremented by half-percent. The most common fee is 1%, though the maximum loan origination fee is 3% on Qualified Mortgages of $100,000 or more.

- Smaller homes may see a higher origination fee on a percentage basis since the mortgage broker will need to do a similar amount of work for a smaller loan amount. On loans of $60,000 or below the cap can be as high as 5%.

- VA loans have a 1% cap on origination fees.

- FHA reverse mortgages can charge a maximum of the greater of $2,500, or 2% of the maximum mortgage claim amount of $200,000 & 1% of any amount above that.

What Are Borrower Discount Points

Discount points are a form of prepaid interest that mortgage borrowers can purchase to lower the interest rate on their next monthly payments. Discount points are a one-time fee, which is paid in advance either at the first mortgage agreement or during refinancing.

What are discount points on a refinance?

A mortgage point sometimes called a discount point is a fee you pay to lower your interest rate on buying a home or refinancing. One point discount costs 1% of the amount of your home loan. For example, if you take out a $ 100,000 mortgage, one point will cost you $ 1,000.

Are loan discount points negotiable?

Discounts and points of origin can be negotiated, even if your lender claims they are not. Discount points have value for you and may have less negotiation than the variety of origin. Still, you can still save some valuable money by convincing the lender to reduce the points they ask for.

How much do discount points reduce interest?

When you buy one point discount, you will pay a 1% mortgage fee. As a result, the lender usually reduces the interest rate by 0.25%.

Also Check: What If I Pay Extra On My Mortgage

How Much Do They Cost

Points cost 1% of the balance of the loan. If a borrower buys 2 points on a $200,000 home loan then the cost of points will be 2% of $200,000, or $4,000.

Each lender is unique in terms of how much of a discount the points buy, but typically the following are fairly common across the industry.

Fixed-Rate Mortgage Discount Points

Each point lowers the APR on the loan by 1/8 to 1/4 of a percent for the duration of the loan. In most cases 1/4 of a percent is the default for fixed-rate loans.

Adjustable-Rate Mortgage Discount Points

Each point lowers the APR on the loan by 3/8 of a percent , though this discount only applies during the introductory loan period with the teaser-rate.

Cost of Discount Points

As mentioned above, each discount point costs 1% of the amount borrowed. Discount points can be paid for upfront, or in some cases, rolled into the loan.

Fractional Discount Points

Some lenders may offer loans with fractional discount points. In mortgage rate listing tables it is not uncommon to see a loan with 1.1 discount points.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: What Is The Mortgage On A 1.5 Million Dollar House

Mortgage Points Vs Origination Points

Mortgage points give you the option to lower your interest rate and decrease your monthly mortgage payments. There are two types of these points: discount points and origination points.

Discount points are a form of prepaid interest that you can purchase to reduce your interest rate. Doing so will give you ongoing savings on your mortgage costs over a number of years.

Origination points are a fee paid to the lender that provides your mortgage for the evaluation, processing and approval of your loan. These also help lower the interest rate on your mortgage.

In most cases, youll pay a fee equal to 1% of the mortgage amount for each discount point.This fee is typically paid directly to your lender or as part of a fee package.

Are Mortgage Points Tax Deductible

Because the cost of discount points represents prepaid interest, points are deductible for taxpayers who itemize. Though, the loan must be secured by your main home and meet some other criteria. You generally have to deduct them over the life of the loan though sometimes, you can deduct the points in the year you pay them. But you can usually only deduct points paid on up to $750,000 of mortgage debt .

Example. Say you take out a $1,000,000 mortgage loan and purchase one point for $100,000. You’ll only be able to deduct $75,000 the remaining $250,000 isn’t tax-deductible.

In some cases, the seller will agree to pay for points to incentivize a buyer. Points are deductible in this situation, too.

According to the IRS, origination fees are also tax-deductible, but points paid for items that are usually listed separately on the settlement sheet such as appraisal fees, inspection fees, and attorney fees, aren’t.

Also Check: What Is A Reverse Mortgage For Dummies

Calculating Points On Arm Loans

While a point typically lowers the rate on FRMs by 0.25% it typically lowers the rate on ARMs by 0.375%, however the rate discount on ARMs is only applied to the introductory period of the loan.

ARM loans eventually shift from charging the initial teaser rate to a referenced indexed rate at some margin above it. When that shift happens, points are no longer applied for the duration of the loan.

When using the above calculator for ARM loans, keep in mind that if the break even point on your points purchase exceeds the initial duration of the fixed-period of the loan then you will lose money buying points.

| Loan Type |

|---|

| 120 months, or whenever you think you would likely refinance |

Discount Points Vs Origination Points

There are two different types of mortgage points: origination points and discount points. Discount points represent prepaid interest that can be used to negotiate a lower interest rate for the term of a loan.

Origination points, on the other hand, are lender fees that are charged for closing on a loan. Origination points donât save borrowers money on interest, although they can sometimes be rolled into the balance of a loan and paid off over time. Discount points, however, have to be paid up front.

You May Like: How To Figure Out Mortgage Budget