Material Clauses Of A Mortgage Contract

If you use a mortgage broker or agent to find your mortgage loan, they are required to disclose to you the material risks of your mortgage in writing and in plain language. You are also allowed to have at least two business days to review a mortgage disclosure statement before you sign a mortgage contract with a mortgage broker or agent or sign a mortgage instrument, whichever is earlier.

Mortgage contracts can have different clauses based on the borrower-lender relationship, but they all have the same core promises, known as covenants, as outlined below.

Borrower Covenants

Mortgage lenders have an interest in the property a homebuyer is purchasing or refinancing. They want to ensure it is a sound investment in the event a homeowner cant pay back the mortgage in full. Borrower covenants are set so the lender can take action if the homeowner is found to be irresponsible with the status of their home.

Typically, there are four financial obligations you agree to, as the borrower:

Mortgage Lender Covenants

Mortgage lender covenants protect the borrower and ensure their mortgage contract is in good faith. If a borrower meets their obligations, a mortgage lender must:

Closing Process Liaison

Ongoing Mortgage Administration

Renewal

Closing Costs And Credit Scores

How much your lender is willing to negotiate on closing costs will often depend on your credit score. Credit scores are a rating system lenders use to measure your reliability as a borrower. Your score is based on how regularly you pay your debts, how much you owe, past foreclosures or bankruptcies and other credit related events. Credit scores generally range from 350 to 850. The higher your credit score, the more attractive a customer you are, which will determine how willing lenders will be to negotiate closing costs.

References

There Are Two Primary Categories Of Mortgage Fraud:

Contents

When youre prequalified for a mortgage, youre getting a general idea of how much you can borrow, based on a modest amount of information about your financial situation, including a credit check. It can be committed by both borrowers and lenders. Commitment letters are legal documents between the lender and the consumer, outlining terms such as the interest rate, loan term, or other aspects related to the deal.

Read Also: What Happens To Mortgage Rates During Inflation

Commitment Fees Vs Lock

In some cases, lenders are willing to provide not only a commitment to lend in the future, but also a commitment to lock in a specific interest rate. That means a borrower is guaranteed to borrow at the specified interest rate for a period of time, regardless of whether prevailing interest rates go up or down in the future.

A lock-in fee, or a fee to guarantee the future loan rate, may be charged as part of a commitment fee. Or in some cases, it may account for the entire commitment fee. Be sure to review the commitment agreement ahead of time to identify all costs involved.

Secure Your Mortgage Commitment Letter Today

Talk to a mortgage loan officer to see if you qualify for our Commitment Letter First Program. Once your application is approved, our mortgage lenders are ready to provide the commitment you need to purchase right away.

Just fill out the form below to learn more information about our Commitment Letter First mortgage loan program.

Ready to speak with someone now? Give us a call toll-free at or email .

Read Also: How Much Is An Application Fee For A Mortgage

Mortgages : A Guide To Getting Your Mortgage

Youre probably already familiar with the fundamental concept of obtaining a loan to become a homeowner. But in reality a mortgage is a rather complex marathon of financial calculations, comparing offers, and various approval stages.

In this article well explore mortgages in depth, and in simple, comprehensible terms. Well go over the mortgage process from start to finish, where to look for the best rates, and the vocabulary youll need along the way.

In This Article:

Meeting And Information Download

Your mortgage broker/agent or your lender will ask you for information to help them better understand you, your goals for the mortgage loan, and the type of mortgage you want or need including:

- Your financial circumstances

- Your preference in terms of amount, rate, term, amortization and conditions

- Your risk tolerance

- Other parties to the transaction

- If you have identified a property you wish to purchase, information about the property that will become the security for the mortgage loan

- If you know what your credit rating is

- Your debt load or liabilities

- The amount of down payment you have saved

They will also ask for documentation to confirm the information you provide.

Take the following information with you to your first meeting with a mortgage broker/agent or lender:

Lenders or mortgage brokers/agents will rely on the information you provide. This information helps them find the mortgage option and/or lender that are right for you. It is critical that you are completely honest when providing them this information. Errors in your application can easily lead to a mortgage that is not right for you or fit for your circumstances, plus misstating facts or providing false information in your mortgage application can have serious consequences. You could face up to 10 years of jail time.

Lenders and mortgage brokers/agents are expected to ask questions and seek additional information in the event of inconsistencies with the information you provide.

You May Like: Can You Get Rid Of Fha Mortgage Insurance

Mortgage Commitments: A Broker Explains Why Banks Rush You Into Them

Patrick Nilandin Board Operations

Having served as the president of my own co-op’s board of directors, I can understand the frustration. Refinancing an underlying mortgage is the most important decision a board will make during its tenure. Three days hardly seems enough time to review and vote on such a critical issue, especially after waiting so long to get it.

On the other hand, having been a banker for several years, I can understand things from the lender’s viewpoint as well. By the time it issues a commitment letter, the lender will have done much work, and doesn’t want that effort to be in vain because the borrower takes the commitment and shops it around with other lenders. The lender assumes you have already done your comparison shopping and are ready to move forward. In the lender’s mind, five days is more than enough time for an organized and serious borrower to review, sign and return a commitment.

So, who’s right? Both are. Let’s start with the lender. Loan officers have multiple loan requests on their desks and will work on whichever ones have submitted all the required information. If your application package is poorly organized or incomplete, or the loan officer has questions that go unanswered for more than a day or so, it might get put aside.

The faster you give loan officers

everything they need,

the faster you’ll get a commitment.

Ask for an Extension

Give Yourself Extra Time

Negotiating with lenders and sellers takes time. Consider taking a vacation day to spend extra time on negotiations. If you cant take time off from work to negotiate, be sure to give yourself extra leeway between your offer and your targeted closing date. The extra long window of time will ensure that you have ample time to negotiate with lenders before you finalize the loan details.

Don’t Miss: What Is A Point For Mortgage

Our Commitment To You

Speaking more from a customer service perspective, our commitment to you is to listen, understand, and act on providing the best mortgage advice and products available. We will do this in an environment where you feel comfortable and understand the process.

Our goal is to work for you in an effort to remove any associated stress that comes with one of the largest financial decisions youll make in your life. As we are licensed through the Real Estate Council of Alberta, we are committed to upholding the highest standards of protection for consumers, and providing services that enhance and improve the industry.

What Is A Mortgage

A mortgage is a loan that can be used to purchase property, which in turn acts as security for the loan. A mortgage tends to be for a large sum and is usually paid off over 25 or 30 years.

When you sign up for a mortgage, youre agreeing to make regular payments. These mortgage payments are comprised of both principal and interest. When a payment is made, its first used to cover the interest, then the principal. A mortgage lets the mortgage lender take possession of the property should you fail to make the agreed-upon payments on time.

You May Like: How Much Income To Qualify For 400 000 Mortgage

Mortgage Commitment Letter Before Appraisal

The appraisal is a significant part of the approval process because it lets the lender know there are no major defects or repairs on the home before committing to lending. Additionally, with an appraisal, the loan underwriter can know whether the appraisal value estimate lines up with the buying price.

Typically, the lender doesnt issue a mortgage commitment letter before appraisal. However, its possible to request conditional approval to show the seller youre a serious home buyer. For instance, if your lender only provides you with a pre-qualification letter, you can request a credit only approval to show youre qualified to obtain a mortgage. This approval verifies that your lender has reviewed your credit, assets, and income and simply needs a satisfactory appraisal before providing a loan commitment.

You can also request a credit only approval letter when delays occur. For example, the appraiser may need to revise the report, or the lender can be too busy to get the loan filed through underwriting on time, causing delays.

Are You Going To Break Your Mortgage

When you sign up for a mortgage, breaking it is probably the last thing on your mind. But a lot can happen during the standard, five-year mortgage term. If you think theres a chance you might need to break your mortgage during your mortgage term, its a good idea to go with a lender and mortgage type with a lower mortgage penalty. Variable rate mortgages tend to have lower penalties than fixed rate.

Read Also: What Were Mortgage Rates In 1980

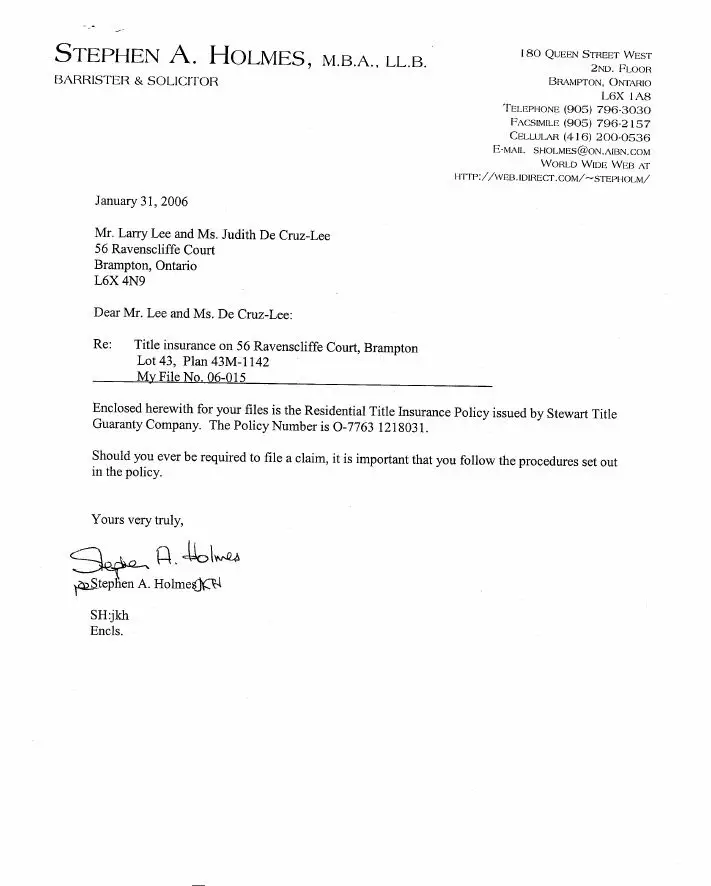

Mortgage Commitment Letter Sample

Different lenders will use different wording for their mortgage commitment letters, but they all provide the same basic information. Heres an example:

Lender: Main Street BankBorrower: John and Jane DoeDate: 11-21-20221000 Main Street1529 Oak Street Loan Number: 52343Duluth, MN 55807Detroit, MI 48226

Property Address: 4321 First Street, Duluth, MN 55807

Main Street Bank is happy to inform you that your mortgage loan application has been approved. This approval is subject to the following conditions:

Product: Fixed Rate MortgageInterest Rate: 4.25%Origination Charges: $1,200

This mortgage is to be repaid in 360 monthly installments of $984, including principal and interest. Prior to funding, an escrow fund is required for payment of insurance and property taxes. The required escrow payment for the first 12 months is $350. There is no prepayment penalty for this mortgage.

This offer will expire on 12-21-2022. Your loan must close prior to midnight on this date.Each person signing this commitment letter fully understands its contents and acknowledges that they have read and received it.

When To Shop For Lenders

If your bid has been accepted by a home seller, closing the deal typically takes 30 to 60 days, Hosterman says. Of course, your real estate agent could ask for an extension.

After a bid gets accepted, thats typically when theyll shop around for better rates, he says, adding that waiting until the last two weeks of closing to shop is cutting it close.

A change in lenders shouldnt hurt a seller, Hosterman says, though its something they should be made aware of. Moving to a different type of loan, such as from a conventional to an FHA loan, could affect the seller, he says, because FHA loans require more stringent appraisals that could delay a sale.

A drop in mortgage interest rates is the biggest reason to switch lenders. Still, your current lender may be able to move your loan to a lower interest rate unless your rate is locked. The interest rate is usually locked in after the contract is accepted, and lenders will usually only change it if the terms can be significantly better for a borrower, Hosterman says.

If any earnest money has been given to the seller, that money could be at stake if deadlines in the contract arent met by trying to find a new lender.

Sellers and real estate agents will likely assume that the initial lender listed on a preapproval letter is going to be the buyers lender. Dont leave them out of the loop and let them assume your switching lenders because the first lender later decided you didnt qualify for a loan.

Follow us on and .

You May Like: What Are Mortgage Loan Closing Costs

Failing To Meet The Buyer Condition Of The Loan Commitment

It is possible for the buyer to fail to meet the condition of the loan commitment, thereby losing their loan commitment and even their pre-approval.

Lenders are looking for financially stable borrowers. And any disruption in a buyers finances during the loan application process can return the process to square one. Examples of behavior that could result in a revocation of the loan commitment and pre-approval include:

- Employment changes

- Late or missed payments on any debt, bill, or even rent

- Applying for another loan

- Legal issues, including marriage and divorce

- Closing a credit card account or settling an old debt

- Making a large deposit or taking a large withdrawal

As a general rule, buyers should avoid doing anything that might change their financial position from the time pre-approval is granted until the close of escrow.

Massachusetts REALTOR® Bill Gassett has a great article that explains 14 things a home buyer can do to inadvertently get a mortgage pre-approval revoked.

Stage : Loan Commitment

Once the buyers offer on a home is accepted by the seller, the buyer can request loan estimates from multiple lenders to find the lender offering the best terms.

And once a lender has been selected, the lender will review the file and provide a loan commitment letter confirming their intention to provide funding for the purchase, as long as both the property and the buyers financials meet the lenders criteria.

Youll notice that, unlike the pre-qualification and pre-approval, which each evaluate only the buyer, the loan commitment conditions require an evaluation of both the buyer and their chosen property.

To satisfy the condition relating to the buyers financials, the buyer must provide up-to-date documentation of their financial position, source of income, and creditworthiness.

To satisfy the condition relating to the property, the property must appraise for the purchase price and may need to pass a physical inspection.

Also Check: What Factors Go Into Mortgage Approval

Types Of Mortgage Loan Commitment Letters

There are two types of commitments: conditional and final.

A conditional commitment letter approves the borrower for a certain loan amount, as long as certain conditions are met. This type of commitment letter may contain the following pieces of information:

- List of conditions that must be met before final approval

- Amount of days preapproval is valid

A final mortgage commitment is when the conditions have been met and the lender promises to lend you the specified amount. This letter typically contains the following information:

- Property address if an offer has already been made

- Statement of approval for loan

- Commitment expiration date

How Much Equity Do I Need To Refinance My Home Mortgage At A Low Interest Rate

A good rule of thumb for refinancing is that you should have at least 20% equity in your home. That means that you have paid down at least 20% of your original mortgage.

However, many lenders look at your loan-to-value ratio instead of your equity. Your loan-to-value ratio is the amount of debt you owe on your mortgage divided by your homes market value. Most lenders want you to have a loan-to-value ratio of less than 80% to refinance your mortgage.

Don’t Miss: How To Prepare For Applying For A Mortgage

What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

Getting Prescreened Mortgage Offers In The Mail

Why am I getting mailers and emails from other mortgage companies?

Your application for a mortgage may trigger competing offers . Heres how to stop getting prescreened offers.

But you may want to use them to compare loan terms and shop around.

Can I trust the offers I get in the mail?

Review offers carefully to make sure you know who youre dealing with even if these mailers might look like theyre from your mortgage company or a government agency. Not all mailers are prescreened offers. Some dishonest businesses use pictures of the Statue of Liberty or other government symbols or names to make you think their offer is from a government agency or program. If youre concerned about a mailer youve gotten, contact the government agency mentioned in the letter. Check USA.gov to find the legitimate contact information for federal government agencies and state government agencies.

Does a lender have to give me anything after I apply for a loan with them?

Under federal law, lenders and mortgage brokers must give you:

- this home loan toolkit booklet from the CFPB within three days of applying for a mortgage loan. The idea is to help protect you from unfair practices by lenders, brokers, and other service providers during the home-buying and loan process.

- a Loan Estimate three business days after the lender gets your loan application. This form has important information about the loan:

- the estimated interest rate

Don’t Miss: Who Uses Equifax For Mortgages