See How Better Mortgage Can Help You Save

Before you close on a loan, make a point to shop around for homeowners insurance, and investigate whether buying points would be a good financial decision for you. When you lower the cost of your homeowners insurance, youll reduce the monthly amount youll need to pay into escrow.

To get an idea of what your monthly mortgage payment will look like if you buy points or accept credits, take a look at the Better Fixed-rate loan comparison calculator. It will help you see how much money you stand to spend or save.

Whether you are purchasing or refinancing, we will help you choose the best mortgage for you by seeing how the cost of a home changes based on your loan costs.

Get started to find out your estimated closing costs in as little as 3 minutes and discover how Better Mortgage can help you save on your homebuying or refinance journey.

Closing Costs: What Should Your Clients Know About

Closing costs can get pricy and are subject to increases. If you want to help your clients avoid closing costs when buying a home, there are some approaches you can take. While it is impossible to cut out all closing costs entirely, you can negotiate to minimize some costs. It is common for buyers to pay most of the closing costs, but buyers are also able to negotiate with sellers to reduce fees.

Who Pays The Closing Costs

Most of the closing costs fall on the buyer, but the seller typically has to pay a few, too, such as the real estate agents commission and often a real estate transfer tax.

» MORE:What are the closing costs for the home seller?

Buyers can also ask sellers to pay some of their closing costs. When the seller agrees, it’s called a seller concession. The seller is more likely to contribute if there are more homes for sale than would-be buyers in the local market, or the property has issues that make it challenging to sell. Your real estate agent can help you decide the best negotiating strategy.

Recommended Reading: How To Cut Down Mortgage Payments

Closing Costs You Can Deduct In The Year Theyre Paid

Origination fees or points paid on a purchase. The IRS considers mortgage points to be charges paid to take out a mortgage. They may include origination fees or discount points, and represent a percentage of your loan amount. For these costs to be tax-deductible in the same year theyre paid, you have to meet all of the following conditions.

Points paid on a home improvement cash-out refinance. If you took out a new home loan for home improvements, the refinance points may be deductible. Youll have to document that all of the cash was used for renovations and show that the points meet the first six requirements listed above.

Mortgage insurance. Lenders may require mortgage insurance to cover the extra risk of offering a loan with a down payment of less than 20%. If you bought a home before or during 2021, private mortgage insurance premiums are deductible.

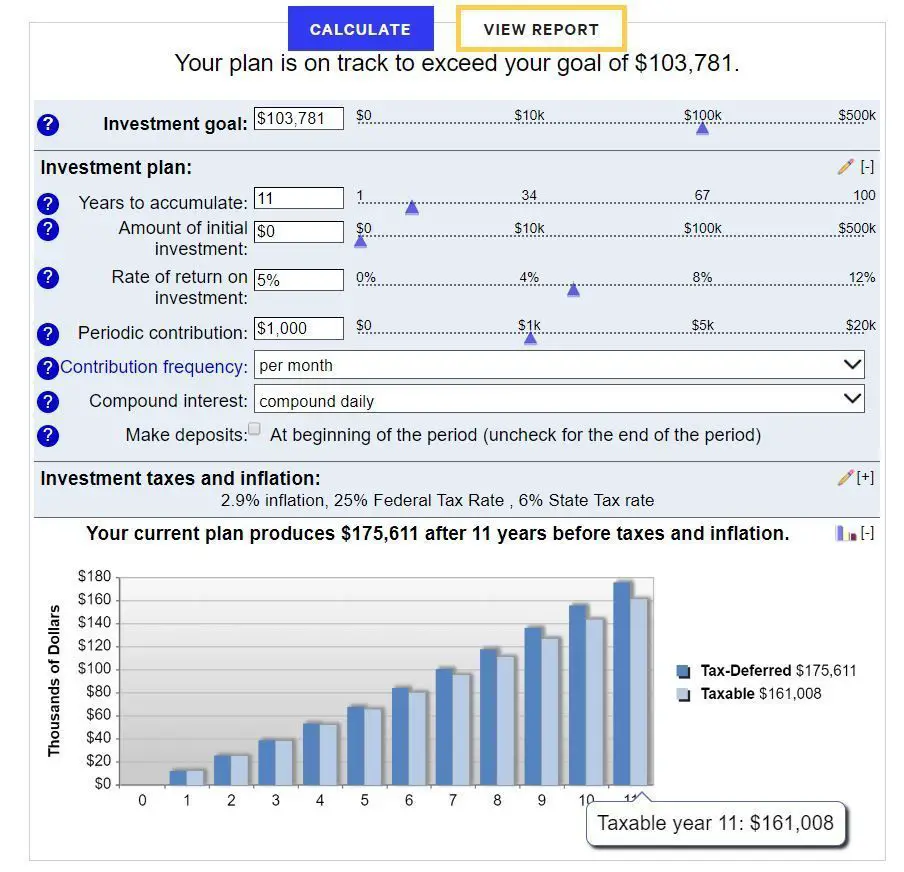

Shop Around When Investing

If you are looking to invest in a new property, its a good idea to take your time before selecting a property to purchase. Research is extremely important when you are considering buying real estate. Its good to know that a property is not a bad investment, even if it needs fixing up there are ways to remodel without breaking the bank.

Consider these costs when shopping around for an investment property since fees differ by lender. Be sure to ask for closing cost estimates while shopping around, as few mortgage lenders assist with the closing costs.

You can also ask a lender to find and match low closing costs that are offered elsewhere. Dont be afraid to seek out lower-cost services by evaluating your options if anything is optional and you feel you dont need it, opt out!

You May Like: How Do You Get A Mortgage To Build A House

How Much Are Typical Mortgage Closing Costs

Recent data show youll shell out more closing cost cash to buy a home versus refinancing one. The table below highlights average closing costs for buying and refinancing in 2021.

| Purchase mortgage closing cost highlights* | Refinance mortgage closing cost highlights** |

|---|---|

|

|

*According to Corelogics 2021 Purchase Closing Cost Report, not including transfer taxes.

**According to Corelogics 2021 Refinance Closing Cost Report, not including specialty taxes.

Attorney Or Title Agent Fee

Closings generally take place in the office of either an attorney or a title agent. This is due to the requirement for preparing and filing legal documents connected with the loan.

In some states, closings routinely take place in the office of a title agent. In others, its handled in an attorneys office.

Generally speaking, title agents charge lower fees for closings. They may charge between $200 and $500, while attorneys may charge between $500 and $1,000.

Recommended Reading: Who Do I Pay My Mortgage To

What Do Closing Costs Pay For

Your closing costs will depend on your particular transaction and can be impacted by interest rates, local insurance fees, tax rates, local appraisal fees and other factors. But here’s a general breakdown of some of the common expenses covered by closing costs:

Title insurance: This protects lenders from financial losses stemming from problems related to a property title, such as liens or ownership conflicts.

Taxes: These could include the property tax on the home, local government fees — such as one for recording the sale of the property — and a tax for transferring the title from the seller to the buyer.

Appraisal fees: These are charged by an appraiser for coming to the property and assessing the home’s value to determine an appropriate loan amount.

Tax service provider fees: These help pay for third parties to keep track of property tax payments and other tax monitoring duties.

Prepaid expenses: These are items like homeowners insurance, property taxes and interest until the first payment is due.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How is this page expert verified?

At Bankrate, we take the accuracy of our content seriously.

Expert verified means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

Arrow Right Arrow Right Arrow Right

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

Also Check: What Is Flex Modification Mortgage

How To Be Prepared For Closing Costs

At least three business days before closing, your lender must send you a Closing Disclosure. This form lists all final terms of your loan such as closing costs and the details of who pays and receives money at closing.

Review each cost carefully ahead of time and compare it to your original Loan Estimate. This is the form you received soon after you applied that told you the estimated interest rate, monthly payment and total closing costs for your loan. If anything has changed, ask your lender why.

Double-check your monthly mortgage amount to be sure everything was calculated correctlyand that you really can afford it. Your mortgage payment shouldnt exceed 25% of your monthly take-home pay.

Can You Roll Closing Costs Into A New Mortgage

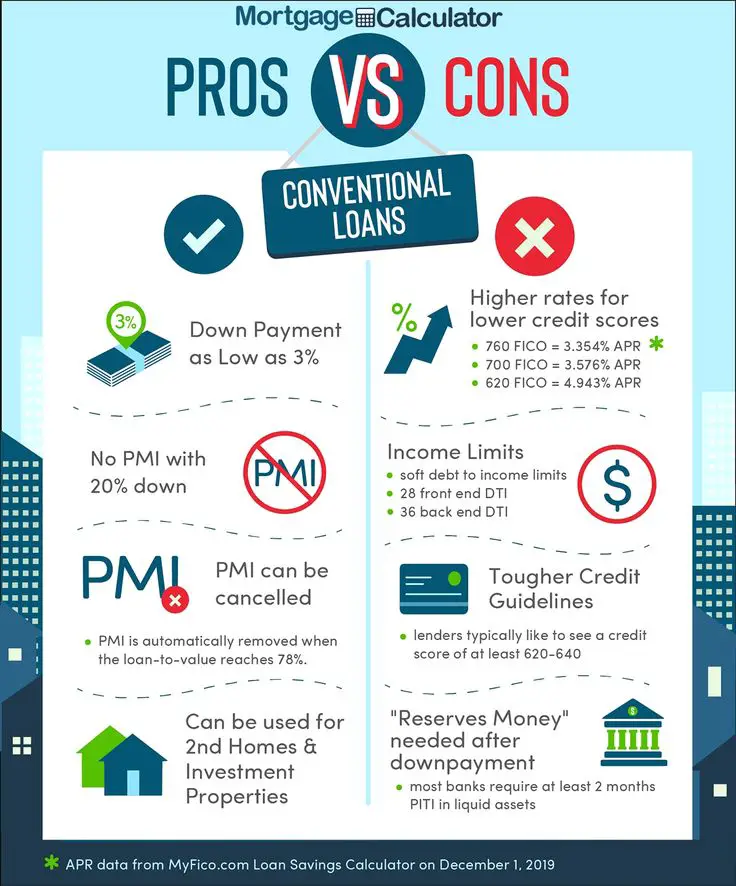

If your mortgage is for a new purchase, directly rolling your closing costs into the mortgage may not always be possible. However, there are other ways to save on your upfront expenses. You can reduce your down payment to decrease your out-of-pocket expenses at closing. However, keep in mind that a reduced down payment increases the LTV ratio. If your LTV goes above 80%, you’ll typically need to pay private mortgage insurance .

You could also try to negotiate a “sellers concession,” in which the seller of a property will pay for certain fees on the buyer’s behalf. Whatever you save on loan fees in this way can be put toward your down payment, reducing the overall upfront expense of the mortgage. However, sellers won’t make such concessions unless they’re willing to accept a lower net profit in exchange for a better chance at closing the sale.

Rolling closing costs into a refinance is permissible as long as the added costs don’t push your total loan over the lender’s LTV and DTI thresholds. Additionally, the increased loan amount cannot exceed the maximum loan-to-value ratio your lender is willing to extend. For example, if your home is worth $100,000 and the maximum LTV is 80%, your lender will lend you only $80,000. That number will not be extended to accommodate closing costs.

Also Check: What’s The Difference Between Fha And Conventional Mortgage

What Does Closing On A House Mean

Closing is the phase in the home selling process when money and documents are transferred in order to transfer ownership of the property to the buyer. In a successful closing, both buyer and seller fulfill the agreements made in the contract.

The seller will pay off all loans on the property to clear title, and the buyer and their lender will wire transfer money to cover the balance owed on the purchase. Closing is facilitated by a third party called an escrow company, which ensures that all money, documents, and other items needed to close the sale are properly exchanged.

Havent heard of Opendoor? Were making it easier to buy, sell, or trade-in a home.

Tips For Lowering Closing Costs On A New Investment Property

When investing in a new property, its important to make the most out of the transaction to ensure as successful an investment as possible. Investing in a new property requires multiple upfront costs, such as down payments, fees, and renovation costs.

There are ways to lower closing costs in a new investment property, and Stoner Law Offices, LLC. real estate lawyers recommend you hire an attorney who will support you each step of the way. Knowing what kind of property to invest in is important, especially when trying to save on closing costs. Real estate attorneys understand that real estate is a great way to invest your money and are happy to provide counsel before you make any decisions.

Don’t Miss: Is 5.1 Interest Rate Good For Mortgage

What Are Closing Costs

Closing costs are fees paid to cover the property, insurance and mortgage costs incurred by your lender and other third parties while processing your loan during a purchase or refinance.

Lenders are required by law to provide a Loan Estimate within 3 business days of receiving your application. The estimate provides a detailed list of what you can expect to pay at closing. This document is a TILA-required lender disclosure that provides a good-faith estimate of the cost of the loan but its just an estimate. Youll know exactly how much youll owe when you receive a Closing Disclosure 3 business days before you close.

Whats Included In Closing Costs

When you first see your Good Faith Estimate or Closing Disclosure Statement, it can be a little overwhelming the list of individual line items seems to stretch on and on. Heres a list of the most common closing costs in alphabetical order, including the general amount of the charge and purpose for the cost.

Also Check: Can You Refinance Into A 15 Year Mortgage

Origination And Underwriting Fees

It takes a lot of time and resources to collect, evaluate, and verify an applicants financial information. The lender will also have to order a home appraisal, order the final loan documents, and make sure all laws and regulations are followed. The origination and underwriting fees cover all of the work involved in processing the mortgage.

Most Common Origination Fees

The exact list of origination fees may vary slightly from lender to lender, and some lenders may use different titles for specific fees. However, some of the most common origination fees generally include:

-

Processing or underwriting: This fee is designed to cover the lenders costs of gathering the required documentation to process your loan.

-

Appraisal: As part of the closing process, the home being purchased must be appraised for its fair market value, which is the basis for this fee.

-

The mortgage lender charges this fee to cover the cost of checking your credit score and profile.

-

Tax service processing: This fee is charged by the lender to establish an escrow account that will be used to ensure that there is no interruption in the payment of property taxes as the home changes hands.

Its also important to note that there are some origination expenses or costs that a lender controls and others that the lender cannot control. For instance, application, processing, and underwriting fees are typically fees controlled by the lender. But and appraisals are fees charged by third parties and thus are fixed costs that the lender must pay.

Origination fees may sometimes also include whats known as up-front points, which are not to be confused with the discount points used to buy down the interest rate on a mortgage.

Recommended Reading: Where Are 30 Year Mortgage Rates Headed

An Example Of Seller Concessions In Practice

How does this work in practice? Lets say that you take out a conventional loan worth $200,000. If its a conventional loan and you made a down payment of less than 10%, the seller could only contribute a maximum of 3% toward your closing costs. If your closing costs come to less than 3% of your loan value, the seller can only contribute up to 100% of the closing cost value. This means that if your closing costs on the same loan were to equal $2,500, the seller can only offer up to $2,500. These limitations help prevent fraud.

Take the first step toward the right mortgage.

Apply online to see how much you can get approved for and determine your closing costs.

Which Closing Costs Can Be Financed

Not all closing costs can be included in the mortgage loan when you refinance.

Some costs youre typically allowed to finance include:

- Loan origination fee: An upfront fee charged by the lender. Other lender fees may include processing fees, underwriting fees, and application fees

- Discount points: Cash youd pay upfront to lower your new refinance rate

- : A fee charged to your lender to access your credit score

- Title fees/title insurance: Fees charged, usually by an attorney or title company, for the title search which ensures no one else can claim ownership of your home

Other closing costs cannot always be rolled into the loan. These include items like prepaid property taxes, a homeowners insurance policy, and HOA dues. Rules vary by loan program.

If you need your new loan to cover these costs, too, let your loan officer know in advance so you can learn about your best options.

You probably wont be able to roll in the home appraisers fee since its charged earlier in the closing process.

Recommended Reading: Can I Get A Mortgage Before I Sell My House

Ask The Seller To Cover Some Of Your Closing Costs

As a buyer, you can request that the seller pay for some or all of your closing costs while negotiating the offer. Negotiating concessions is common. According to the Zillow Group Consumer Housing Trends Report 2020, 85% of sellers make some kind of trade-off with the buyer to facilitate the sale of a home. This is a beneficial strategy if you dont have enough cash available after paying your down payment to cover closing costs, too. Its most commonly used when there are many sellers competing for a small pool of buyers.

Keep in mind that lenders must adhere to regulations that dictate which closing costs sellers can cover for buyers, and the amount sellers can contribute. Be sure to ask your lender about the specifics of your loan program.

Where To Find A Mortgage

Quicken Loans and Rocket Mortgage are two sides to the same organization. Rocket Mortgage is the online interface of Quicken Loans. While Quicken Loans is the largest retail mortgage lender in America, Rocket Mortgage is the better known of the two, if only because its so widely advertised. But its impossible to discuss one without the other.

As an online mortgage lender, Rocket Mortgage offers speed and simplicity. You can complete the entire application process online including uploading supporting documents without leaving your home or office. They offer both pre-approvals and full approvals. FHA and VA loans are provided, in addition to conventional and jumbo mortgages.

Credible is an online lending marketplace, offering loan products from multiple lenders. That includes mortgages, in addition to student loans, personal loans, and credit cards. By completing a single, simple online loan application, you can get loan quotes from several companies.

You can then choose the lender that offers the best rate and terms for your purchase or refinance. It will give you an opportunity to shop between various lenders, without the need for completing multiple applications.

Don’t Miss: Are Mortgage Interest Rates Going Up