What Is Fha Mortgage Insurance Premium

FHA mortgage insurance premium, also known as FHA MIP, helps keep the Federal Housing Administration loan program operating.

The FHA is not a lender instead, its an insurance provider for lenders. When you get an FHA loan, your lender provides the money. The FHA insures the loan.

So if you stopped making payments and the lender had to foreclose, the FHA would step in to help cover the lenders losses.

With this insurance coverage in force, the lender can approve loans even when the borrower has average credit, a low down payment, and a debt-to-income ratio up to 50 percent.

But its the borrower who pays the mortgage insurance premiums .

How To Cancel Mortgage Insurance Early

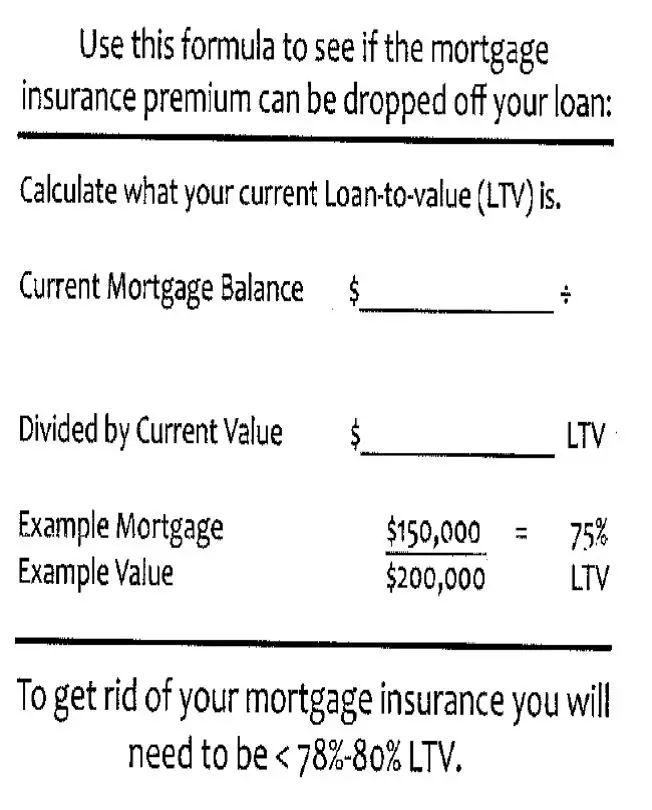

The easiest way to get rid of your PMI before your scheduled termination date is to make extra mortgage payments. By making an extra payment every month or several times per year, you can quickly build equity in your home.

You can also cancel your PMI more quickly by making substantial upgrades to your home that increase its property value. Shelling out some cash to revamp your kitchen or the outside of your home could raise your homes worth while your mortgage balance remains the same. You could also try getting a home appraisal and asking your lender to reference that number instead of your homes original value.

Another helpful tactic could involve refinancing your mortgage in order to lower your mortgage rate and qualify for PMI cancellation at the same time. But refinancing may not make sense, especially if your LTV ratio doesnt fall to 80%.

Related Article: What Are the Upsides of Private Mortgage Insurance?

How To Speed Up The Process

You may want to make extra payments on your loan if you want to stop paying for PMI as soon as possible. Your money can go directly to reduce your principal balance when you make an extra payment, but you have to tell your lender specifically thats where youd like it credited. Many lenders will automatically apply extra money toward next months payment instead.

Additionally, if youre planning on making extra payments with the express goal of getting rid of PMI, be sure to talk to your lender. Some types of loans dont allow you to make payments ahead of time for the purpose of mortgage insurance removal.

Also Check: What Is A Hero Mortgage Loan

Things You Should Know About Mortgage Insurance

Many homeowners are not aware of the significant cost associated with PMI. PMI rates vary from as low as 0.5% to 1% of the total mortgage balance. When you consider this, you are adding a substantial cost to the mortgage. PMI payments dont decrease. And unlike regular mortgage payments, they dont help build up equity. The money you pay toward PMI doesnt help you one bit. It is purely to protect the lenders investment. When purchasing a new home, consider the added cost of PMI.

What Is An Options Contract

- An options contract is a promise that you can buy, promising that youll be able to buy 100 shares of a specific stock, at a specific price on or before a specific date.

- If you buy 5 options contracts on a stock with a strike price of $100 a share and the stock moves up to $135 a share, you will be able to buy $67,500 worth of the stock for $50,000.

- You will immediately enter into this process of eliminating your mortgage $17,500 in profit.

Read Also: What Is A 10 Year Arm Mortgage

Request Pmi Cancellation When Mortgage Balance Reaches 80 Percent

Instead of waiting for automatic cancellation, you have the right to request that the servicer cancel PMI once your loan balance reaches 80 percent of the homes original value. If youre making payments as scheduled, you can find the date that youll get to 80 percent on your PMI disclosure form .

If you have the cash to spare, you can get there faster by making extra payments.

You can prepay the principal on your loan, reducing the balance, which helps you build equity faster and save on interest payments. Even $50 a month can mean a dramatic drop in your loan balance and total interest paid over the term of the loan.

Some borrowers choose to apply a lump sum toward their principal or even make an extra mortgage payment per year. That will get you to the 20 percent equity level faster. To estimate the amount your mortgage balance needs to reach to be eligible for PMI cancellation, multiply your original home purchase price by 0.80.

Who this affects: Homeowners can use this method once they have achieved 20 percent equity. You must also do the following to cancel PMI:

- Make the PMI cancellation request to your lender or servicer in writing.

- Be current on your mortgage payments, with a good payment history.

- Meet other lender requirements, such as having no other liens on the home .

- If required, you might need to get a home appraisal. If your homes value has declined, that would mean you have yet to reach that 20 percent equity and might not be able to cancel PMI.

Refinance Your Mortgage To A Lower Rate

One of the best ways to lower your mortgage payment is by refinancing your home loan. As a rule of thumb, a mortgage refinance is probably worth it if you can shave at least 0.75% off your current mortgage rate. This will ensure youre saving money on interest even after you factor in closing costs, as long as youre planning on having the house for a bit.

Example:

Here are some of the major refinance options, by loan type:

If youre ready to lower your mortgage payment, refinancing can be a great option. Just be sure to shop around and consider as many lenders as possible. With Credible you can compare prequalified rates from our partner lenders in the table below in just three minutes.

Read Also: What Day Of The Week Are Mortgage Rates Lowest

If Your Mortgage Is From A Federally Chartered Lender

Under federal law, lenders are not required to take market appreciation into account when determining the value of your home. Federal law requires lenders to cancel PMI, upon request, when the homeowner has made payments that reduce the principal amount owed under the mortgage to 80 percent of the homes value at the time it was purchased. For example, if a homes purchase price was $100,000, the lender is not required to cancel the PMI until the principal amount due on the mortgage is reduced to $80,000. Because the first years of a mortgage payment are mostly interest, a homeowner making only the minimum required payments would have to wait years, sometimes a decade or more, before reaching the required 20 percent threshold as calculated under federal law.

Once a homeowner pays the mortgage principal down enough to qualify for PMI cancellation, federally chartered lenders may require an appraisal to ensure that the homes value has not declined below its original value when purchased. Although federal law does not require lenders to take market appreciation into account, some lenders may agree to do so. For example, some lenders may agree to cancel PMI based on the homes current value if you have made substantial improvements to it others may elect to cancel PMI if an appraisal shows that the value of your home has markedly appreciated. You must contact the lender directly to begin the appraisal process.

How To Get Rid Of Pmi And Lower Your Mortgage Payment

Many home buyers have to pay private mortgage insurance on their home loans. PMI will cost you hundreds of dollars on your monthly mortgage expenses, and clearly, something youre want to stop paying as soon as possible.

If you are in this situation, there are ways to stop paying it sooner. Lets review your options and help you stop paying mortgage insurance.

Don’t Miss: How Much Interest Will I Pay Mortgage Calculator

Ask Your Lender About Recasting Your Loan

If youre happy with your current interest rate on your conventional loan but have an extra $5,000 to $10,000 to spare, you can request a mortgage recast. Rather than going through the refinance process, youd use the extra cash to pay down your loan balance, and the lender would then reset the payment based on your current interest rate at the original loan repayment term.

You dont have to qualify, and lenders typically charge a small fee for the process. This is a great option for homeowners who had to buy a new home before they sold their old home, but now have the profit from their old home to pay down their mortgage and reduce their monthly payment amount without all the costs and documentation of a regular refinance.

How To Remove An Existing Escrow Account

In some cases, you might be able to cancel an existing escrow account, though every lender has different terms for removing one.

Sometimes, the loan must be at least one year old with no late payments. Another requirement might be that no taxes or insurance payments are due within the next 30 days.

If you decide that you want to get rid of your escrow account, call your servicer to find out if you qualify for a deletion of the account.

Don’t Miss: Does Usaa Do Mortgage Loans

Tips To Lower Your Fha Mortgage Insurance Rate

When youre shopping for a mortgage, the FHA loan programs mortgage insurance premiums may seem like a big downside especially since annual MIP often lasts for the life of the loan.

But not all borrowers pay the full 0.85 percent annual MIP rate for the life of the loan. By shortening your loan term to 15 years or making a larger down payment, you can reduce your annual MIP rate and term.

For example, if you:

- Get a 15-year loan instead of a 30-year loan: Your annual MIP rate would be 0.70 percent for the life of the loan

- Put 5 percent down on a 30-year loan: Your annual MIP rate would go down to 0.8 percent for the life of the loan

- Put 10 percent or more down on a 30-year loan: Youd pay an annual MIP of 0.8 percent for 11 years

- Put 10 percent or more down on a 15-year loan: Youd pay a 0.45 percent annual MIP rate for 11 years

If you borrow more than $625,500, youll see higher annual MIP rates. They could go as high as 1.05 percent of your loan balance.

Wait Till Your Mortgage Hits The Midpoint Period On Your Loan

Your lender will automatically terminate PMI when your loan reaches the midpoint period on your loan. For example, if you have been paying your 30-year mortgage for 15 years, and you still dont have an 80% loan to value ratio, your lender should remove your mortgage insurance.

The Federal Homeowners Protection act requires lenders to eliminate the PMI once the homeowner makes monthly payments on 50% of the loan term. It is only really applies to conventional mortgages that start with an interest-only payment and have a balloon payment at the end of the period.

Read Also: How To Calculate Mortgage Approval

Security Backed Line Of Credit

- A Securities Backed Line of Credit is a loan that you are given against shares of stock that you currently own. You will still own your stocks as they grow in value and the interest rate is lower than a regular loan.

- Since the Security Backed Line of Credit which you will be using to pay your mortgage is a loan, it is untaxed money, unlike job income which you use to pay your mortgage

-

When the stock is at or near its 52 week high you can sell the shares or let it move back down but start selling monthly option contracts for extra money.

How To Lower Your Monthly Mortgage Payment: Guide

If your mortgage payment is no longer affordable, you can refinance the loan, ask the lender for help, or check out your insurance options.

Edited byChris JenningsUpdated April 25, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

If you currently pay a mortgage, you might be looking for ways to save on your monthly bill.

A lower mortgage payment can put some breathing room in your budget and let you focus on other financial goals. There are plenty of options, including refinancing your mortgage, removing private mortgage insurance, applying for forbearance, and more.

Heres a rundown on how to lower your mortgage payment:

Recommended Reading: How To Write A Hardship Letter For Mortgage Modification

Example : A Rapid Rate Of Home Price Appreciation

The example below is based on the same mortgages as above. However, the following home price appreciation estimates are used.

In this example, we only show a single table of monthly payments for the two options . Notice that PMI is dropped in this case in month 13 because of the rapid home price appreciation, which quickly lowers the LTV to 78%.

With rapid home price appreciation, PMI can be eliminated relatively quickly.

The combined mortgages only have a payment advantage of $85 for 12 months. This equals a total savings of $1,020. Starting in month 13, the stand-alone mortgage has a payment advantage of $35. If we divide $1,020 by 35, we can determine that it would take about 29 months to make up the initial savings of the combined first and second mortgages.

In other words, starting in month 41, the borrower would be financially better off by choosing the stand-alone first mortgage with PMI.

Wondering How To Get Out Of A Home Loan Rest Assured That You Do Have Options

When youre in a situation where you need to sell quickly but dont want to sink money into the sale, the best way to get out of a mortgage legally is by selling to a company. This way, youll get the most money for your home without damaging your credit.

HomeGo provides same-day offers and a fast closing process that takes just 7 days. We take care of the details, help with closing, and can even make offers on homes with title issues.

HomeGo may utilize the services of an affiliated real estate brokerage to transact home purchases. Any reference to a licensed real estate agent is meant to imply an agent representing HomeGo and its affiliates as a principal buyer. Any agents referenced do not represent you as a home seller. All homes are purchased in the name of an affiliated holding company designed to acquire properties and may not vest in the name of HomeGo. Generally, properties are simultaneously resold as-is to a non-affiliated entity for a profit. One or more of HomeGos owners, employees and affiliates may also be licensed real estate agents, salespeople, or brokers at affiliated or unaffiliated brokerages.

Also Check: How Long Is A Mortgage Application Good For

Purchase A Home You Can Afford

âIf you want to finance a home, youâll need to get prequalified first,â writes Mike Timmerman, who paid off his mortgage in just two years. âThe bank will look at your overall financial picture and spit out an amount that youre likely to get a loan for. Some people use this number to set a housing budget, but not me.â

âThe bank is just guessing. I examined my monthly budget and determined what I wanted to spend on housing,â Timmerman adds. â It ended up being much less than what the bank told me I could afford.â

How To Get Rid Of Your Mortgage

Welcome to Pretired.org! Note some links are to products and services available for purchase. As an Amazon Associate I earn from qualifying purchases. Thanks for visiting!

Welcome to Pretired.org! Note some links are to products and services available for purchase. As an Amazon Associate I earn from qualifying purchases. Thanks for visiting!

Recommended Reading: How To Buy Land When You Already Have A Mortgage

Pay Fortnightly Instead Of Monthly

A simple yet effective strategy for paying off your loan faster is switching from monthly to fortnightly repayments. This is because there are 26 fortnights in a year, but only 12 months. So by paying fortnightly, you will be making the equivalent of 13 monthly payments every year instead of 12. This can end up chipping away at the principal and interest, therefore reducing the life of your loan.

Paying Back Or Refinancing A Home Equity Loan

When your home equity loan is active, the only way to get out of it is to pay it back. If youve just received the money from your loan or are lucky enough to have the cash on hand, you can do this directly. Just make sure you understand the penalties that might apply if you do so: Some lenders will charge you for early repayment of the loan.

If your loan has been running for a while and you dont have enough cash on hand to repay it, there are several common ways of raising the funds needed to pay off the balance and get out of the loan:

- You can sell your home, even if you have an active home equity loan taken out against it. As long as your house has increased in value since you took out the loan, this is a fairly straightforward way to get out of the loan because you can use the money you receive from the sale to pay off the home equity loan .

- You can refinance your home equity loan. If its been a few years since you took out your home equity loan, and your house has increased in value or interest rates have decreased, it might make sense to take out another loan. Its possible to take out another home equity loan to repay the first, or to repay a home equity line of credit . Its even possible to roll a home equity loan into your primary mortgage.

Also Check: How To Sell A House Before Mortgage Is Paid Off